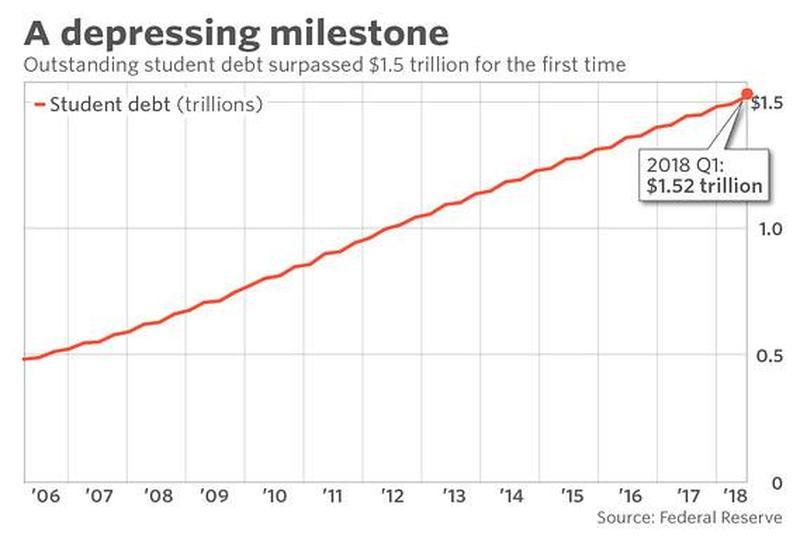

As the businesses cycle is alive and well, despite central bank interventions, the global economy has recently cycled into a prolonged downturn expected to last throughout 2H19. This could be more disastrous news for heavily indebted millennials, who now owe approximately $1.6 trillion in student loans.

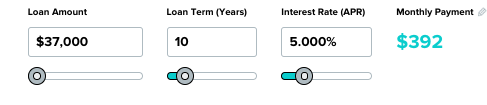

A new report from WalletHub, reveals which US cities millennials have the most difficult time paying off their student debt. In the last several years, student debt has ballooned to become the second highest form of household debt after mortgages. The average 2018 student loan debt was $37,000, equating to a $392 (5% interest rate for ten years) per month payment.

Even though college graduates earned significantly more than non-graduates, there hasn’t been a significant increase in earnings across some major cities to make their debt servicing manageable, thus hindering youngsters from buying homes and having families.

“High balances combined with a payoff timeline that lasts into middle age force many graduates to significantly delay or forego other financial goals such as saving for retirement or buying a home,” the report said.

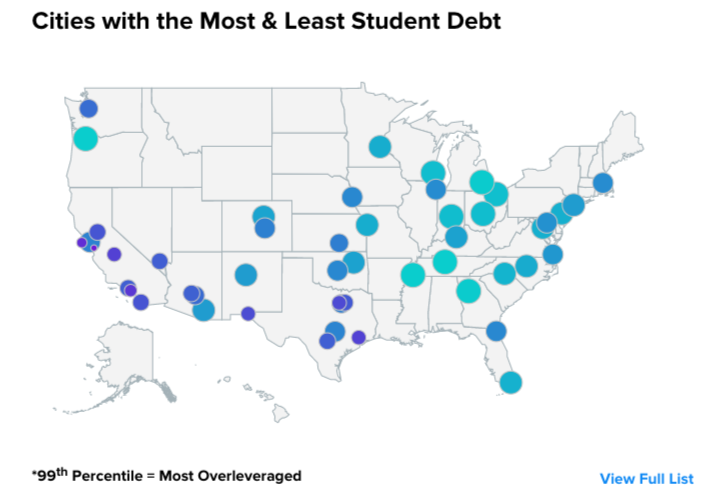

While some cities offer better job opportunities and higher wages for millennials, many other metropolitan areas across the country have a jobs environment that makes it almost impossible for college graduates to pay off their debt.

Researchers used the median student loan balance against the median earnings of millennials (aged 25 and older) with a bachelor’s degree in 2,510 US cities to determine the worst areas for paying off student loans.

Here are WalletHub’s top ten cities where millennials shouldn’t move to if they have massive student debt loads:

10. Dacula, Georgia

- Median student debt balance: $20,655

- Median earnings of bachelor’s degree holders: $26,250

- Ratio of student debt to median earnings of bachelor’s degree holders: 78.69%

9. Austell, Georgia

- Median student debt balance: $25,146

- Median earnings of bachelor’s degree holders: $31,935

- Ratio of student debt to median earnings of bachelor’s degree holders: 78.74%

8. Murray, Kentucky

- Median student debt balance: $21,555

- Median earnings of bachelor’s degree holders: $27,356

- Ratio of student debt to median earnings of bachelor’s degree holders: 78.79%

7. Elizabeth City, North Carolina

- Median student debt balance: $24,339

- Median earnings of bachelor’s degree holders: $30,172

- Ratio of student debt to median earnings of bachelor’s degree holders: 80.67%

6. Lady Lake, Florida

- Median student debt balance: $27,290

- Median earnings of bachelor’s degree holders: $33,675

- Ratio of student debt to median earnings of bachelor’s degree holders: 81.04%

5. Waycross, Georgia

- Median student debt balance: $17,994

- Median earnings of bachelor’s degree holders: $22,158

- Ratio of student debt to median earnings of bachelor’s degree holders: 81.21%

4. East Liverpool, Ohio

- Median student debt balance: $18,466

- Median earnings of bachelor’s degree holders: $22,222

- Ratio of student debt to median earnings of bachelor’s degree holders: 83.1%

3. Palatka, Florida

- Median student debt balance: $21,487

- Median earnings of bachelor’s degree holders: $25,772

- Ratio of student debt to median earnings of bachelor’s degree holders: 83.37%

2. Green Valley, Arizona

- Median student debt balance: $20,464

- Median earnings of bachelor’s degree holders: $24,250

- Ratio of student debt to median earnings of bachelor’s degree holders: 84.39%

1. Sun City West, Arizona

- Median student debt balance: $17,771

- Median earnings of bachelor’s degree holders: $21,046

- Ratio of student debt to median earnings of bachelor’s degree holders: 84.44%

via ZeroHedge News http://bit.ly/2JQ2ssl Tyler Durden