It’s a bloodbath. No matter where you look, global manufacturing surveys are signaling growth is over (and in most cases, outright contraction is upon us).

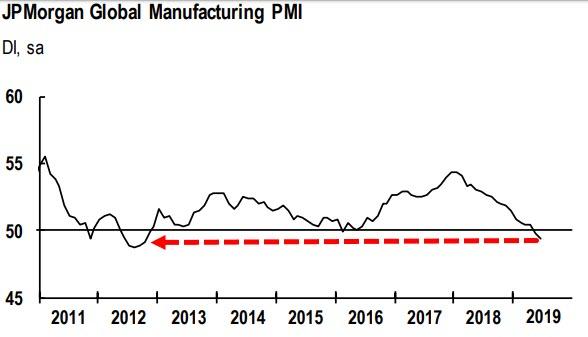

JPMorgan’s Global Manufacturing PMI fell to its lowest level for over six-and-a-half years and posted back-to-back sub-50.0 readings for the first time since the second half of 2012.

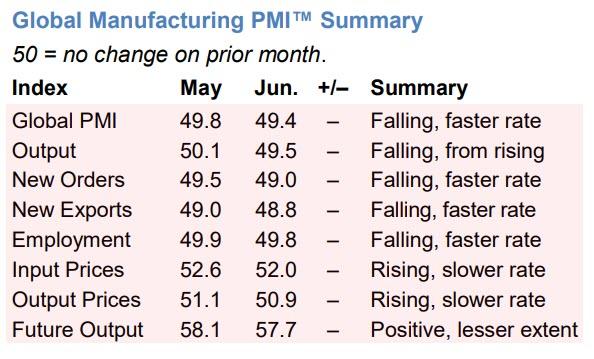

June data signalled a mild decrease in global manufacturing employment for the second month running (but every sub-index declined in June).

Of the 30 nations for which a June PMI reading was available, the majority (18) signalled contraction. China, Japan, Germany, the UK, Taiwan, South Korea, Italy and Russia were among those countries experiencing downturns. The US, India, Brazil and Australia were some of the larger industrial nations to register an expansion.

Commenting on the survey, Olya Borichevska, from Global Economic Research at J.P.Morgan, said:

“The global manufacturing sector downshifted again at the end of the second quarter. The PMI surveys signalled that output stopped growing, as inflows of new business shrank at the fastest pace since September 2012. This impacted hiring and business optimism, with the latter at a series-record low. Conditions will need to stage a marked recovery if manufacturing is to revive later in the year.”

So, we ask you, which market do you think is getting things right? Bonds or stocks?

It’s not rocket science!!

via ZeroHedge News https://ift.tt/2KQ2ukm Tyler Durden