The market may have hit peak absurdity this morning because just hours after another round of US tariffs against China went into effect as some $200BN of Chinese imports saw tariffs hiked to 25% and Beijing vowed it would strike back, world stocks and US equity futures jumped after a volatile overnight session because, as the official narrative goes according to Reuters, “investors held out hopes for a trade deal between the United States and China” even as, as noted above, another round of U.S. tariffs on Chinese goods took effect.

Eager to “explain” the bizarre market (non) reaction, the WSJ went into full blown narrative-building mode, and wrote that stocks shrugged the tariff hike for these reasons:

- Hike was priced in;

- Negotiations are still ongoing;

- This could accelerate agreement.

Then again, not everyone bought this cheap attempt to goalseek a story to market action, and Credit Suisse wrote that “In the short term, a renewed intensification of trade tensions between the United States and China could fuel further volatility and lead to temporary setbacks. Still, we see recent developments as the United States strengthening its negotiating position in order to achieve a better deal, potentially later than expected.”

Bullshit attempts to explain why algos are doing what algos are doing, here are the five takeaways from the tariff hike which went live at 12:01am this morning.

- The Trump administration imposed a 25% tariff on more than $200 billion in Chinese goods, up from 10% before, in its most aggressive step yet in the trade war. China said it will take “necessary countermeasures,” though has yet to specify them.

- Day one of talks between top Chinese and U.S. economic officials in Washington ended with little progress and a downbeat mood, according to people familiar with the talks. Negotiations are set to resume Friday morning.

- Asian markets were whipsawed in heavy trading as news emerged, with stocks swinging from gains to losses. As the Shanghai Composite slumped 3% from the morning-session high, state funds intervened to prop up stocks, people familiar with the matter said. The index closed up 3.1% and the yuan rose.

- Investors are also on the lookout for any sign of a call between Presidents Donald Trump and Xi Jinping, after Trump said he’d received a letter from Xi and flagged the potential for a phone conversation between them.

- Next steps to watch include the details on China’s retaliation, news on any broader stimulus efforts to safeguard growth and on any move by Trump to impose new 25% tariffs on $325 billion more of imports, a threat that he reiterated Thursday.

To be sure, global stocks took the news in stride, even if it require some major state intervention, and Asian stocks rebounded after a four day losing streak as fresh American tariffs kicked in on Chinese goods and traders awaited countermeasures promised by Beijing. The Shanghai Composite Index surged 3.1%, with Kweichow Moutai and Ping An Insurance Group Co. leading gains, with the very clear help of some pretty aggressive plunge protection team intervention, as noted in an earlier post. Now that the gloves are off between the US and China, expect far more such aggressive intervention.

Japan’s Topix gauge dipped 0.1%, driven by SoftBank and Mitsubishi, while in India, the S&P BSE Sensex Index gained 0.2%, as Housing Development Finance and HDFC Bank offered the biggest boosts.

Piggybacking on the “hope is back even though new tariffs were just launched” narrative, or perhaps China’s PPT intervention, European stocks also bounced off six-week lows, with Germany’s China-sensitive DAX index leading the charge with a 1% rise for absolutely no obvious reason, while tech shares led the Stoxx 600 higher.

Confirming the global rush, MSCI’s World Index was up 0.2% after the start of European trading, but even with that move, the gauge was set for its worst weekly performance since late December 2018, with a loss of 2.75% as tensions on trade ratcheted up again between the U.S. and China.

However, while stocks levitated in the low-volume overnight session, S&P 500 futures then abruptly reversed course a little after 6am, dipping after President Donald Trump tweeting there is “no need to rush” for a deal (a tweet which he has since deleted).

Some on Wall Street are bracing for much more pain to come, and on Thursday UBS Wealth Management cut its exposure to emerging market stocks, changing its portfolio as the intensification of trade tensions took its toll on markets, the asset manager said in a note. Trump also threatened on Thursday to take steps to authorize new tariffs on $325 billion in Chinese imports.

Meanwhile, geopolitics are not helping: North Korea fired two short-range missiles on Thursday in its second such test in less than a week and the United States said it had seized a North Korean cargo ship. On Iran, Trump said he could not rule out a military confrontation after Tehran relaxed restrictions on its nuclear program in response to U.S. sanctions imposed following Trump’s withdrawal of the United States from the accord with a year ago.

