The monthly Bank of America Fund Managers Survey (FMS) is perhaps best known for exposing Wall Street’s cognitive dissonance, if not schizophrenia, to the world because while on one hand survey respondents cry over soaring corporate and global leverage, at the same time they rush to 5x oversubscribe Italian 30Y bonds (using other people’s money of course) despite knowing it will all end in tears.

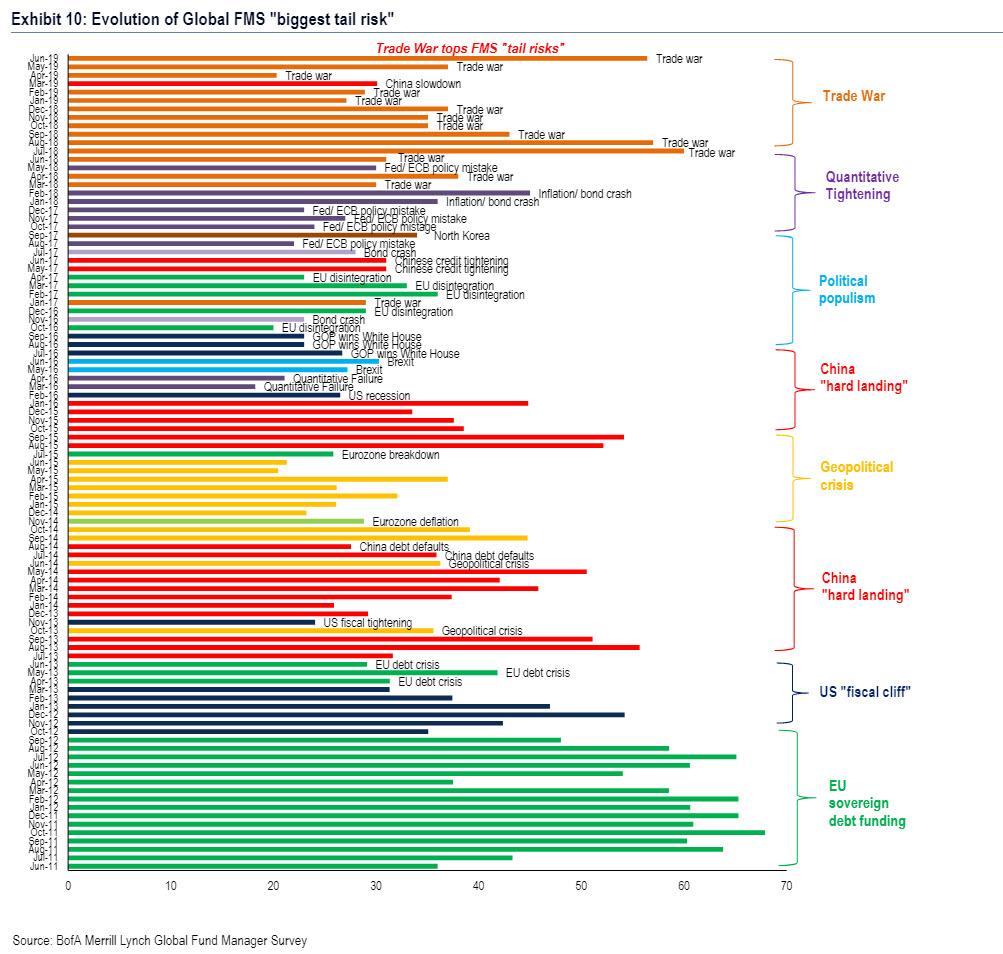

However, while generally perceived as a novelty sentiment index to be faded, with little information value, the monthly survey does provide some useful indicators of herd sentiment, two of which have been especially notable in recent years, namely what is the “biggest tail risk” for the market, and what is “the most crowded trade” at any moment

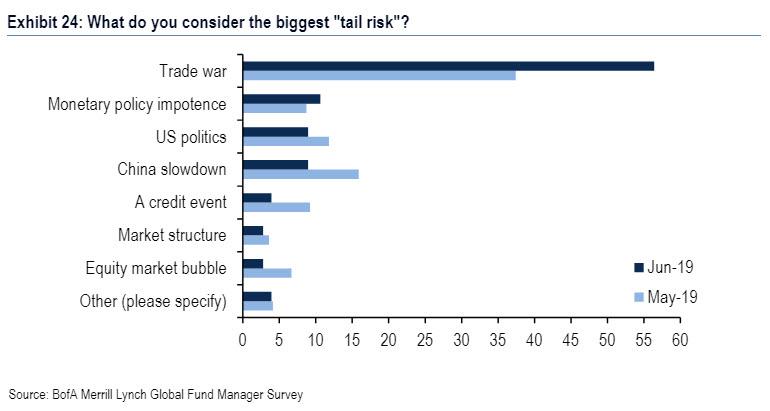

As we already noted earlier, there were several major surprises in the June edition of the FMS – which polled 230 participants with $645BN in AUM – and which found that investing professionals had turned the most bearish they have been since 2008 financial crisis even though the S&P is back at all time highs. Curiously, there were no surprises in what Wall Street saw as the biggest tail risk this month.

