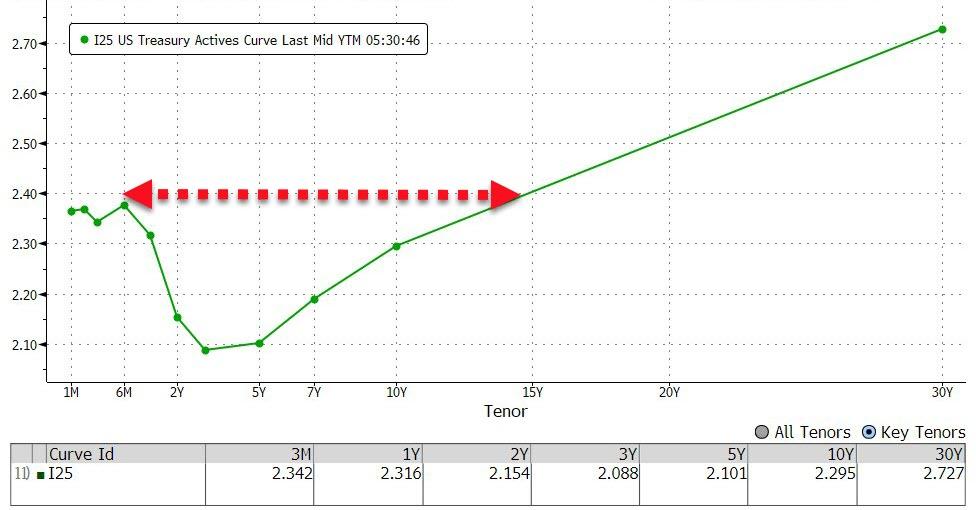

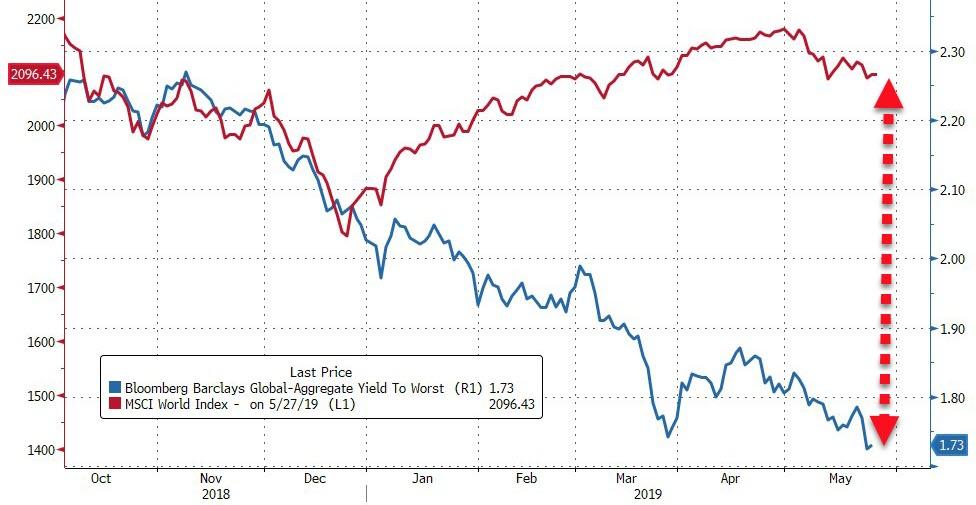

While global stocks remain near record highs, global bond yields are at their lowest since January 2018, with US Treasury rates at their lowest since Q4 2017 (and the curve inverted out beyond 10 year maturity).

Of course, investors are told to shrug this dramatic divergence off (“it’s Japan and Germany’s fault, not a reflection of US growth”, keep buying NFLX calls and pray to the god of central banking that all will be well.

Former fund manager, and FX trader Richard Breslow disagrees, warning in his latest note that “bond yields signal all is not right with the world.” And understatement perhaps, but there are more disturbing divergences not so easily shrugged off…

