There was renewed turbulence in global markets overnight, which however eased modestly following Monday’s rollercoaster, after the late Tuesday shock confirmation by USTR Lighthizer that the US would indeed hike tariffs at midnight on Friday even as China’s top trade negotiator Liu He confirmed he was headed to the US for what may prove to be a futile trip. And, like yesterday, stocks in Europe and Asia dropped alongside U.S. equity-index futures as a slew of trade headlines continued to roil traders around the globe. The dollar edged higher and Treasury yields were steady, while Turkey’s lira plunged as concerns about its politics erupted again.

“Reality is setting in that they are not going to get the master deal, the grand deal that they are hoping for and there’s a lot of work to be done,” Oliver Pursche, Bruderman Asset Management’s chief market strategist, told Bloomberg TV. “Our best guess is that these tariffs will be implemented on Friday, but will then be reversed relatively quickly.’’

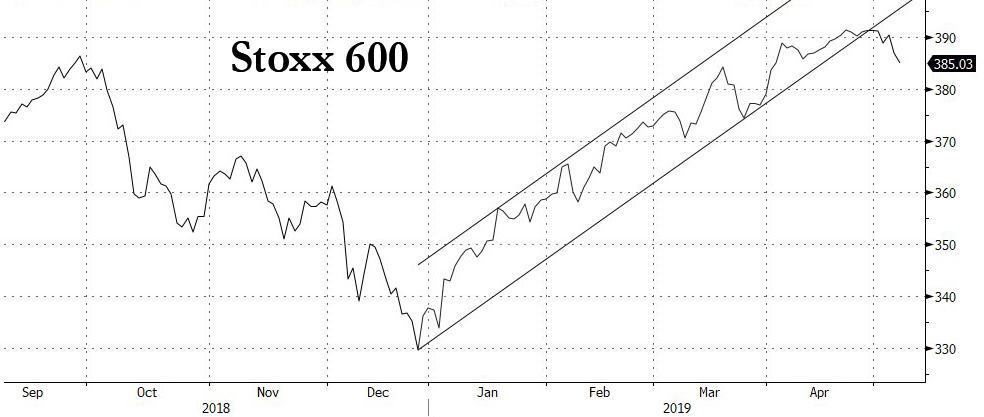

Europe’s Stoxx 600 Index fell to a five-week low as declines for banks and oil producers outweighed gains for real-estate companies; the index slumped to session lows just after 7am ET, falling as much as 0.6% with energy shares among the worst performing industry groups as crude extended losses. The SXEP was down 1.2%, tracking oil lower as Saudi Arabia was reported to supply extra crude to its customers in Asia. Banks also dragged Stoxx 600 lower, with SX7P down for a 2nd day. As a result of the recent selling in Europe, the Stoxx 600 upward channel has now been broken, and more downside is to be expected.

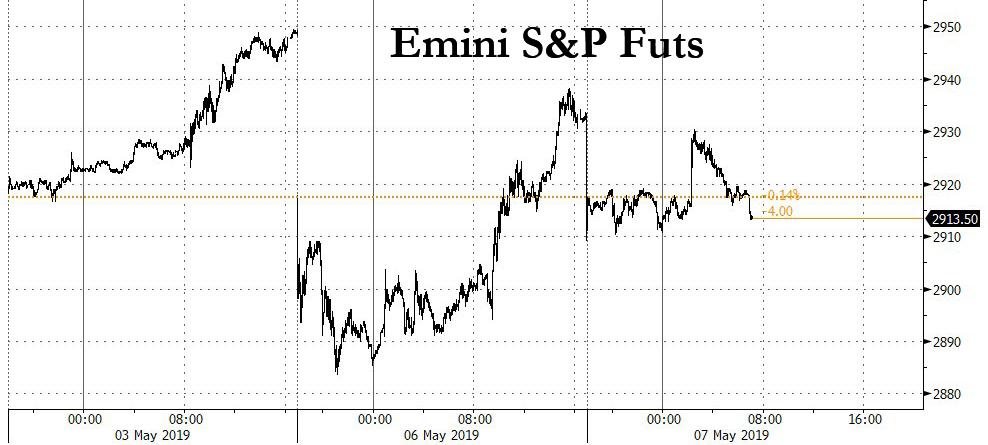

Futures on the S&P 500 index retreated even as China confirmed its vice premier would attend trade talks in Washington this week; the report sparked a brief 15 point spike earlier in the session which however was quickly faded.

