Earlier today, we reported that the S&P 500 posted the best June return (+6.9%) since 1955, with all 38 major assets tracked by Deutsche Bank ending the month with a positive total return. If one looks at monthly data back to the start of 2007, “this has only ever happened once before” according to Deutsche Bank’s Craig Nicol. Amazingly, that was back in January of this year, just after Steven Mnuchin called the Plunge Protection Team. In other words, January and June of this year are the only months in the last 150 which have seen all assets post a positive total return.

Such performance is, for lack of a better word, unprecedented.

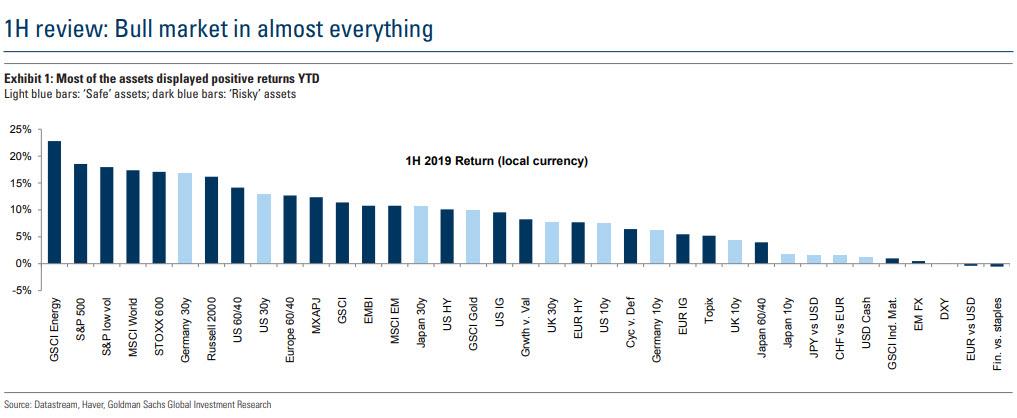

In a follow up note, Goldman picks up on this observations with the bank’s Alessio Rizzi writing that much in contrast to last year, most of the assets delivered positive performance YTD.

Having said that, with growth data softening again in May, risky assets have been range-bound since. The equity correction in May has been relatively small and followed by a sharp recovery in June supported by more dovish central banks and fading trade tensions concerns.

So what has been behind this unprecedented move higher in risky, safe haven and all other assets?

Take a wild guess…. and you’re probably right.

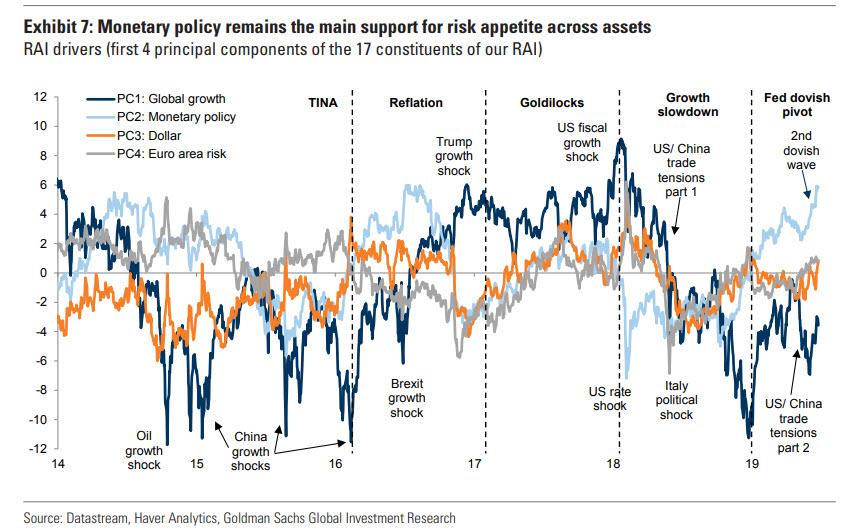

As Goldman answer, since June, there has been a second dovish wave with increased expectations for more ECB easing post Draghi’s Sintra speech and the June FOMC meeting. As a result, Goldman’s proprietary indicators shows that “monetary policy” remains the main driver of risk appetite and expectations are now very bullish.

