Morgan Stanley’s Mike Wilson, already the most bearish of Wall Street’s sellside research analysts, turned his bearishness up a notch today, when he slashed his EPS forecast for next year as a result of Morgan Stanley’s economists changing their forecasts for global growth to a stagnation through year end rather than a continued recovery as a result of “sustained escalation and incremental tariffs further slowing growth projections to the point of recession”, and now sees not only a further decline in earnings in 2019 but also unchanged earnings in 2020, downward revised from a prior forecast of a +5% increase in EPS, as corporate profit hit their plateau for this cycle, and obviously once the recession hits, it’s only downhill from there.

Wilson summarizes his gloomy outlook as follows: “we believe an exogenous cost shock would be very hard to absorb. Autos,electrical equipment & machinery, textiles, computers/electronics,and certain chemical/commodity sectors appear the most exposed to rising tariffs on goods from China”.

The basis of Wilson’s latest cut to corporate profits is a scenario analysis which assesses economic growth in three distinct paths around US-China trade tensions, and uses these paths to scenario test the S&P itself.

We further use the results to adjust our official S&P forecasts, though we note that since our forecasts take into account additional considerations beyond trade, our bull, base,and bear cases do not match the three trade paths one for one. Even in the absence of incremental trade escalation, our earnings model is already calling for negative EPS growth over the next 12 months and trade tensions add to the downside in earnings growth.

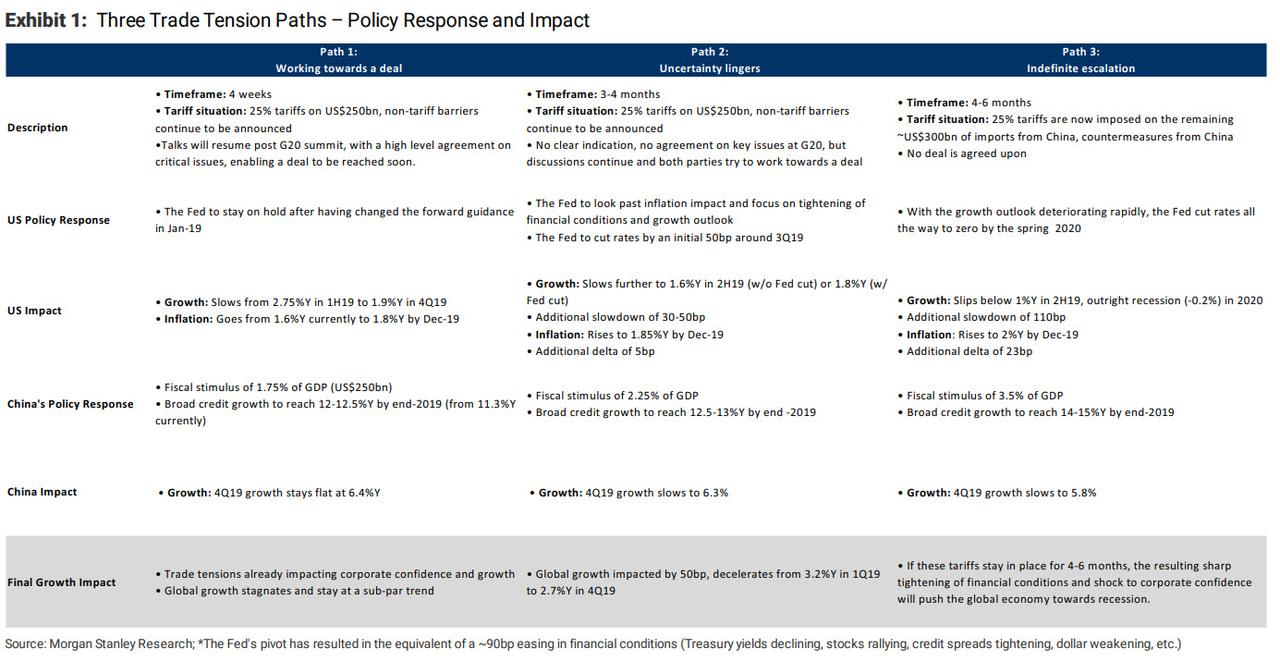

In the chart below, Wilson provides a brief summary of the trade paths analyzed as well as implications for economic forecasts:

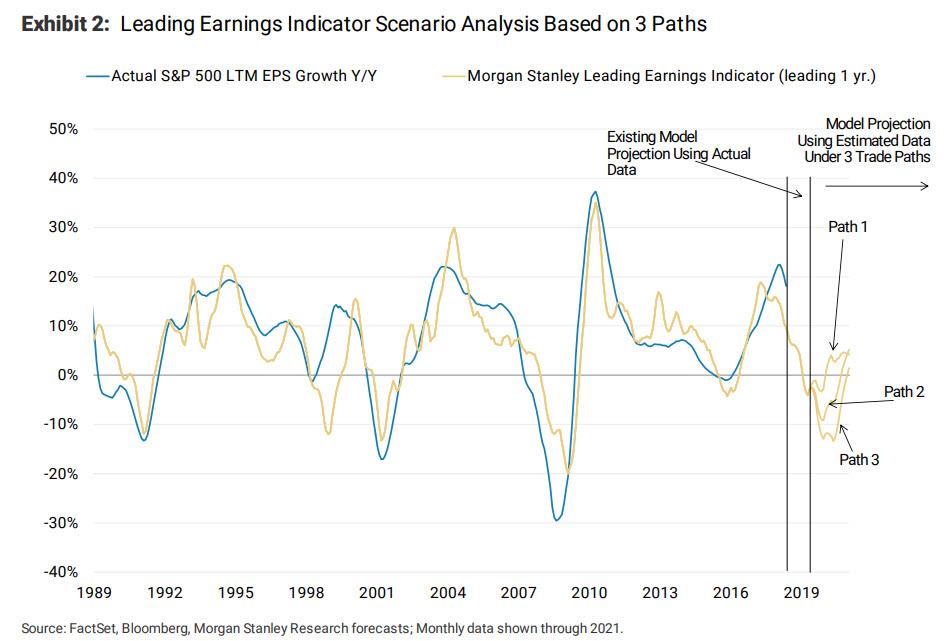

The next chart then shows the projections of the bank’s Leading Earnings Indicator with the three trade paths modeled out to 2021. Clearly the period around late 2019 when EPS are expected to slide below 0% is key.

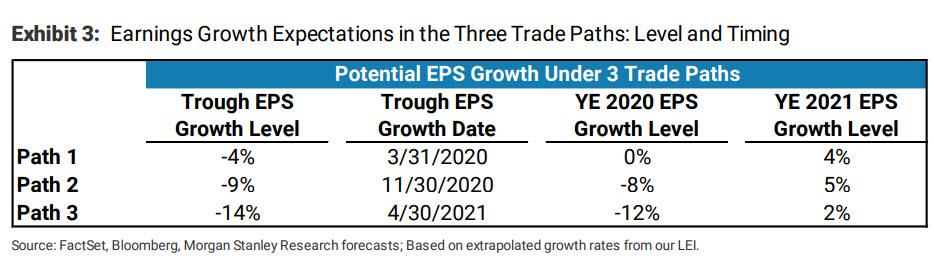

Exhibit 3 presents these data in table form, with the MS analyst providing more details on the price level/earnings impact of each of these paths below, noting that earnings growth troughs at -4% in March 2020 for path 1, -9% in November 2020 for path 2and -14% in April 2021 for path 3. Ominously for 2020, the best case anticipates an unchanged EPS print at best, with the downside path resulting in an additional 12% drop in EPS. The earnings recession ends only in 2021, when EPS is expected to grow between 2% and 5%.

What are the details behind the 3 specifics paths considered? The details are laid out below:

- Path 1: Working Towards a Deal (S&P rises to 3,000 but then slides down to 2,750)

If a deal is reached around the G20 meeting or if there is a sense that negotiations are moving towards a resolution, Wilson expects US equities to initially rally back towards our bull case of 3,000 on the S&P 500, but likely fall short of new highs. From there, he believes that risk/reward skews to the downside (towards our base case of 2,750) as the market still has to confront the earnings deceleration that Morgan Stanley has been calling for since last year. In path 1, earnings growth decelerates to -4%Y by March 2020 (trough level) and ends 2020 at 0%Y. Wilson “highly doubts” that the S&P would be pricing in this level of earnings deceleration at ~3,000.For context, consensus 2019 EPS growth is still 4%Y (above the 0%Y base case estimate) and consensus 2020 EPS growth is still 11%Y (well above our revised 0%Y base case estimate).

