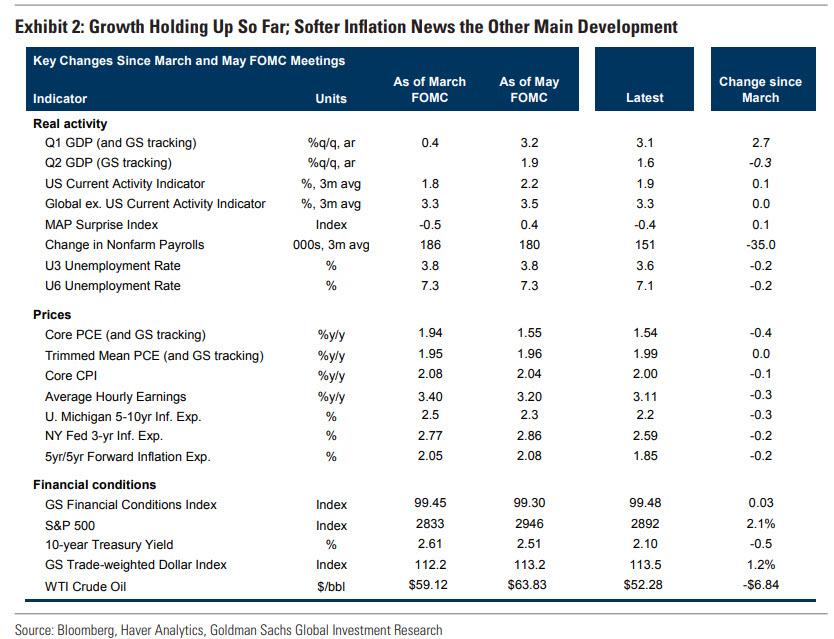

Over the weekend, we laid out an extended case from Goldman Sachs – whose base case is still for no rate cuts in 2019 and one rate hike in 2020 – why the Fed will likely disappoint tomorrow. In a nutshell, the main reason why Goldman’s Jan Hatzius has adopted such a contrarian view is simply that not enough has changed to warrant a clear signal of an upcoming cut: “since the March SEP meeting, stock prices are higher, the unemployment rate fell to a 50-year low, consensus growth forecasts are unchanged, and the very tariffs on Mexico that prompted the latest calls for rate cuts have been taken off the table.” Not only that, but the economy continues to chug along largely as expected: outside of May payrolls, the growth data still look decent: Goldman’s Q2 GDP tracking estimate has rebounded to +1.6%, Atlanta Fed GDPNow is +2.1%, and the bank’s own tracker of private final demand is at an even healthier pace (+2.8%).

As a result, the bank expects “unchanged” policy at the June 18-19 FOMC meeting and sees the subjective odds of a June cut at only 10%. More importantly, while Goldman looks for a dovish tilt to the proceedings it won’t be nearly enough to appease markets that have aggressively priced rate cuts in the fall. Looking at this week’s main event, barring an unlikely surprise on the funds rate, Hatzius expects the market to focus on four key developments:

- the statement’s policy stance/balance of risks paragraph,

- the number of participants projecting cuts in the Summary of Economic Projections (SEP),

- the extent of dovish changes to the statement and economic forecasts, and

- the tone of Powell’s press conference.

* * *

So Goldman aside, the base case is for rates to remain unchanged at 2.25-2.50% however, as Goldman said, messaging will be crucial, and there will be great focus on the statement and forecasts for any signs the FOMC is mulling lower rates at future meetings; the market is at least expecting the Fed to signal an openness to cut rates should the conditions require and certainly to at least hint that a July cut, where the market sees a 82% probability of a cut. If Powell is, in turn, unexpectedly hawkish, then watch as the alligator jaws snap shut with a vengeance.

Additionally, the rate decision and staff economic projections will be published at 1900 BST/1400 EDT on 19th June 2019; post-meeting press conference with Chair Powell to commence at 1930 BST/1430 EDT

Below we present a detailed preview of what to look for in tomorrow’s statement, press conference and projection materials courtesy of RanSquawk.

