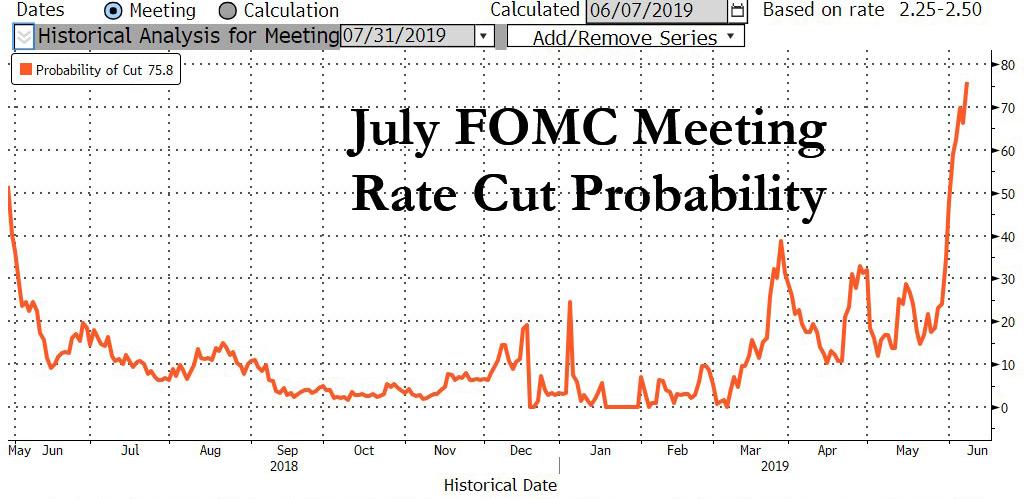

After today’s dismal payrolls report, which sent bond yield plunging and stocks surging, the market’s verdict is in: a Fed rate cut in July is now the base case, with odds of 76% (and even a June cut is possible, with odds of 25%).

And while a rate cut would be delight to President Trump, who earlier today proclaimed that had rates been lower the Dow would be “10,000 higher”, there a far greater, potentially existential threat, to the Fed should it proceed with a rate cut according to Bank of America.

In his latest Flow Show report, Bank of America CIO Michael Hartnett presents several reasons why – despite today’s payrolls print – the market does not a rate cut, among which:

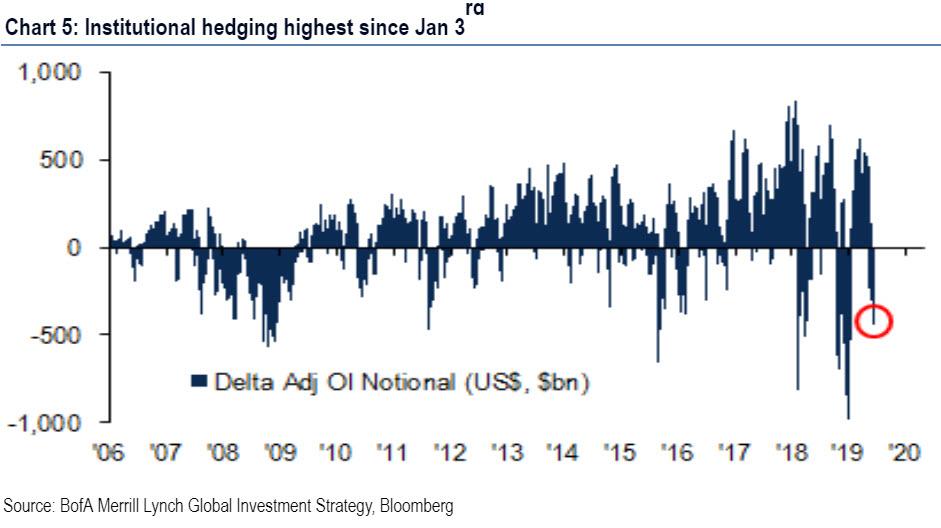

Positioning: investors are extremely bearish, with the BofAML Bull & Bear Indicator plunging to 2.5, a fraction away from “buy” signal level of 2.0; and equity investors very bearish – as the latest BofA FMS survey revealed, investors are most hedged since Jan 3rd equity lows. The weekly flow data suggests the same: $17.5bn into bonds (2nd biggest week of inflows ever) offset by $10.3bn out of equities; YTD $183bn into bonds, $155bn out of equities as nobody wants to have anything to do with stocks (despite the S&P being just shy of all time highs again).

