Authored by Sven Henrich via NorthmanTrader.com,

Game over. The grand central bank experiment of the last 10 years has ended in utter and complete failure. The games of cheap money and constant intervention that have brought you record global debt to the tune of $250 trillion and record wealth inequality are about to embark on a new round of peddling blue meth again.

Australia has already cut, so has India. The ECB is talking about it, markets are already pricing in multiple Fed cuts. The new global rate cutting cycle begins anew before the last one ever ended. Brace yourselves as no one, absolutely no one, can know how this will turn out.

Absolutely staggering. We are witnessing a historic unraveling here. Everything every central banker has uttered last year was completely wrong. Every projection they made over the last 10 years has been wrong. No wonder Jay Powell wants to toss the dot plot. It’s a public record of failure.

Why place confidence in people who are staring at the ruins of the policies they unleashed on the world and are about to unleash again?

All the distortions of 10 years of cheap money, debt, wealth inequality, zombie companies, negative debt, TINA, you name it, will all be further exacerbated by hapless and scared central bankers whose only solution to failure is to embark on the same cheap money train again. All under the banner to “extend the business cycle” at all costs. Never asking whether they should nor considering the consequences. But since they are not elected by the people and face zero consequences for failure they don’t have to consider the collateral damage they inflict.

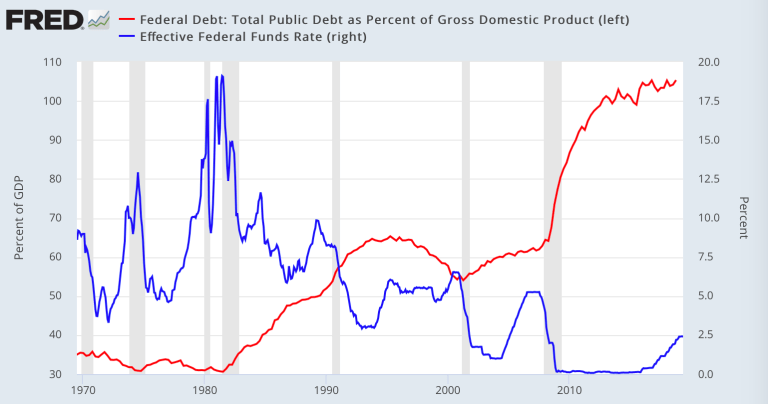

I repeat: Structural bears who have predicted that central bankers would never be able to normalize the construct they created and has produced the world’s greatest debt explosion ever were 100% correct. We’re all staring at a colossal policy failure with no accountability.

And so it begins:

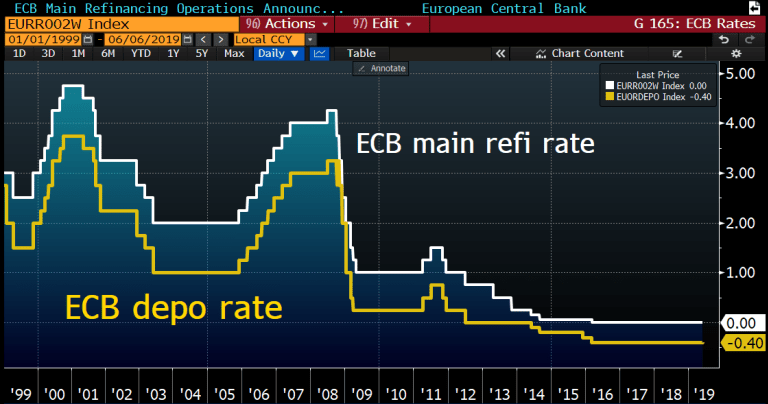

Draghi: Several members of the Governing Council raised the possibility of rate cuts, others the possibility of restarting the APP or the extension of forward guidance

— European Central Bank (@ecb) June 6, 2019

Back to the same TINA (there is no alternative) nonsense:

