Well that re-escalated quickly…

A small bounce in China did nothing to lipstick that pig…

European stocks were ugly as various data and forecasts disappointed…

And Bund yields dropped back below zero…

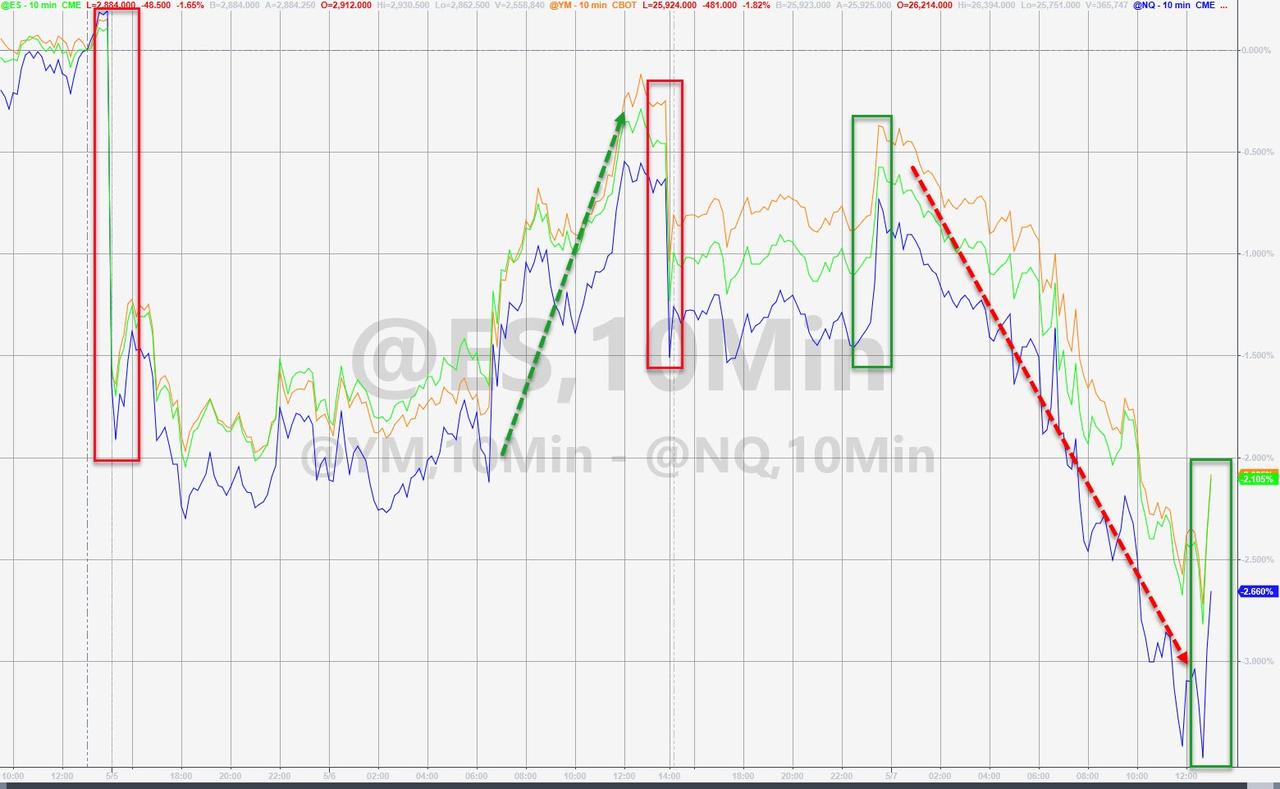

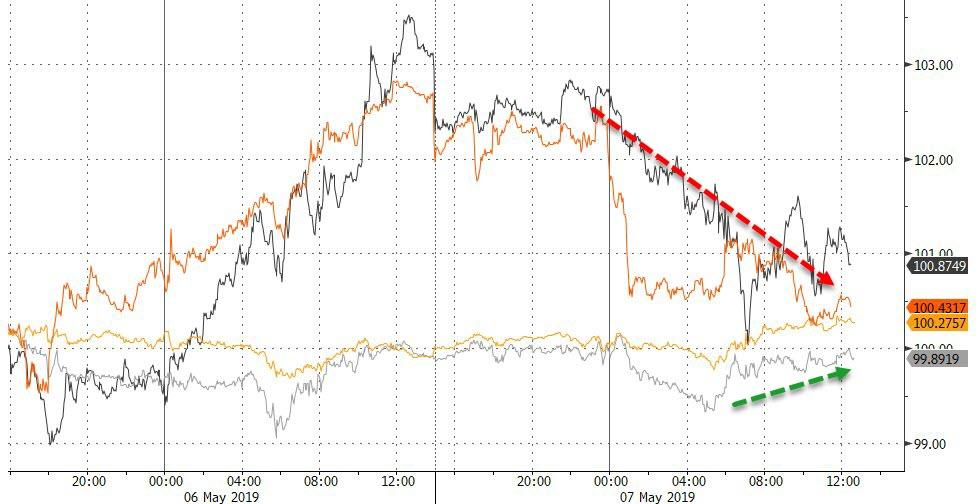

And then there was ‘Murica! Futures dumped right after the bell on Lighthizer confirmation of increased tariffs, then spiked during the EU session on headlines that China VP Liu would make it to DC, but that didn’t last long as yet another dead-cat-bounce died… The machines went panic-bid into the close

In cash markets, Trannies lead the collapse on the week but Nasdaq was ugly today…The Dow was down 648 points at the lows of the day…

Today was The Dow, S&P and Nasdaq’s biggest daily point loss since 2018

