It was the peak of poetic justice that on the day Deutsche Bank held its annual general meeting, during which the top leadership of the imploding German lender felt the ire of its shareholders who withheld their backing for executives and several urged the chairman to step down early during the tense Frankfurt meeting, that DBK stock hit a fresh all time low of €6.35 per share, its market cap sliding to $15.8 billion, just barely above the market cap of Darden Restaurants.

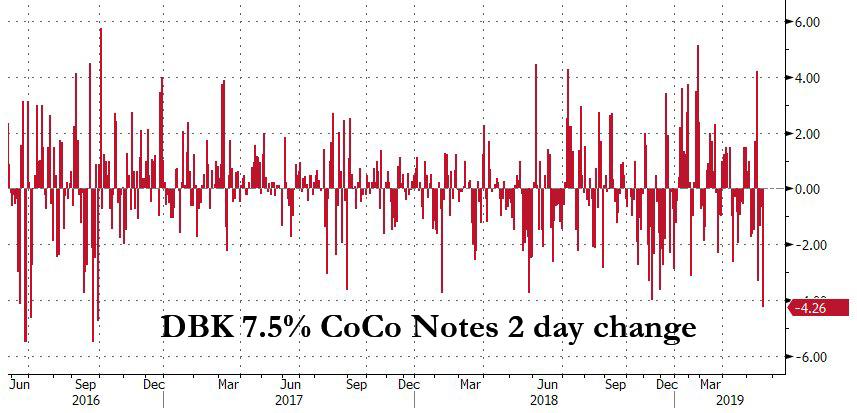

It was also the day when the bank’s 7.5% Contingent Convertible notes suffered their biggest 2-day drop since the September 2016 collapse which brought Deutsche Bank to the verge of nationalization.

Naturally, none of this helped ease the fury of investors, who have lost tremendous capital by keeping their faith in a turnaround that never comes. While the bank’s largest shareholders – Qatar and Cerberus – kept a low profile, those who spoke during the investor day, expressed anger and disbelief that what was once among Europe’s dominant banks has a market value that would make it the fifth-biggest in France according to Bloomberg. One noted that the price for a share had fallen below the cost of a pack of cigarettes.

“Mr. Achleitner, the restructuring of the bank hasn’t been completed and profitability continues to be something to be desired despite multiple management changes over the past seven years,” said Andreas Thomae, a portfolio manager with Deka Investment, who planned to vote against the supervisory board actions.

One investor asked why the German pope resigned, yet the Austrian chairman, Paul Achleitner doesn’t. Another said they would withhold support for the chairman, though didn’t want him to step down to avoid a power vacuum. A third recited his own poem to vent his frustration.

The bank’s new CEO, Christian Sewing, also received a thumbs down from investors, receiving 75% of votes, down from 95% a year ago. At the meeting, he announced plans for “tough cutbacks” to the investment bank in a campaign to restore market confidence following the breakdown of takeover talks with Commerzbank.

“I can assure you: we are prepared to make tough cutbacks” to the securities unit, Sewing said. The CEO said he’s “rigorously focusing” on building up profitable and growing businesses.

Sewing didn’t say where the cuts to the investment bank would be, but he highlighted businesses where they’re unlikely to happen, such as origination and advisory as well as as foreign exchange, global credit trading and U.S. commercial real estate.

One place where there certainly were cost cuts, was in the cafeteria, because to confirm the draconian severity of the bank’s new and improved belt-tightening, while also demonstrating how close to the edge of collapse Deutsche Bank truly is, the FT’s banking correspondent, Olag Storbeck, tweeted a picture of the food that the bank served to investors and the press: two (and a quarter) Frankfurters, something that may or may not be eggs, and a roll.

Lunch. #DeutscheBank pic.twitter.com/rigAKwhM34

— Olaf Storbeck (@OlafStorbeck) May 23, 2019

More demonstrative than any plunging chart – and yes, the DB logo is appropriately turned 90 degrees on its side to indicate the bank’s most appropriate direction – that particular menu served in a world in which investors, even of soon to be insolvent companies, are used to 5-star meals especially as the day of execution draws near, to loosely paraphrase Seinfeld, this is what you serve when “you’ve kind of given up on life.”

via ZeroHedge News http://bit.ly/2EurKYH Tyler Durden