To be sure, the drop could be worse, but many investors continue to hope that the tariff threats are a negotiating tactic, especially as Beijing confirmed its top negotiator, Vice Premier Liu He, would go to Washington on Thursday and Friday as planned.

“We expect the situation to de-escalate as the issue seems solvable and Liu He, China’s lead negotiator, is continuing with his plans to travel to Washington D.C. for talks this week,” said Oxford Economics economist Louis Kuijs. “Nonetheless, the probability of renewed escalation of the U.S.-China trade war has risen substantially, which would be a drag on their respective economies, especially on China.”

Earlier in the session, Asian stocks edged lower, led by industrial and technology firms, after slumping on trade tensions Monday. MSCI’s broadest global and Asian indexes had largely held their ground overnight, though Japan’s Nikkei did take a delayed 1.5 percent hit, having been closed for over a week. Markets in the region were mixed, with China advancing and Japan and South Korea retreating. The Topix fell 1.1% as Japanese traders returned from a long holiday break. Murata Manufacturing Co. and Komatsu Ltd. were among the biggest drags. The Shanghai Composite Index rose 0.7%, driven by Foshan Haitian Flavouring & Food Co. and Shanghai International Airport Co. The S&P BSE Sensex Index fluctuated, with a rally in Housing Development Finance Co. countering Reliance Industries Ltd.’s decline. Read more about stocks in Japan here, China here and India here. Asia Picks Up the Pieces After Trade Sell-off: Taking Stock

In FX, the euro erased an advance after German factory orders rebounded less than economists’ forecasts in March; bonds in the region rose.

Earlier, Australia’s dollar jumped and government bonds fell after the central bank kept its benchmark interest rate at a record-low 1.50% for the 30th consecutive meeting. RBA Governor Philip Lowe says in statement Tuesday that “The Board judged that it was appropriate to hold the stance of policy unchanged at this meeting. In doing so, it recognized that there was still spare capacity in the economy and that a further improvement in the labor market was likely to be needed for inflation to be consistent with the target. Given this assessment, the Board will be paying close attention to developments in the labor market at its upcoming meetings.” According to the RBA , falling property prices — Sydney down 14.5% from 2017 peak — are prompting households to rein in spending as consumption accounts for nearly 60% of GDP. Reflecting that, economic growth slowed to an annualized 1% in the second half of last year from almost 4% in the first six months.

Also overnight, the Swedish krona was caught in choppy trade following contrasting headlines from the minutes of a Riksbank review.

Over in China, the yuan had recouped most of its early losses against the dollar by the end of trading there as investors largely digested the situation. The offshore yuan clawed as high as 6.7628 per dollar at one point, trimming the intraday loss to 6 pips from the previous late night close of 6.7622.

However, the highlight of the overnight session was once again the Turkish lira, which was back under heavy fire after the country’s elections board ruled to scrap and re-run Istanbul elections. It slid 1.5% past the 6.15 per dollar which also sent government bonds tumbling.

“The rule of law is under scrutiny by markets,” UniCredit EM FX strategist Kiran Kowshik said. “It is also clear that Turkish reserves are depleted and there are questions about whether Turkey can weather its immediate challenges without an external anchor like the IMF.”

In overnight central bank news, Fed’s Kaplan (Non-Voter. Dove) said he would currently stand pat and doesn’t see a need to lower rates to address inflation, while he added that he doesn’t have a bias for the direction of the next rate move. Furthermore, Kaplan said he has been trying to flag issue of risky corporate debt which could be a burden on the economy in a downturn and is concerned global growth is decelerating.

