The US labor market continues to grow at a blistering pace.

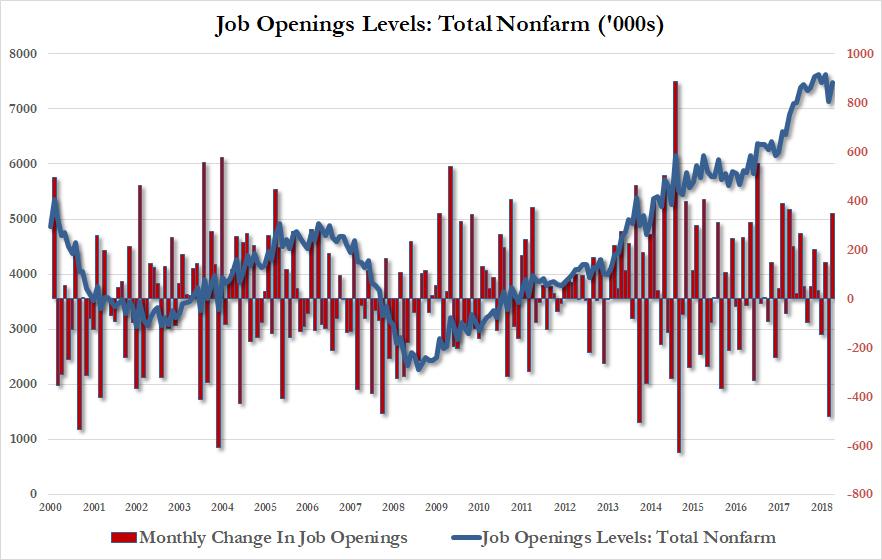

After the Job Openings and Labor Turnover Survey (JOLTS) reported record prints for virtually every notable labor market series for January, followed by a modest slowdown in February, there was another impressive higher across most labor market indicators in March. According to the BLS, after an upward revision to the February job openings from 7.087MM to 7.142MM, in March this number surged by a whopping 346K to 7.488 million, the fourth highest number of job openings on record.

According to the BLS, the number of job openings increased for total private (+363,000) and was little changed for government. Job openings increased in a number of industries, with the largest increases in transportation, warehousing, and utilities (+87,000), construction (+73,000), and real estate and rental and leasing (+57,000). Job openings decreased in federal government (-15,000).

More notably, February was the 13th consecutive month in which there were more job openings then unemployed workers: in fact, considering that according to the payrolls report there were 7.488 MM unemployed workers, there was a record 1.664 million more job openings than unemployed workers, (how accurate, or politically-biased the BLS data is, is another matter entirely).

In other words, in an economy in which there was a perfect match between worker skills and employer needs, there would be zero unemployed people at this moment (of course, that is not the case.)

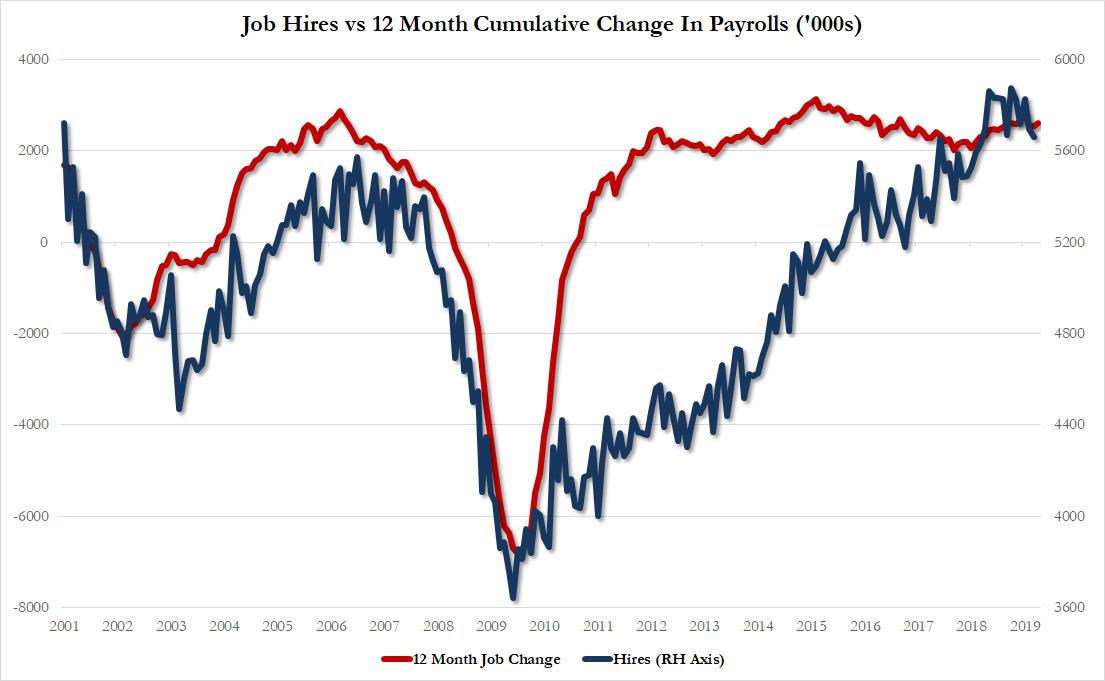

And yet, there was some disappointing aspects to the report: while job openings soared, the number of hires declined for a second consecutive month, dropping by 35K, to 5.660 million, following a 134K drop in February, and the lowest since last March. The hires level hires level was little changed for total private and fell for government.

