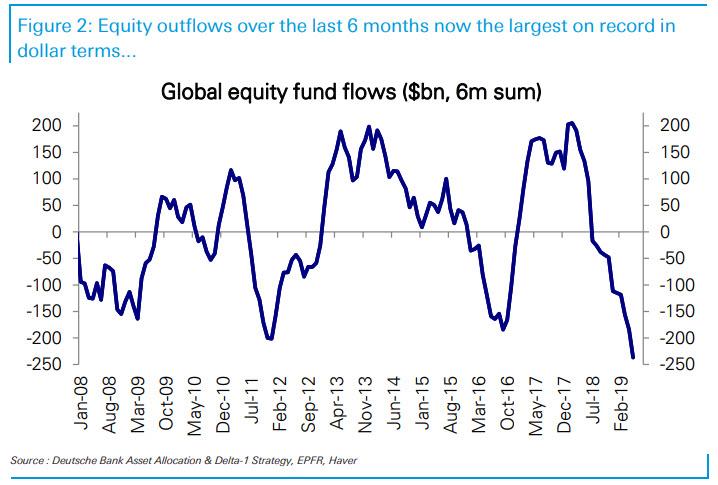

There is a decidedly more subdued tone to the reports by Marko Kolanovic in recent days. Gone is the euphoria from early April, when the JPM quant predicted the S&P would hit 3,000 as soon as May (which instead turned out to be the worst May for stocks in decades) and instead it has been replaced with “we maintain our cautiously positive stance on equities, which is relying on progress in the trade war with China” especially since once again institutional investors refused to follow Marko’s advice and put it all in the market where “sentiment is fragile, and over the past few weeks most discretionary investors reduced their equity exposure.” That sure is one way of putting what is now been a record 6 month outflow from equities.

Also gone are forecasts of 3000 in the S&P being just around the corner, and instead Kolanovic has become far more nuanced in his “positive” forecast, which now “excludes defensive and low-volatility segments (e.g., low-beta stocks, utilities, REITs, staples), which are very expensive and might be poised to underperform in both positive and negative trade scenarios.”

So what is the theme of his latest report published on Wednesday morning? It appears to be another lament of those things which a strategist (such as the JPM quant) should have predicted earlier in the year, yet was unable to (despite our repeated cautions otherwise), such as the re-escalation of trade war, and the unpredictability of Donald Trump.

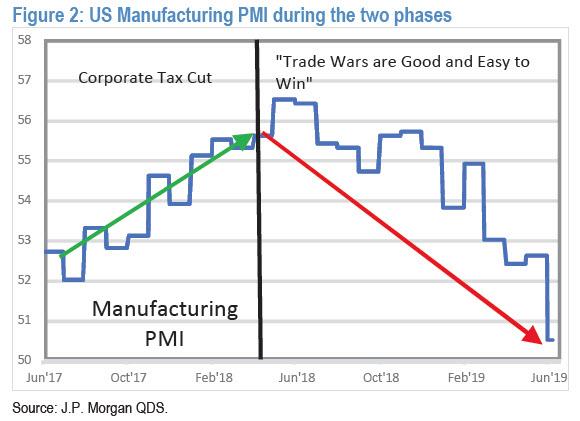

Taking a more diplomatic approach than directly blaming Trump for once again screwing up his bullish forecast, Kolanovic look at the equity market history over the past 2 years of and divided it into 2 phases: “a rising market in anticipation of fiscal reform (that boosted the economy and corporate earnings), and a value-destroying trade war.”

A fan of the former, the JPM quant has a thing or two to say about the latter, which he continues to be unable to rationalize, noting that “the trade war has so far offset all benefits of fiscal stimulus and, if continued, may lead to global recession.” And here the ad hominem once again emerges:

“If this recession materializes, historians might call it the ‘Trump recession’ given that it would be largely caused by the trade war initiative.”

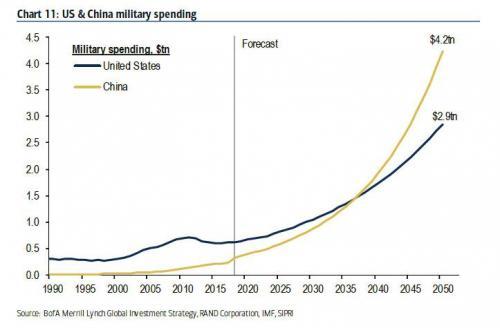

Alternatively one could call it the “Trump recession” that prevents a shooting war in under two decade when China would surpass the US economically, socially but most importantly, militarily…

… as a result of “Thucydides Trap“, and which has to be prevented from doing so at any cost, even if it means both countries taking a decisive step back as globalization – which has benefited China vastly – is splintered.