While the S&P held above its 50DMA, Dow broke and closed below its 50DMA – the first close below it since Jan 15th…

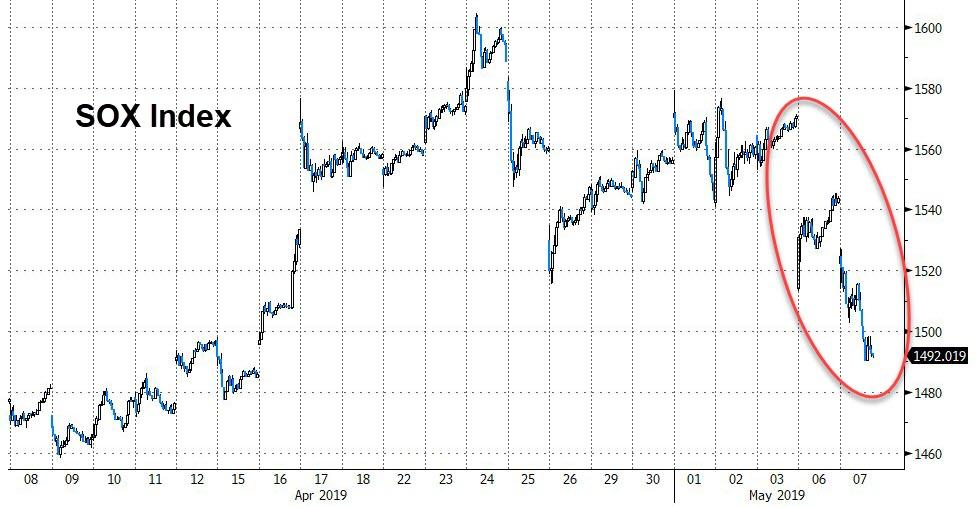

As Semis were slaughtered…worst day since the start of 2019…

As Nomura’s Charlie McElligott shows in this stunning intraday chart, the magnitude of the excess Futures notional of S&P, Nasdaq and Russell above the combined Cash notional (and adjusting ‘roll’ days, defined as the first future traded notional-second fut traded notion) is supportive of the view that today’s trade is absolutely driven by futures deleveraging…

…And perhaps indicative that this is indeed both the 1) Asset Manager monetization of “Longs;” 2) our estimate that CTA Trend models may be reducing their “Long” (as described in more detail below) and of course 3) dealer Gamma hedging activity.

