With US traders eyeing a half-trading day today ahead of tomorrow’s July 4 holiday, and volumes even more abysmal than usual, the market’s confounding divergence accelerated overnight, with global bond yields tumbling to fresh multi-year lows, which pushed US equity futures higher amid expectations of even easier central banks, and on pace to hit 3,000 just ahead of the US holiday while European stocks were green across the board even as Asian markets were modestly lower.

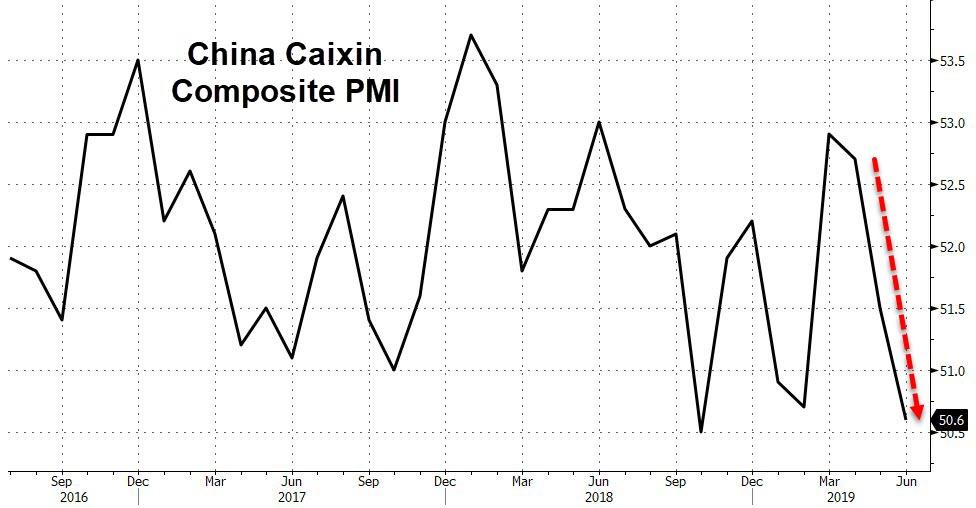

Benchmark debt yields slumped to fresh lows as simmering global trade war and recession fears rose after the latest round of dismal service PMI data across the globe, which saw China’s Caixin Composite PMI tumble in June to one of the weakest prints since the financial crisis…

… however the latest catalyst for even lower rates were two particularly dovish developments, when the IMF’s Christine Lagarde was unveiled as the ECB’s next head ushering in a candidate analysts anticipate will take up departing President Mario Draghi’s mantle in providing stimulus, while Trump nominated two particularly dovish economists to the Fed’s board, St Louis Fed’s Christopher Waller, and Judy Shelton, an informal advisor to Trump who publicly said the central bank should reduce rates.

Europe’s nomination of IMF chief Christine Lagarde as Mario Draghi’s ECB replacement reinforced expectations of monetary policy easing in the bloc. Traders greeted the decision by sinking German 10-year Bund yields to record lows of minus 39 basis points, threatening to drop below the European Central Bank’s deposit rate of -0.40% for the first time in history, and Italian two-year yields back into negative territory for first time in over a year.

Meanwhile, in the US 10Y Treasury yields also tumbled, dropping as low as 1.93%, or the lowest since November 2016.

“An absence of inflation, the shortages of ‘safe’ positive yielding bonds that is a legacy of QE, geopolitical concerns and a dovish monetary policy bias almost everywhere are seeing the bond rally go on, and on,” Kit Juckes, chief global FX strategist at Societe Generale, wrote in a note.

In the UK, 10Y UK gilts yield fell 4 basis points to 0.687, bringing the below the BoE’s main policy rate for the first time in a decade after Bank of England Governor Mark Carney warned overnight of damage from rising protectionism and a “widespread slowdown.”

“We have already seen some weak data in recent weeks so that is the backdrop (for the plunge in bond yields),” said Head of Macro Strategy at Rabobank Elwin de Groot. “And now have Christine Lagarde as the likely successor of Mr Draghi at the ECB, which for the market says that the dovish policies will continue.”

