Authored by Irina Slav via OilPrice.com,

Persistent pressure on profit margins has forced Asian refiners to start considering a reduction in their run rates, Reuters reports, citing unnamed sources from the industry. According to the sources, higher international oil prices are behind the unfavorable development, which has seen refiners’ margins drop to the lowest since the spring of 2003, according to Reuters data.

Among the refiners considering run rate cuts are South Korea’s SK Energy, the Singapore Refinery Company, and at least one refiner in Thailand. Some Chinese independent refiners are already running at less than 50 percent of capacity because of the pressure on margins, one Chinese analyst told Reuters.

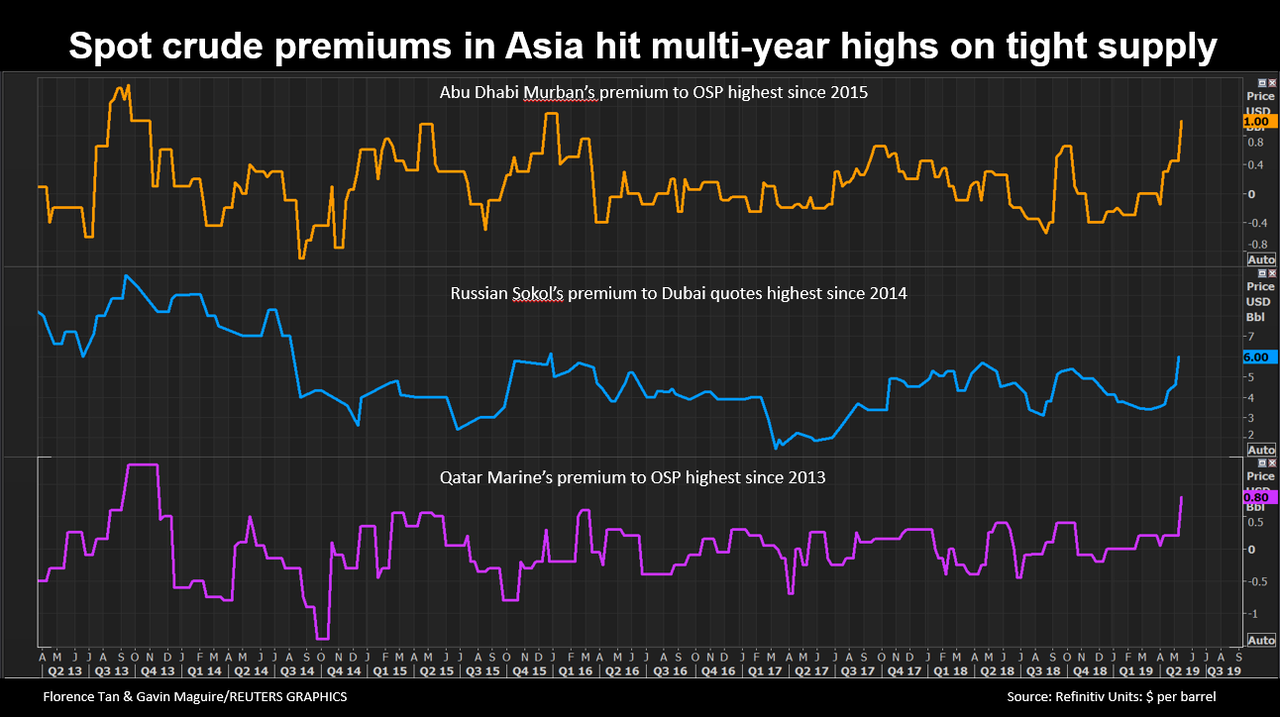

International oil prices have risen since the start of the year on the back of OPEC+ production cuts, which has combined with U.S. sanctions on Venezuela and Iran to shrink supply. The recent spike in U.S.-Iran tensions has also been bullish for prices. Interestingly enough, even so, over the past month both Brent and West Texas Intermediate have generally trended lower despite several spikes. However, this decline has not been enough to push Asian refiners’ margins higher.

There may be another reason for this, too: a fuel glut coming from China. An increase in refining capacity, particularly from the independent refiners, also called teapots, and another increase in oil product export quotas have seen a substantial increase in the availability of Chinese oil products in the region, and this increase has added its own pressure to refining margins.

Despite the glut and despite their run rate cuts, Chinese refiners will be processing even more crude this year: earlier this week Beijing allocated a new round of oil product export quotas and they were higher than the respective quotas last year. Since the start of the year, total oil product export quotas have hit 50 million tons.

via ZeroHedge News http://bit.ly/2Eq13o3 Tyler Durden