Authored by Sven Henrich via NorthmanTrader.com,

Remember all that talk of optimism in Q1 and into April? It came easy after markets rallied hard following the Fed caving. The Q1 slowdown was just temporary, it’s going to be like early 2016, easy Fed is all that matters.

Besides, a trade deal is just around the corner. Don’t you know? Look at all those ‘trade optimism” headlines.

Bollocks. All of it. It’s called complacency and price driving sentiment.

The slow down did not end in Q1, it continued and perhaps accelerated also into May.

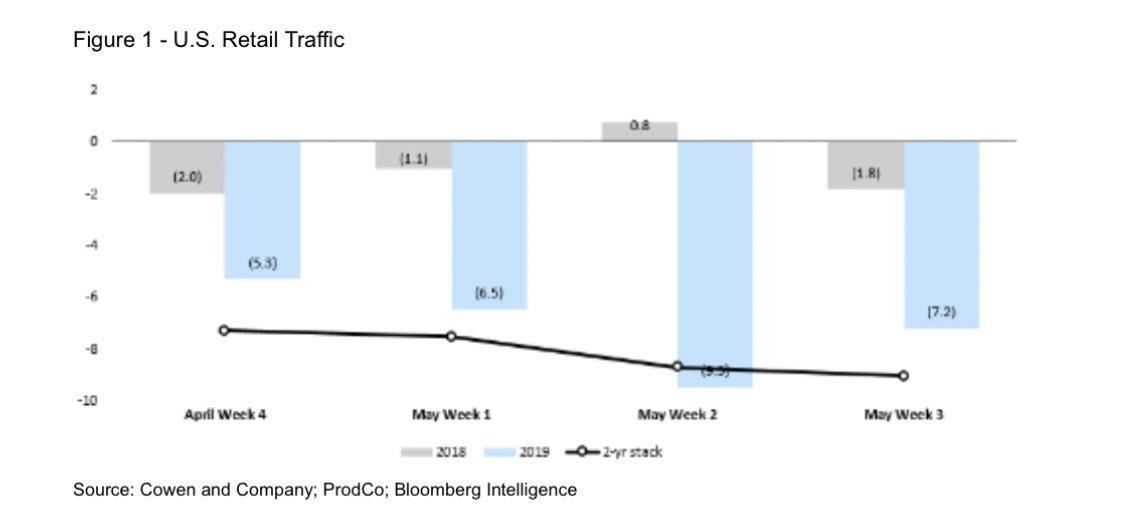

Here’s retail traffic, – 7.2% in May so far:

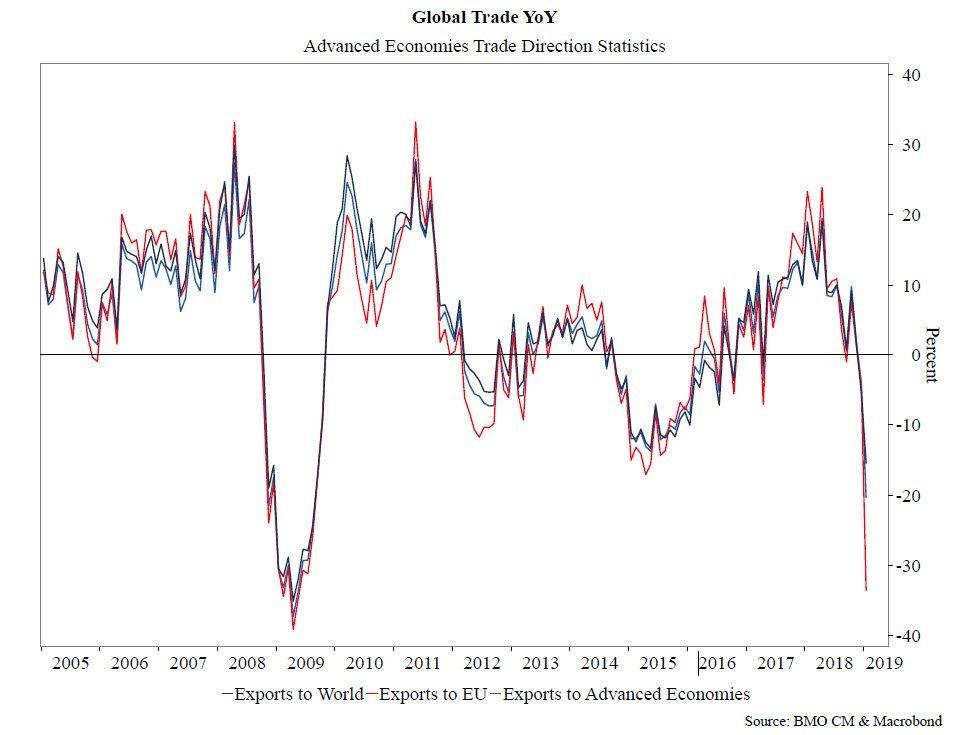

Here’s global trade:

And what is the data saying exactly?

Facts:

April: Retail sales growth: Negative. Industrial production growth: Negative Chicago Fed National Activity Index: Negative

May: Manufacturing PMI to nine-year low.

The slowdown is not over. Perhaps it’s just beginning.

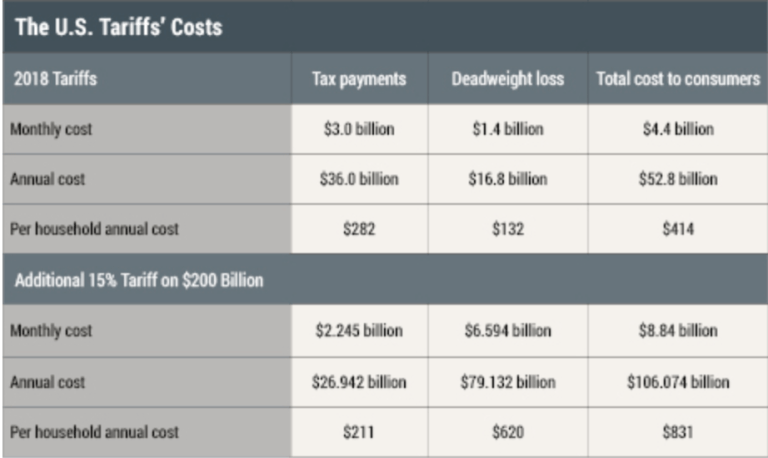

Don’t forget retailers are already announcing price increases on products coming from China.

The New York Fed today put out a study that estimates that the cost of tariffs will impact the average family by $831 per year:

Add that to record credit card interest rates and you tell me where the incremental spending growth it to come from.

Forget the hype and the cheerleading. That was Q1 chatter. Now Q2’s data is starting to show that the optimistic narratives were misplaced. Which means earnings estimates for the rest of the year may be too high. Perhaps far too high as there is no trade deal in sight. What is in sight is a slow down.

And markets may just be in the process of realizing that.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2MlXbej Tyler Durden