Global markets are set to end the week – barring a shock from today’s nonfarm payrolls report – diametrically opposite from how they started it: with global market a sea of green, and the S&P on pace to close 100 points higher compared to where they started largely thanks to Powell’s hint that the Fed is open to a rate cut, one which is almost priced in by the market for the June FOMC meeting.

US equity futures rose with European stocks ahead of a “critical” jobs report, while the dollar climbed following the recent rout and Treasury yields also nudged higher, after Mexican and U.S. officials held a second day of talks on trade and migration on Thursday, with markets rebounding on optimism a deal could be close, although it was unclear if Mexican pledges to curb migration flows were enough to persuade the Trump administration to postpone tariffs.

Yet risks were still present after Vice President Mike Pence said Mexico had offered “more” on Thursday than on Wednesday but that it would be up to Trump – who returns from a European trip on Friday – to decide if it were enough. “There has been some movement on their part. It’s been encouraging,” he said. “The discussions are going to continue in the days ahead.”

As reported last night, Mexican Foreign Minister Marcelo Ebrard said the Mexican government had offered to send 6,000 members of the National Guard to secure its southern border with Guatemala. In a sign of a wider crackdown, the leftist administration of Mexican President Andres Manuel Lopez Obrador said earlier that it blocked the bank accounts of 26 people for alleged links to human trafficking, while it detained on Wednesday at least 350 migrants crossing into Mexico and arrested two prominent migrant rights activists.

U.S.-Mexico migration talks will continue on Friday, Ebrard said, and markets breathed a sigh of relief with Europe’s Stoxx 600 Index headed for its biggest weekly advance in two months, boosted by a rise in oil stocks as crude prices rallied, ignoring the latest dismal data out of German, where the recent rebound in Industrial Production faded, and the May print of -1.9% was the worst going back five years.

Japanese and South Korean shares advanced, while China’s markets were closed for a holiday. Traders are closely watching developments in U.S.-Mexico trade talks after Vice President Mike Pence said his country still plansto impose tariffs on its neighbor next week.

On the other hand, if the tariffs do go ahead, the United States would be in a serious trade dispute with both China and Mexico – two of its three top trading partners. Analysts have warned that tariffs could spark a recession in Mexico. Credit ratings agency Fitch downgraded Mexico’s sovereign debt rating on Wednesday, citing trade tensions among other risks, while Moody’s lowered its outlook to negative.

Separately, the White House has drafted a document for Trump that would declare a new national emergency to implement the Mexican tariffs, according to a copy of the order seen by The Hill, however the head of the U.S. House of Representatives Ways and Means Committee vowed to take steps to block such a move.

In terms of immediate catalysts, all eyes are on the U.S. jobs report in an hour looking for clues on the strength of the economy, after Powell signaled this week he’s open to easier policy as trade tensions persist, and as investors are pricing in a 92% chance of a rate cut by September, Fed fund futures show. Powell’s counterpart in Europe, Mario Draghi, indicated Thursday he will react to any deterioration in the outlook for the region’s economy, though some had expected a clearer signal he’s willing to further loosen policy.

“It appears too early to call for the next round of liquidity-on fueling all asset classes,” said Alexander Kraemer, head of cross asset strategy at Commerzbank AG. “Markets are apparently not yet fully giving in to the central bank put.”

In FX news, the dollar advanced and Treasuries stabilized as traders awaited the U.S. jobs report. The euro dropped following a miss in German data while the pound led gains among G-10 currencies as the race for the U.K. prime minister’s post took center stage. The offshore yuan tumbled to its weakest level since November 2018 as PBOC governor Yi Gang said in an interview with Bloomberg that the nation has “tremendous” room to adjust policy.

In geopolitical news, the Russian Pacific Fleet issued a formal protest to the US regarding dangerous manoeuvring by a US ship, Russia said that one of their ships was forced to make a dangerous manoeuvre to avoid collision in the East China Sea. Subsequently, the US Navy says that a Russian destroyer made and unsafe and unprofessional approach to a US Missile cruiser in the Philippine Sea, which put the safety of US sailors at risk.