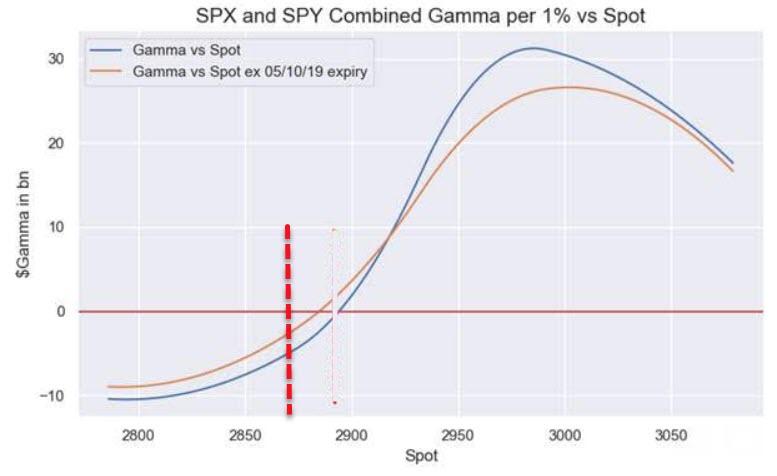

Additionally, McElligott warned, we are now in “negative Gamma” territory in SPX / SPY and QQQ options landscape –

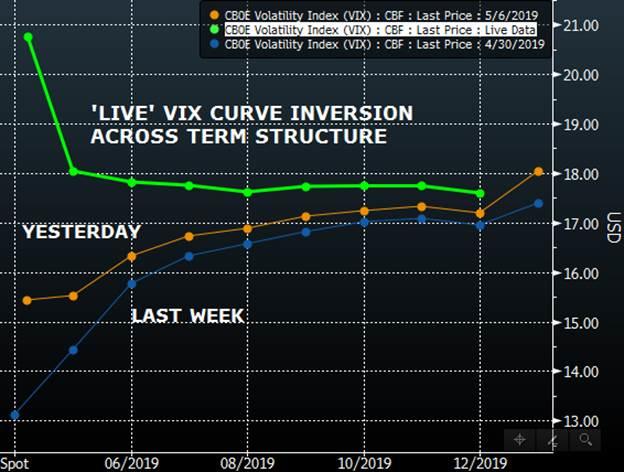

All as the VIX curve inverts and forces “short vega” covering from systematics…

With VVIX really beginning to dance and price some serious “gap” / tail-risk @ 111:

Given the record short positioning…

VIX is notably inverted…

It is not a surprise that VIX is dramatically underperforming credit (although spreads have started to crack wider)…