- Path 2: Uncertainty Lingers (S&P drops to between 2,400 – 2,750)

If escalation continues for the next 3-4 months, we would anticipate the near-term price action at the benchmark level to be poor over that period—the S&P trades between our base case and bear case price targets of 2,750 and 2,400, respectively. The economy may escape a recession, but the mild earnings recession that we foresee taking place this year likely gets exacerbated amid weakening corporate/consumer confidence, further cost pressure and an inability to pass on costs through pricing. The model shows earnings growth troughing at -9%Y in November 2020 and finishing the year at -8%Y in path 2. From a price level standpoint, Wilson does not believe that the market would trade all the way down to his bear case in this scenario as the earnings recession would not be extreme enough to drive an unemployment cycle (i.e.,an economic recession, which is Morgan Stanley’s bear case). Furthermore, the bank’s economists believe that the Fed would cut rates around 3Q19 in this scenario, which may be supportive of risk assets,at least initially.

- Path 3: Indefinite Escalation (S&P drops to 2,400)

If talks stall, no deal is reached and 25% tariffs are put into place on all China imports, MS expects the S&P 500 to trade to Wilson’s bear case of 2,400 and potentially to December lows (2,351) over the next 6-12 months. Essentially, this path accelerates the likelihood of our bear case price expectation playing out. Earnings growth would reach a trough level of -14%Y by April 2021, and an unemployment cycle and economic recession would take place in the US. This level of trough earnings growth is roughly commensurate with levels seen during the 1990-91 and 2001 economic recessions (that said, MS does not believe that the earnings cycle would be as extreme as 2008-09 even in a path 3 outcome).

* * *

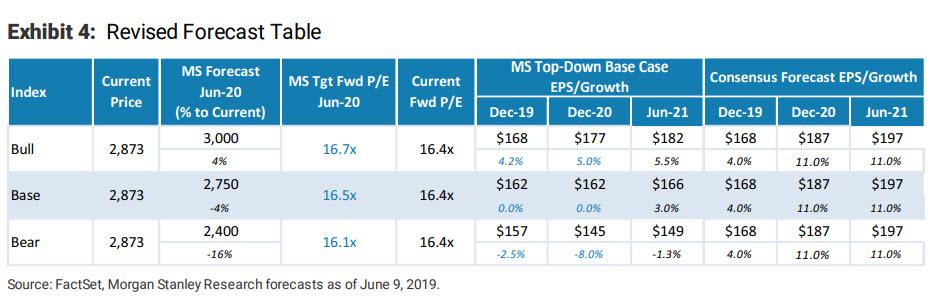

With these paths in mind, the already bearish Mr. Wilson has gotten even more bearish, and as a result he is adjusting his S&P earnings forecasts even lower to account for higher risk of slowing growth, noting that his model points to troughing earnings growth by early 2021 in the most bearish of the trade outcomes above. Additionally, he notes that his bull/base/bear cases reflect the subjective assessment of a 20/60/20 probability framework.

The resulting EPS revisions are the following:

- Bull Case: No changes. Earnings meet growth estimates this year but disappoint next year as domestic excesses and margin pressures continue to weigh on growth. Earnings in line with expectations,and reduced trade tensions allow for yields to rise while the equity risk premium compresses, lifting the multiple on net to 16.7x.

- Base Case: Continued trade uncertainty and modest increases in tensions further pressure business confidence and investment, lowering the 2020 earnings growth estimate to 0% from 5% and the June 2021 earnings growth estimate to 3% from 5.5%. As the economy avoids a recession and looks past an earnings growth trough, the multiple expands modestly off of current levels (to 16.5x) as the risk premium falls and rates remain supportive of valuation.

