Looking at this week’s key events, Deutsche Bank’s Craig Nicol writes that while the unpredictable nature of US-China trade developments will likely continue to be the main focus for markets again next week, we also have the European Parliament elections circus to look forward to as well as various survey reports including the flash May PMIs which may offer some insight into the impact of trade escalation on economic data. The FOMC and ECB meeting minutes are also due, along with a heavy calendar of Fed officials speaking.

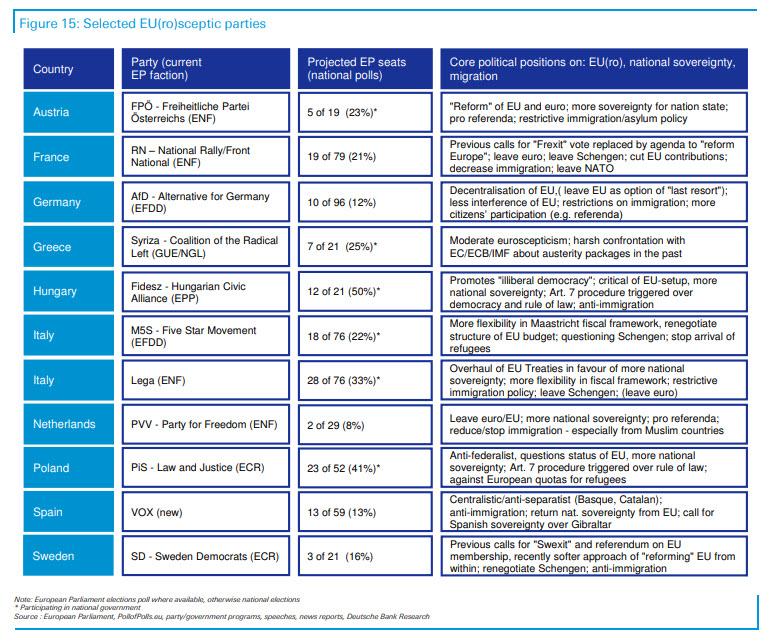

The European Parliament elections will kick off next Thursday with voting continuing into the weekend across the continent, with results expected on Sunday. With the elections surrounded by internal and external challenges for the EU, members divided on issues ranging from migration, digital taxation to EMU reforms, and Eurosceptic and anti-European groups challenging the EU’s integrity and credibility across the continent, the results will likely be closely watched by markets, particularly given the real possibility that anti-EU parties could win enough seats to disrupt legislative business as opposed to just rallying against it. DB’s UK economists note that current polling data suggests that the vote could see large swings away from the two major parties and towards the newest UK parties (Brexit Party and Change UK).

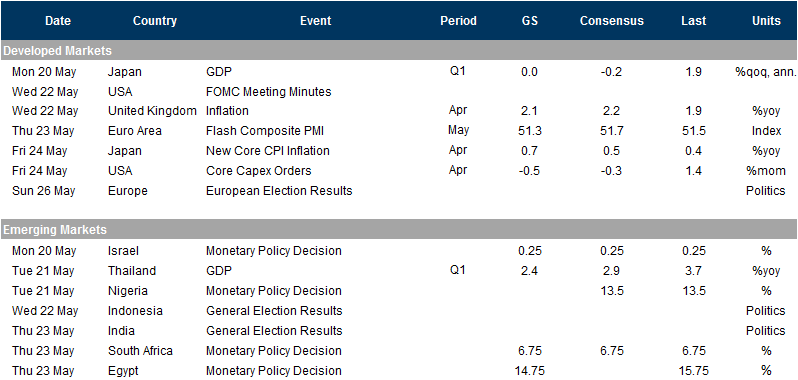

As for the data highlights, we will start to see surveys which cover the trade-escalation period next week and front and centre will be the flash May PMIs in Europe and the US on Thursday. A reminder that last month the manufacturing reading for the Eurozone bounced an albeit modest 0.4pts off the recent low to 47.9. The consensus for next Thursday is further modest improvement to 48.2. The services reading is also expected to rise 0.2pts to 53.0 putting the consensus for the composite at 51.8 versus 51.5 in April. For Germany, the manufacturing reading is expected to improve 0.4pts but to a still lowly 44.8, while France is expected to flatline at 50.0. For the US, the manufacturing reading is expected to rise 0.4pts to 53.0.

Also worth watching next week given the survey timing is the May IFO survey in Germany on Thursday and May confidence indicators in France on the same day. In the US we’re due to get a regional manufacturing reading from the Kansas Fed on Thursday. Other data worth flagging in the US next week includes April existing home sales on Tuesday, claims on Thursday and preliminary durable and capital goods orders for April on Friday. In the UK we’re due to get the April inflation data docket on Wednesday and April retail sales report on Friday. In Japan preliminary Q1 GDP is due Monday – and expected to show a contraction – and April inflation on Friday.

