Authored by Bryce Coward via Knowledge Leaders Capital blog,

Yesterday we wrote about three macro factors that will act to restrain economic growth through the rest of 2019 and into 2020. Those risks are the baked-in fiscal tightening, the lagged effects of monetary policy tightening, and growth retarding trade policy. Together, they could restrain growth to levels well below expectations and induce a profits recession at the least. At the worst, they could cause an economic growth recession if an appropriate policy response is lacking.

In today’s report we will address one of the asset allocation implications of those factors, namely that long-term US Treasury bonds could have substantial downside in yield even from these levels.

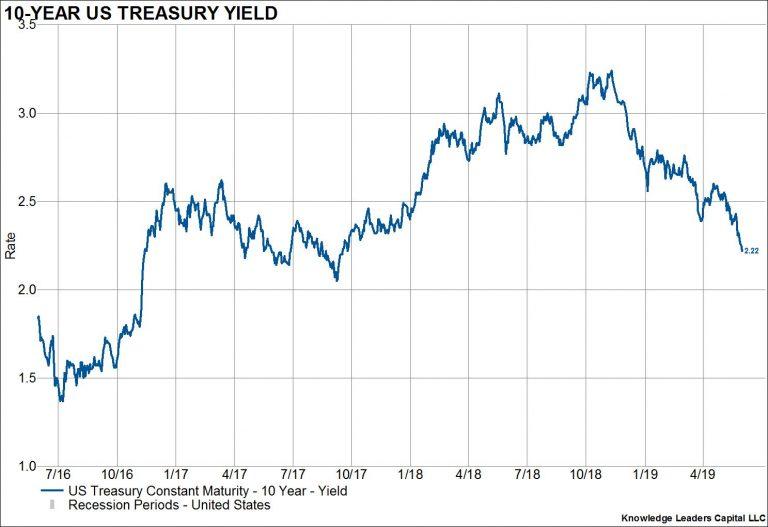

As our readers know, the yield on a US Treasury bond is composed of inflation expectations, growth expectations, and a term premium. The term premium is the added yield investors require to compensate them in the case of unexpected rises in inflation or growth over the course of the bond’s life. Since last Fall the yield on the 10-year treasury bond has fallen from 3.23% to 2.16% as of this writing.

