With rate markets pricing in a certain rate cut by the Fed at the July FOMC meeting, and another two before year end, the market is convinced that the Fed’s hiking cycle is over and – with the occasional hawkish holdout such as Goldman still refusing to throw in the towel – the Fed is facing an uphill battle to disabuse investors that the party is about to start: after all, as we noted over the weekend, the Fed has always cut interest rates when the market priced a cut on the day prior to a FOMC meeting.

And yet, for those who are brave, or crazy enough, to fight the Fed and take the other side of the dovish bet that is now virtually assured when looking at tumbling bond yields and stocks just shy of all time highs again.

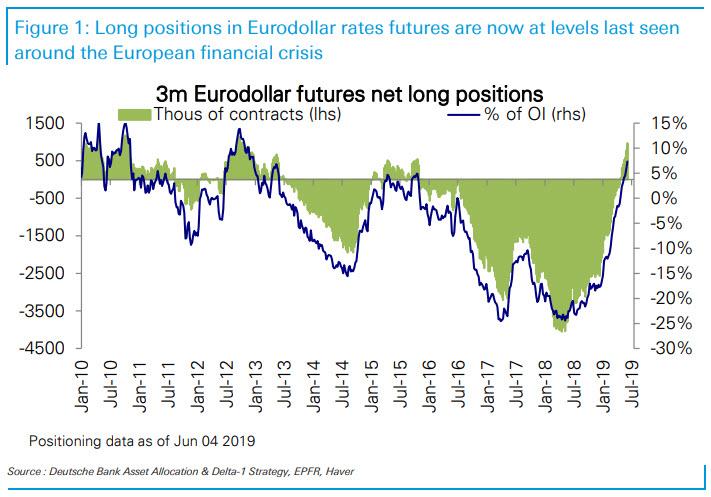

UBS is targeting that group of investors who believe that the Fed will find it impossible to cut rates three times before 2020, in the process disappointing a market that is poised on the edge of a recessionary panic if one only looks at the long positions in Eurodollar rates futures, which are now at levels last seen around the European financial crisis, suggesting that traders are bracing for a deflationary tsunami to sweep across the world and pricing in extensive easing (of course, stocks are once again near all time highs, because, well, the Fed and more QE is just over the horizon).

As Bloomberg notes, amid the near uniform conviction of an easing cycle this year, “the bar for the next bond-driven tantrum in risk assets has been lowered, the thinking goes. All that’s spurring structuring desks on Wall Street to offer hedge funds and institutional investors fresh ways to speculate on the fraught relationship between the world’s largest bond and equity markets.”

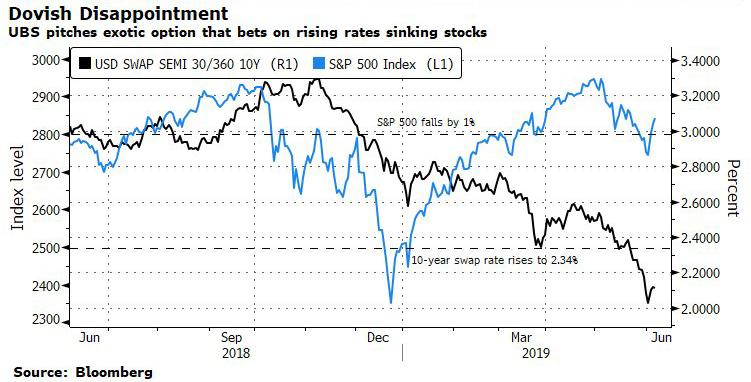

To UBS, this presents a tremendous arbitrage opportunity between what the market expects (a lot) and what the Fed can deliver (far less), and as a result the Swiss bank is pitching a derivative trade that pays out 10-to-1 if Treasury yields near historic lows rebound even modestly, while snapping the equity rally out of its latest trance, sending stock markets lower.

“Three rate cuts are now baked in by year-end, which is quite a high hurdle for the Fed to meet, let alone outperform,” said Pete Clarke, global head of equity derivatives strategy at UBS, in an interview with Bloomberg. “There’s definitely a risk that they end up easing by less than what’s expected, exacerbating the downside risks for equities in the process.”

The UBS trade of choice is multi-asset derivatives that would pay out 10 times the outlay, if a rise in the 10-year swap rate is accompanied by a modest drop in the S&P 500. What’s striking is how little bonds and stocks need to move for the investing style to pay off handsomely.

According to the in the money thresholds of the trade, shown below, the 10-year rate has to rise to a mere 2.34%, just 23 bps from current levels, while stocks trade just 1% lower than current levels by September.

To be sure, while in the past a sharp spike in yields has proven painful to equities, it is unclear if a quarter percent rise would be sufficient to hit stocks, but a 1% drop certainly sounds doable if the massive easing priced in the by the Fed fails to materialize. It is also open to debate if a less-dovish-than-expected monetary stance will spur a rise in the 10-year rate. Which is why the 10-1 upside/downside of the trade is so attractive.

So while fighting the Fed may be a bad idea, arbing the delta between what the market and the Fed is expecting certainly may be a lucrative proposition. Last Wednesday, futures reflected more than 70 basis points of easing in 2019, showing traders have concluded that the case for rate cuts is only strengthening – suggesting any disappointment could spark a backlash in risk assets. Yet even as Powell last week hinted the Fed was open to cutting rates, many banks have speculated that such a dramatic reversal for the “patient” Fed could have dire consequences for what little credibility it has left, certainly a consideration the FOMC would need to be aware of should it cut rates three times in the next 6 months. Incidentally, Goldman still sees no rate cuts in 2019 and in fact expects one rate hike in 2020.

For UBS, however, the biggest draw of this trade is the historical correlation between asset classes: “There’s a correlation discount in playing S&P down with rates up — since they’ve previously tended to move together,” according to UBS’ Clarke. “Entry levels look good right now – the S&P is back closer to highs, whereas the 10-year dollar swap rate is down 125 basis points since the fourth quarter of last year – approaching 2017 lows.”

So for all those who wish to fight if not the Fed as much as the market’s interpretation of the Fed’s reaction function, you now have a great incentive to put your AUM where your mouth is and make a ten-bagger if the market is wrong.

via ZeroHedge News http://bit.ly/2I8n7FW Tyler Durden