The FOMC meeting minutes from the April 30-May 1 meeting due on Wednesday will also garner the usual attention. A reminder that at that meeting Chair Powell emphasised that a good portion of the weakness in core inflation was due to transient factors and pointed to the trimmed mean inflation rate being at the Fed’s 2% target. Powell also sounded more upbeat on the growth outlook, noting a dissipation in downside risks with financial conditions accommodative. That appeared to disappoint the market at the time which was leaning towards a more dovish outcome.

As well as the minutes, we’ve also got a raft of Fedspeak to get through next week which will be worth keeping an eye on for officials’ views on recent trade escalation, if anything. Tomorrow evening, the Dallas Fed’s Kaplan will speak at a conference in Arizona. On Monday afternoon we’re due to hear from Philadelphia Fed President Harker in Boston then at midnight Chair Powell is due to deliver the keynote address at the Atlanta Fed’s annual conference. On Tuesday the Chicago Fed’s Evans is due to discuss the economy and monetary policy in Florida, before the Boston Fed’s Rosengren speaks to the Economic Club of New York. On Wednesday the St Louis Fed’s Bullard speaks on the US economic outlook early in the morning in Hong Kong, before the New York Fed’s Williams and Atlanta Fed’s Bostic speak in the afternoon. Finally on Thursday the Dallas Fed’s Kaplan, San Francisco Fed’s Daly and Bostic take part in a panel.

Over at the ECB we’re also due to hear from President Draghi in Frankfurt on Wednesday morning where he opens an ECB colloquium in honor or Peter Praet stepping down from his role. Praet will also speak at that event while Nowotny is due to make remarks on Thursday and Friday. It’s worth noting that the ECB meeting minutes from the April meeting are due on Thursday. Over at the BoE, Carney is due to testify on the April inflation report on Tuesday morning, while Broadbent speaks on Monday. In Japan the BoJ’s Harada speaks on Wednesday morning.

Finally, other things worth watching next week include the Australian Federal election tomorrow as well as a meeting of the Joint Ministerial Monitoring Committee which oversees the OPEC+ deal to boost oil prices. On Sunday Switzerland will hold a referendum on corporate tax reform. On Tuesday the OECD will publish its latest Economic Outlook and on Thursday we’re expecting to get the results of the Indian general election. We should also note that US fixed income markets are expected to close early on Friday ahead of the Memorial Day holiday weekend.

Key events in the coming days, courtesy of Deutsche Bank

- Monday: A quiet day for data with Japan’s Q1 GDP report and March industrial production, Germany’s April PPI and the April Chicago Fed national activity index in the US the only releases due. The Fed’s Harker is scheduled to speak in the afternoon followed by the BoE’s Broadbent.

- Tuesday: Another sparse session for data releases with the May CBI survey in the UK, May consumer confidence for the Euro Area and April existing home sales in the US the data due. The Fed’s Powell will speak early in the morning, followed later on in the afternoon by Evans and Rosengren. BoE Governor Carney is due to testify to Parliament about the May inflation report. The OECD will also publish its latest Economic Outlook.

- Wednesday: The highlight will likely be the release of the FOMC minutes from the April 30-May 1 meeting. As for data, Japan’s April trade balance is due in the morn ing followed by April inflation and public sector net borrowing data in the UK. There’s nothing of note in the US. The Fed’s Bullard, Williams and Bostic are all due to speak, along with the ECB’s Draghi and Praet. The BoJ’s Harada will also speak in the morning.

- Thursday: The European Parliament will start the four-day process of holding continent wide elections. As for data, the headline release are the flash May PMIs in Europe and the US. The flash manufacturing PMI in Japan will also be released. Elsewhere, the final Q1 GDP revisions are due in Germany, May confidence indicators in France, May IFO survey in Germany and claims, April new home sales and April Kansas Fed manufacturing survey due in the US. The Fed’s Kaplan, Daly, Bostic and Barkin are also due to speak, while over at the ECB Nowotny is due to speak. The ECB meeting minutes from the April policy decision is also due.

- Friday: Data releases include April inflation in Japan, April retail sales and May CBI survey data in the UK, and preliminary April durable and capital goods orders in the US. The ECB’s Nowotny will also speak