In yields, the 10-year U.S. Treasuries yield stood at 2.45% near its lowest levels since late March; Three-month bill yields stood at 2.456%. On Thursday, the curve inverted again as the 10-year yield briefly fell below the shorter three-month yields on Thursday. German 10-year government bond yields were headed for their biggest weekly fall in seven weeks in a sign that a ratcheting up in U.S./China trade tensions have exacerbated concern about the global growth outlook.

In FX, the yen headed for its fourth week of gains while the Bloomberg Dollar Spot Index stood little changed. Sterling steadied after U.K. growth data signaled a slowdown while Norway’s krone led gains in the Group-of-10 currencies after inflation beat estimates. MSCI’s emerging market currency index also tumbled to a four-month low on Thursday.

In commodities, oil prices rose. Brent was up 0.3% to $70.61 a barrel while U.S. West Texas Intermediate (WTI) crude fell 0.3% to $61.89. Gold ticked up 0.1% to $1,284.84 per ounce.

Scheduled earnings include Linde, Enbridge, Marriott International. Uber will start trading after pricing shares near the bottom of their marketed range

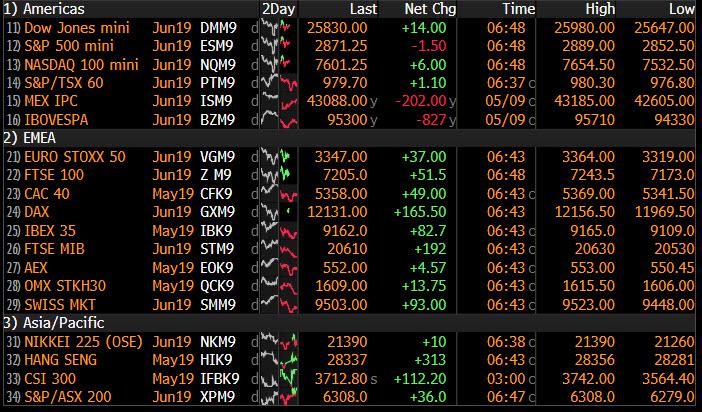

Market Snapshot

- S&P 500 futures down 0.2% to 2,868.00

- STOXX Europe 600 up 0.9% to 379.17

- MXAP up 0.2% to 157.03

- MXAPJ up 0.6% to 519.00

- Nikkei down 0.3% to 21,344.92

- Topix down 0.08% to 1,549.42

- Hang Seng Index up 0.8% to 28,550.24

- Shanghai Composite up 3.1% to 2,939.21

- Sensex up 0.08% to 37,590.71

- Australia S&P/ASX 200 up 0.3% to 6,310.85

- Kospi up 0.3% to 2,108.04

- German 10Y yield rose 0.6 bps to -0.041%

- Euro up 0.04% to $1.1220

- Brent Futures up 0.4% to $70.65/bbl

- Italian 10Y yield rose 6.7 bps to 2.31%

- Spanish 10Y yield fell 1.5 bps to 0.974%

- Gold spot up 0.06% to $1,284.84

- U.S. Dollar Index up 0.05% to 97.42

Top Overnight News from Bloomberg

- Trump boosted tariffs Friday on more than $200 billion in goods from China in his most dramatic step yet to extract trade concessions, further roiling financial markets and casting a shadow over the global economy. China immediately said in a statement it is forced to retaliate, though hasn’t specified how

- Chinese state-backed funds were active in buying domestic equities on Friday after they had slumped in the wake of the Trump administration imposing the biggest hit yet to China’s exports to the U.S.

- Brexit stockpiling and consumer spending spurred the British economy in the first quarter but a disappointing March suggests that a slowdown may already be well under way

- South Africa’s African National Congress has won 57% of the votes cast in May 8 national elections, official tallies from 81 percent of the voting stations show, to extend its quarter-century grip on political power

- Danske Bank A/S has named Chris Vogelzang as its chief executive officer, ending months of speculation over who will steer Denmark’s biggest bank through the continuing fallout of its money-laundering scandal