The same was true in 1H 2016 but after the Brexit shock on June 23, ‘global growth’ expectations picked up, further boosted by Trump being elected in 3Q, which drove a more traditional ‘risk on’ pattern with equities rallying and bonds selling off.

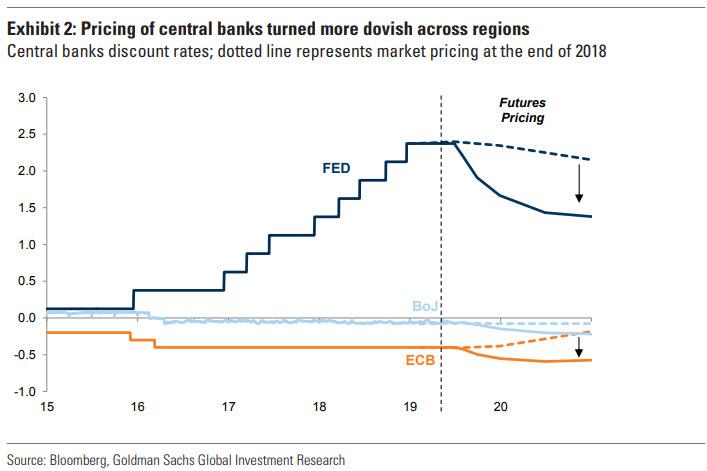

And here it is again, for the cheap seats: “while global growth has softened YTD, the boost from easier monetary policy has driven more appetite both for risky and ‘safe’ assets. Market expectations have turned much more dovish since the end of 2018.”

Some more color:

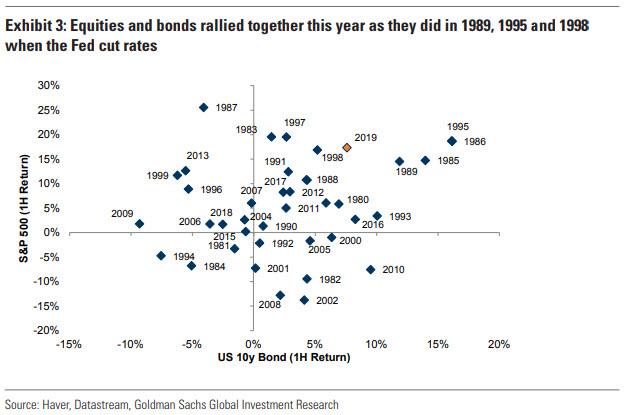

… the market is now pricing c.3 cuts and similarly investors have priced further ECB easing. As a result, both equities and bonds rallied and had one their best starts of the year since the 80s. This is not unusual after dovish monetary policy shifts, e.g. when the Fed starts cutting interest rates; in fact 1989, 1995 and 1998 were strong years for equity and bonds.

So with the Fed, and only the Fed, the driver of most if not all market upside in 2019 (as a reminder, in June PE multiple expansion – i.e., rate expectations – and not earnings were responsible for 90% of the upside), here are some of the consequences:

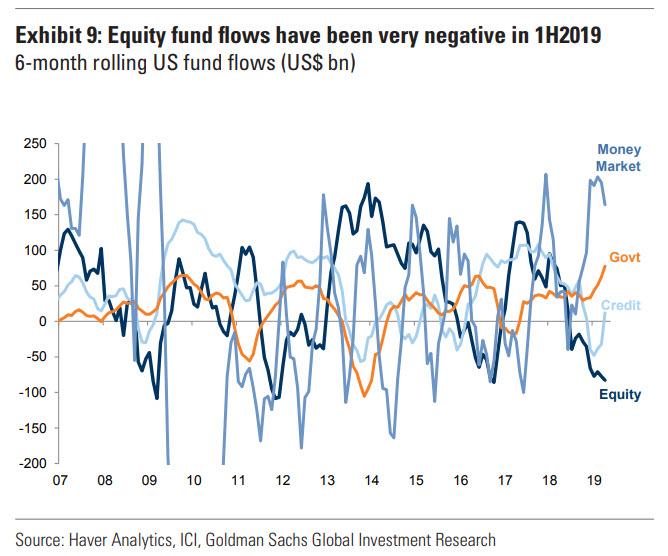

Due to the weak growth, the leadership within risky assets has been defensive – low vol stocks, defensive sectors and growth stocks outperformed. US low vol stocks had their best start in the last 30 years and a 6-month return similar that post the GFC trough. Investors have been reluctant in adding exposure to riskier assets and fund flows into equity have been quite negative, comparable to previous bear markets.