- Bear Case: Morgan Stanley’s bear case most closely reflects a mix of paths 2and 3 above which are set to see rising trade tensions and tariffs. In the bear case, 2019 earnings growth goes negative on the year (to -2.5% from our prior forecast of -1%) and earnings continue to compress in 2020 (-8% growth vs -6% prior). Earnings growth troughs in late 2020 but the recovery is not enough to deliver positive trailing growth by mid 2021, moving June 2021 earnings growth estimate to -1.3% from 3.2%. Significantly lower rates and a second derivative change in earnings growth help mitigate a higher equity risk premium,allowing the multiple to remain in line with current levels (~16.1x)

However, the scariest message in Wilson’s note is not his EPS forecast, which very well may prove optimistic in the case of an all out trade war, but his take on how the market will respond to what is now seen as an inevitable rate cut (or as much as three by the end of 2019).

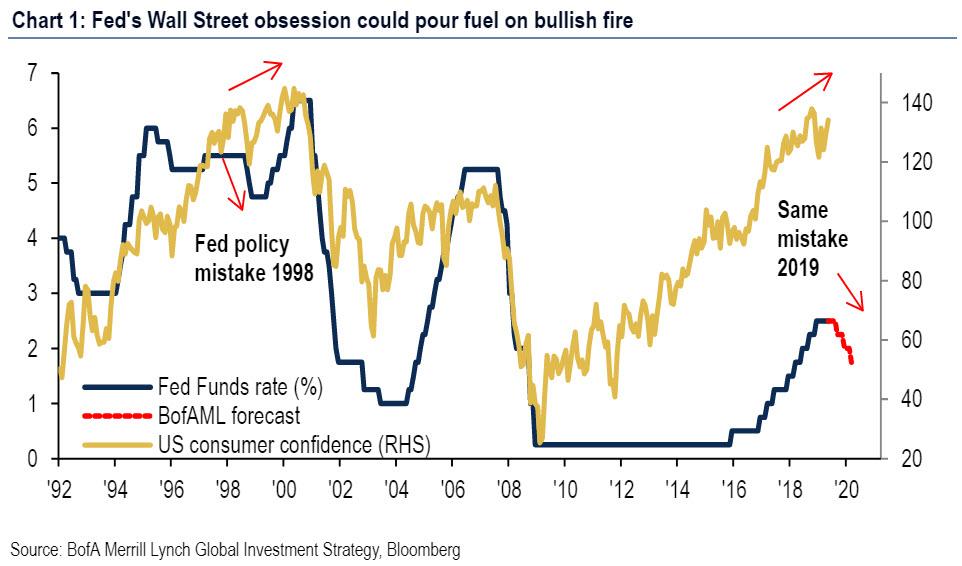

Recall that on Friday, Bank of America’s CIO warned that a rate cut now could be a “huge risk” to the market as it would prompt a furious scramble for stocks even though macro data does not actually require one, let alone three rate cuts. As such, cuts by Powell would precipitate the next big bubble – a sentiment which was echoed just days later by One River’s Eric Peters – similar to the mistake the Fed did in 1998 which spawned the dot com bubble and the crash of 2000.

Picking up on this theme, Wilson writes that “the Fed has sounded more dovish lately and [is] open to cutting rates sooner than many had expected just a few months ago” but instead what the market really needs is solid fundamental data to sustain the rally.

Indeed, part of the Fed’s concern has been the still falling rate of inflation and inability to hit its 2 percent goal. Second is the fact that trade tensions are starting to weigh on business confidence and third is the weaker jobs data, which is the key to the economic cycle.

As such, “investor enthusiasm around the idea of easier Fed policy is understandable” he writes, but cautions that “if the Fed were to cut out of concern that we are entering a real unemployment cycle, such a cut should not be bought.”

In other words, a Fed cut – precautionary or not – may hit as soon as July “but it may not halt [the coming] slowdown/recession.”

As a result, until there is further clarity on the employment picture, Wilson think “Friday’s rally should be faded and investors should continue to skew portfolios defensively with a cautious eye toward expensive growth stocks that are now at a greater risk of missing earnings estimates due to these very real macro economic risks that are independent of the trade outcome or monetary policy.”

One final point: last year, when Wilson predicted fire and brimstone in the early part of 2018, most of his peers (and clients) laughed at him. In late December, Wilson had the last laugh when the S&P closed almost right on top of his S&P forecast. Will this time be different, or will Wilson’s gloom prove right again, and if so with the Fed’s credibility in tatters, what happens in a world in which not even the buyer of last resort can push risk assets higher? We’ll know the final answer in just a few short months.

via ZeroHedge News http://bit.ly/2IxVMMt Tyler Durden