In the commodity market, oil futures traded steady to higher on Tuesday as U.S. sanctions on crude exporters Iran and Venezuela kept supply concerns alive, while the Trump administration dispatched warships to the Middle East in a warning to Iran.

Today we get the JOLTS and consumer credit data, while Allergan, Emerson Electric, Ferrari, Sprint, and Lyft are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.4% to 2,922.25

- STOXX Europe 600 down 0.3% to 385.68

- MXAP down 0.1% to 160.85

- MXAPJ up 0.3% to 531.93

- Nikkei down 1.5% to 21,923.72

- Topix down 1.1% to 1,599.84

- Hang Seng Index up 0.5% to 29,363.02

- Shanghai Composite up 0.7% to 2,926.39

- Sensex down 0.04% to 38,583.72

- Australia S&P/ASX 200 up 0.2% to 6,295.68

- Kospi down 0.9% to 2,176.99

- German 10Y yield fell 1.7 bps to -0.011%

- Euro up 0.01% to $1.1200

- Italian 10Y yield rose 1.8 bps to 2.208%

- Spanish 10Y yield fell 2.3 bps to 0.961%

- Brent futures down 0.9% to $70.57/bbl

- Gold spot little changed at $1,281.23

- U.S. Dollar Index little changed at 97.53

Top Overnight News from Bloomberg

- China’s top trade negotiator Liu He will visit the U.S. this week for trade talks, in a sign its leadership is battling to keep negotiations on track after President Donald Trump ratcheted up pressure with plans to raise tariffs on Chinese goods Friday

- The Federal Reserve is further amplifying its warnings about the perils of risky corporate debt, saying in a Monday report that the market grew 20 percent last year and that lending standards continue to slip.

- German factory orders rose for the first time in three months in March, though the increase was smaller than economists forecast and marks only a partial recovery from a recent slump.

- President Donald Trump’s top trade negotiator said the U.S. plans to raise tariffs on Chinese goods on Friday, accusing Beijing of backpedaling on commitments it made during negotiations

- Chinese stocks saw muted gains after Monday’s $487 billion rout. The Shanghai Composite Index added 0.3 percent at the midday break after losing 5.6 percent Monday

- U.S. interest rates are “in the right place” and don’t need to be lowered, although weak inflation merits close watching, according to Robert Kaplan, president and CEO of the Federal Reserve Bank of Dallas

- Turkey ordered a re-run of mayoral elections in Istanbul, overturning a rare defeat for President Recep Tayyip Erdogan and threatening long-term damage to the country’s democracy and economy

- Iran signaled Monday that it may scale back some commitments made as part of the 2015 nuclear deal in response to tightening U.S. sanctions, a move that could escalate tensions after the Trump administration deployed an aircraft carrier to the Gulf

- Iron ore rallied after Brazilian mining giant Vale SA’s operations were hit by fresh disruption, with a local court reversing a decision that had allowed operations at a key mine to resume and the company scaling back expectations for 2019 sales volumes

- Treasury Secretary Steven Mnuchin refused to release President Donald Trump’s personal and business tax returns, setting up what could become one of the biggest legal showdowns between the president and a Congress seeking to investigate him.

