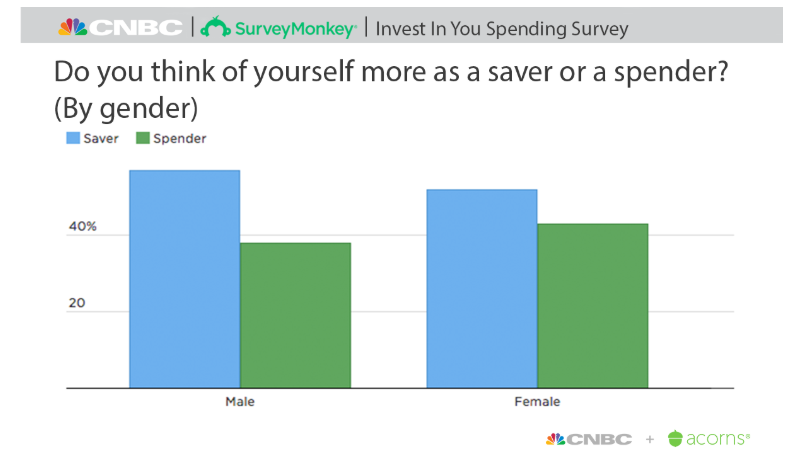

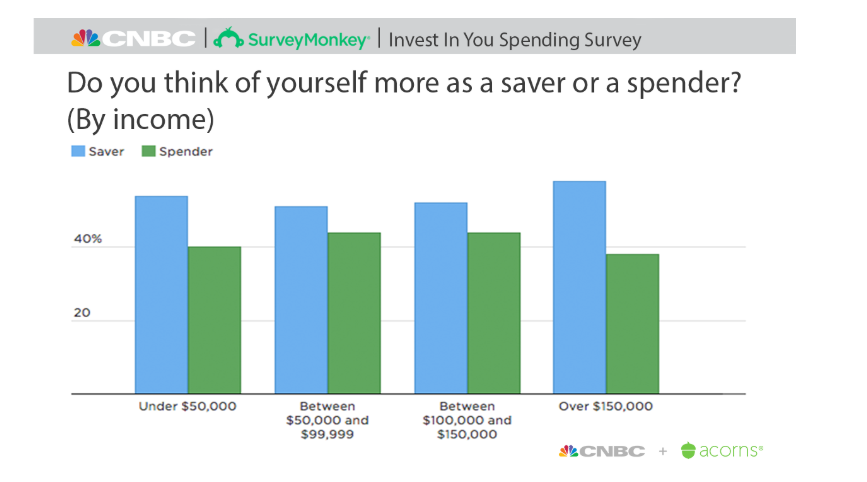

A third of all Americans have cut their spending this year, according to a new survey by CNBC. And for a country indoctrinated by a system that encourages spending and abhors savings, readers may be surprised to learn that a majority of the respondents, that 54% of survey respondents still described themselves as savers.

The survey polled men and women across the country, and looked at changes in people’s money behaviors. Many people are taking a critical look at their spending and preparing for “what ifs”, the survey concluded.

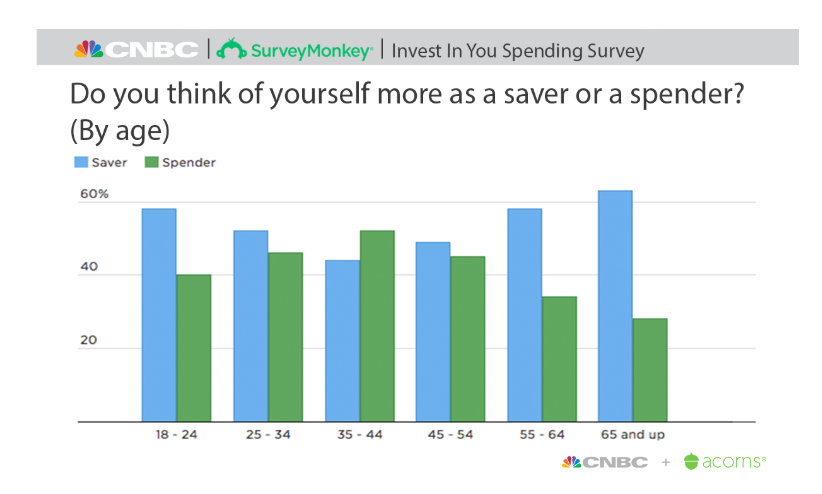

Spending versus saving habits were relatively equal across age groups. The 35 to 44-year-old group showed higher levels of spending, which then moved back toward saving as people neared retirement. 63% of seniors described themselves as savers and 28% described themselves as spenders.