Other expected data include wholesale inventories. No major earnings releases are scheduled.

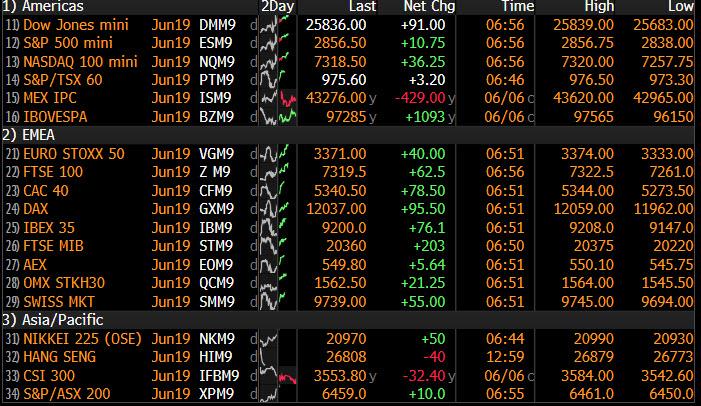

Market Snapshot

- S&P 500 futures up 0.3% to 2,853.50

- STOXX Europe 600 up 0.7% to 376.60

- MXAP up 0.07% to 153.69

- MXAPJ unchanged at 501.43

- Nikkei up 0.5% to 20,884.71

- Topix up 0.5% to 1,532.39

- Hang Seng Index up 0.3% to 26,965.28

- Shanghai Composite down 1.2% to 2,827.80

- Sensex down 0.2% to 39,452.02

- Australia S&P/ASX 200 up 1% to 6,443.89

- Kospi up 0.2% to 2,072.33

- Brent futures up 1.8% to $62.79/bbl

- German 10Y yield rose 0.5 bps to -0.234%

- Euro down 0.1% to $1.1263

- Italian 10Y yield rose 1.8 bps to 2.118%

- Spanish 10Y yield fell 2.8 bps to 0.582%

- Gold spot up 0.05% to $1,336.01

- U.S. Dollar Index up 0.05% to 97.09

Top Overnight News

- Vice President Mike Pence said the U.S. still plans to impose tariffs on Mexico next week, as American and Mexican officials planned further talks aimed at defusing a crisis between the two countries over the flow of undocumented migrants into the U.S.

- The main U.K. opposition Labour Party unexpectedly held onto its Peterborough seat, slowing the march of Nigel Farage’s new pro-Brexit movement which bookmakers’ had expected to win Thursday’s by-election. The result will alarm members of the U.K.’s ruling Conservatives — who were beaten into third place

- German industrial production plunged the most in almost four years in April and the nation’s central bank gave a gloomy assessment of the outlook, suggesting a persistent slump in Europe’s largest economy

- China has “tremendous” room to adjust monetary policy if the trade war with the U.S. deepens, People’s Bank of China Governor Yi Gang said. Asked about his scheduled meeting with U.S. Treasury Secretary Steven Mnuchin this weekend, Yi said it would probably be a “productive talk, as always,” though the trade war topic would be “uncertain and difficult”

- New York Fed President John Williams said the outlook for the U.S. economy remains solid while acknowledging that risks are rising and investors expect the central bank to lower interest rates

- President Trump said he’ll decide whether to enact tariffs on another $325 billion in Chinese imports after the Group-of-20 meeting

- U.S. Vice President Mike Pence said the U.S. still plans to impose tariffs on Mexico next week, as American and Mexican officials planned further talks

- Bank of Japan increased purchases of bonds due in 10-to-25 years by 40b yen at its regular operation on Friday

- Boris Johnson received a boost to his bid to become Britain’s next prime minister after a leading Conservative donor promised to give funds to his campaign

