Oil rallied overnight from a five-week low as concern over supply losses from Iran to Russia overrode an API-reported rise in American stockpiles and trade-war fears.

“There are concerns about the broad economic environment,” said Michael Tran, a commodity strategist at RBC Capital Markets LLC in New York. “Clearly, the biggest risk to the oil market right now is the Trump factor coupled with macro headwinds.”

After last week’s surprisingly large crude build, all eyes are on this week’s data for hints at whether the extreme long positioning in the energy complex will be squeezed any further.

API

-

Crude +2.81mm (+1.2mm exp)

-

Cushing +618k

-

Gasoline -2.833mm

-

Distillates -834k

DOE

-

Crude -3.96mm (+1.9mm exp)

-

Cushing +821k

-

Gasoline -596k

-

Distillates -159k

After the prior week’s huge build, crude stockpiles were expected to build modestly (as API reported) but instead crude saw a large drawdown (3.96mm) and gasoline and distillates also drewdown.

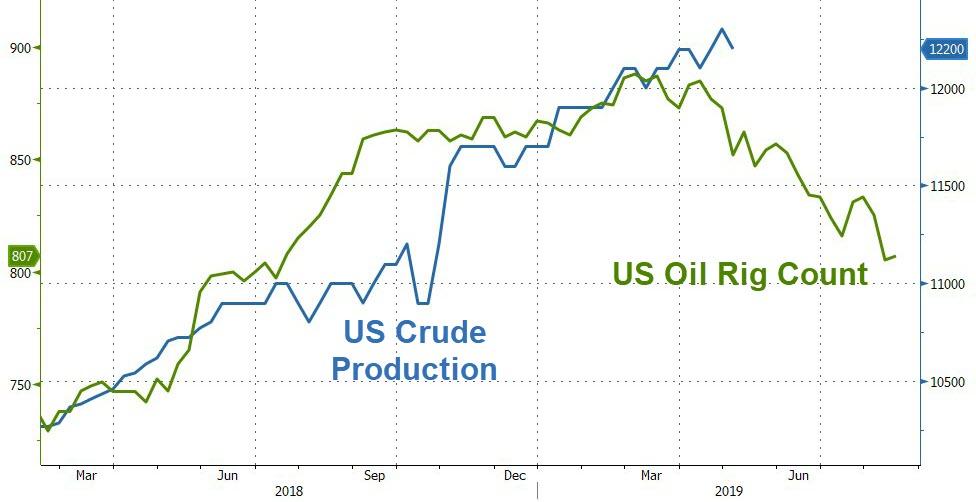

The rig count continues to drift lower (with a lag) as production hits record highs…but rolled over very modestly last week.

WTI hovered around $61.50 ahead of the DOE print, and popped near $62 as the DOE data hit…

“We have a great divergence in the making,” with timespreads in Brent and Dubai crude soaring but flat prices falling, Energy Aspects chief oil analyst Amrita Sen wrote in a note.

“This is perhaps the widest divergence we have ever seen between the strength in the physical markets and the weakness in flat price.”

Bloomberg Intelligence Senior Energy Analyst Vince Piazza sums up the situation in the energy complex:

“We affirm our more cautious view on oil, with trade tensions resurfacing and concerns about slowing global economic growth. U.S. output remains resilient. Tensions in Libya have constrained volume, and chaos in Venezuela has diluted flows as well, while sanctions against Iran will artificially remove barrels from the market. Our takeaways from conference calls highlight less capital restraint than expected in 1Q, while production growth will moderate.

We sense OPEC and its partners will struggle in 2H for consensus on maintaining volume curbs and tighter balances. Sentiment continues to weigh slightly bearish in our view.”

via ZeroHedge News http://bit.ly/2JaLVim Tyler Durden