And regardless of demographic, a third of Americans say that they’ve cut spending over the last year. They have done this as a result of a loss of household income, new debt, fears of recessions and medical expenses.

Most of the people spending less did so due to job losses, followed by people that took on new debt. It’s also worth noting that the number of Americans filing for unemployment rose more than expected last week. African-American respondents were far likelier to cut spending at 43%. Divorced men were the only group that came close, at 39%. Unemployment could be to blame again, as the survey found that twice as many black respondents as white pointed to “loss of job” as the reason that they were spending less.

Laura Wronski, chief researcher at SurveyMonkey in San Mateo, California said: “This ranks high for everyone, and much more so for blacks. Jobs and the economy is the No. 1 issue for blacks by a wider margin”, which is strange considering the BLS has been reporting near record-low unemployment for African-Americans.

Marc Morial, president and CEO of the National Urban League says that jobs remain a major issue: “When you look at national statistics, while unemployment numbers are at an all-time low, unemployment is still persistently higher among blacks than whites. If you lose your job, you have to make some hard trade-offs in your life.”

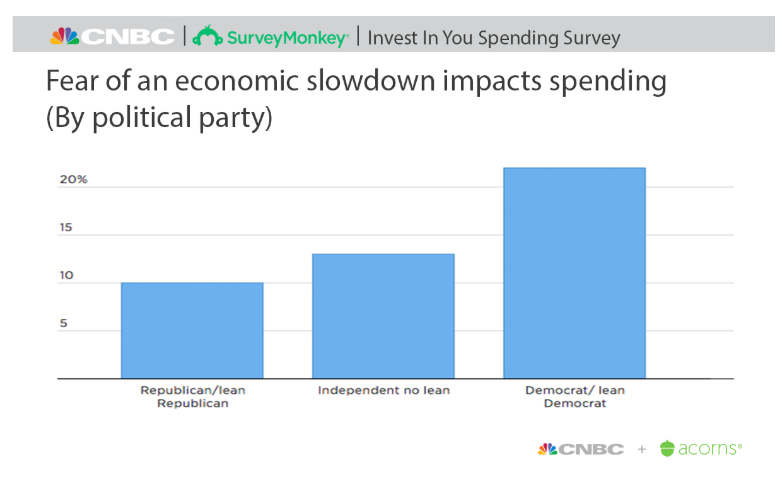

From a political standpoint, two times as many Democrats as Republicans said they’d cut spending due to anxiety over the economy.

Former FDIC chair Sheila Bair said: “I’m for anything that increases financial resilience. If you’re trying to do forecasting, it’s better to be on the conservative side and increase your cash reserves. Where’s the harm in that? Trying to predict the direction of the economy, though, might be a waste of resources. It’s like trying to time the stock market. You’ll never get it right.”

