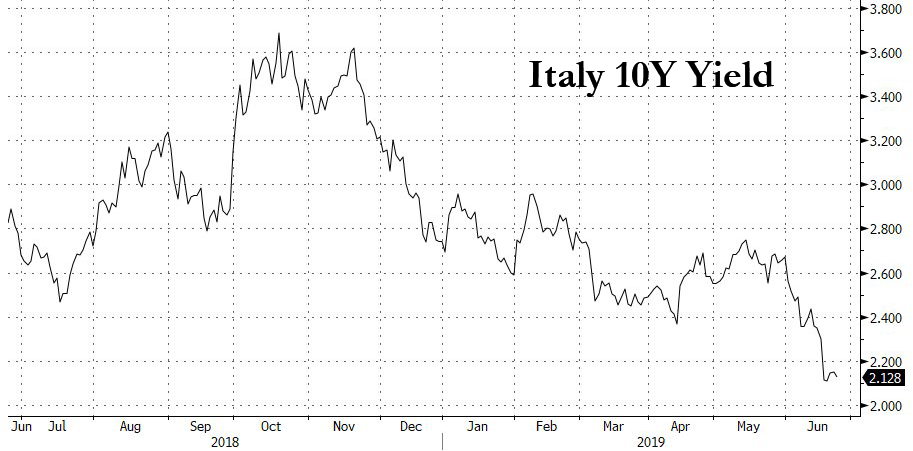

Italian yields tumbled on Monday, with the 10-year yield falling as much as 5 basis points to 2.1% – its lowest level since May 2018 – after Brussels signaled that it would be willing to wait before launching a disciplinary process against Italy over the country’s rising debt plans, potentially allowing the two sides to seek a compromise.

Instead of triggering the Excessive Debt Procedure when the European Commission meets on Tuesday, the panel is going to give the Italian government another chance to revise its spending plans.

According to the FT, the truce will buy time for Rome’s populist government to reach a deal and avoid budget sanctions and fines that could stretch into the billions of euros. Even though the squabbling over Italy’s debt has returned after purportedly being settled late last year, debt investors are cheering the news because it signals that some members of the populist government might still be open to compromise.

For one, Prime Minister Giuseppe Conte, considered more of a technocrat than Deputy PMs and coalition leaders Matteo Salvini and Luigi Di Maio, is hoping to do enough to avoid an infringement procedure, the FT reports, citing figures from within the Italian government. Conte and Finance Minister Giovanni Tria are trying to find budget savings that might convince Brussels to dispense with moving ahead with the sanctions process.

Rome wants to use a €5.2 billion ($6 billion) net improvement in its 2019 spending plan to mitigate its financial position. “It is not Mr Conte’s intention to sign an infringement procedure and we want to move within the rules. However, we also expect to be offered some room for interpretation [of those rules],” one person with knowledge of the prime minister’s thinking said. “We are confident the procedure won’t kick off.

The Italian finance ministry will send a letter responding to the commission’s assessment this week, and the commission has until early July to inform the various EU finance ministers whether it wants to proceed with the EDP. Officials say Wednesday, the due date for Rome to submit a spending review to the Italian parliament, is also a key moment.

Given that Italy is the third largest eurozone economy and, after Greece, has the highest debt-to-GDP, the outcome of these negotiations could have serious repercussions across the bloc. From a financial stability standpoint, the worst-case scenario is that the EU moves ahead with its plans to fine Italy, forcing Italy to the brink of a banking crisis, followed by a hasty exit from the euro, possibly to be replaced by the BoT.

via ZeroHedge News http://bit.ly/2IEJ3J1 Tyler Durden