Oil suffered its worst reaction to an OPEC meeting since 2014 today, plunging almost 5% prompting OPEC Secretary-General Mohammad Barkindo to tell reporters in Vienna that, “the drop in crude prices on Tuesday was an ‘anomaly’.” Not everyone agreed.

“There are concerns that demand might slow to where it overpowers supply,” Bart Melek, head of commodity strategy at Toronto’s TD Securities, said in an interview.

The “gloomy” data, especially from China, “is very much part and parcel of what we’re seeing.”

API

-

Crude -5mm (-3mm exp)

-

Cushing +882k (-1.26mm exp)

-

Gasoline -387k (-2.2mm exp)

-

Distillates -1.7mm (=1.0mm exp)

After last week’s huge crude draw, expectations were for another decent-sized draw and API reported a bigger than expected crude draw…

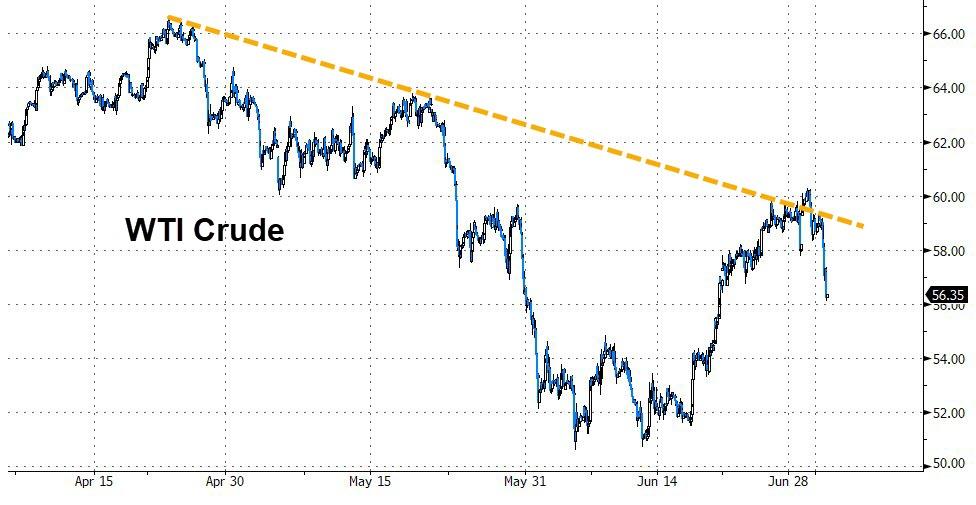

WTI rolled over at a key trendline level…

But was unable to hold a modest rebound after the API print…

via ZeroHedge News https://ift.tt/2LyuY1A Tyler Durden