As markets cross the halfway point for the year, other than a minor pullback in May, it’s hard to argue against the first six months as being anything but spectacular for global assets.

According to Bank of America, the S&P 500 posted the best June return (+6.9%) since 1955. Meanwhile, as Deutsche Bank notes, besides the thrust of the move, it was the broadness of returns which stands out. If we exclude currencies, then 37 of the 38 assets in Deutsche Bank’s sample which cover a variety of asset classes have delivered positive total returns in local currency terms. In other words, just one asset class is down YTD (read on to find out which).

That’s the best start to a year through the first half in terms of broadness of returns since at least 2007. As for June, well this proved to be a microcosm of the year so far with all 38 assets ending the month with a positive total return. If one looks at monthly data back to the start of 2007, “this has only ever happened once before” according to Deutsche Bank’s Craig Nicol. Amazingly, that was back in January of this year.

In other words, January and June of this year are the only months in the last 150 which have seen all assets post a positive total return. Quite remarkable. Given that the USD weakened during June, it’s perhaps

of little surprise to hear that all 38 assets also had a positive total return in dollar

adjusted terms too.

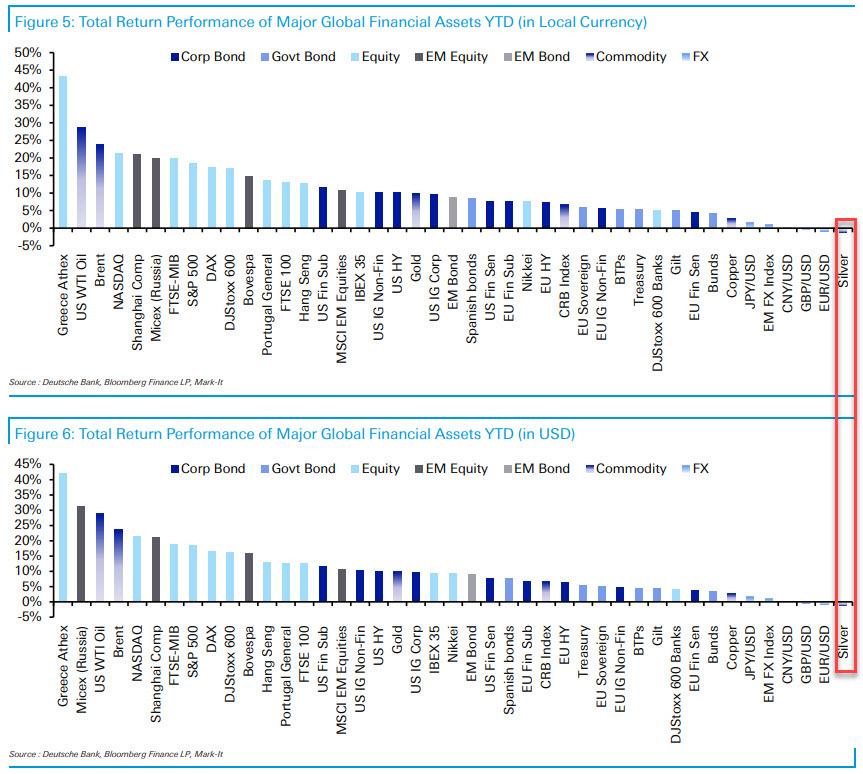

Looking at last month’s equity performance, aU.S. equities were the clear winner, +18.5% on a total return basis, with the equal-weighted S&P 500 gaining even more (+19.6%), despite small caps underperforming large caps. Global equities lagged US equities, but still posted healthy gains (+16.3% in local currency terms and +16.6% in USD). Long-term treasuries also rose 10.9% as the 10-year yield fell 68bps, while gold gained 10.2%. The VIX index averaged 15.9 in 1H, 4% below 2018’s average.