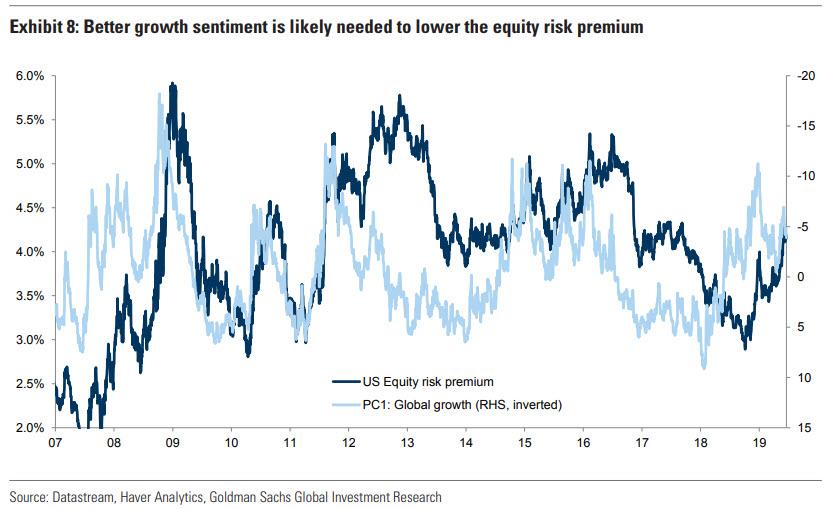

Additionally, the continued lack of positive growth news (and the preponderance of negative news) during the equity rally YTD also helps explain the growing gap between equity and bond yields – the US equity risk premium has increased alongside the de-rating of ‘global growth’ expectations as investors remain relatively cautious. The same has been true across regions and in those markets with increased secular stagnation concerns, such as Europe, where the de-rating of equities relative to bonds has been even larger.

The same investor cautiousness shows in fund flows – in the last 6 months, US equity fund flows have been the most negative since the global financial crisis, while there have been large inflows into money market funds and more recently credit and government bond funds due to the more carry-friendly backdrop.

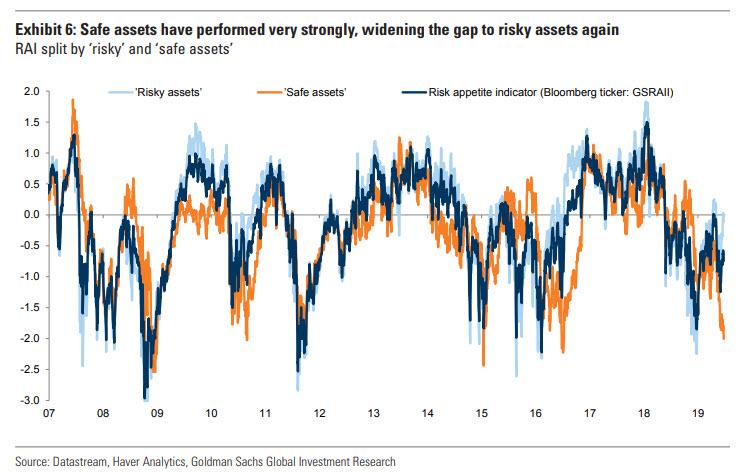

Finally, there is a large gap between risk appetite in ‘risky’ and ‘safe assets’ – Goldman’s aggregate index for ‘risky assets’ is close to neutral again while the continued strong rally of global bonds and safe havens such as Gold and the Yen signal very low risk appetite. The same gap exists between global equities, with the S&P 500 at all-time highs and 10-year bond yields heading to all-time lows. This, according to Goldman, is common in ‘bad news is good news’ regimes, when monetary policy drives a strong search for yield – the same was the case in 1H2016, when easier monetary policy stabilized markets.

So if not growth and not profits, and only the Fed is pushing stocks to new all time highs (on a string), how much longer can this farce of a market continue to levitate? The truth? Nobody knows of course, but as even Goldman now admits, “eventually growth has to take over as the main a driver to drive a procyclical rotation across and within assets.”

via ZeroHedge News https://ift.tt/2RT7AwT Tyler Durden