Finally, Italian bonds extended gains with the 2Y Italian yield dropping below zero and the 10Y tumblined to levels below last May’s rate quake, after a report that Rome has approved legislation aimed at setting aside future savings to keep the fiscal shortfall in line with EU limits.

As yields dropped, stocks rose, perpetuating the divergence observed ever since the start of June when hopes of an all-in thrust by central banks unleashed a furious risk buying spree.

European shares took little notice of some sizeable overnight falls for Asia’s big bourses to push 0.6% higher. Gains were however led by an unusual pairing of traditionally defensive healthcare stocks and carmakers, which jumped 1.2%. There was plenty of data to digest too. Euro area business activity picked up slightly last month, figures showed, but it remained weak as a modest upturn in the services industry offset a continued deep downturn in factory output. Worse, forward-looking indicators did not point to a bounce back, and other data showed Britain’s economy appeared to have contracted in the second quarter against a backdrop of Brexit and global trade worries.

“The latest downturn has followed a gradual deterioration in demand over the past year as Brexit-related uncertainty has increasingly exacerbated the impact of a broader global economic slowdown,” Chris Williamson, chief business economist at IHS Markit, said of the UK reading.

Earlier in the session, Asian traders were less excited by the prospect of negative rates across the globe as Asian stocks dropped, led by technology and energy firms, while buying Treasuries and gold amid a murky global growth outlook. Most markets in the region were down, with South Korea and China leading declines. Japan’s Topix gauge fell 0.9%, driven by Toyota Motor and Keyence, as the yen strengthened against the dollar. The Shanghai Composite Index declined 0.9%, led by Industrial & Commercial Bank and Kweichow Moutai. The S&P BSE Sensex Index advanced 0.3%, with IndusInd Bank and Reliance Industries among the biggest boosts, as traders looked toward possible government stimulus in a federal budget due Friday.

In the US, S&P futures rose 8 points just shy of 3,000 with Nasdaq 100 contracts advancing as Tesla climbed in premarket trading after a record quarter of deliveries for the electric-car maker.

In currency markets, the pound flirted with two-week lows after the PMI data and stood at $1.2568, on course for its fifth drop in the last six sessions. The euro was steadier at $1.1282 while the dollar traded down at 107.70 yen, off Monday’s high of 108.535 after the Bank of Japan made small tweaks to its bond buying program. The euro pared a small drop as purchasing manager data for the region was revised slightly higher. Gold extended gains.

Sweden’s crown meanwhile hit a 2-1/2 month high of 10.4890 versus the euro after the Riksbank bucked the global trend back towards cutting interest rates and said it remained on track to raise its by early 2020, albeit with some caveats.

Oil prices also rose a touch after data showed U.S. crude inventories fell more than expected last week but remained wobbly after a more than 4% dive on Tuesday, even after OPEC and allies including Russia agreed to extend supply cuts. Brent crude futures traded at $62.85 per barrel, up 0.7%, while U.S. West Texas Intermediate (WTI) crude futures rose 0.6% to %56.56 a barrel, following a 4.8% drop the previous day.Safe-haven gold was back on the rise too, up 0.5% at $1,425.64 per ounce having reached as high as $1,435.99

Data on U.S. private hiring, factory orders and the services sector will come on Wednesday before an early close. June’s government jobs report is due Friday, after the July 4 break.

Expected data include trade balance, jobless claims, and factory orders. International Speedway is reporting earnings.