Asian equity markets were mixed with some seemingly hopeful for a resolution to the US-China trade dispute despite the higher tariffs taking effect overnight, as markets initially found solace from US President Trump’s comments that he received a ‘beautiful’ letter from his Chinese counterpart and suggested a trade deal is possible this week. ASX 200 (+0.2%) and Nikkei 225 (-0.3%) began positive amid hopes of an 11th hour trade-breakthrough which failed to materialize and subsequently saw their early gains wiped out, with sentiment in Tokyo also at the whim of currency moves and a deluge of earnings. Hang Seng (+0.8%) and Shanghai Comp. (+3.1%) initially outperformed on early trade optimism but then retreated off their highs as the steeper tariffs took effect, which China announced it is forced to retaliate against but hoped the sides would meet halfway. Furthermore, some reports noted there was little to no progress talks, although discussions will continue on Friday and it was also suggested that President Trump and President Xi are expected to speak over the phone. Finally, 10yr JGBs were choppy with support seen in late trade after the increased US tariffs kicked in and following stronger demand at the 10yr inflation-indexed bond auction.

Top Asian News

- Delhi Politics Turns Nasty as Core Issues Ignored: India Votes

- Gold Set For Weekly Gain as U.S. Hikes China Tariffs

- China’s Car Slump Drags On as Consumers Wait for Incentives

Major European indices have held onto gains seen at the cash open [Eurostoxx 50 +0.8%] following on from a stellar session in China amid hopes of a trade deal by the end of the week. SMI (+1.0%) marginally outperforms its peers with all 20 stocks in the green. Sectors are posting broad-based gains, albeit the defensive sectors are somewhat lagging amid the risk-appetite. In terms of movers, Thyssenkrupp (+14.0%) shares spiked to the top of the Stoxx 600 after sources initially suggested that the company are to shelve their intended separation of materials and industrial divisions and are to instead consider a listing of its elevator business. Sources also stated that it anticipates a failure of Thyssenkrupp’s JV with Tata Steel, which the company later confirmed as it expects EU to block the planned JV. Meanwhile, to the downside, ADP (-9.3%) shares sharply declined after its privatisation plan is put on hold. Elsewhere, the latest BAML flow show saw USD 20.5bln out of equities (US USD 14bln, EU USD 2.5bln and EM USD 1.3bln), the third largest YTD amid trade jitters. Finally, with a quarter of EU stocks left to report earnings, Deutsche Bank highlights that 54% of companies have thus far topped expectations (vs. 44% last quarter) which is the highest since early 2017. “Across countries, the strongest beats have come in Germany and Switzerland while Italy has disappointed slightly” Deutsche Bank says, adding that the largest earnings beats have come from the Consumer Discretionary and Healthcare sectors, whilst Material and Real Estate are at the other end of the spectrum.

Top European News

- Richest Asian Buys 259-Year-Old British Toy Store Chain Hamleys

- German Airline Staff Say Sexual Harassment Is Rife in Industry

- A Rothschild Broke From Dynasty and Still Became Fabulously Rich

- Singapore’s CapitaLand Plans $325 Million London Hotel Sale

In FX, EUR/CAD/CHF/AUD/NZD/GBP – All on a firmer footing vs a broadly soft Greenback in wake of round 1 and reportedly little progress towards a US-China trade deal. Indeed, heading into the 2nd day of negotiations tariffs have now been lifted on another Usd200 bn Chinese imports and Beijing looks poised to retaliate, but the overall market reaction has been sanguine if not calm (or complacent some might argue) amidst optimism that an agreement will ultimately be forged. The single currency is consolidating above 1.1200, albeit just off Thursday’s highs and underpinned by decent option expiries at 1.1200-05 (1 bn), with the 30 DMA (1.1223) looking pivotal from a technical perspective. Meanwhile, the Loonie has pared more losses from 1.3500+ around a 1.3450 axis ahead of Canadian jobs and housing data and the Franc is holding its recovery gains within a 1.0160-30 range. Similarly, the Aussie and Kiwi are supported above post-RBA and RBNZ lows between 0.7018-0.6980 and 0.6613-0.6584 respective bands, with the former gleaning some traction from the overnight SOMP underscoring data dependency after Tuesday’s dovish hold. Finally, Cable is hovering around 1.3000 in the absence of fresh Brexit news and a raft of UK data that had little impact given that Q1 GDP was in line with consensus and the pick-up in growth from the previous quarter was largely due to inventory provisions for the original March 29 Article 50 deadline.

- NOK/SEK – The Scandi Crowns have also bounced on the more bullish or less risk averse tone, and with the Norwegian Krona also inflated by above forecast CPI data hot on the heels of yesterday’s Norges Bank guidance for a rate hike in June. Eur/Nok is back under 9.8200 and Eur/Sek has retreated to 10.8000.