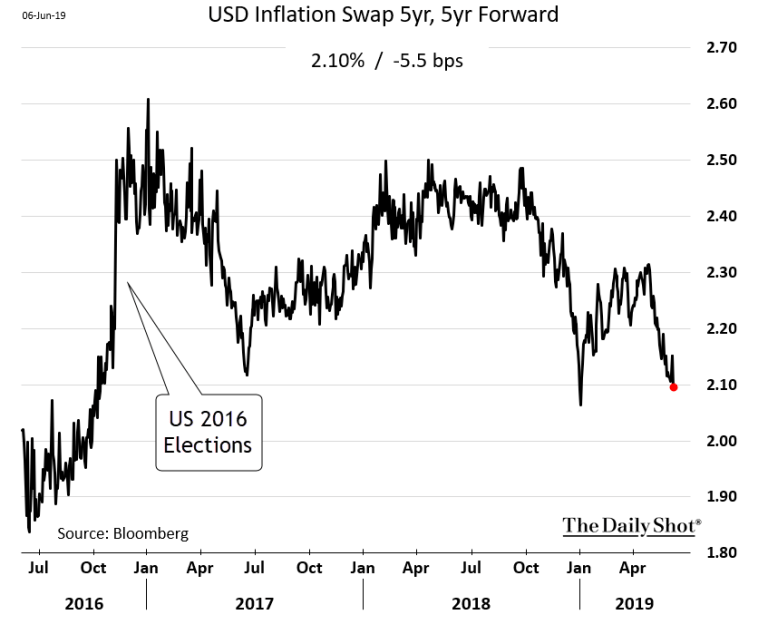

At this moment in time with the ECB’s balance sheet at all time highs amid collapsing inflation expectations:

With rates still negative:

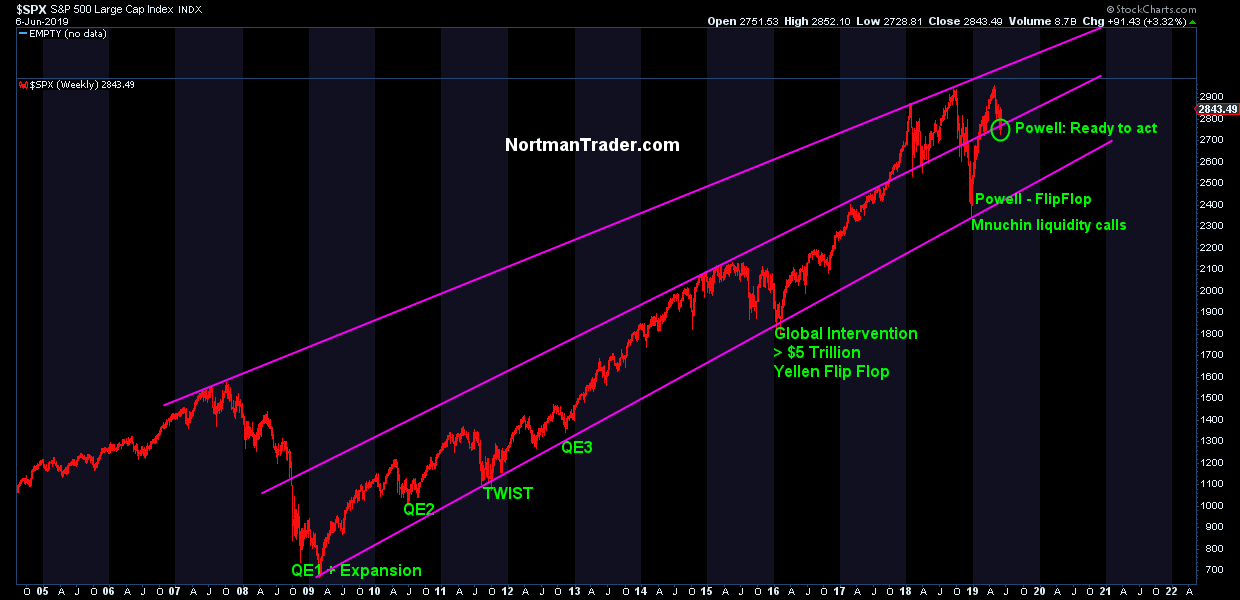

Coming rate cuts in the US following the most pitiful rate hike cycle in history with debt to GDP higher than ever before:

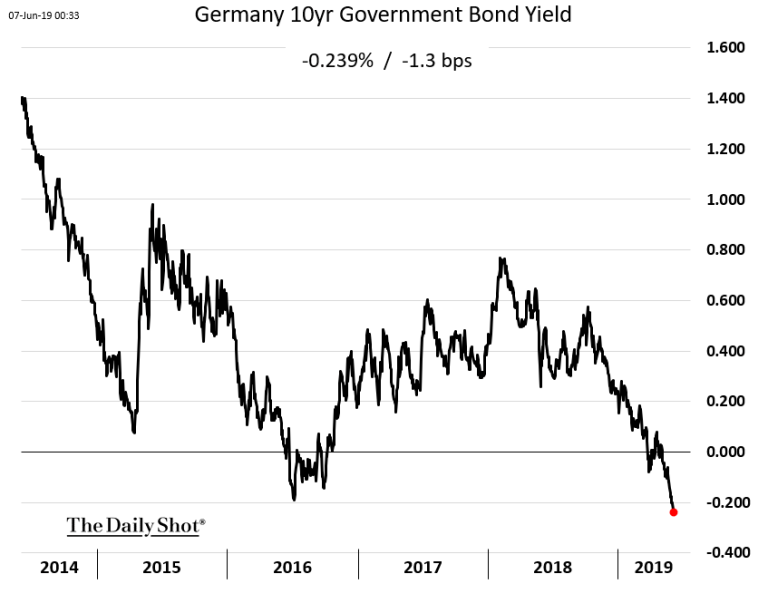

And with economic data, yields and inflation expectations collapsing all around:

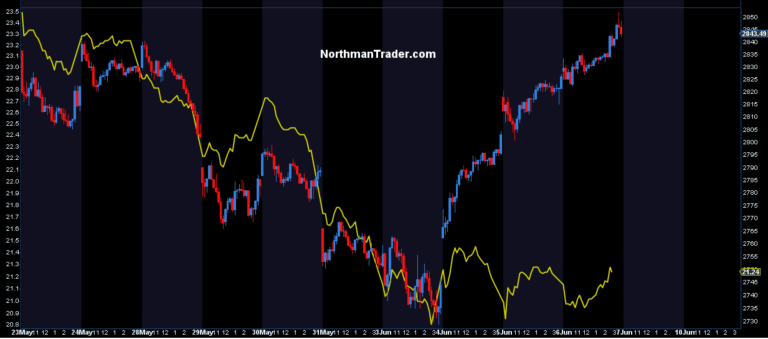

And so the TINA effect is back, the blue meth is on the market again and investors are chasing back into stocks in the face of deteriorating fundamentals:

Bringing FOMO back with the expectation that this will usher in a new era of record highs as central bankers are once again stepping in at the right moment trying to prevent another key break in stock prices:

One is virtually enticed to chase assets again for that big grand finale perhaps.

Not because of earnings, not because of revenues or growth. Because they have to as yields are once again collapsing and central bankers are again promising free money.

As I’ve outlined for quite some time: Stock markets can’t sustain gains or record prices without intervention, without a helping hand, without dovish and intervening central banks. This has been true for 10 years and it continues to be true in 2019 cause that’s where all the big gains are:

This is not capitalism, nor does this ongoing farce constitute free market price discovery. It’s politburo based central planning, desperately trying to keep the balls in the air.

“To extend the business cycle” Jay Powell stated this week. Since when is this the primary purpose of the Fed? What happened to inflation and price stability? Already they are tossing their stated inflation goals and are talking about letting inflations run hotter if they can juice it up. There’s no integrity, only moving targets and carrots driven by equity prices.

The pretense is gone, it’s all about keeping the illusion alive that the Fed knows what it’s doing, that it’s always there to save markets from any trouble.

But its track record is obvious: It has failed to meet its inflation targets (ill guided as they may be) for 10 years. It has failed to normalize despite years of promises to do so, and will never be able to normalize. Between 2008-2019 the Fed was non-accommodative for 3 months. It blew up in their faces in December. They’ll never be non accommodative again. They can’t.

This week investors are happy to chase the coming free money train again. They may well be rewarded for the same gig that has worked for 10 years with the consequences already apparent: Ever more record government, corporate and consumer debt and yes, ever more extreme wealth inequality. Bravo.