As a reminder, the dominant concerns of investors since 2011 have been Eurozone debt & potential breakdown; Chinese growth (and slowdown); populism, quantitative tightening & trade wars. And, in June, it was more of the same as concerns about Trade War soared 19% to 56% of FMS investors saying it is the top “tail risk”, the biggest “risk” outright since Trade War fears in July 2018 (+60ppt); it has now topped the charts for 14 of past 16 surveys.

Other risks cited include monetary policy impotence (11%), US politics (9%) and a slowdown in China (9%).

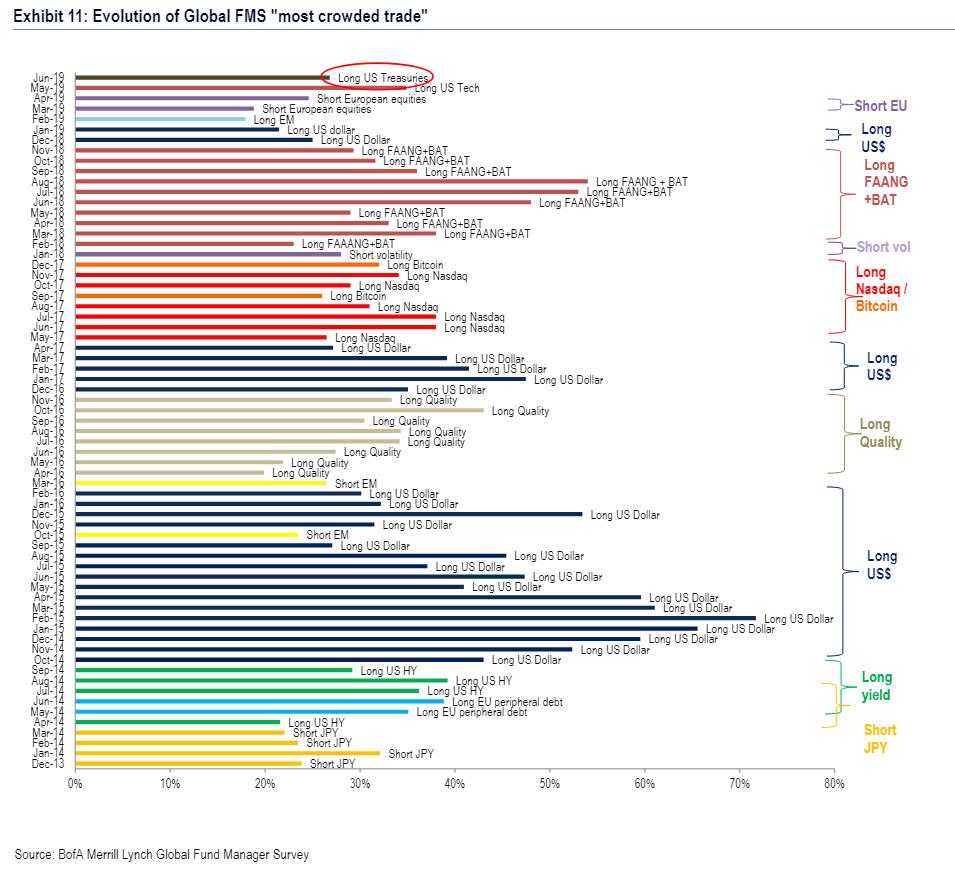

Where there was a surprise this month, was in what investors saw as the “most crowded traded.”

Like in the case of the “biggest tail risk”, here the market leadership has been relatively narrow since 2013, shifting from high yielding debt; long US$; long Quality; long Tech, long Emerging Markets, then short Europe in the spring before reversing again to long tech, and now for the first time since 2013, “Long US Treasuries” is seen as Wall Street’s most crowded trade.

What is notable about this series is that just last month, Long US Tech was the winner by a mile, while being long Treasuries was only in 4th position. However, after a dramatic plunge in yields back to almost the 1-handle, there was a major reversion in this list.

As we showed yesterday, there is a simple reason why investors are concerned: yields have collapsed. However, they have done so as equities have soared, so it is somewhat surprising that investors have focused on long bonds being the most crowded trade, instead of, say, being long stocks.

With all that said, we should note that there is little practical value to the above data – it is all based on a poll response in reaction to a gut feeling. Still, it does indicate that Wall Street, which has been chronically wrong on bonds for years and has been consistently short even as it has lost money again and again, it remains convinced that the bubble is in bonds, not stocks, which is precisely the asset class most targeted for levitation by central banks. Which also means that if the Fed somehow disappoints on Wednesday it will be stocks that get clobbered, with the resultant flight to safety send yields even closer to zero.

via ZeroHedge News http://bit.ly/2XlRtx9 Tyler Durden