Via Bloomberg’s Richard Breslow,

ECB President Mario Draghi spoke today and was full-on dovish. The price action made that clear and the accompanying commentary providing the instant analysis was that the market heard his message and loved it. And that, of course, is the problem. There was nothing said that should make anyone feel particularly good other than traders willing to push the envelope further in paying up for any sort of yield and front-running the central bank on renewed hope for additional asset purchases.

For everyone else, they will have to settle for an assessment that the risk outlook “remains tilted to the downside” and the dour expectation that more stimulus will be needed if things don’t start to improve. One trader’s “we stand ready, resolute and able to do more,” is another citizen’s “we’ve made some progress and don’t have any new ideas so we’ll plow on ahead”

And once again, anyone fooled into hedging some of the risks inherent in credit spreads, yields and equities at these startling levels will have been burned. And left agonizing over whether this will be a buy the rumor, sell the fact blow-off move or a time to totally reevaluate.

French government 10-year yields are flirting with zero. Which, ironically, has suddenly made them not as attractive compared to domestic yields for the Japanese investors who have been active and important buyers in this market on a hedged basis. Something well worth keeping an eye on. Bond markets believe in globalization.

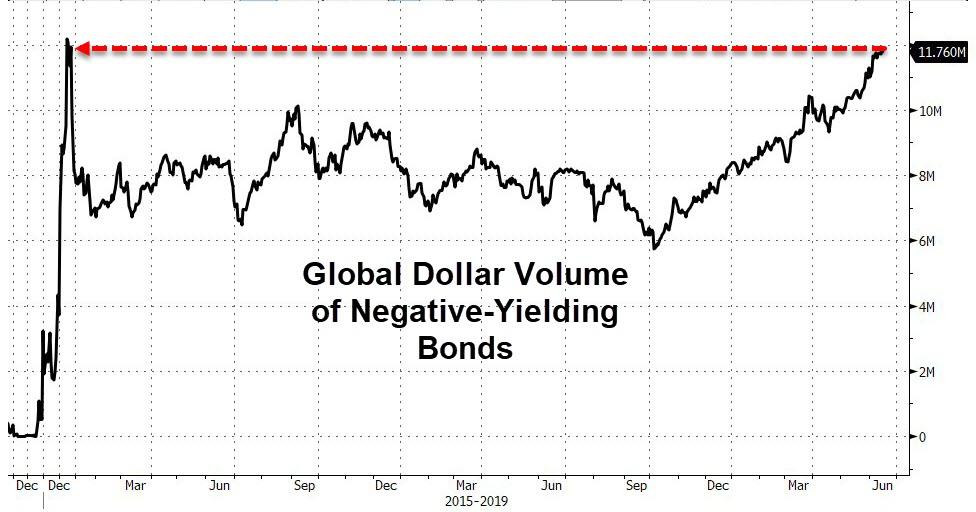

[ZH: but it’s global and spreading]

Negative Bond Yields through…

30 yrs: Switzerland

15 yrs: Germany, Netherlands

10 yrs: Japan, Denmark, Austria, Finland, Sweden

9 yrs: France, Belgium

8 yrs: Slovakia

7 yrs: Ireland, Slovenia

6 yrs: Spain

5 yrs: Portugal

3 yrs: Malta, Bulgaria

1 yr: Italy pic.twitter.com/QP9EwmNMvX— Charlie Bilello (@charliebilello) June 18, 2019

It would seem that puts the FOMC in a bit of a tough place. It will be very hard to follow this speech with anything that sounds hawkish. Although it does make one wonder if Draghi was doing the Fed a favor by giving them the cover to deliver its own dovish surprise. Certainly the price of poker just went up for anything that deviates very far from the OIS pricing for rate cuts. Especially if they don’t want to see the dollar confound all of the experts and think about retesting last month’s year-to-date highs.

The potential challenges for the G-20 meeting just get more interesting by the day. And that probably explains why the U.S. currency, while bid, is really nowhere in the grand scheme of things. So far this year we’ve seen these prices multiple times before. From that perspective, it’s underperforming.

The 10-year Treasury yield is approaching 2 percent. I still suspect that, no matter what is said at Fed Chairman Jerome Powell’s press conference tomorrow, there will be a battle royale down there should it come into play. And while below 2.06% we have snuck under an important retracement level of the entire July 2016 to October 2018 move higher, it’s yet to do so convincingly.

That will be the pivot to follow. It will matter. Especially on a day when bonds are already up big before the North American open.

While the market is contemplating Draghi, and waiting on Powell, what the S&P 500 does with this 2900 level should provide the day’s excitement. Traders want to believe that bad news is still good news. It certainly took that attitude this morning.

via ZeroHedge News http://bit.ly/2Zubzmb Tyler Durden