Via Bloomberg,

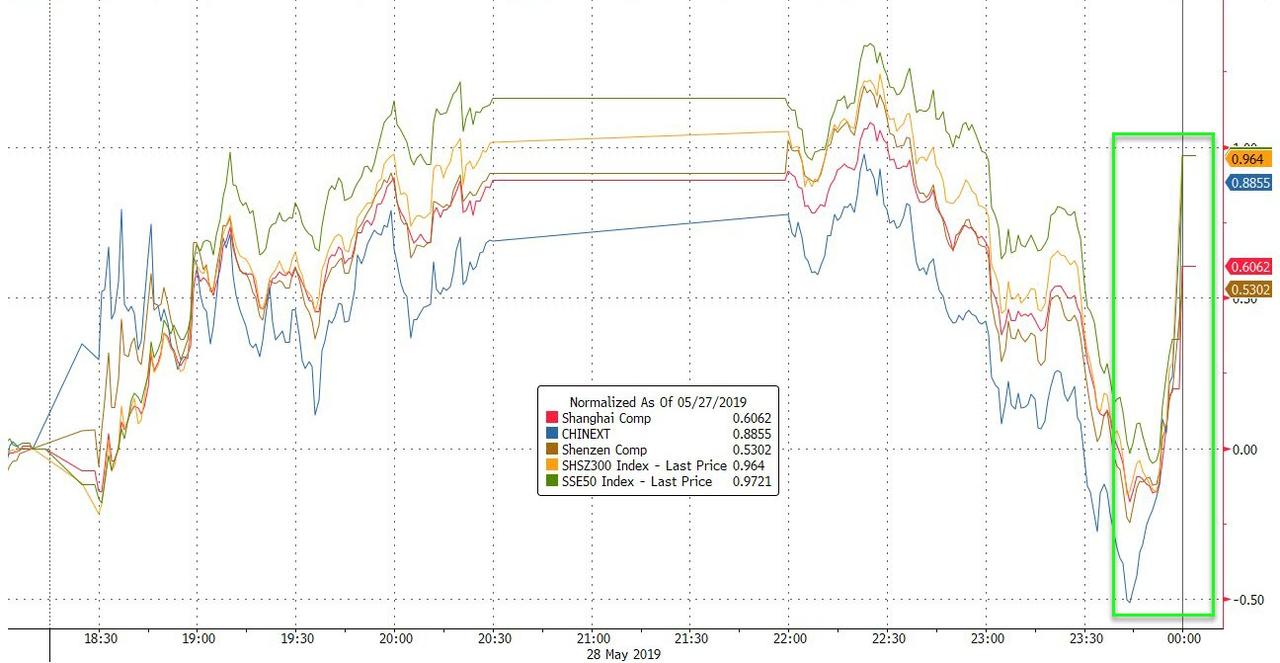

Talk about receiving mixed signals. Equity markets are basically quiet. Up a little in Asia, down a little in Europe. Pretty much trading at very familiar levels that we’ve seen multiple times this month. When the Shanghai Composite rallied in the last minutes of the day, it felt like it just wanted to get back to being neutral rather than responding to any particular news. Foreign-exchange markets have been somewhat more cautious but nothing jaw-dropping. Just a slow start to a holiday-shortened week.

Then you look at global bond yields and can’t help but wonder if something is seriously the matter. This isn’t about inflation undershoots. It isn’t about the latest batch of economic numbers. This is about geopolitics and where do you invest in a world where the quick resolution of our troubles and uncertainties can no longer be most investors’ base case.

Traders are looking at bond yields and concluding that they may be lower than the models suggest but they’re good enough. Bizarrely, even those with negative yields. Dumping stocks wholesale is hard to do. And not possible given many strategies. Besides, as tenuous as they have looked at times, they really haven’t done anything wrong — other than having stopped making new all-time highs on a regular basis. The retracement levels continue to hold. If that ceases to be true, we can revisit.

Getting out of carry is all about timing. You can lighten up, and, obviously, traders have, but it places you one headline away from being seriously off-sides. And the hunt for yield remains a powerful inducement to be involved. Especially for your limited partners who pay for the privilege of sleeping at night. The important skill will be to differentiate between the expected winners and losers within the asset class. You just have to decide which of the world’s problems you are trying to avoid.

It remains something of a mystery why the price action in commodities like precious metals has remained so moribund. And whether that can continue. They may look comatose, but are surely worth keeping a close eye on. The longer they sit, moreover, the technical picture will begin to be more supportive.

In a world of perpetual quantitative easing it became an accepted investing strategy to ignore geopolitical risk other than for very short bursts of time. Maybe that will largely remain the case. Or at least look like it. But not if you are trading bonds. And the more bonds you own, the more “risk” assets you can not only afford to own, but may have no alternative. Don’t expect a single market narrative to neatly describe all price action.

via ZeroHedge News http://bit.ly/2QvM0y4 Tyler Durden