Asian equity markets were mostly higher following the tailwinds from US where sentiment was underpinned by hopes of averting tariffs on Mexico after reports the US was considering delaying tariffs as time for a deal was running short. However, White House Press Secretary Sanders later cast doubts on this and stated the US is still moving ahead with tariffs, while President Trump reportedly plans to declare a national emergency to impose the tariffs on Mexico. ASX 200 (+1.0%) was positive with the index led by the energy sector after similar outperformance stateside following a rebound in oil prices and Nikkei 225 (+0.5%) gained as exporters coat-tailed on favourable currency flows. KOSPI (+0.2%) eventually shrugged off the early indecisiveness and conformed to the upbeat tone but with gains capped across Asia-Pac bourses amid holiday closures across the Greater China region, ongoing trade uncertainty and ahead of the key NFP jobs data. Finally, 10yr JGBs traded marginally higher despite the gains in stocks as prices edged back above the 153.50 level and as yields declined in which the 30yr yield fell to its lowest since August 2016. The BoJ were also present in the market today for JPY 720bln in the belly to super-long end in which it increased its buying amount in 10yr-25yr maturities, although this was after it had already announced to reduce frequency of those purchases for the month.

Top Asian News

- Turkish Traders Return Just in Time for End of Lira’s Hot Streak

European equities are higher across the board [Eurostoxx 50 +1.0%] as the region continues the positive handover from Asia with sentiment buoyed by reports that the US is considering delayed tariffs on Mexico. European sectors are all in the green with energy names outperforming as the oil market continues to recover from recent lows, whiles other sectors are showing broad-based gains. In terms of individual movers, Bpost (-9.7%), Deutsche Wohnen (-6.6%) and Royal Mail (-5.9%) all rest at the foot of the Stoxx 600 amid negative broker moves. Meanwhile, Sanofi (+4.9%) are higher after the Co. appointed Paul Hudson as CEO effective 1st September after the current CEO retired. Finally, MediaSet Espana (+8.6%) spiked higher in European trade amid reports that that the company is considering options in Spain, including a potential combination with its parent company MediaSet (+2.6%)

Top European News

- Pound May Fall 2% If Boris Johnson Becomes U.K. PM, Survey Shows

- Real Estate Extends Slump as German Rent Freeze Fears Persist

- U.K. House Prices Unexpectedly Rise in Sign of Stabilization

- Labour Wins U.K. By-Election as Farage Warns Tories Over Brexit

In FX news, the DXY index is holding just above the 97.000 level in a very tight range (97.007-124) into NFP, with the Dollar firmer or steady vs most major counterparts and racking up heftier gains against EMs. Clearly the upcoming US jobs data will provide the next big directional pointer for the Greenback and currency markets as a whole, but from a technical perspective the DXY is highly likely to remain well within nearest support and resistance around 97.745 (Wednesday’s low) and 97.546 (late May base) on the charts in advance.

- GBP/CHF – The G10 outliers, as Cable continues to consolidate above the 1.2700 handle, though faces some resistance in the form of the 21 DMA at 1.2730, while the Franc is underperforming and still meeting offers ahead of the psychological 0.9900 mark as Eur/Chf eyes 1.1200 ahead of next week’s SNB Quarterly Policy review and post-Thursday’s ECB action.

- CAD/NZD/AUD/EUR/JPY – All narrowly mixed vs the Usd, with the Loonie straddling 1.3350 and awaiting Canada’s labour report that should provide some independent impetus alongside the aforementioned US release, while the Aussie and Kiwi remain in flux following RBA and RBNZ inspired moves earlier this week, the former meandering between 0.6969-82 and latter from 0.6615 to 0.6626. Elsewhere, the single currency seems content or merely relieved to conform to the usual quieter pre-NFP trading environment after yesterday’s post-ECB whip-saw price moves, as Eur/Usd skirts 1.1258 and 1.1284 bounds, but is also ensconced in hefty expiries – 8.6 bn spanning 1.1200-1.1325, and 3.4 bn running off between 1.1250-60 and 1.1275 alone. Conversely, the Yen looks free from option interest after Thursday’s cluster stretching from 108.00 to 109.00, but has lost a bit more safe-haven premium as the broad recovery in risk appetite enters its 4th day. Hence, Usd/Jpy has probed above 108.50 to test the weight of supply reportedly close by.