Asian equities traded mixed as sentiment remained at the whim of the ongoing US-China trade uncertainty with Nikkei 225 (-1.5%) and KOSPI (-0.9%) the underperformers on return from holiday closures as they got their first opportunity to react to US President Trump’s tariff threat. Nonetheless, there was no lack of success stories in Japan with Sony among the biggest gainers after having waited through a 10-day closure to finally benefit from a return to profit in Q4 and with SoftBank boosted as it considers an IPO for its USD 100bln Vision Fund. ASX 200 (+0.2%) was positive with the index led by strength in mining names and after mostly encouraging Trade Balance and Retail Sales data, while some participants were also hopeful for a rate cut by the RBA although this failed to materialize and subsequently saw the index give back some of the gains. Hang Seng (+0.5%) and Shanghai Comp. (+0.7%) nursed some of the prior day’s sell-off in which the mainland bourse had dropped nearly 6% due to the heightened trade tensions. Furthermore, the recovery also followed a substantial rebound on Wall St after reports that the China delegation will still travel to Washington D.C. provided a glimmer of hope, although this was later clouded after-hours as US Treasury Secretary Mnuchin and Trade Representative Lighthizer confirmed a deterioration in negotiations and that tariffs will be increased if there is no agreement by Friday. Finally, 10yr JGBs were higher as the risk-averse tone in Tokyo spurred demand government bonds and with the BoJ also present in the market for JPY 940bln of JGBs.

Top Asian News

- Lira Bears Out in Force as Vote Re-Run Ramps Up Political Risk; Credit Agricole Sees Lira Weakness Leading to Tighter Policy

- China Stocks See Muted Gains From Monday’s $487 Billion Rout

- Saudi Aramco Said to Give Extra Oil to Crude-Hungry Asian Buyers

- Malaysia Joins Asia Easing Cycle With Quarter-Point Rate Cut

Major European indices are broadly in the red, and after drifted lower as the day has advanced [Euro Stoxx 50 -0.6%] in spite of risk sentiment receiving a boost prior to the cash open when China announced that Vice Premier Liu He is to attend trade talks in the US on the 9th & 10th of May. The FTSE 100 (-0.2%) is mildly lagging its peers as UK markets return from a bank holiday, and as such are reacting to the US-China trade updates; although, downside in the index is limited by the likes of Vodafone (+1.4%) and AstraZeneca (+1.5%) in the green after making a deal with Telefonica Deutschland (+2.2%) and announcing that their Phase 3 Calquence study achieved its primary endpoints respectively. Sectors are similarly mixed with energy names down in tandem with the oil complex, and notably the auto sector is once again in the red dragged down by heavyweight BMW (-1.0%) post-earnings. Following the Co. posted Q1 EBIT significantly lower than the prior levels and that the Co. have set aside EUR 1.4bln for anti-trust provisions after the Co. were previously warned of a significant charge resulting from an EU probe into collusion over delaying the implementation of cleaner-emissions cars. Other notable movers this morning include, AB Inbev (-0.1%) who at first fell around 1% at the open due to a slight miss on Q1 revenues and stating that short term dividend growth will be impacted deleveraging commitments. However, Co’s shares subsequently retraced much of this downside after stating that they are considering the IPO of their Asia-Pacific unit in Hong Kong, which could reportedly value the business at up to USD 40-70bln. In contrast, Infineon (-0.3%) initially moved higher by around 1.3% but gave up much of this surge as the Co. initially posted a beat on Q2 revenues but did emphasise that the market environment remains competitive.

Top European News

- UniCredit Is Preparing for Possible Exit From FinecoBank

- Vodafone Seeks EU Nod for German Deal With Telefonica Pledge

- German Factory Orders Rebound Less Than Forecast After Slump

- Niel Agrees to $3 Billion of Phone Tower Sales to Cellnex

In FX, Aud/Usd is firmly back above 0.7000, albeit off overnight recovery highs circa 0.7050, while Aud/Nzd remains nearer the top of its range (1.0640+) having reclaimed 1.0600 status from a low of 1.0575 ahead of the eagerly awaited RBA policy meeting. In sum, the OCR was maintained at 1.5% and the accompanying statement struck a less dovish tone than most were anticipating as rate expectations were finely balanced between 51% for on hold and the remainder predicting a 25 bp ease. However, the Bank reiterated that strength in the labour market outweighed weakness in wages and inflation, supporting the decision to stand pat again and monitor data/economic developments (domestic and external). Conversely, Nzd/Usd has drifted back down towards 0.6600 as the spotlight switches to the RBNZ amidst even greater expectations that an ease is in the offing – see the Ransquawk headline feed for a more detailed preview.