- JPY – The major outlier or exception to the overall trend as Usd/Jpy hovers near the midpoint of 110.05-109.65 trading parameters even though the DXY is straddling a key chart level (30 DMA at 97.398) within a lower 97.455-298 range than of late.

- EM – At last some respite for the beleaguered Lira as Usd/Try reverses sharply towards 6.0000 vs 6.2400+ on Thursday before the CBRT decided to suspend 1 week repos again in an attempt to tighten liquidity and deter short-selling. However, the recovery has come about in large part by direct intervention to the tune of circa Usd1 bn, in contrast to the latest Rand revival on SA election updates, as the ruling ANC has secured 55%+ of the votes with less than 20% left to be counted. Usd/Zar inching closer to 14.20000 at present.

In commodities, WTI and Brent futures trade with mild gains with the former straddling USD 62.00/bbl whilst the latter meanders just above USD 70.50/bbl. Price action in the complex has been mostly dictated by risk-sentiment as the expected US tariff hike on Chinese goods came into effect, ahead of potential Chinese retaliation, although President Trump has not ruled out a possible trade deal this week. Elsewhere, some desks have been keeping an eye on the more pronounced backwardation in Brent futures with ING highlighting that the July/August spread has been trading above USD 0.90/bbl vs. Wednesday’s USD 0.75/bbl, which points towards a tightening market. Meanwhile, some traders noted that the Brent 3M time-spread is at the deepest backwardation in over 4 years. Metals are relatively tentative with precious metals trading flat whilst copper and iron ore are somewhat stable and awaiting China’s response to Trump’s tariff hike. Barclays expects a tighter iron ore market and have thus raise its FY forecast for the base metal to USD 83/tonne (vs. Prev. USD 75/tonne) whilst expecting copper declining to USD 5900/tonne by Q4 2019 before recovering to USD 6300/tonne by Q2 2020 due to trade risk and a potential global slowdown.

US Event Calendar

- 8:30am: US CPI MoM, est. 0.4%, prior 0.4%; YoY, est. 2.1%, prior 1.9%

- 8:30am: US CPI Ex Food and Energy MoM, est. 0.2%, prior 0.1%; YoY, est. 2.1%, prior 2.0%

- 8:30am: Real Avg Hourly Earning YoY, prior 1.3%; YoY, prior 1.31%

- 2pm: Monthly Budget Statement, est. $160.5b, prior $214.3b

DB’s Jim Reid concludes the overnight wrap

I am pretty shattered this morning. I attended a fascinating DB macro dinner with 30 clients last night and got home late. This was sandwiched around three successive sleep deprived nights. Night one the adrenaline was flowing because of Liverpool and I couldn’t get to sleep. Night two saw the new burglar alarm system go off twice and disturbed the whole house for well over an hour. However last night will take some beating. At 2ammy wife wakes me to say she’s heard a loud bang downstairs. I grumpily wake up and say the alarm hasn’t gone off and go back to sleep. She then looks out the bedroom door and says the hallway lights downstairs (which are on motion sensors) are on. Someone must have triggered them off. I’m still not convinced but she forces me out of bed. We creep downstairs and start to hear noises coming from the living room. At this point I’m a bit scared. We get to the hall and the noises are getting louder. My wife dials 999 and I grab the nearest blunt weapon (my golf driver). She keeps the 999 operator on the phone and says we’re going to go into the room with the intruder. We go in the room and the loud rustling noises suddenly stop. We’re very scared and creep around the room. On the floor behind the sofa we find a half unwrapped Easter Egg (still in wrapping paper) with teeth marks in it and our new radiator cover collapsed on the wooden floor (the apparent source of the bang). At this point Bronte has decided to rescue us (she sleeps upstairs with us so it wasn’t her) and starts to poke her nose down a hole where the radiator work has been done. She is very excited. From all this we concluded that we have a huge rat that escaped from the hole in the floor where the radiators are, knocked off the cover, roamed around the ground floor, took an unused Easter egg from the kitchen, set off the motion light sensors and then started unwrapping it and nibbling it back in the living room. My wife then apologises to the 999 operator and luckily she laughs it off. 90 minutes later I finally manage to calm down enough to go to sleep. It was genuinely quite scary at one point.