- EM – As noted above, further depreciation or bullish retracement across the region, and in particular the Cnh after dovish PBoC commentary overnight and with no official Cny midpoint fix to anchor the offshore Yuan. Accordingly, Usd/Cnh has hit highs just over 6.9600 and cleared option barriers at 6.9500 on the way. Meanwhile, Usd/Zar has extended through 15.0000 to 1.1650+ as the Rand suffers even more pronounced angst from ANC wrangling over the SARB’s mandate.

In commodities, WTI and Brent prices are firmly in the green and recovering from a five-month low amid reports of more engaged US-Mexico talks, which lifted sentiment during the US session. In the EU session, upside was exacerbated as Russian Energy Minister Novak and his Saudi counterpart Al-Falih participated in a panel discussion alongside a few CEOs from energy giants. Al-Falih noted that the precise volume of output (i.e. any potential revision to the OPEC+ deal) is still up for discussion and any decision taken at the upcoming meeting can be adjusted in H2 2019 (which was then echoed by the Iraqi Oil Minister), but he is sure that OPEC+ will extend the output pact. Furthermore, Al-Falih acknowledged that the Kingdom is “already cutting deeper”, referring to the overcompliance noted at the JMMC meeting last month, which comes in the context of sources noting that the Russian and Saudi Energy Minister discussed a scenario which would see an elimination of over-compliance (currently over 150%, equating to output cuts of just under 2mln BPD, according to calculations). This would mean a continuation of the current deal and an increase in production of around 0.8mln BPD. Finally, regarding the date of the next meeting, Novak spoke of consensus among “many oil producers” are skewed towards a July 2/4 meeting in Vienna, i.e. a delayed to the original June 25/26 date. Elsewhere, precious metals are uneventful and largely tentative ahead of the key US labour market report (Full preview available in the Research Suite), although the yellow metal is poised for its biggest weekly gain in six-months. Elsewhere, copper trades with marginal gains but with upside capped ahead of the US jobs numbers and the absence of China. To provide some colour, Codelco, the largest miner of the red metal, notes that copper demand “remains good” despite recent trade-sparked decline in prices, but the price rout could discourage mining companies from making investment decision, which could lead to tightened supply, while a potential strike at one of the Co’s main mines could add to the global deficit.

Looking at the day ahead, we’ve got the May employment report as well as April wholesale inventories and April consumer credit data. Away from that, the ECB’s Nowotny and Rimsevics are due to speak.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 175,000, prior 263,000

- 8:30am: Unemployment Rate, est. 3.6%, prior 3.6%

- 8:30am: Average Hourly Earnings MoM, est. 0.3%, prior 0.2%; YoY, est. 3.2%, prior 3.2%

- 8:30am: Average Weekly Hours All Employees, est. 34.5, prior 34.4;

- 8:30am: Labor Force Participation Rate, prior 62.8%; Underemployment Rate, prior 7.3%

- 10am: Wholesale Trade Sales MoM, est. -0.2%, prior 2.3%; Wholesale Inventories MoM, est. 0.7%, prior 0.7%

- 3pm: Consumer Credit, est. $13.0b, prior $10.3b

DB’s Jim Reid concludes the overnight wrap

It’s my birthday next week and last night summed up all that is wrong about getting old. My wife was helping to shave my (mostly) bald head and told me that my eyebrows were growing a bit wilder these days. Then she said “I know what I’ll get you for your birthday… an eyebrow comb”. Part of me died as I heard that. As an example of how things have changed for my 21st birthday my university friends got me 21 bottles of my favourite 2 litre bottles of cider which came in handy post my finals which finished on the same day. As I’m now about to turn 45, an eyebrow comb is clearly seen to be the most suitable present. How depressing and underwhelming.