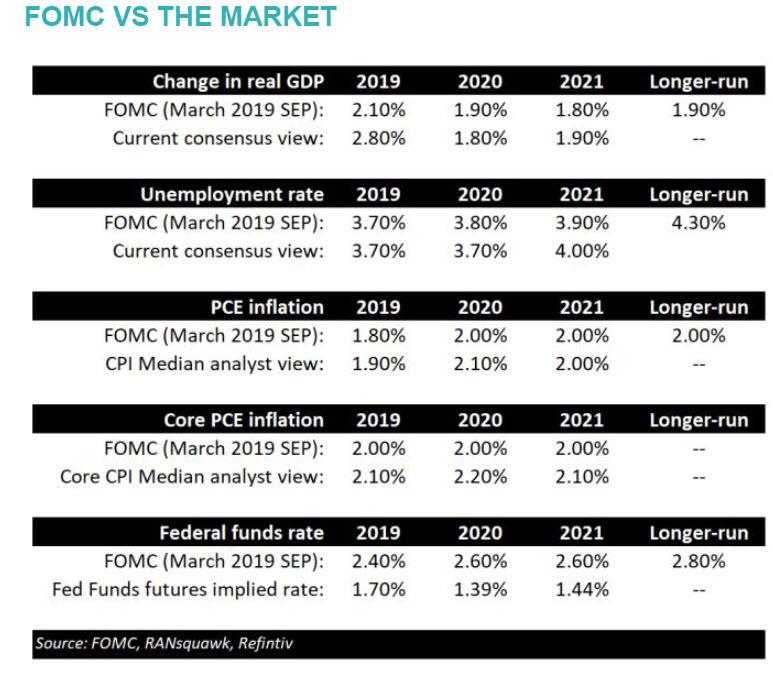

EXPECTATIONS

The consensus looks for rates to be kept unchanged at 2.25-2.50% in June, with money markets assigning around 27.5% probability it will cut rates. Looking towards July, money markets have priced over one rate cut (hinting a double cut of 50bps could be on the cards, rather than the usual 25bps increment). Looking through to the end of 2019, markets have priced around 67bps of easing (nearly three rate cuts).

CHINA/US TRADE WARS

Lower rate expectations have been driven by concerns that an escalation in US/China trade tensions could weigh on global growth, and this has given rise to chatter that the FOMC could cut rates to pre-empt any negative fallout. However, ahead of the 28-29th June G20 meeting – which is being billed as an event that could significantly shape the trade landscape – the FOMC may want to retain optionality, but signal it has a readiness to act if required. RBC says that the Fed can play the June meeting messaging with flexibility to suggest the possibility of a rate cut contingent on how trade talks evolve.

“INSURANCE” RATE CUT

The idea of insurance rate cuts is not without precedent, and the 75bp of cuts between 1995-96 and in 1998 are widely cited. Goldman Sachs believes the hurdle is higher in the present case. Arguing that in the first case, the 1995-96 and 1998 cuts were not merely insurance; “In 1995, the real funds rate was at a highly restrictive level (as Fed officials recognized in real time) and the economy had slowed sharply; in other words, policy looked clearly too tight,” and in 1998, “financial conditions had tightened by 100bps within six weeks and market functioning had deteriorated meaningfully in the wake of the Russian default and LTCM failure.” Goldman explains that in both scenarios, the case for Fed easing rested at least as much on observable deterioration as on an insurance motive. Additionally, the bank argues that one key assumption behind the insurance story is that policymakers can reverse the cuts once the risk abates. “Indeed, the Greenspan Fed moved rates back up soon after the 1995-96 and 1998 cuts (in March 1997 and June 1999, respectively). However, the greater political scrutiny of Fed hikes now—especially with a presidential election approaching—could make this harder to do in 2020, so that overly hasty insurance cuts now might increase the risk that the funds rate gets stuck at too low a level if the economy remains resilient.”