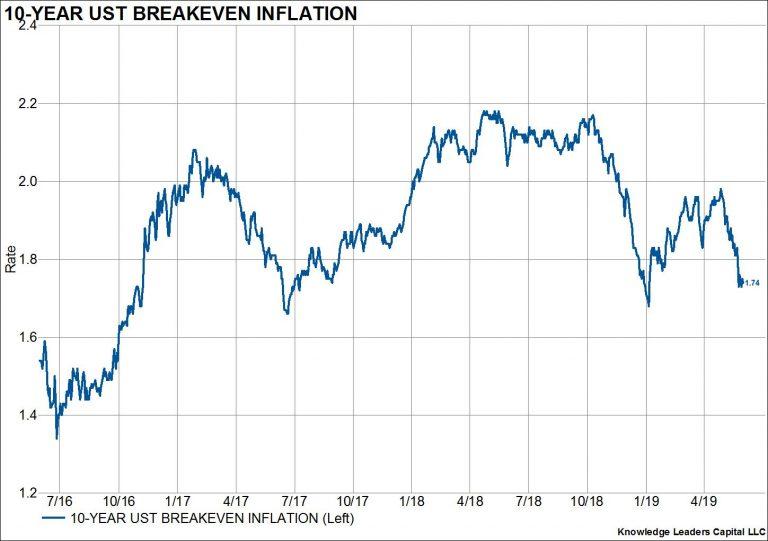

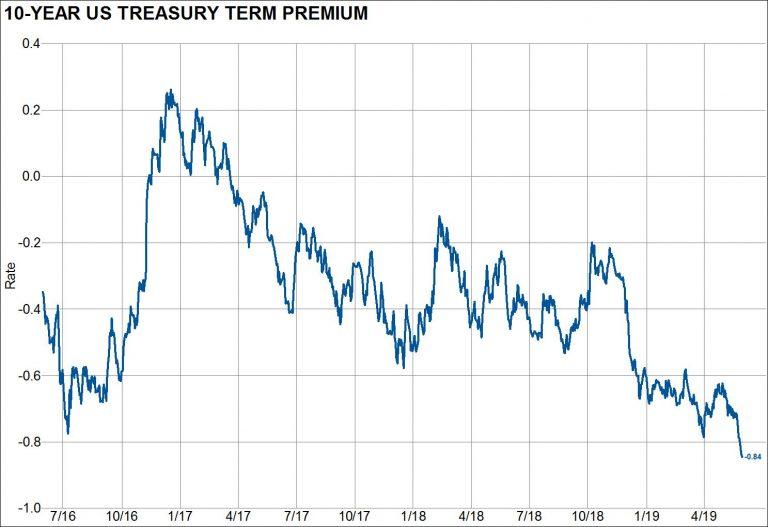

The interesting thing about this substantial 1.07% drop in yield is that the entirety of the move is accounted for by the drop in inflation expectations (-43bps) and the drop in the term premium (-64bps).

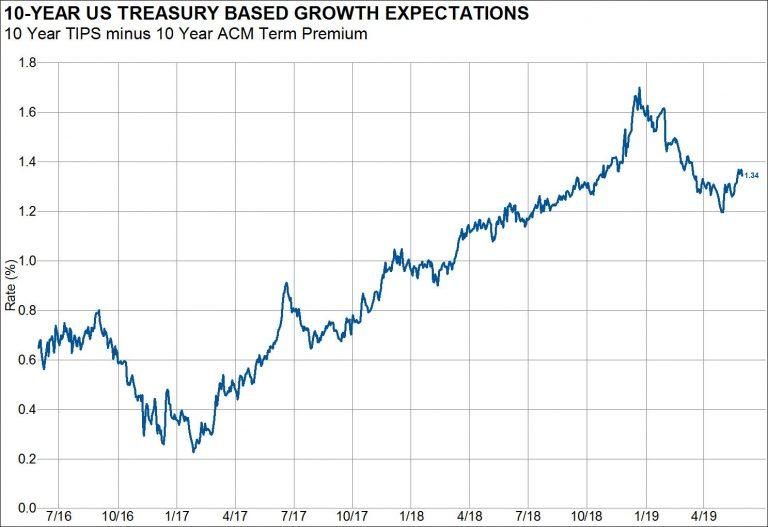

Growth expectations are exactly flat from where they were at the peak in rates last Fall.

Taking this one step further, we observe that the contraction in both inflation expectations and the term premium is a function of oil prices dropping from $65 to $56 per barrel. Oil prices affect inflation expectations directly and they impact the term premium indirectly as lower oil prices induce the market to start pricing out an inflation shock down the road, or induce the market to start pricing in a deflation shock…

The implication here is that the bond market has yet to price in any amount of lower growth, leaving bond investors with a tremendous opportunity for capital appreciation should any of the macro factors we highlighted in Part 1 put a dent in growth. That also begs the question of what oil prices are likely to do if an when growth starts to falter in earnest? Most likely they would fall considerably more, adding further downside to both inflation expectations and the term premium, all else equal.

But, you say, rates have already fallen by quite a lot. How much further could they really drop? Indeed, rates have fallen by a large amount. Even still, let’s remember that the 10 year yield hit 1.36% in 2016 the last time we had a real growth scare, almost a full percent lower than today’s level. Furthermore, speculators in long-term Treasury bonds – the people who in aggregate tend to take the losing end of bets – are still solidly short of bonds.

In the past, rates have not bottomed until speculators have moved to neutral or long positioning in bonds.

via ZeroHedge News http://bit.ly/2Weo0Wd Tyler Durden