- SEK/NOK – The next best performing G10 currencies as the Swedish Krona rebounds from recent lows vs the Euro through 10.7000 on a broad stabilisation in risk sentiment and despite Riksbank minutes reaffirming the more dovish shift at the last policy meeting. Similarly, the Nok has pared losses to trade back above 9.7500 against the Eur and the backdrop of steadier oil prices.

- EM – The Cnh is consolidating off Monday’s lows around 6.7750 vs 6.8000+ in wake of reports that China’s Vice Premier Lui will attend the next round of trade talks in Washington and the perception if not reality that his presence improves the chances that an agreement will be reached in time to avoid the 25% tariffs on a further Usd200 bn goods threatened by US President Trump over the weekend. However, this has not done much to lift the gloom for the Try as the Istanbul rerun is not due until June 23 and as such the uncertain domestic political scene will remain for another 1 1/2 months at least. The Lira has consolidated off a 6.2000 base vs the Dollar, but Turkish assets are still underperforming and looking vulnerable.

- GBP/EUR/JPY/CAD – All relatively flat vs. the buck as news-flow somewhat slowed in EU trade, albeit Brexit remains in the background with Labour leader Corbyn not partaking to today’s cross-party talks, whilst PM May is speculated to receive her departure date before the 1922 committee. Sky News’ Rigby did however note that prospects have increased for a cross-party deal, citing a Cabinet source. Cable largely was unreactive to a technical speech by Cunliffe on post-Brexit financial stability. GBP/USD remains below the 1.3100 handle (having fallen below its 50 DMA around the figure), with the next technical at its 100 HMA at 1.3077. Elsewhere, the single currency remains just around the 1.1200 level, with the European Commission Spring Forecast pushed back to around 11:30BST due to an earlier speech by the Commission’s President. The focus of the release will be Italy as press reported that the EC may warn of widening Italian budget deficit to 2.6% of GDP, above the government’s forecast of 2.4%. Moving on, the Loonie straddles just below 1.3500 vs. the Greenback ahead of Ivey PMIs later. Elsewhere, JPY remains sub-111 vs. the Buck, holding onto most of its post-Trump risk premia ahead of further trade talks this week with Vice Premier Liu He now attending, signalling high-level talks. USD/JPY remains flat around 110.50 with around 1.3bln in option expiries around 110.00-40.

In commodities, Brent (-0.6%) and WTI (-0.4%) prices are somewhat subdued, but have been relatively steady and are currently trading within a very narrow USD 1/bbl range this morning. News flow for the complex has been relatively light, with prices largely moving in-line with the US-China driven sentiment. However, there were reports that Israel has provided the White House with intelligence regarding a potential Iranian plot to target US interest in the Gulf. Looking ahead, we have the API weekly inventory report with expectations for crude inventories to increase by 2.5mln barrels; additionally, the EIA are releasing their Short Term Energy Outlook, where they previously forecast that the US crude oil production is to average 12.4mln BPD in 2019 and 13.1mln BOD in 2020. For reference, EIA weekly crude production stood at 12.3mln BPD in last week’s release. Gold (U/C) prices are largely unchanged on the day, with the safe haven selling off slightly following China stating that Vice Premier Liu He is to attend trade talks in the US. With the yellow metal still holding firm above the USD 1280/oz level, currently around USD 1281/oz. Elsewhere, Vale state that the Brucutu mining complex has stopped operations due to a court decision; follows on from a prior lower court decision which had stated that mining activities could resume.