“Underwhelmed” is probably the best way to describe how markets felt post the ECB yesterday. Slightly more generous than expected terms on TLTRO3 wasn’t matched by an “or lower” reference to rates guidance that some had been looking for. Draghi’s press conference failed to really deliver the dovishness that the market hoped for either and it begs the question of what will it take for the ECB to really pivot that way now. To be fair I don’t think you should conduct policy by what the market wants to hear, but the problem for the ECB is that we do live in a very “financial conditions” sensitive world and one which they have themselves encouraged in various sugar rush policies of the past. Central banks have created monsters that they now have to try to look after or face a backlash. More on the ECB later, but trade is likely to be a big dictator of what they eventually do next and yesterday we heard President Trump confirm that he will decide on whether or not to trigger the next round of tariffs on China after the G20 meeting at the end of this month. So that will be a big focal point for markets.

The end result of all that was a bit of quiet session for equities with the S&P 500 and NASDAQ ending +0.61% and +0.53% higher, respectively, amid lower-than-average trading volumes. Markets in Europe had traded well pre-ECB, but fell sharply after Draghi. The STOXX 600 finished -0.02% (highs +0.71%) while European Banks slumped -1.42% and were -2.96% down from their intraday highs. The sector is now down -16.80% from the April local peak and therefore only a few bad sessions away from a bear market. Italian Banks also reversed to close down -1.15% and -3.13% from their highs. Meanwhile 10y Bunds ended -1.3bps lower at -0.239% after trading in an intraday range of a little over 5bps. 10y Treasuries ended -0.5bps lower at 2.130% while 2y yields finished +3.6bps higher, flattening the 2s10s curve back to 23.5bps. The euro (+0.47%) was a shade firmer while EUR 5y5y inflation expectations dipped to touch their 2016 lows, but rose just before European markets closed to end the session flat at 1.29%

Overnight, the PBoC Governor Yi Gang said that China has “tremendous” room to adjust monetary policy if the trade war with the US deepens and on the yuan depreciation said that no “numerical number” is more important than another while adding, “recently, it’s a little bit weaker, because the tremendous pressure from the US side.” The offshore Chinese yuan is trading a touch weaker (-0.16%) this morning at 6.9384. Elsewhere, US Vice President Mike Pence is now scheduled to deliver his speech on US-China relations at Washington’s Wilson Centre on June 24. His speech could be significant given the hawkish remarks he had made on China in October last year at the Hudson Institute.

This morning in Asia markets are largely trading up with the Nikkei (+0.58%), Kospi (+0.30%) and S&P ASX (+0.62%) all higher. Markets in Hong Kong and China are closed for a holiday. Elsewhere, futures on the S&P 500 are up +0.14% while WTI crude oil prices are up +1.37% this morning. In other overnight news, President Donald Trump repeated his criticism of the Fed’s interest rate hikes saying that the stock market would be 10,000 points higher had the Fed kept rates lower.

Meanwhile, here in the UK, Theresa May will be stepping down today as Conservative party leader but will carry on as PM until late July when the new leader will be elected. Elsewhere, in the Peterborough by-election yesterday, the Labour party was able to defend the seat by taking 30.9% of the vote and beating candidates from the Brexit Party (28.9% votes) and Conservative party (21.4%).

Back to the ECB now, where the main takeaways included a commitment to keep rates unchanged at least through the first half of 2020 but without an “or lower” reference to forward guidance. The pricing terms for TLTRO3 was set at depo+10bps for banks meeting lending targets and MRO+10bps for those that don’t, better than what our economists and the market more broadly expected but still not as generous as TLTRO2. Growth forecasts were revised down for 2020 and 2021 and inflation revised down one-tenth for 2020, but left unchanged for 2021. Draghi’s press conference included a number of repeats from the last meeting with little reference to any new global risks to the outlook initially or a willingness to acknowledge market pricing, however later on he did cite that council members had raised the possibility of rate cuts, a restart to APP and/or a further extension to forward guidance which was at least somewhat welcome to markets. There was also an abrupt effort to play down the next move being a hike rather than a cut however this all felt a little late in the press conference.