Marko’s bias aside, going back to his visual representation of the market’s two phases in the past two years, focusing on US manufacturing PMI rising during the first, “corporate tax cut” phase, and then dropping during the “trade war”

phase.

Commenting on the chart above, Kolanovic notes that “with the recent escalation of the trade war, the decline in manufacturing PMI accelerated and could enter contraction territory unless there is progress on trade.” Curiously, whereas until just a few months ago Kolanovic was blissfully ignoring this possibility – much to our shock, after all a strategist should consider every eventuality – the JPM quant now also sees a “similar impact in equity markets.”

In other words, S&P 3000 is suddenly not looking too hot.

To an extent he acknowledges as much, saying that “before the trade war, equity markets were rising at an above-trend pace, and then stayed unchanged for ~18 months.” So what happened then? Well, in a word – Trump, who apparently was so unpredictable, at least in retrospect, Kolanovic never even bothered predicting a scenario in which Trump would be, well, unpredictable, to wit:

If one takes that the average annual return of US equities was ~7% (current capitalization of ~$30T), the estimated cost of the trade war so far is about ~$3T. This may be a conservative estimate as many market segments benefited from flight to safety and declining yields, and without the temporary rally in “safe havens,” the market would likely trade lower. The market damage is ~100 times the tariffs collected, so it is clearly not making the country richer.

Wait until Marko realizes that the “estimated cost of trade” war would be vastly greater had the Fed not reversed and stopped what would be a full blown global bear market by now: a cost which again is inevitable if China is to be stopped in its tracks toward a war – a real war, not just a trade war – with the US.

So with that in mind, Marko’s outlook is clearly far more negative, and the JPM quant now admits that “the US economy is facing a quite unique situation in which one individual can disrupt global trade and investment plans of US corporations, tax consumers on a broad range of imports, etc.” For those in the bleachers, that “individual” is Trump… in other words, Marko has once again found someone to scapegoat for his failed bullish outlook, which at least is an improvement from Kolanovic blaming this website, as he did back in December when the S&P crashed, as did the P&Ls of those who followed Marko’s forecast of S&P 3000 by year end 2018.

After all, who can forget when in early December, instead of admitting he was wrong, Kolanovic lashed out… “specialized websites that mass produce a mix of real and fake news. Often these outlets will present somewhat credible but distorted coverage of sell-side financial research, mixed with geopolitical news, while tolerating hate speech in their website commentary section. If we add to this an increased number of algorithms that trade based on posts and headlines, the impact on price action and investor psychology can be significant.”

We certainly won’t.

At least we will agree with Kolanovic on this: the president sure is more influential than “outlets will present somewhat credible but distorted coverage of sell-side financial research, mixed with geopolitical news, while tolerating hate speech in their website commentary section”, although we certainly were flattered.

Which brings us to Marko’s conclusion, which is a pre-emptive mea culpa if and when markets crash again even as JPM still has “house” target of 3000 on the S&P, namely “given all of this – why are we not bearish on equities and the economy?“

His answer: “Because this situation can also be undone on short notice and many market segments already price in worst-case outcomes.”

An example is the most recent Mexico tariffs that were retracted as quickly as they were introduced. If there is a trade deal, which would be rational to expect going into election year, we think that about half of the market damage could be quickly reversed. This would translate into a quick ~5% rally in broad markets, and a 10-20% rally in value and high beta.”

But why is the JPM quant still so adamant that Trump will concede? The answer: because Trump is rational and ultimately wants the trade war to end, as that will somehow reassure his re-election in 2020:

“As a strong market and avoiding a recession would boost re-election odds, it would only be rational to expect this outcome. In addition, there are other ways to neutralize the risk such as Congress taking back control of tariff powers, etc.”

Obvious contradictions in this statement relative to the rest of the note, i.e., the first part blaming Trump’s irrationality for causing trillions in losses, and then concluding that all shall be well because, well, Trump, will eventually be rational, we are confused why Kolanovic still believes that Trump will be so eager to put trade war into the rear view mirror, when it is safe to safe that more than the market and the economy, Trump is convinced his legacy will be bringing China to heel by any means necessary.

And as for the market being high (or low) enough to get Trump re-elected, well that’s what the Fed is for, and so far the Fed has been perfectly “rational” – any time Trump has escalated and sent stocks lower, the Fed has turned even more dovish, providing the needed support for Trump to further escalate trade war, rinse, repeat. In fact, what Trump has succeeded in doing is getting the Fed to subsidize his trade war!

It’s hardly rocket science: even David Rosenberg figured it out.

via ZeroHedge News http://bit.ly/2IGvPKN Tyler Durden