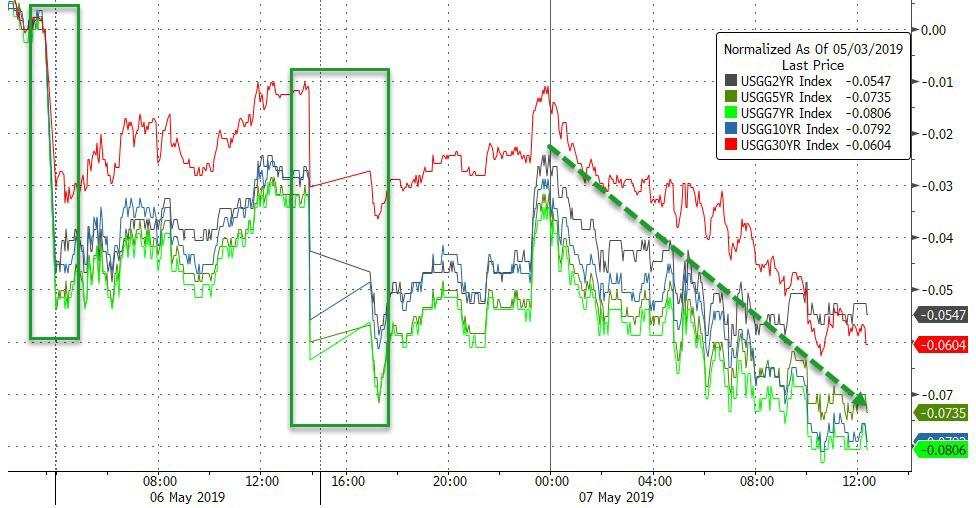

Treasury yields tumbled intraday…

With 10Y Yields back at their lowest since April 1st…

And the yield curve flattened… with 3m10Y spread back near inverted…

The market’s expectations for rate-moves this year shifted dovishly today as stocks fell – dropping to a 30bps rate cut…

The dollar index managed modest gains on the day, once again in demand overnight…

Cryptos were extremely noisy today with a broad-based sell program hitting this morning…

As Bitcoin twice tried for $600, and was rejected…

PMs were higher, crude and copper lower on the day…

Finally, a reminder from BMO’s Brad Wishak highlighted, the world’s favorite (and also largest) index to completely ignore is flashing another negative divergence here…the exact same divergence that kicked off the the fall equity slide lower.

Back in SEP the SPX pushed to new all time highs while the NYSE did not, flagging the initial divergence. Just last week, the SPX again made fresh all time highs with the NYSE again NOT confirming.

Is it different this time?

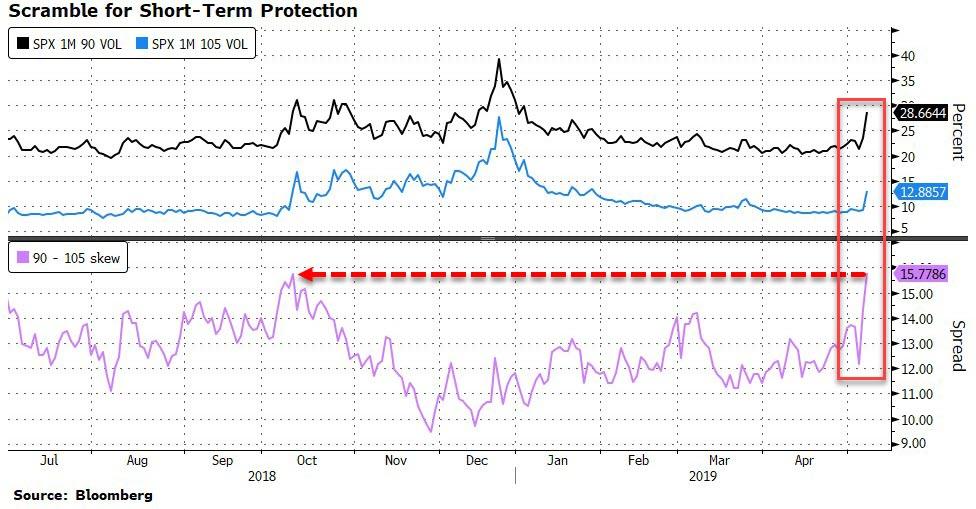

Not according to options traders as Bloomberg reports that a growing cohort of investors is betting the worst is yet to come.

Demand for protection against more losses over the next month is higher than at any time during the fourth-quarter rout that almost ended the bull market, going by relative levels of implied volatility on S&P 500 options. The derived price for one-month puts that pay off if the S&P 500 falls 10 percent below its current level has soared compared to the cost for calls that would pay out if the benchmark gauge rose 5 percent in that time.

“This is an event being priced in the very near term that didn’t exist just a few days ago,” said Pravit Chintawongvanich, Wells Fargo’s equity derivative strategist, who emphasized that the reaction in very near-dated options was disproportionately large relative to longer-dated options.

“Vol is well bid, and it makes sense given we suddenly got a 2 percent move out of nowhere.”

We leave you with a new hope…

Help us Larry Kudlow, you’re our only hope pic.twitter.com/YJRThFBZZZ

— Quoth the Raven (@QTRResearch) May 7, 2019

via ZeroHedge News http://bit.ly/2H7pnwI Tyler Durden