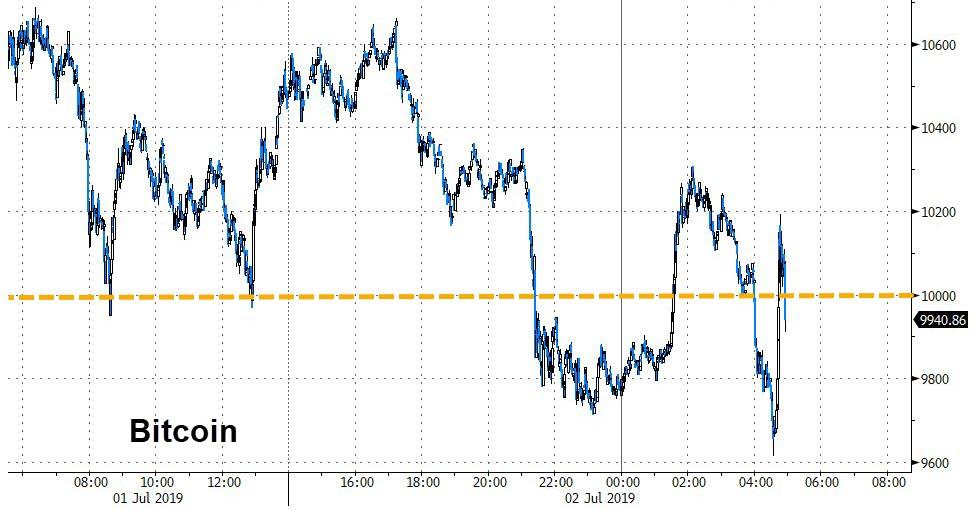

Bitcoin has been battling with the $10,000 Maginot Line for the last 24 hours with aggressive pushes up and down across that level.

A sea of red today…

But, while Bitcoin is leading the pain, the entire crypto space is getting hit this week…

This surge to the downside is occurring after CME reports that the open interest in its Bitcoin futures has risen to a record high

As CoinTelegraph’s Max Boddy reports, the Chicago Mercantile Exchange (CME) Group has announced more record-breaking highs for bitcoin (BTC) futures in an official Twitter post on June 28.

The futures in question are standardized contracts that bind a party to buying or selling bitcoin at some set time after signing.

According to the post, CME Bitcoin futures hit $1.7 billion in notional value traded on June 26, a 30% increase from its last recorded high. The open interest for BTC futures now sits at 6,069 contracts, reportedly as a result of institutional interest.

New CME bitcoin futures record. Source: Twitter

A week prior, on June 21, CME bitcoin futures broke $10,000, according to data on TradingView. Just one day prior to that, on June 20, the CME Group posted another record high of 5,311 open futures contracts totalling 26,555 BTC — approximately $280 million at press time.

The value of the cryptocurrency BTC itself is hovering around $10,500 at press time. Bitcoin peaked around $13,800 last week, but failed to hold at $12,000 after temporarily trading sidewise in that range on June 28 and June 29.

As previously reported by Cointelegraph, BTC bull Max Keiser recently predicted that altcoins will go under as investors move heavily from alts to BTC due to its technical superiority. “The altcoin phenomenon is finished,” said Keiser.

via ZeroHedge News https://ift.tt/2JjApyL Tyler Durden