For months on end, world stocks rallied each and every day on the constant and familiar drumbeat, not to mention flashing red headlines, of “optimistic” trade news, favorable “leaks” by officials and predictions by the media citing “sources familiar” that a trade deal with China was imminent… Instead, as we reminded readers periodically, it was all a lie and absent a last minute miracle, Trump is set to hike tariffs on Chinese imports from 10% to 25% in roughly 12 hours.

And as Wall Street, which until this weekend was naively convinced that the trade war with China is now a thing of the past (only yesterday did Goldman make a Friday tariff hike its base case), faces the stark reality that it was embarrassingly unprepared for what happens next, Wall Street analysts – who by and large failed to predict the events of this week – are now confident that what has until now been a painful if orderly retreat in U.S. stocks, will mutate into something worse and much more painful if and when all-out “nuclear” trade war erupt between the U.S. and China, threatening the entire 2019 recovery, according to a Bloomberg compilation of sellside predictions, which note that “as Thursday’s ugly open in equities shows, Wall Street is coming to terms with the prospect of higher tariffs being imposed after midnight. Equities that rallied as much as 17.5% this year are down four straight days and headed for the worst week of 2019. Damage estimates are swirling.”

As Bloomberg adds, “all bets are” off as a Chinese delegation arrives in Washington on the heels of President Donald Trump’s fiery rhetoric, just hours before Friday’s deadline on fresh tariffs looming. As a result many money managers are dusting off their safety playbook in earnest, with echoes of tumult in 2018. “We tactically added to Treasuries on the back of trade wobbles,” said TwentyFour Asset Management CEO Mark Holman. He’s “holding off credit” and sticking to less volatile, short-term debt.

So just how is Wall Street preparing for what comes next?

As a new, and much more painful phase, of intercontinental trade war set to break out, Wall Street analysts are building up hedges in everything from Treasuries to deep out of the money options, while advising clients to get out of carmakers, and resist credit and emerging markets ahead of what many expect to be a rout , which has already wiped out some $2 trillion in market cap from global stocks, while halting the bubbling melt-up across risk assets along the way (so much for Larry Fink’s predictions).

As compiled by Bloomberg, here are some other ways in which Wall Street’s analysts are preparing for what comes next.

Derivatives

One strategy is that that a worst case scenario would generally spare U.S. small caps (even though the Russell just entered a correction) while Chinese stocks tumble more, and there’s a trade to front-run just that. According to Wall Fargo’s Pravit Chintawongvanich, one should buy puts on the China Large-Cap ETF, FXI, while selling them on the Russell 2000 ETF, the IWM.

Selling protective puts on IWM while buying them on FXI can help investors weather brewing tensions in global commerce, according to the strategist.