Market Snapshot

- S&P 500 futures up 0.2% to 2,986.00

- STOXX Europe 600 up 0.5% to 391.41

- MXAP down 0.3% to 161.67

- MXAPJ down 0.4% to 531.26

- Nikkei down 0.5% to 21,638.16

- Topix down 0.7% to 1,579.54

- Hang Seng Index down 0.07% to 28,855.14

- Shanghai Composite down 0.9% to 3,015.26

- Sensex up 0.2% to 39,893.00

- Australia S&P/ASX 200 up 0.5% to 6,685.46

- Kospi down 1.2% to 2,096.02

- German 10Y yield fell 2.9 bps to -0.396%

- Euro down 0.06% to $1.1278

- Italian 10Y yield fell 12.5 bps to 1.482%

- Spanish 10Y yield fell 8.6 bps to 0.207%

- Brent futures up 0.5% to $62.73/bbl

- Gold spot up 0.5% to $1,425.43

- U.S. Dollar Index little changed at 96.75

Top News Highlights from Bloomberg

- Germany took a top EU job for the first time in more than half a century, after Ursula von der Leyen was nominated to be the bloc’s chief executive. While that’s a win for Chancellor Angela Merkel, the EU power politics involved in distributing the region’s top jobs also laid bare the cracks in her once unassailable power

- President Donald Trump said he’s planning to nominate economists Christopher Waller and Judy Shelton to serve on the Federal Reserve Board. Both are likely inclined to support the president’s call for lower interest rates

- Christine Lagarde is set to swap the helm of the International Monetary Fund for that of the European Central Bank, becoming the first woman to run euro-area monetary policy just as the bloc’s economy looks in need of fresh stimulus

- Germany’s 10-year bond yields are threatening to drop below the European Central Bank’s deposit rate for the first time

- Oil had its worst reaction to an OPEC meeting in more than four years, with prices sliding just after the cartel agreed to prolong production curbs as fears about the global economy mount

- Britain’s dominant services sector all but stagnated in June amid Brexit uncertainty and fears for the global economy. IHS Markit’s Purchasing Managers Index unexpectedly fell to 50.2. It followed weak readings for manufacturing and construction, suggesting the economy has slipped into contraction

- Boris Johnson, the favorite to be the next U.K. prime minister, has pledged he’ll launch a review of “sin taxes” on salt, fat and sugar, a signal that he wants to adopt an economically liberal approach after years in which government tried to clamp down on unhealthy behavior

- After a yearlong assault on the Federal Reserve and its chairman, President Donald Trump has tapped two wildly different economists to the central bank’s board who seemingly have one important thing in common. They’re both likely to support the president’s call for lower interest rates

Asian equity markets traded mostly subdued as the region digested another bout of substandard PMI data from China and following a lacklustre session on Wall St where trade was predominantly range-bound despite the late breakout which helped the S&P 500 notch a consecutive record closing high. ASX 200 (+0.5%) and Nikkei 225 (-0.5%) were mixed with Australia led higher by gold miners as the precious metal resumed its advances but with upside capped by financials amid concerns of tighter margins due to the lower rate environment and as energy names suffered the brunt of a near-5% drop in crude, while sentiment in Tokyo caved in from the weight of a firmer currency. Elsewhere, Hang Seng (U/C) and Shanghai Comp. (-1.0%) were downbeat with underperformance in the mainland after another PBoC liquidity drain and disappointing Chinese data in which Caixin Services PMI missed estimates to print a 4-month low and Composite PMI deteriorated to its weakest since October 2016. Finally, 10yr JGBs were higher as they tracked the gains in T-notes which saw the US 10yr Treasury yield drop to its lowest since 2016, with demand also underpinned by the downbeat risk sentiment and BoJ presence in the market.

