Now that the Osaka G-20 has come and gone, and while nothing has been resolved in the US-China trade war, at least there has been no escalation and China is safe from US tariffs on the remainder of its exports to the US, which in turn has given algos a dose of optimism that all is well pushing S&P futures just shy of 3,000, things in the real world are going from bad to worse.

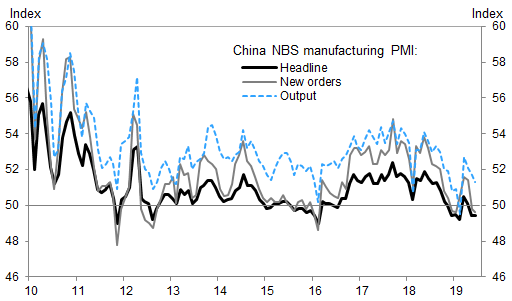

One day after China’s official NBS manufacturing PMI on Sunday printed unchanged at 49.4 in June, below expectations of an increase from May…

… with most of the key sub-components sliding to new cycle lows:

- production index 0.4 lower at 51.3,

- new orders sub-index was 0.2 lower at 49.6

- employment sub-index edged down 0.1pp to 46.9.

- imports sub-index down to 46.8, from 47.1,

- new export order index down to 46.3, vs. 46.5 in May

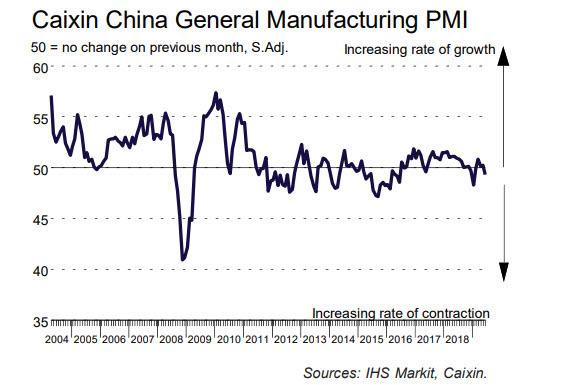

… the other Chinese PMI, the Caixin Manufacturing PMI, hammered expectations as it unexpectedly slumped back into contraction.

Falling from 50.2 in May to 49.4 in June, the Cixin PMI – which differs from the official, NBS report by shifting away from SOEs and large enterprises and instead focusing on small and medium businesses – was below the critical 50.0 threshold which divides contraction and expansion, for the first time in four months.

According to the report, the June data highlighted a “challenging month” for Chinese manufacturers, with trade tensions reportedly causing renewed declines in total sales, export orders and production.

Commenting on the June PMI data, Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “The Caixin China General Manufacturing Purchasing Managers’ Index was 49.4 in June, the second lowest since June 2016, indicating a clear contraction in the manufacturing sector, and only for the first time since late 2016, identical to China’s official Mfg PMI print (which was also 49.4).

“The subindex for new orders slid into contractionary territory, pointing to notably shrinking domestic demand. The gauge for new export orders returned to contractionary territory, but was better than the levels seen from last April to last December. Front-loading by exporters was likely to support this gauge as the China-U.S. trade relationship was under great uncertainty.

The output subindex fell into contractionary territory. The employment subindex remained relatively stable in negative territory, likely due to government policies to stabilize the job market. The State Council set up a leading group on employment in late May.

The subindex measuring sentiment toward future output plunged further, albeit staying in expansionary territory, a reflection of continuously weakening business confidence amid the Sino-U.S. trade conflict.

Overall, China’s economy came under further pressure in June. Domestic demand shrank notably, foreign demand was still underpinned by front-loading exports, and business confidence fell sharply. It’s crucial for policymakers to step up countercyclical policies. New types of infrastructure, high-tech manufacturing and consumption are likely to be the main policy focuses.”

In short, the US-China trade war is Trump’s for the taking… if he wants it: companies responded to the latest escalation by reducing headcounts further and making fewer purchases of raw materials and semi-finished items. At the same time, China appears to be sliding into stagflation, as selling prices were raised following another increase in input costs, though rates of inflation were negligible, suggesting that companies failed to pass on costs to consumers. Also, business sentiment was broadly neutral at the end of the second quarter, with firms mainly concerned about the US-China trade dispute.

It wasn’t just China that was a shitshow: Asian factory PMIs were almost universally awful on Monday, adding to the signal from the official China report out Sunday that as Bloomberg put it, “the global economy has been harpooned by the trade wars.” To wit:

- Taiwan’s PMI dropped to 45.5, the lowest since 2011, and it’s now been below the 50 line separating contraction from expansion for 9 straight months — the longest since a 10-month stretch that ended in Feb. 2009.

- South Korea’s gauge slumped further into contraction (47.5 vs 48.4 in May) to confirm April’s spike above 50 was an outlier

- Japan’s came in at 49.3, worse than the initial reading of 49.5.

- Australia’s AIG factory gauge fell into contraction for the first time since 2016

- Malaysia’s PMI sank again to hold below 50.

- Indonesia and Thailand’s gauges fell, while holding above 50.

- The Philippines was the only substantial regional economy to see a tick up.

Meanwhile, futures blissfully continue to ignore the collapsing global economic reality, and instead rejoice at the “successful” conclusion of the Trump-Xi meeting, which notd only achieved nothing, but confirmed the status quo – massive tariffs and the threat of more.

The decision to resume talks, meanwhile, offers little cause for optimism given that this conflict has now dragged on for more than a year as Bloomberg Garfield Reynolds says, adding that “the PMIs underscore how much damage has been done by the trade spat, and even the central bank stimulus being forecast by rates markets is looking more and more like band aids that won’t stop the bleeding.”

via ZeroHedge News https://ift.tt/2ZSJcOS Tyler Durden