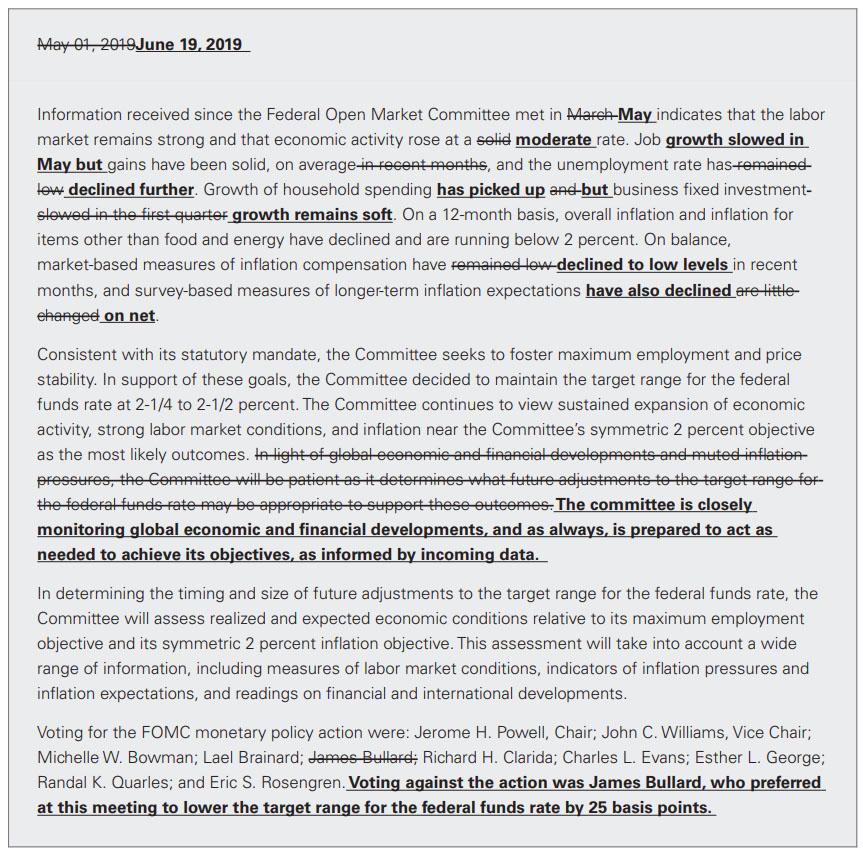

“PATIENT”

Analysts have argued that if the Fed removes the word patient from its statement (“the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes,” which was added in at the January meeting), it would be taken as a signal that an imminent rate cut is being considered. UBS says that the FOMC will be aware of market pricing, and that rate cuts are being priced in, and therefore, removal of “patient” would open the door to a cut, perhaps as soon as the next meeting on 31st July. The bank warns, however, that this would still not directly entail a promise to cut in July.

THE DOT PLOT

Tweaks to the economic projections would also help shape the markets’ view on the rate cut trajectory. The FOMC’s most recent projections made in March have pencilled in one rate hike next year from 2.25-2.50% to 2.50-2.75%, no rate hikes in 2021, and sees a rate between 2.75-3.00% in the long-run (implying two hikes until it gets rates to the ‘longer-run’ level). Within the ‘dot-plot’, 11 of the 17 FOMC participants who provided projections saw rates unchanged in 2019 – whether that number goes down is key. If only one or two of the dots were to move lower (i.e. forecast rate cuts this year), it would still suggest a consensus for the Fed to keep rates unchanged; however, if that number were to go up – perhaps as much as four or five dots, it would provide a more clear hint that the Fed was mulling lowering rates from here.