Our economists have a full review of the ECB fallout and the roadmap moving forward ( here ). They re-emphasize that their base case is still for the ECB to keep its policy stance unchanged this year, as conditions are accommodative and inflation is still expected to rise gradually back toward target. They also argue that we’re approaching the point where Draghi’s comments lose significance, given his impending departure. Our economists will therefore be watching the rhetoric from his potential successors and from new Chief Economist Lane for clues about the policy outlook. Finally, they note three potential scenarios that would likely prompt the ECB to deploy new policy measures: 1) a major risk materializing, e.g. no-deal Brexit, trade war escalation, or Italy crisis; 2) a deeper slowdown in broader economic activity relative to expectations; or 3) a shift in relative policy stance, i.e. policy easing from the Fed that results in a stronger euro and undermines euro area inflation.

So the baton passes to the Fed with the next meeting to mark in your diary being June 19th. It goes without saying that data between now and then will be finely picked apart and it starts with the US employment report this afternoon. In terms of what to expect, following a stronger-than-expected 263k last month, the consensus for today is 175k with a spread amongst economists of 65k to 228k. A reminder that we got a very, very weak ADP this week (27k) albeit offset by improved employment component readings from both the ISM surveys. Our US economists expect a 160k reading which should be enough to keep the unemployment rate steady at 3.6%. As for earnings, they forecast a +0.3% mom reading. Needless to say that with the Fed and market both locked in on the data at the moment, there will be plenty of focus on today’s report.

We got another few snippets of Fedspeak yesterday before the start of their regular blackout period tomorrow. NY Fed President Williams repeated that his “baseline is a very good one” but that he is “prepared to adjust views” as necessary. He also said that the yield curve sends “a pretty strong signal” but that it’s not an “oracle.” Notably, he also said that he’s not worried about the big divergence between market pricing and the fed’s median interest rate projections. Dallas Fed President Kaplan also argued for patience, saying he wants “to give this a little more time” to let events unfold. One interesting tidbit from his remarks, however, was his emphasis on credit spreads rather than equities as the most relevant metric to gauge financial tightening. San Francisco President Daly is due to speak today, then there’s nothing on the calendar until the June 19th meeting.

Turning now to trade, where we are plowing ahead toward President Trump’s Monday deadline for his planned Mexico tariffs. Although the White House has not publicly made any specific demands, they have asked that Mexico “step up and help solve” the issue of illegal immigration. In talks yesterday, Mexican Foreign Minister Ebrard said that the two sides have made “advances.” Anonymous US sources in the media said that the tariffs may be delayed, while simultaneously other sources said that they are likely to be implemented, even if just briefly. Vice President Pence then confirmed that as of now, tariffs are set to be imposed on schedule, though bilateral talks are set to continue today.

Yesterday’s data didn’t really add much to the debate. Claims were unchanged at 218k and marginally higher than expected. The April trade balance showed a deficit of $50.8bn, narrowing from the month prior, while final Q1 revisions for nonfarm productivity and unit labour costs were confirmed at 3.4% and -1.6%, respectively – the latter revised down. That said, the Atlanta Fed’s nowcast model for second quarter GDP growth did inch +0.2pp higher yesterday to 1.5%, its highest level in a month.

To the day ahead now, where data this morning includes April industrial production prints in Germany and France as well as trade data in the former. In the US we’ve got the aforementioned May employment report as well as April wholesale inventories and April consumer credit data. Away from that, the ECB’s Nowotny and Rimsevics are due to speak.

via ZeroHedge News http://bit.ly/2R2k5WN Tyler Durden