With The Dow on course for its longest losing streak in 8 years, albeit remaining modestly off its record highs and still significantly on the year, traders are anxious that President Trump’s plunge-protecting-tweets appear to have stopped working, along with the guru-creating BTFD strategy that has worked so well for every Tom, Dick, & Harry home-gamer playing the stock market.

As Bloomberg reports, three weeks after the president rekindled the trade war with China, sending the Dow into a 4% tailspin, traders are growing increasingly impatient for their dose of White House succor.

“It’s beginning to feel lousy,” said Donald Selkin, chief market strategist at Newbridge Securities Corp.

“I own stocks. Of course you’d like to see some kind of a stop to this downtrend we’re in now.”

Stocks have been rattled by trade-related headlines ever since Trump hiked tariffs on Chinese goods earlier this month. Since then, there’s been a tit-for-tat escalation, with China retaliating, the president targeting Chinese tech companies and China subsequently warning of its unwavering resolve to fight.

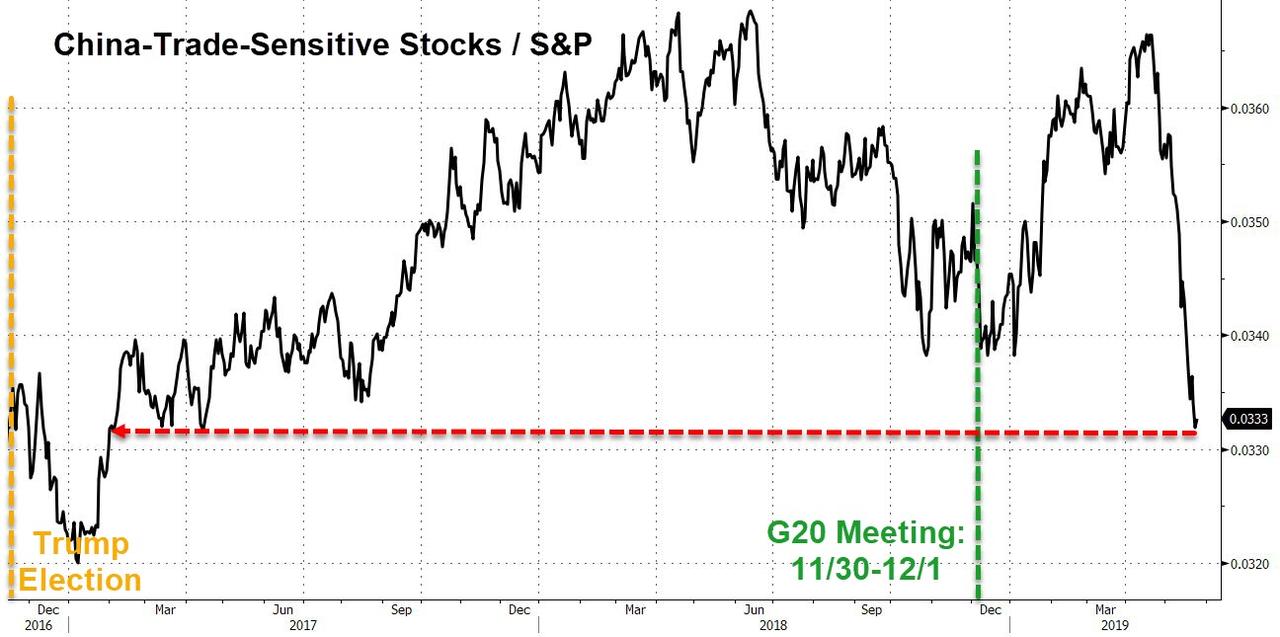

This has sparked a collapse in ‘hope’ for a trade deal with China-sensitive stocks underperforming the market by the most since January 2017.

And as the decline accelerates, traders become ever more hopeful that a well-placed tweet, or leaked optimistic headline, will trigger a re-run of January/February’s panic-bid short-squeeze meltup once again.

“He’s not afraid to use his social media pulpit. He’s not afraid to try to jawbone the market,” Chris Gaffney, president of world markets at TIAA, said in an interview.

“He does look at the equity markets as a measure of confidence in his administration, certainly with any big problems facing the equity markets he has a tendency to try to.”

But, as Bloomberg notes, Trump’s been relatively quiet about the market since then. JPMorgan’s quant market-whisperer Marko Kolanovich suggested the president’s threshold for market pain is about 4%, but for now, no sign of him.

Instead of talking up equity markets, Trump is devoting attention to assuaging a key political constituency, with plans to announce an aid package for farmers suffering under the latest batch of tariffs.

Leaving some to wonder whether the trade war had escalated to the point where markets have grown inured to any presidential soothing.

“I don’t think that either the presidency or the Fed has infinite power over economic activity or over markets,” said Ed Keon, portfolio manager for QMA, a quantitative firm in Newark, New Jersey.

“I’d be a little reluctant to place an investment on the theory that the Fed or president will have my back under any circumstances and I can therefore downplay risk.”

And don’t forget, there appears to be a constituency in the Asia sessions that is willing to heavily sell US equities…

Who could that be?

via ZeroHedge News http://bit.ly/2EwnsQs Tyler Durden