According to the historical correlation between the number of hires and the 12 month cumulative job change, the pace of hiring right now is precisely where it should be relative to the cumulative change in hiring.

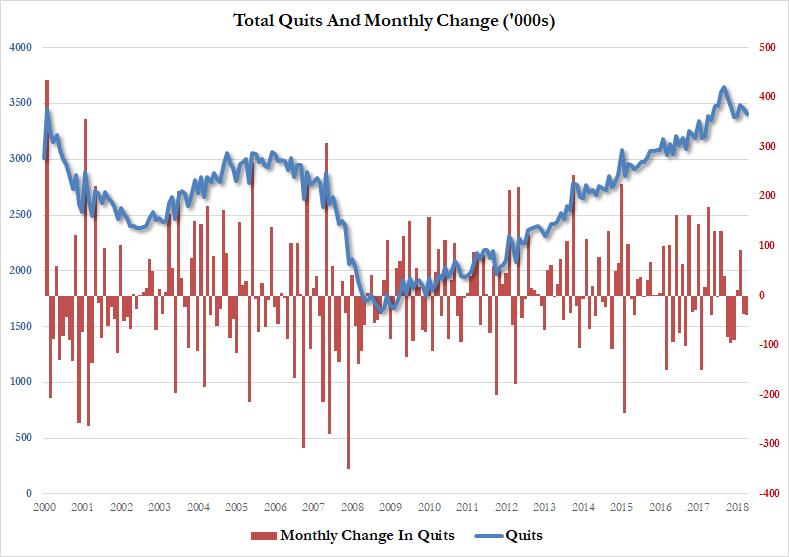

At the same time, another adverse trend emerged in the so-called “take this job and shove it indicator” , i.e., the total level of quits, which shows worker confidence that they can leave their current job and find a better paying job elsewhere, it also declined for a second consecutive month, dropping by 38K to 3.490MM.

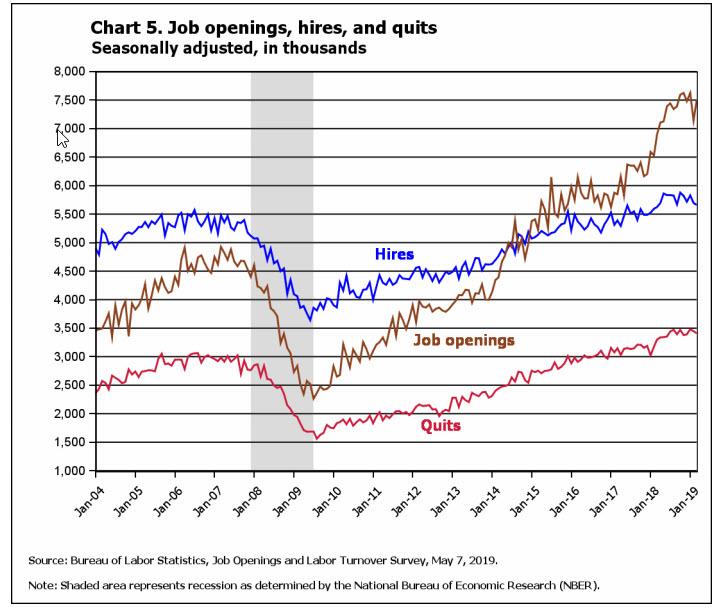

Putting this all in context:

- Job openings have increased since a low in July 2009. They returned to the prerecession level in April 2014 and surpassed the prerecession peak in August 2014. There were 7.5 million open jobs on the last business day of March 2019.

- Hires have increased since a low in June 2009 and have surpassed prerecession levels. In March 2019, there were 5.7 million hires.

- Quits have increased since a low in August 2009 and have surpassed prerecession levels. In March 2019, there were 3.4 million quits.

- For most of the JOLTS history, the number of hires (measured throughout the month) has exceeded the number of job openings (measured only on the last business day of the month). Since January 2015, however, this relationship has reversed with job openings outnumbering hires in all months.

- At the end of the most recent recession in June 2009, there were 1.1 million more hires throughout the month than there were job openings on the last business day of the month. In March 2019, there were 1.8 million fewer hires than job openings.

And visually:

via ZeroHedge News http://bit.ly/2JnTXUs Tyler Durden