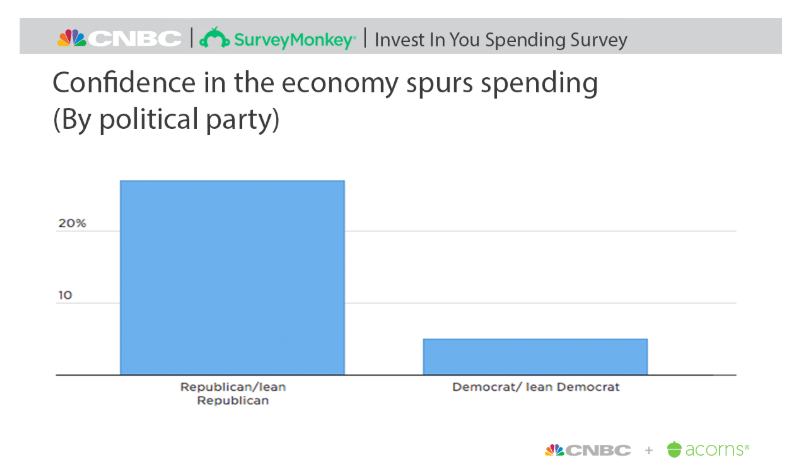

Republicans, on the other hand, were likelier than Democrats to say their confidence in the economy led them to spend more. Overall, however, Democrats were more likely to say they were spending more.

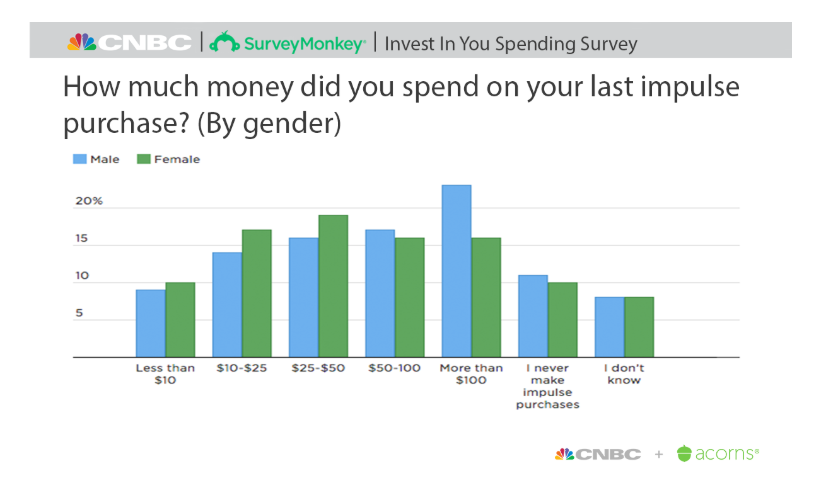

And impulse spending, believe it or not, is an issue that affects both genders. In fact, 23% of men say they’ve spent more than $100 the last time they made an impulse buy, versus 16% of women.

On the other hand, slightly less than a quarter of respondents who increased their spending said it was due to getting a better paying job. The top expense of those polled was delivery and take out meals:

Takeout or delivery meals were the top expense, with 28% of the general population. But those who identify themselves as spenders are far more likely than savers to say they spend $200 a month on convenience meals.

People seem to have their spending under control, Wronski said, noting the survey didn’t show much spending on alcohol or tobacco. “People are aware of the amount of money they’re spending and trying to spend it responsibly.”

In addition to job loss, the widening inequality gap is likely contributing to Americans tightening their financial belts, as well. Gabriel Zucman, an economist at the University of California, Berkeley told Tuscon.com: “The recovery has been very disappointing from the standpoint of inequality.”

More than 33% of the household wealth gain as a result of the “recovery” – amounting to $16.2 trillion— went to the wealthiest 1%, figures from the Federal Reserve show. In addition, the homeownership rate fell to about 60% in 2016 from roughly 70% in 2004. And despite the market nearly quadrupling during the recovery, the proportion of middle-income households that own stock has actually declined.

Lael Brainard, a member of the Federal Reserve’s Board of Governors said in May: “Many households find it challenging to make key middle-class investments because incomes at the middle are not keeping up with the rising costs of education and homeownership, and it is difficult to save enough.”

And consistent with the results from the CNBC survey, data shows that the widening inequality gap has disproportionately affected African Americans:

As financial inequalities have widened over the past decade, racial disparities in wealth have worsened, too. The typical wealth for a white household is $171,000 — nearly 10 times that for African-Americans. That’s up from seven times before the housing bubble, and it primarily reflects sharp losses in housing wealth for blacks. The African-American homeownership rate fell to a record low in the first three months of this year.

via ZeroHedge News https://ift.tt/2XKvQa2 Tyler Durden