Top Asian News

- Singapore Deal Forms Biggest Asia Pacific Hospitality REIT

- Turkish Inflation Respite Starts Countdown to First Rate Cut

- Teva Credit Investors Ramp Up Short Bets as Legal Costs Weigh

- Saudi Makeover Masks Same Old Habits When It Comes to Jobs

European Indices are firmer this morning [Euro Stoxx 50 +0.9%] diverting from the somewhat mixed performance seen overnight, where sentiment was afflicted by poor Chinese data and a PBoC liquidity drain; upside in European bourses so far has led to some chatter that the Stoxx 50 is on track to enter a bull market soon. This mornings stock strength follows on from the SPX setting a fresh record close of 2973 yesterday, in-spite of the backdrop of increasing global growth concerns. Sectors are broadly in positive territory, with the exception of the Energy sector; which is lagging on the back of yesterday’s near-5% oil complex decline. In terms of notable movers this morning, Vonovia (+3.0%) are towards the top of the Stoxx 600 on the back of a broker move where they were upgraded to buy from neutral. Alcohol and tobacco are faring better following reports that UK PM Candidate Johnson is to review ‘sin taxes’, thus upside is seen in related names such as British American Tobacco (+2.5%) and Fever Tree (+1.8%). At the other end of the index are Sainsbury’s (-1.4%) after reporting poor grocery sales and commenting that consumer outlook remains uncertain.

Top European News

- U.K. Services Stagnate, Pointing to an Economy in Contraction

- Euro-Zone Business Stays Somber as ECB Plans for More Stimulus

- Unite Buys Student Landlord Liberty Living for $1.8b

- How the Two Tory Rivals for PM Reckon They Can Fix Brexit

In FX, the Antipodean Dollars have both overcome overnight dips on the back of sub-forecast Chinese Caixin services and composite PMIs following reports that Beijing is considering purchasing a reduced amount of US agricultural products in acknowledgement of the agreement to resume trade talks. Aud/Usd has reclaimed 0.7000+ status, but remains capped below the pre-RBA high, while Nzd/Usd has not quite managed to revisit 0.6700 as the Aud/Nzd cross holds firmly above 1.0450. However, the Aussie may yet be hampered by decent expiry options sitting between 0.6985-0.7000 (1 bn) into the NY cut.

- JPY/SEK – The Yen and Swedish Crown are vying for position as the next best major, as Usd/Jpy consolidates within a 107.92-54 range after the latest safe-haven move through 108.00 and the headline pair now looks likely to remain contained by hefty expiry interest spanning 107.00-10 (3 bn) through 107.65-80 (1 bn) to 108.00 (2.2 bn). Meanwhile, Eur/Sek has pared some losses after a test of Fib support under 10.5000 in wake of the Riksbank policy meeting that stuck rigidly to previous (April) guidance in terms of the rate path and likely timing of the next hike, as growth and inflation assessments were deemed to be unchanged in the interim period.

- EUR – Mostly better than expected Eurozone PMIs and an almost glowing review of Italy’s 2019 and 2020 finances, according to EU officials citing Government analysis have propped up the single currency to an extent, with Eur/Usd trading in a tight 1.1294-69 band. Moreover, option expiries appear influential given as much as 4.7 bn running off from 1.1290 to 1.1300 vs strong technical support in the form of the 100 DMA at 1.1260.

- GBP – The Pound remains rooted to the base of the G10 ranks and another dismal UK PMI has rattled Sterling sentiment, as the services sector only just escaped contraction and the composite fell through 50 to signal negative Q2 GDP, albeit very marginal. Cable held above 1.2550, but partly due to a lethargic Dollar as the DXY continues to straddle the 200 DMA in a confined 96.873-662 range, while Eur/Gbp edged back up towards 0.9000 and recent highs only a few pips shy of the round number.

- TRY – The Lira has maintained its recovery momentum in wake of broadly in line and softer Turkish CPI data that offset subsequent news that tax on retail FX transactions could be doubled to 0.2% and President Erdogan may be given the green light to hike levies further. Usd/Try currently around the middle of 5.6645-6090 bounds.

In commodities, WTI (+0.7%) and Brent (+0.8%) are higher this morning and at the top of the day’s range, although, both WTI and Brent did drop to within a few cents of the USD 56.00/bbl and USD 63.00/bbl handles to the downside earlier in the session. Last nights larger than expected headline API draw failed to provide much in the way of impetus for the complex, which was already heavily subdued having experienced around a 5% decline in prices; in-spite of the OPEC+ meeting concluding and resulting in a agreement to extend the output cuts, with analysts citing a “sell the fact” scenario. Looking ahead, we have the EIA release later in the session where markets will be looking for confirmation of the larger than expected draw and ahead of tomorrow’s US market holiday for Independence Day. Gold (+0.5%) is supported this morning as safe havens are benefiting from the ongoing concerns around global growth, which has most prominently been seen across Fixed Income. The yellow metal has is convincingly above the USD 1400/oz mark, and has printed session highs of USD 1437/oz. Separately, Copper is subdued due to the mixed overnight Asia-Pac performance and after Chinese data missed on expectations.