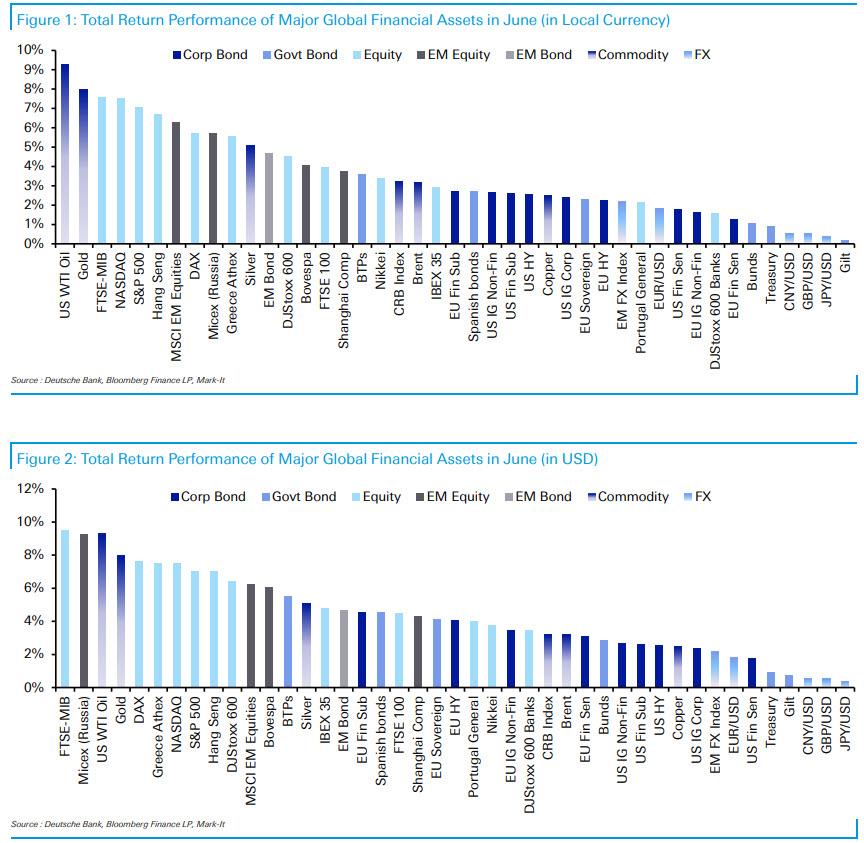

But as DB notes, the most notable aspect of the moves last month was that it wasn’t a traditional risk-on rally that one might expect. For instance Gold (+8.0%) was the second best performing asset. Silver (+5.1%) also posted a reasonable return while Bunds (+1.1%) hit record lows and Treasuries (+0.9%) broke below 2% at the 10y level. Even a traditional safe haven currency like the JPY (+0.4%) was stronger. This all happened for a reason: central banks are back, and expected to flood the world with more cheap money before they start buying up everything that isn’t nailed down.

Interspersed between those moves though were a fairly wide range of returns for equity markets. At the top end we had the FTSE MIB return +7.6% followed by the NASDAQ (+7.5%), S&P 500 (+7.0%) and Hang Seng (+6.7%). In Europe the STOXX 600 finished in the middle of the pack with a +4.5% return while at the bottom the Portugal General (+2.2%) and European Banks (+1.6%) lagged – the latter clearly impacted by the move lower in rates.

Meanwhile, topping the June leaderboard was oil with WTI rallying +9.3% as tensions in the Middle East rose towards the end of the month. EM equities (+6.3%), EM bonds (+4.7%) and EM FX (+2.2%) all got a boost from that move along with the weaker USD. As for credit, it was another month of solid but unspectacular returns. US and EUR HY for example returned +2.5% and +2.2% respectively, while US and EUR IG returned +2.7% and +1.6% respectively.

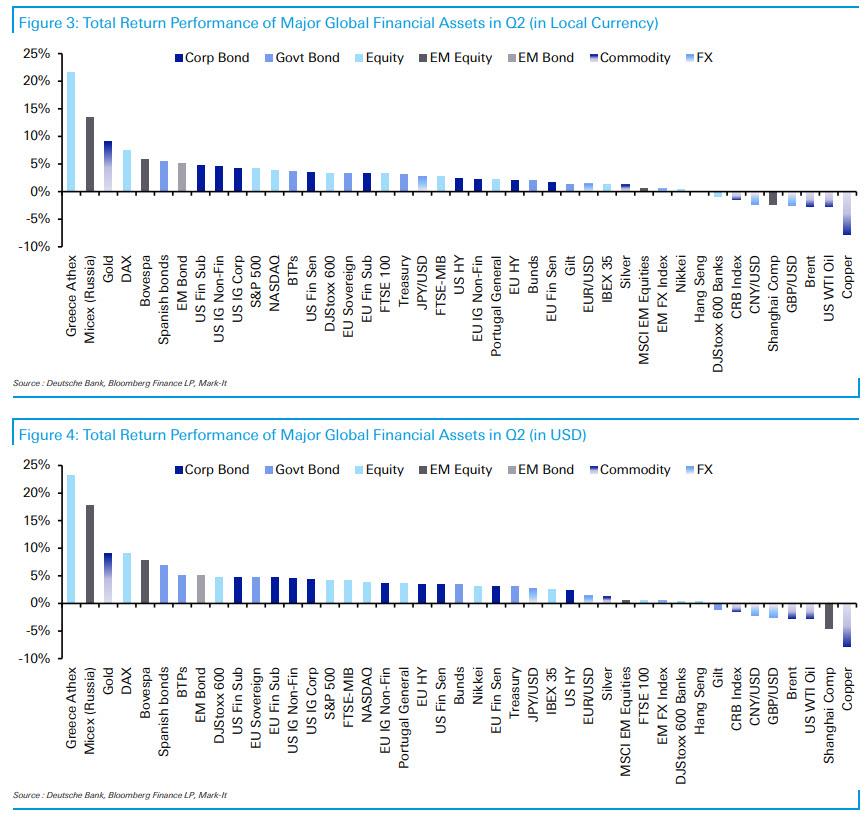

As for Q2, the May dip wasn’t enough to offset the strong performance in April and June. In local currency terms 31 out of 38 assets had a positive total return while 32 did so in dollar adjusted terms. The big winners were Greek and Russian equities, returning +21.7% and +13.4% respectively. DM equity markets posted much more modest returns. The DAX (+7.6%) was the big outperformer with the STOXX 600 returning +3.4% and S&P 500 +4.3%. European Banks (-0.9%) underperformed. As for bonds, Treasuries and Bunds returned +3.1% and +2.0% respectively, with Spanish (+5.5%), EM (+5.1%) and BTPs (+3.7%) delivering solid returns also. In terms of where that left credit, returns spanned from +1.7% to +4.9% with US outperforming EUR and IG outperforming HY.

Finally, the leaders YTD are still the Greek Athex (+43.1%), WTI (+28.8%) and Brent (+23.7%). In terms of the main equity markets, the NASDAQ (+21.3%) leads the way with the S&P 500 up +18.5% and STOXX 600 +17.2%. US and EUR HY have returned +10.1% and +7.4% respectively while in bond markets Treasuries and Bunds have returned +5.3% and +4.2% respectively.

Finally, for those asking, the only asset that remains down in 2019 is – drumroll – Silver (-1.2%).

via ZeroHedge News https://ift.tt/2RT9Zb8 Tyler Durden