So the alarm this morning was as welcome as tariffs to financial markets. Indeed as we type this, the latest round of US tariffs on $200bn of Chinese exports has just come into place, taking the rate from 10% to 25%. Ahead of this equity markets fell across the globe yesterday, but they did rally off their lows during the afternoon in New York. Investors seemingly continue to try to cling to hope that policymakers on both sides opt to deescalate. The S&P 500 was down -1.49% just before the European close, but it bounced over a percent into the close after President Trump told reporters that a “deal is still possible,” and that he had received a “beautiful letter” from President Xi, and he may have a call with his Chinese counterpart soon. All in all this beautiful letter was worth $372 billion to US stocks (using Wiltshire 5000) from the lows. Most of my letters at the moment are bills so I would love that letter!! Anyway, high-level talks could keep a deal alive but Trump also said that “tariffs are very powerful” and that if he ends up raising them further, that would be “an excellent” alternative to a deal. In the meantime, Bloomberg is reporting that yesterday’s talks yielded little to no progress (citing sources). So uncertainty is clearly elevated moving forward. So far there has been no news of any retaliation from China as we go to print. China’s ministry of commerce has said though that it “deeply regrets” the US tariff hike and says that it is forced to retaliate. One source of a potential retaliation announcement or hints could be the Foreign Ministry’s usual afternoon press conference (08:00am London Time). Yesterday, China’s Commerce Ministry spokesman Gao had said to watch the Ministry of Commerce website for retaliation details. So one to keep an eye on.

So recapping the moves yesterday, starting with equities, the S&P 500 ended -0.31% yesterday, substantially above its -1.49% lows. The NASDAQ fell -0.41% (-1.85% at the lows) and DOW retreated -0.54% (-1.73% at the lows). Continuing the trend of the week, tech and materials bore the brunt of the pain. In Europe, the STOXX 600 closed near its lows at -1.65% and DAX -1.69% with losses accelerating after the US walked in. This morning in Asia markets are trading mixed with the Shanghai Comp being up +1.50% which puts the move this week back to -5.99% but the worst week since October last year as we get into the final session. Other markets in China are also up with the CSI +1.86% (-6.30% on week) and Shenzhen Comp +1.82% (-6.01%). Bloomberg is reporting though that this week has seen China “national team” of state-linked buyers being active. Elsewhere the Nikkei is down -0.37% (-4.59%) and the Hang Seng is up +0.64% (-5.28%). For completeness EM equities got hit to the tune of -1.58% yesterday, down -5.63% on the week.

With the sharp moves in equities, volatility naturally rose, with the VIX rising +3.98pts to reach its highest intraday level (23.38) in four months, however it ultimately retraced and actually closed -0.24pts lower on the session. The V2X earlier rose +2.40pts before closing around lunchtime in New York, so it missed the afternoon retracement. Interestingly we haven’t seen anything quite like the same intra-day volatility in FX with the CVIX about 1pt below the average of the last 12 months and not moving much. Elsewhere EM FX followed the trajectory of other risk assets, initially dipping -0.56% before retracing to end -0.19%. It’s the CNH which is starting to hit people’s radars though after weakening -0.42% yesterday (-0.81% at the lows), before trading a touch weaker this morning. At 6.8350 it’s also around the weakest levels since January. It’ll well be worth continuing to watch the price action in this.

Meanwhile, the MOVE index (Treasury vol) is also well off its peaks of March and January this year with Treasuries rallying another -3.4bps yesterday to hit 2.449% – the lowest since March. The 3m10y spread also briefly inverted again, touching -0.2bps before retracing to end -2.4bps flatter at 2.9bps. For the record, over the last 11.8 years since the last major inversion ended, the only time this measure has inverted previously in this period was during a 5-day stretch in March this year. At the moment the curve doesn’t quite know which way to go as it weighs up rate cut possibilities at the front end, softer growth at the longer end, and maybe a battle between softer or higher inflation depending on whether softer activity outweighs goods price increases. In the end both the front and the long end rallied later with the market continuing to price Fed cuts back into the outlook. The futures-implied odds of a cut this year are back up to 61%, up +11pp this week though still below the level of before Powell’s recent press conference.