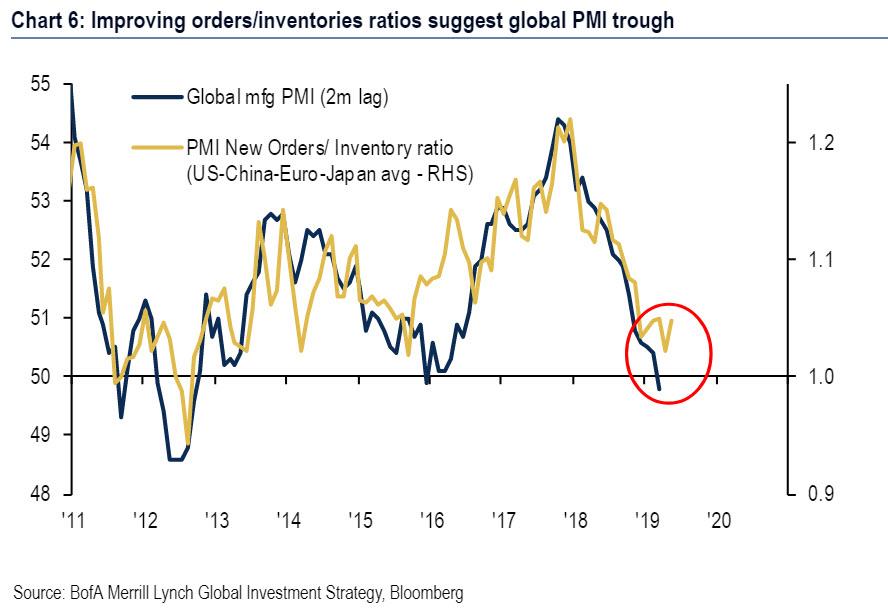

Profits are about to trough: the Global PMI (highly correlated with global EPS) was 49.8 in May, i.e. on “boom-bust” border; makes stocks a one-decision market…”sell” if PMI heads toward 45, and “buy” if PMI heads toward 55. However, providing a somewhat bullish take on this series, is the ratio of orders/inventories which leads PMI by 2-months and has turned higher. At the same time, US/China financial conditions are easing via liquidity/lower yields/lower oil, and assuming no material escalation of trade war, BofA thinks that PMI troughs next 3 months, resulting in a rebound in EPS as well.