ETFs

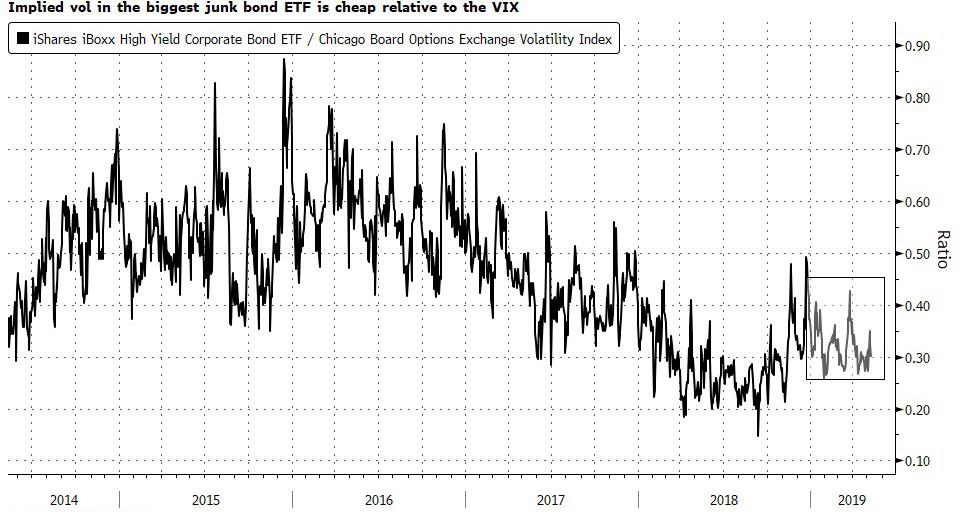

Others focus on cross-asset arbs, and note that the first asset which will likely get hammered is anything with a high beta which tracked stocks higher, namely junkbonds, which would be first on the firing line “should the latest jawboning over commerce assume a more insidious posture.” Yet consider that the implied vol tracking the biggest junk-bond ETF, HYG, which is decidedly lower compared to the VIX, also making it a cheap hedge. As a result, Macro Risk Advisors recommends buying put options on BlackRock’s benchmark product, with the investing strategy reaping fruit if the price of the ETF dips or price swings break out.

Safe Havens

Others are keeping it far simpler, and instead of dealing in derivatives or ETFs – both of which expose you to counteparty risk, something which should not be ignored should trade war go nuclear – are simply buying historical safe havens, such as Treasurys. Indeed, longer-dated bonds have traditionally made the most money during dashes to safety like the current one. Furthermore, in recent months bonds have tended to rally a lot more when risk appetite nose-dives, and they have a canny propensity to stay relatively firm when equities advance.

“For now, our worst-case scenario is a modest correction in global risk assets rather than a full-fledged meltdown,” according to Gaurav Saroliya, head of macro strategy at Oxford Economics. “Even so, the case for maintaining portfolio hedges remains.” TwentyFour asset’s Holman agrees: “We initially thought UST had the chance to creep higher in yield so we sold some 10-year notes,” he said. “But after the U.S.-China talks wobble we bought them back.”

Geographic Safety

An even simpler strategy is to focus on those regions which are relative immune to a global trade war. According to SocGen, while it is still too early to go all-in on America First trades, that may soon change: “The protection for now is back to the U.S.,” said Alain Bokobza, head of global asset allocation at Societe Generale in an interview with Bloomberg TV Wednesday. “These are periods where you go back into U.S., you go back into the dollar, you go back into U.S. equities, which are outperforming the rest. They are falling, but in a lower manner than what happens in China or Japan.”

Crashing Cars

With Europe once again dead center in the firing line if trade war escalates, carmakers in the region, a favorite Trump target, look especially vulnerable. The Stoxx 600 Automobiles & Parts Index has outperformed the broader benchmark by around 3 percentage points this year. That may not last however, according to Citigroup, which suggests buying a put spread on Europe’s automotive sector, in which buyers simultaneously purchase protective options at a strike price of 490 euros while selling contracts with a 460 strike. The structure helps offset the cost of the bearish bet and limits losses. The trade makes sense for investors who expect the index to fall, but not too far. “With the Trump administration in a hawkish mood, we believe SXAP remains vulnerable” Citi concluded.

Submerging Markets

In a replay of mid-2018, when we say various EM indices crumble, Evercore has recommended a put on the iShares MSCI Emerging Markets ETF to hedge against event risk, especially as China now takes up more than a quarter of the index. The trade gains with limited downside risk as long as the price of the fund drops, though returns are capped. And while Evercore still thinks an agreement can be reached – curbing the allure of the investing style – it says the $34 billion ETF remains a hedge-worthy vehicle for trade bears.

Services Good, Goods Bad

Another hedge comes from Goldman, which recommends exposure to services, while shunning goods sectors. Referring to trading last year, Goldman strategist David Kostin writes that”“services-providing stocks will outperform goods-producing stocks as long as the trade dispute continues.” Among the service providers cited are Microsoft, Amazon.com and Berkshire Hathaway; while goods producers include Apple, Johnson & Johnson and Exxon Mobil.

* * *

Finally, courtesy of Bloomberg, here are several snapshots from specific analysts, who while especially bullish until recently, have suddenly turned quite bearish, starting with Ameriprise Financial’s Anthony Saglimbene, who says that the S&P 500 at 2,900 is fair based on the current state of earnings and the economy, but all that could “quickly” go away.