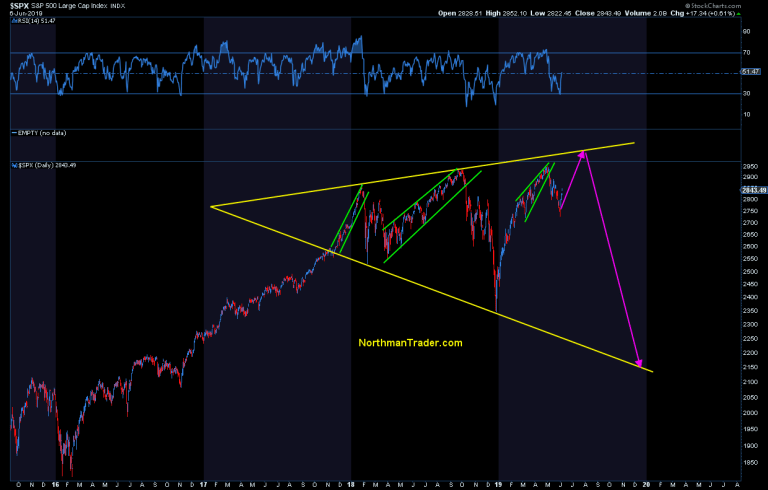

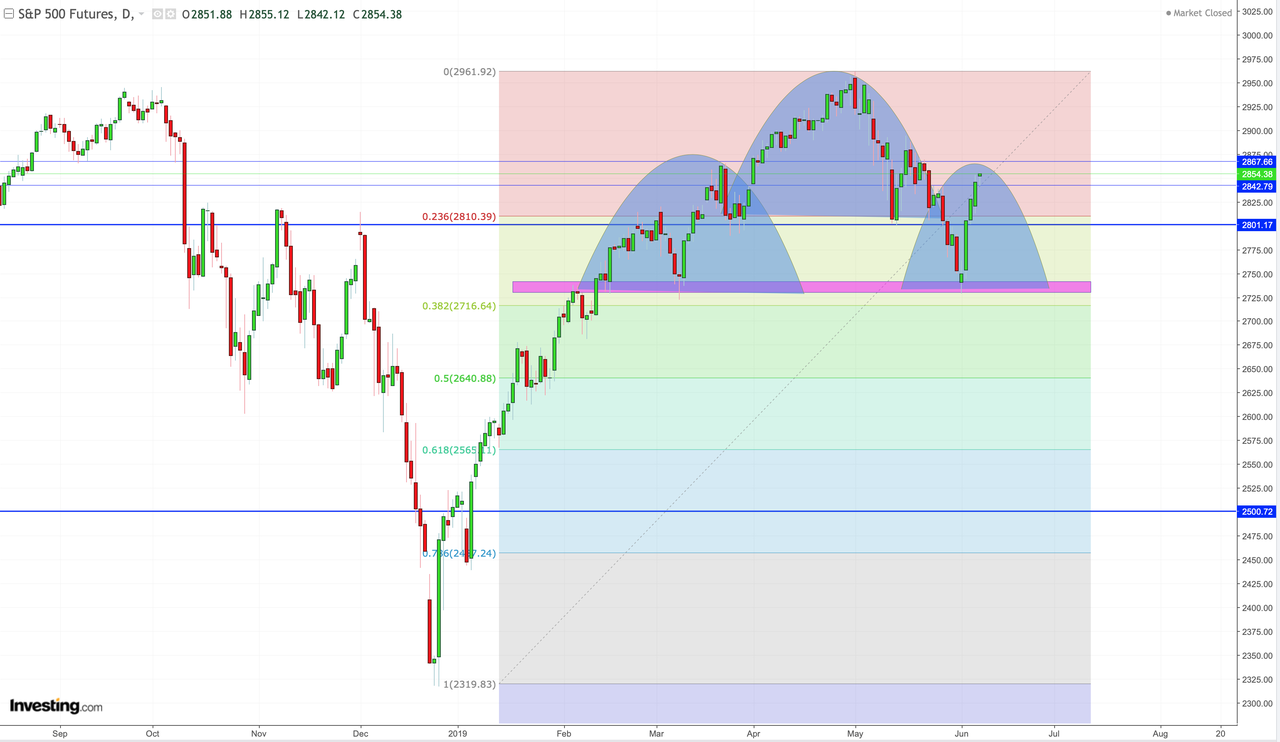

Alternatively investors may want to exercise caution in chasing policy failure, but rather keep an eye on technicals that may well point to a different result:

While markets will negotiate the ultimate outcome the verdict on the policy front is already in: Game over. The grand central bank experiment has been revealed to be a colossal failure. Brace yourselves.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2KyDZXX Tyler Durden