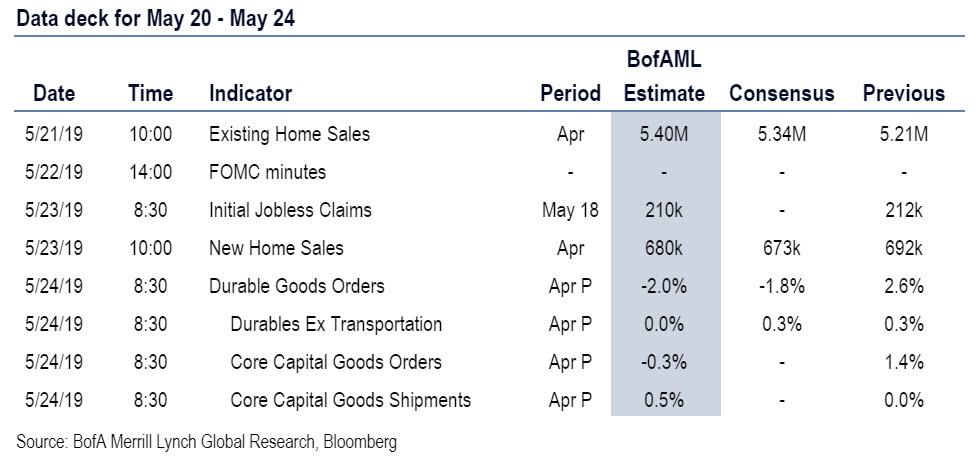

Finally, here are the key events just in the US, courtesy of Goldman Sachs, which notes that “the key economic data release this week is the durable goods report on Friday. In addition, the minutes from the May FOMC meeting will be released on Wednesday. There are several scheduled speaking engagements by Fed officials this week, including one by Vice Chair Richard Clarida on Monday, one by Fed Chair Jerome Powell on Monday evening, and an economic press briefing by New York Fed President John Williams on Wednesday.”

Monday, May 20

- 09:30 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Harker will discuss management science at Boston University. Audience Q&A is expected.

- 01:00 PM Vice Chair Clarida (FOMC voter) and New York Fed President Williams (FOMC voter) speak: Fed Vice Chair Clarida and New York Fed President Williams will take part in a Fed Listens event in New York. Audience Q&A with Clarida is expected.

- 07:00 PM Chair Powell speaks: Fed Chair Powell will deliver the keynote speech at the Atlanta Fed’s annual financial markets conference in Florida.

Tuesday, May 21

- 10:00 AM Existing home sales, April (GS +4.0%, consensus +2.7%, last -4.9%): After falling 4.9% in March, we estimate that existing home sales rebounded by 4.0% in April, based on a sizeable rebound in regional home sales data. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

- 10:45 AM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Evans will discuss the economy and monetary policy at the Atlanta Fed conference in Florida.

- 12:00 PM Boston Fed President Rosengren (FOMC voter) speaks: Boston Fed President Rosengren will speak to the Economic Club of New York. Audience Q&A is expected.

Wednesday, May 22

- 01:00 AM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President Bullard will discuss the outlook for the US economy and monetary policy in Hong Kong. Audience Q&A is expected.

- 10:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President Williams will deliver opening remarks at a press briefing on home ownership and will join a panel to answer questions.

- 10:10 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Bostic will deliver opening remarks at a conference on technology-enabled disruption at the Dallas Fed.

- 02:00 PM Minutes from the May FOMC Meeting: At its May meeting, the FOMC left the target range for the policy rate unchanged at 2.25-2.50%, as widely expected, and adjusted the IOER. During the press conference Chair Powell offered a relatively upbeat view on growth and downplayed the recent decline in inflation as largely due to “transitory factors.” In the minutes, we will look for some further discussion of inflation, the path of the policy rate, and balance sheet normalization.

Thursday, May 23

- 08:30 AM Initial jobless claims, week ended May 18 (GS 215k, consensus 215k, last 212k); Continuing jobless claims, week ended May 11 (consensus 1,669k, last 1,660k): We estimate jobless claims were unchanged at 215k in the week ended May 18. Claims normalized in the most recent reading following a spike in New York State filings and broader volatility over the past month related to the timing of Easter. Taken together, the claims reports of April and May suggest that the pace of layoffs remains low, albeit modestly above the pace of last fall.

- 09:45 AM Markit Flash US manufacturing PMI, May preliminary (consensus 52.7, last 52.6)

- 09:45 AM Markit Flash US services PMI, May preliminary (consensus 53.5, last 53.0)

- 10:00 AM New home sales, April (GS -4.5%, consensus -3.2%, last +4.5%): We estimate that April new home sales fell 4.5% in April, reversing last month’s 4.5% rise. Our forecast reflects the 4.2% drop in single-family permits and our view that the level of March new home sales was elevated relative to other housing indicators.

- 11:00 AM Kansas City Fed manufacturing index, April (consensus +7, last +5)

- 01:00 PM Fed Presidents Kaplan, Daly, Bostic and Barkin (FOMC non-voters) speak: Dallas Fed President Kaplan, San Francisco Fed President Daly, Atlanta Fed President Bostic and Richmond Fed President Barkin will participate in a panel on technology-enabled disruption and the implications for business, labor markets and monetary policy in Dallas. Audience Q&A is expected.

Friday, May 24

- 8:30 AM Durable goods orders, April preliminary (GS -3.5%, consensus -2.0%, last +2.6%); Durable goods orders ex-transportation, April preliminary (GS flat, consensus +0.1%, last +0.3%); Core capital goods orders, April preliminary (GS -0.5%, consensus -0.3%, last +1.4%); Core capital goods shipments, April preliminary (GS -0.3%, consensus -0.1%, last flat): We expect durable goods orders retrenched by 3.5% in April, mostly reflecting a further decline in Boeing aircraft orders. We also estimate declines in the core capex measures (orders -0.5%, shipments -0.3%), echoing the 1.9% decline in April business equipment production and reflecting a potential drag from energy-sector bankruptcies.

Source: Deutsche Bank, BofA, Goldman,

via ZeroHedge News http://bit.ly/2LX2OPB Tyler Durden