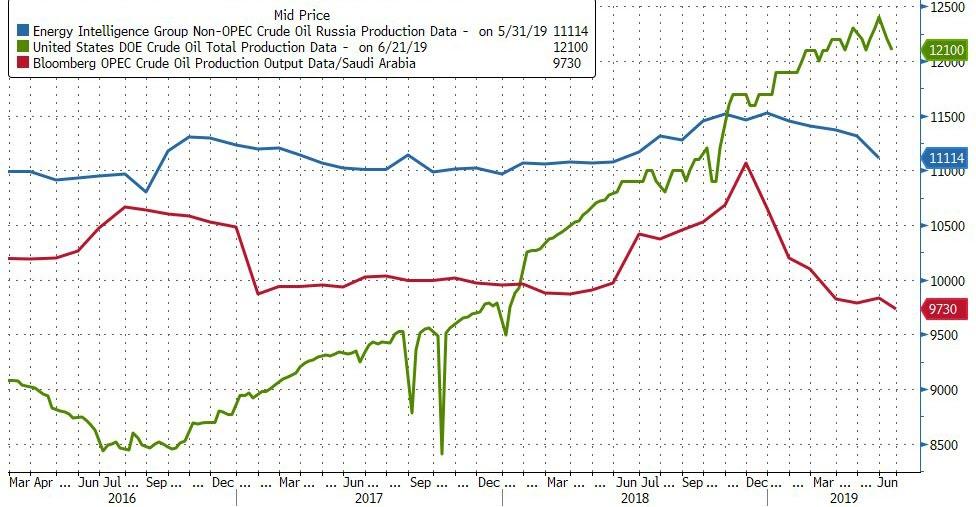

As OPEC+ proudly announces it is extending its production cuts into 2020 (while desperately talking down US shale production), in a last-ditch attempt to support prices, the slew of dismal manufacturing data in the last 24 hours has sparked selling in oil.

“Although a truce has been called between U.S. and China, global manufacturing is in a very bad shape,” said Tamas Varga, an analyst at brokerage PVM Oil Associates Ltd.

WTI is back below $58, erasing all post trade-truce and OPEC-deal gains…

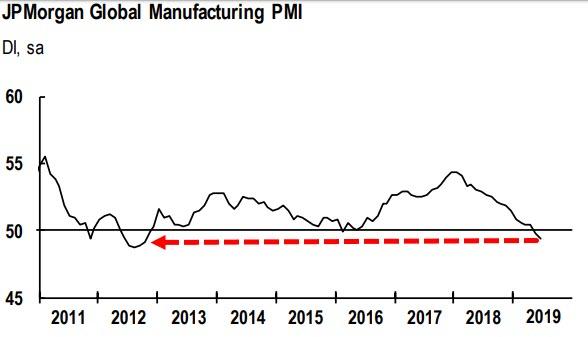

As global manufacturing appears to enter a recession…

Saudi Arabian Energy Minister Khalid Al-Falih said the OPEC+ pact was just the start of a long fight to contend with booming American production…

As Bloomberg notes, the OPEC pact leaves the door open for U.S. shale producers to grab more market share, as the group will have to cut deeper to achieve inventory targets, according to Goldman Sachs Group Inc. The decision creates a clearer downside risk to the bank’s forecast for Brent to average $60 a barrel next year, even though it could result in some shorter-term price spikes.

via ZeroHedge News https://ift.tt/2KUYKOs Tyler Durden