US Event Calendar

- 10am: JOLTS Job Openings, est. 7,350, prior 7,087

- 3pm: Consumer Credit, est. $16.0b, prior $15.2b

DB’s Jim Reid concludes the overnight wrap

Since we last spoke, I’ve lugged about 200 boxes up and down stairs, spend most waking hours unpacking them or stopping three young children and a dog from doing so, had 4 water leaks (including one sewage leak into our new larder cupboard and thus ruining it and the food of course!), co-habited daily with about 50 builders/decorators/plasterers/plumbers/electricians/landscapers, etc., which wasn’t part of the plan, watched four new episodes of Game Of Thrones (anyone see the Starbucks cup accidentally left in a scene in this week’s?), have thrown a cushion at Lionel Messi on the TV, cursed Man City, had lots of medicinal de-stressing glasses of wine, and for the first time on holidays in my career have hardly looked at financial markets. Yesterday was a bank holiday in the UK and little Maisie was really upset as there was no builders in the house for the first day since moving in two weeks ago. She was really worried about them and was a bit tearful when we said that they wouldn’t always be living with us. Well I don’t think they will be always living here but a glance at the new house suggests that it might be a while yet!

So back at work and after going on holiday before Easter believing that the US/China trade deal was more a matter of when not if, clearly since Sunday all this has changed. Inevitably market action yesterday was dominated by the dramatic trade headlines, initially sparked by President Trump’s Sunday tweet threatening an escalation in tariffs against China. Equity markets sold off across the world, though sentiment improved throughout the US session, helping stocks close off their lows. The S&P 500, NASDAQ, and DOW had opened -1.61%, -1.78%, and -2.23% lower, respectively, but ultimately rallied to end the session only -0.44%, -0.50%, and -0.25% lower. That partially reflected improving news flow that suggested trade talks will continue this week with the Chinese delegation still flying to Washington, as opposed to being cancelled as initially feared.

The real carnage was in Asia yesterday, where the Shanghai Composite fell -5.58% for its worst day since February 2016. This morning it is recouping a small amount of those declines (+0.32%). The Hang Seng is also up +0.16% a touch after falling -2.90% yesterday while the Nikkei (-1.18%) and Kospi (-1.08%) are both down as they have re-opened after holidays. China’s onshore yuan is down -0.18% this morning to 6.7781. In terms of data releases, Japan’s final April manufacturing PMI came in at 50.2 vs. a preliminary reading of 49.5 and last month’s 49.2

Overnight trade headlines have continued to pour in with the US Treasury Secretary Mnuchin saying that China sent through a new draft of an agreement over the weekend that included them pulling back on language in the text on a number of issues, which had the “potential to change the deal very dramatically.” He added that “we are not willing to go back on documents that have been negotiated in the past.” USTR Robert Lighthizer though said last night that the trade talks will continue and a Chinese delegation will visit Washington on Thursday and Friday. He also confirmed that the tariff hike will proceed this Friday, though he did not say if or when the additional tranche would be applied. He also said, in a confirmation of earlier unconfirmed reports, that President Trump announced the tariffs in response to the Chinese team’s apparent backtracking on prior commitments, specifically regarding their promise to change Chinese law as part of the trade deal in order to better protect foreign investors and intellectual property holders. On the other side, China’s Global Times reported in its editorial today that China is “well prepared for other potential outcomes” of its trade talks with the US, “including a temporary breakdown in talks,” while adding that even if the negotiations break down and Washington comprehensively raises tariffs, that does not mean the door to talks is closed.

The situation is still fluid, but DB’s economists have outlined their views on the likely course of events and possible macro and market implications in a series of notes published yesterday. First, our China team outlined their views here . They think China is unlikely to back down, as recent experience suggests: 1) the cost of the tariffs is borne by US consumers, 2) China’s economy has stabilised and therefore lowers the risks of a harsher impact, and 3) previously, the US administration has responded to market sell-offs by moderating their tone. The rest of our Asia macro team outlined the associated implications for the rest of the region here . If the trade war escalates, they expect currencies across the region to weaken versus the dollar. Lastly, our US economics team published their views here . They think that, on balance, tariffs could certainly be raised this week as threatened, but they are unlikely to be followed by further major escalation. They note that the impact of a broader row would have significant implications, however.