Elsewhere in fixed income, Bunds were back down to -0.0467% (-0.3bps) with the Bund-BTP spread now back out at 273bps (+7.1bps yesterday) and to the widest since February. Credit hasn’t been immune from the risk-off but spreads have still remained fairly resilient all things considered. Cash US HY spreads were +11bps yesterday which puts the week to date move at +25bps. For context, the current spread level of 417bps is still 120bps below where it was in early January. Cash European HY spreads have performed similarly, widening +9bps yesterday to take the weekly move to +25bps.

Now to a quick recap of the initially grim news that drove the selloff yesterday morning. Markets really started to take the strain after the Chief Editor of China’s Global Times tweeted that the possibility of reaching a deal before the tariffs went into effect today was zero, and that the real suspense was whether talks would even continue today. Senator Rubio also said that China is “not ready for a deal yet” after Lighthizer had briefed senators while the Fed’s Bostic called lifting tariffs to 25% a “whole other game”. On a not completely unrelated note, the FCC yesterday voted to bar China Mobile from the US over national security concerns. So that only raises the tension between the two sides.

The next focal point for markets will be whether we see Trump and Liu actually meet. As mentioned, a potential release valve for sentiment would be if Trump and Xi speak on the phone following Liu’s visit. Either one of those should at least dictate the direction of travel into the weekend and whether or not either side is willing to put a lid on further escalations for now.

In light of the development in the last few days, it’s worth flagging a good summary from our Asia FX strategists as to what options China may have to retaliate given tariffs are now in effect. They note three possibilities. The first is retaliatory tariff measures, specifically flagging increasing tariffs on $60bn of US goods from 5-10% currently to 5-25%. The second is non-tariff measures, including the likes of export controls or slowing down approval of US companies’ investment in China, or even banning certain US imports. The third is currency depreciation. The team note that 25% on $200bn will bring weighted average tariffs to 11.6% – commensurate with the CNH at just north of 7 to offset the impact. The China policy reaction function, the team suspect, will hinge critically on the assessment of the shifting cost-benefit analysis of a weakening currency. See their full report here .

One last point on this, over the weekend the State Council in China is due to hold a meeting with a press statement expected after the conclusion. So expect there to be plenty of focus on this with our colleagues noting also that both monetary and fiscal easing could be considered.

Ahead of that data, yesterday’s US PPI report wasn’t a great one for risk assets. While the headline was weaker than expected in April (+0.2% mom vs. +0.3% expected), the core which excludes food, energy and trade printed at +0.4% mom and two-tenths ahead of expectations. Significantly, the healthcare component rose +0.3% mom which was the second strongest monthly reading since 2009 while portfolio management services rose +5.3% mom and the most since 2010. That translates into a decent boost for the core PCE from both of those components, with our US economists estimating we could see a boost of as much as 15bps from the various direct inputs. So that should help to alleviate some of the inflation miss concern from Fed officials including Evans recently, however as noted it’s not the greatest news for risk assets.

Other US data included the March US trade balance, which came in pretty in-line with expectations at -$50bn and flat on the month. Notably, the bilateral balance with China improved to -$21bn, which takes the YTD deficit to -$80bn, which is a marked improvement from last year’s level of $91bn. So not necessarily a change in the overall trade deficit, but it seems like tariffs are working to shift US imports away from China and toward other countries.

In terms of the day ahead, this morning we’ll get March trade data out of Germany followed not long after by March industrial production in France. The UK then follows with the March and Q1 GDP prints (+0.0% mom and +0.5% qoq expected respectively). We’ll also get March industrial production, the trade balance and construction output for the UK this morning. In the US the highlight is the April CPI report. The consensus is pegged for a +0.2% mom core reading – like it has been for 42 months prior to this – which would likely be enough to push the year over year rate up to +2.1% again. Our US economists also forecast for +0.2% mom and +2.1% yoy readings. The Fed’s Bostic said yesterday that escalating tariffs on Chinese goods could push US businesses to pass on these higher costs to consumers as the businesses he spoke to said “we are willing to forbear on 10%. 25% is a whole another game.”

Elsewhere we’ll also get the April monthly budget statement this evening. Meanwhile, it’s a busy day ahead for central bank speakers. At the ECB we’re due to hear from Villeroy, Praet, Lautenschlaeger, Visco and Coeure, while over the Fed we’re due to hear from Brainard, Bostic and Williams.

via ZeroHedge News http://bit.ly/2E1nUWV Tyler Durden