INFLATION

Inflation has remained weak, and some FOMC participants have warned that persistently low inflation risks de-anchoring expectations, and itself provides a justification for the Fed to cut. The Fed may acknowledge the more muted inflation in its projections. Deutsche Bank argues that “the annual growth rates of both the headline and core PCE deflators are near their real-time levels at the May meeting, as a reversal of some of the “transitory” factors that Chair Powell discussed in the May post-meeting press conference has been offset by weakness and downward revisions in other categories,” However, “the annual growth rates of both headline and core CPI fell a tenth and the six-month annualized change in core CPI has declined roughly 40 basis points (bps) relative to the data available at the May meeting.” Deutsche sees the Fed emphasising tweak its guidance from “overall inflation and inflation for items other than food and energy have declined and are running below 2 percent” to “overall inflation and inflation for items other than food and energy continue to run below 2 percent,” which the bank says would signal an added level of concern relative to the May statement. And additionally, given that the five-year/five-year breakeven inflation rate has declined roughly 20 basis points since the May meeting, Deutsche expects the Fed to acknowledge that “market-based measures of inflation compensation have declined and remain low; survey-based measures of longer term inflation expectations are little changed,” from the current “market-based measures of inflation compensation have remained low in recent months, and survey-based measures of longer-term inflation expectations are little changed.”

POSSIBLE ENDING OF QT

There are risks that the Fed might express a dovish stance by choosing to end its balance sheet run-off plans earlier; Citi reasons that it would be a low cost option of ending its tightening bias. “The counterarguments are that the Fed has designated policy rates as the ‘active tool’ and that runoff was due to end in Q3 anyway and that an early end could therefore seem ‘panicky’,” Citi says, and also notes that some have suggested that ending QT could be interpreted as substituting for future rate cuts, and therefore might even be seen as slightly hawkish. “However, to us, none of these reasons outweigh the view that it makes little sense to continue to tighten policy via the balance sheet, while considering to cut policy rates.”

* * *

Finally, in terms of what the proposed FOMC statement could look like, here is the less optimistic one from Goldman…

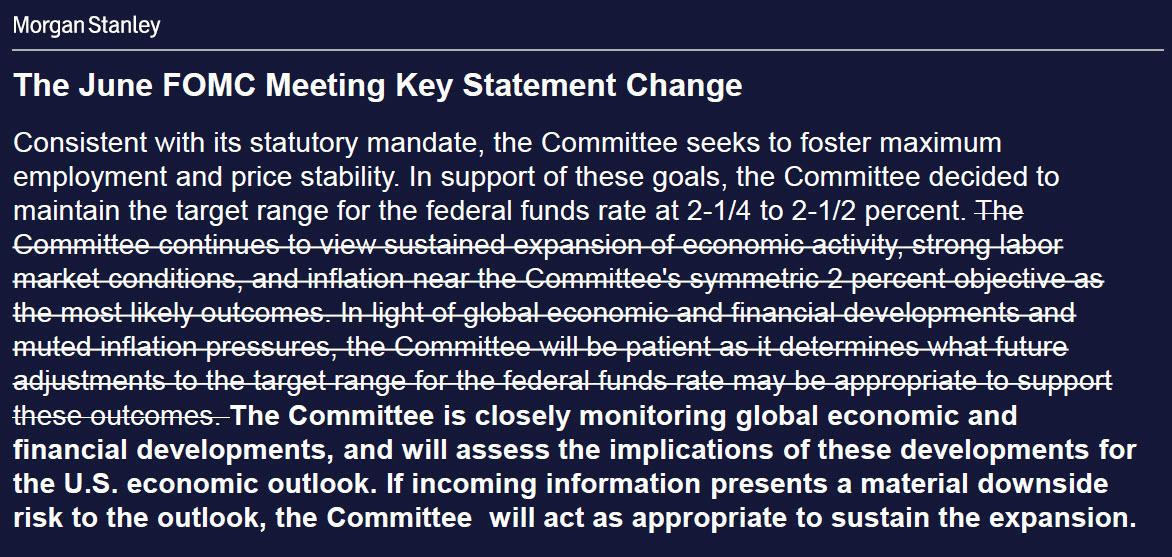

… and here is the more dovish take, from Morgan Stanley:

via ZeroHedge News http://bit.ly/2x47clO Tyler Durden