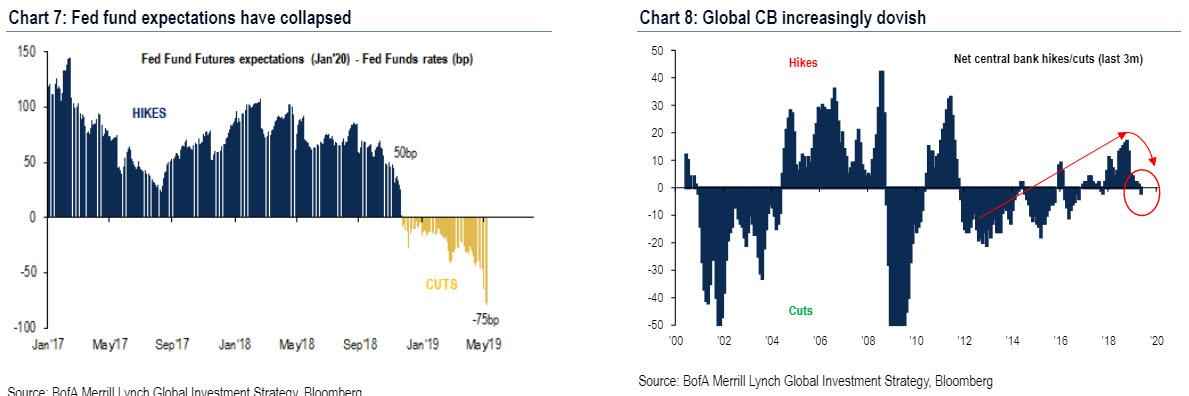

Monetary policy is already max bullish and exhibits clear parallels to the Shanghai Accord ’16, ahead of the Osaka G20 meeting. As a reminder, the Shanghai Accord saw global coordinated policy easing coinciding with extreme pessimism & trough in profit expectations. In its aftermath, the S&P500 & ACWI multiple jumped 1.5-2x in next 3 months. Fast forward to today, when in the run-up to Osaka G20 big global monetary ease underway, investor sentiment is likewise plunging. At the same time, a key catalyst is already in play – there is a big global monetary ease underway for 1st time since Q2’17 as 9 central banks cutting rates and Fed/PBoC/ECB/BoE are all turning dovish while there are rate cuts in Malaysia, New Zealand, India, Philippines, Australia; additionally if Trump changes his mind and there is no U.S. imposition of 25% tariffs on remaining $300bn of Chinese goods policy will be max bullish for risk in H2; however, the narrative can quickly flip to trade war, leading to 2019 playing out like Asia crisis ’98.

In other words, all else equal, the foundations for the S&P rising to 3,000 in the summer – which is BofA’s base case (before the S&P slides back down in the second half) are already there. In light of this, the risk is that the Fed does precisely what the market now expects with certainy, that it cuts rates as soon as July.

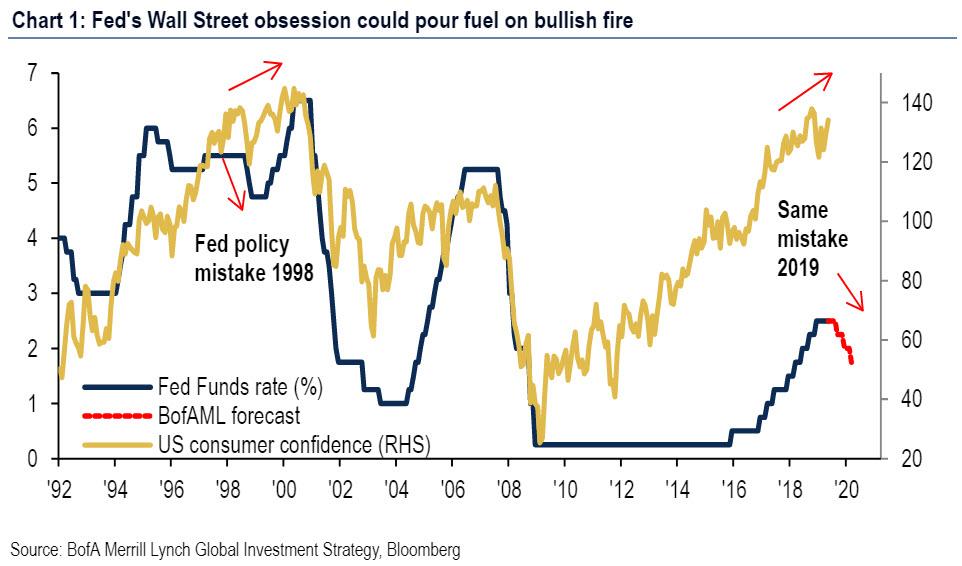

This is shown in the chart below, when in the aftermath of the Asian crisis of 1998, the Fed cut rates only to cause the dot com bubble… and its subsequent bursting and the plunge in rates from 6%+ to just 1% as the first 21st century bubble popped.

It is this risk that threatens markets now as well: an overly easy Fed cutting rates, only to create a historic meltup just ahead of the 2020 election, and eventually bursting the biggest asset bubble in history.

* * *

Two more points from Hartnett: he notes that according to client feedback, most are bearish on global macro and thus hedged; have been waiting for SPX 2650 entry point and also looking to short rally (hence the recent furious short squeeze); meanwhile the long-onlies are paralyzed by recession risk from yield curve, but missed Jan-Apr rip so inclined to buy weakness; private clients totally unfazed, conservatively positioned.

The final point: Risks, two of them.

- Risk 1 Tariff Man = recession: tariffs not yet leading to rise in unemployment in key battleground states for Trump re-election (Chart 10); we assume Trump would rather campaign as the Jobs President rather than Tariffs President; but trade war escalation via full US tariffs on China & Mexico, China offensive via rare-earth embargo & CNY devaluation, tech wars via market access embargoes.

- Risk 2 Powell pushing-on-a-string: if and when the Fed does cut, the tell will be that credit spreads widen, indicating that Fed has joined the BoJ & ECB in monetary policy impotence.

If that is what happens, then sell and don’t look back, as the worst-case scenario recently proposed by none other than Pimco, in which the Fed loses control of the market, will then be in play.

via ZeroHedge News http://bit.ly/2XxV9su Tyler Durden