“If we have this global flare up in trade tensions and we actually see more tariffs put on, then I think markets could very quickly give back 5 to 10% very easily,” he said in an interview at Bloomberg’s New York headquarters. “If we get to a point in the escalation where we’re actually slapping tariffs on all Chinese imports and you have China coming back and retaliating through various measures, then I think as quickly as we’ve seen the last four months be positive, we could quickly see that go away. However, the U.S. economy is fairly isolated, it’s a closed economy. We should continue to do OK, but it’s just not a great environment. And really it comes down to profits — profit margins, sales trends, those could all be more serious.”

Beware the Profit Hit: UBS estimates that with higher tariffs and a breakdown in talks, profits for U.S. companies could contract by 5%. With analysts currently forecasting earnings growth of 4.6% for the year, that number would be wiped out. In turn, equities could fall as much as 15%, said Mark Haefele, CIO of UBS Global Wealth Management. Worse, with a 25% tariff rate instead of the current 10% level, gross margins for S&P 500 companies could shrink by 23 basis points, according to Bloomberg Intelligence. If the U.S. administration slaps the tax on all goods from China, the hit to margins could be an even larger 50 basis points.

“China-trade risks have largely been priced out of U.S. equities this year, suggesting any tariff-policy shift is likely to trouble stocks’ bullish trend, in our view,” wrote Bloomberg Intelligence’s Gina Martin Adams and Michael Casper. “Share values of the median S&P 500 companies with China exposure have rallied twice as much as the index this year. While valuations imply investor awareness of complications of selling into China — perhaps a result of slower growth in the region in the past year — trade tension should pressure stocks of companies exposed to higher input costs.”

Beware the downside if no deal is reached: Bank of America estimates that the S&P 500 should end the year around 2,900 and has the potential to rally as high as 3,000 throughout the course of the year. If a deal is reached and some of the existing tariffs are dropped, that could provide a positive catalyst, says Jill Carey Hall, a U.S. equity strategist for Bank of America Merrill Lynch. But if we don’t get a deal, volatility could move higher.

“Bottom line is this is a market where we’ve been expecting higher volatility this year given geopolitics, given the trade backdrop, given the flattening of the yield curve cutting into this year that typically precedes a higher VIX,” she said on Bloomberg Television. “There’s certainly been a healthy amount of optimism priced in around a trade deal, so if we don’t get a deal, we do expect that the market could pull back. We’ve written that we could see a 5 to 10% pullback if trade tensions do escalate into an all out war and the tariffs rise or if we see tariffs on the remaining goods and China retaliates. There’s certainly downside risk that the market may not be fully pricing in.”

Beware a 7% Pullback if support is breached: Miller Tabak + Co.’s Matt Maley is keeping his eyes glued on the technical levels. If one breaks, then the S&P 500 could be headed even lower to the next stop. The result? A minimum of a 7% pullback. As noted earlier, on Thursday morning the S&P already tumbled some 20 points below the 50-day average, although it has since stabilized.

“The odds I suppose are still good that they’ll get some sort of a deal eventually, but the problem is that the market had been pricing in that they would get one signed certainly by June, if not by this week,” he said on Bloomberg Radio. “Since we’re not going to get that, the market was a little bit priced for perfection, I think it’s got more to pull back. If we get through this week and the tariffs do get placed on, the minimum I think is down — everybody’s been talking about the 50-day moving average on the S&P, which it looks like we’ll be testing this morning — I think it could take us down to at least the 200-day moving average, which is at 2,740ish. That would be down about 7% from the highs. I think that’s the minimum we’d see.”

GDP Smash: according to JPMorgan’s chief U.S. economist, Michael Feroli, estimates a higher tariff rate of 25% could reduce 2019 GDP growth by about two-tenths of a percentage point; the real number will certainly be far worse.

“Most economists agree that the trade war is likely to have limited impact on global economic growth, but a large impact on company earnings,” said Dennis Debusschere, head of portfolio strategy at Evercore ISI. “We wouldn’t take comfort in the idea that a limited impact on economic growth would also limit the downside risk to equities.

In any case, if “tariffs are increased at 12:01 AM Friday, the decline in risk assets is likely to intensify and we would not take comfort that it would take two weeks for tariffs to have an impact. The signal of continued escalation is what’s important” the gloomy Evercore prediction concluded.

via ZeroHedge News http://bit.ly/2HaFr0M Tyler Durden