Back to yesterday and the sectors most exposed to China led losses in developed markets, with US semiconductor stocks down -1.72% and indices of materials firms down -1.38% and -1.19% in the US and Europe. Volatility surged, with the VIX index rising as much as +5.93pts, which would’ve been its biggest spike since December, but it ultimately retraced to end only +2.44pts higher at a fairly contained level of 15.31pts.

Safe havens rallied, with treasury and bund yields falling -2.9bps and -1.9bps. Those moves might have been somewhat cushioned by healthy economic data in Europe, where the composite PMI for April was revised up 0.2pts to 51.5. The improvement was driven by upgrades in Germany and France, as Spain and Italy saw marked deterioration. The FTSE MIB lagged, falling -1.63%, while the IBEX fell -0.84%, in line with the STOXX 600, which fell -0.88%. Yields on BTPs rose +1.8bps while the other major bond markets in Europe all rallied. The Turkish lira fell -1.93% after Turkey’s national election commission ordered a re-run of mayoral elections in Istanbul, overturning a rare defeat for President Erdogan.

After the Fed drove market action last week, there was some attention paid to Philadelphia Fed President Harker’s speech yesterday, but he ended up reiterating Powell’s prior comments in a pretty uneventful way. He said that the softer inflation appears transitory and that he continues to envision one more hike this year, at most. Elsewhere, the Fed’s Kaplan (non-voter) said overnight that the US interest rates are “in the right place” and don’t need to be lowered, although weak inflation merits close watching. On revival of trade tensions he said that the US-China trade war isn’t having a major impact on the US economic growth, though he warned that businesses are being forced to reconsider supply chain and logistics operations with some of them seeking alternative arrangements in South-East Asia and Mexico instead.

As mentioned above, we had final European services and composite PMIs yesterday, which were a shade better than expected. The Euro Area composite print was revised up +0.2pts to 51.5 while the services reading was up +0.3pts to 52.8. Germany’s and France’s composite readings were up +0.1pts each to 52.2 and 50.1, respectively. Italy’s and Spain’s composite prints came in below expectations, however, at 49.5 and 52.9, down -2.0pts and -2.5pts, respectively, from March. That tips Italy’s reading back into contractionary territory for the fifth time in the last seven months.

Other data yesterday included the Euro Area’s Sentix investor confidence survey, which rose to 5.3 from -0.3. That’s the first positive reading since November. Retail sales were also flat on the month in March, versus expectations for a -0.1% mom decline, and the prior month was revised +0.1pp higher. In the US, there were no major data releases, but the Fed did release its Senior Loan Officer Survey, which showed easing credit standards for mortgage loans as well as corporate and industrial loans. Credit card standards tightened a bit, but on net it was a positive report.

Turning to a recap of last week and rest of the week ahead now given that the UK was out yesterday. The highlight on Friday was the US jobs report, which showed yet another example of robust growth but tepid inflation pressure. Bond yields fell and equity markets rallied, with most US indexes returning to near their levels of Wednesday afternoon before the Fed-inspired swoon. On the week, the S&P 500 and NASDAQ finished +0.20% and +0.22% higher (+0.96% and +1.58% Friday), while the DOW fell -0.14% (+0.75% Friday) on some poor earnings reports. Cyclical sectors led gains, with the NYFANG index up +2.30% (+1.88% Friday) and bank stocks rallying +1.41% (+0.68% Friday). In Europe, the STOXX 600 retreated -0.16% on the week (+0.39% Friday) and the DAX outperformed, up +0.79% (+0.55% Friday). Treasuries ultimately ended up +2.7bps (-1.6bps Friday) while bunds rose +4.7bps (-0.5bps Friday). Despite a brief move near 16 earlier in the week, the VIX retraced to return to sub-13 levels, ending the week +0.2pts (-1.5pts Friday). The dollar retreated -0.54% (-0.37% Friday) as the euro strengthened +0.48% (+0.29% Friday). Emerging markets held up well, with currencies gaining a slight +0.04% (+0.50% Friday) and equities up +0.77% (+1.19% Friday).

via ZeroHedge News http://bit.ly/2PSYEGJ Tyler Durden