US Event Calendar

- 7:30am: Challenger Job Cuts YoY +12.8%, prior 85.9%

- 8:15am: ADP Employment Change, est. 140,000, prior 27,000

- 8:30am: Trade Balance, est. $54.0b deficit, prior $50.8b deficit

- 8:30am: Initial Jobless Claims, est. 222,500, prior 227,000; Continuing Claims, est. 1.68m, prior 1.69m

- 9:45am: Bloomberg Consumer Comfort, prior 63.6

- 9:45am: Markit US Services PMI, est. 50.7, prior 50.7; Markit US Composite PMI, prior 50.6

- 10am: Factory Orders, est. -0.6%, prior -0.8%; Factory Orders Ex Trans, prior 0.3%

- 10am: Durable Goods Orders, est. -1.3%, prior -1.3%; Durables Ex Transportation, prior 0.3%

- 10am: Cap Goods Ship Nondef Ex Air, prior 0.7%; Cap Goods Orders Nondef Ex Air, prior 0.4%

- 10am: ISM Non-Manufacturing Index, est. 56, prior 56.9

DB’s Jim Reid concludes the overnight wrap

A stray offside toe, VAR, a very bad penalty miss and a late sending off led to yet another World Cup semi-final heartache for England last night. Yes England’s women lost 2-1 to the USA in a very tense and dramatic last 25 minutes of football. Meanwhile over in cricket, England’s women lost the first game in the Ashes so the nations hopes roll back to the men who effectively have a World Cup quarter final in the cricket today. As someone who has followed England cricket round the world in my younger days I would be glued to this game except for the fact I’m in Milan today. I suspect the TV screens will not have it on!

It was a better day for females in the business/political world than English sportswomen yesterday as Ursula von der Leyen was nominated to be president of the European Commission with Christine Lagarde proposed as the President of the ECB. The former may face more nomination hurdles than the latter but the latter is the more important one for markets.

These nominees and the relentless march lower for bond yields were the main stories in markets yesterday. Interestingly, Lagarde will be the first ECB President who isn’t a professional economist. Given her relative inexperience with the ECB’s (complicated) policy toolkit, there is a credibility risk, especially if and when things get more complicated economically, but markets will like the fact that she is a skilled and well connected political operator.

The euro weakened a touch in response to the announcement, possibly reflecting the fact that a more hawkish individual was not chosen. It’s probable that the intellectual economic legwork will now need to be carried solely by Chief Economist Lane, the only trained economist at the top of the new leadership team (recently-appointed Vice President de Guindos is, like Lagarde, a lawyer by training). That said, a lawyer could prove to be useful in the current environment, with the focus on the legal limits of ECB asset purchases, “disenfranchisement,” the risk of debt restructurings, and the prohibition on monetary financing of governments.

Though not a central banker, Lagarde does have a catalogue of prior economic views that may provide clues of her likely policy preferences. Unsurprisingly, she is in favour of deeper European integration. She previously called for “truly integrated financial and capital markets that allow companies to raise financing across borders more easily and support investment” and also pushed for a “rainy day fund” of common EU money. More specifically, she has called for “agreement on a schedule for common deposit insurance, together with a roadmap for reducing vulnerabilities in the banking sector.” She has also cautioned against the risk of deflation, saying that “if inflation is the genie, then deflation is the ogre that must be fought decisively.” So the good intentions are likely there.

Not to be overshadowed, after US markets closed, President Trump announced two nominations to the Fed Board of Governors: Judy Shelton and Christopher Waller. Shelton is currently the US Executive Director at the European Bank for Reconstruction and Development, a role for which she was already confirmed by the Senate. Her confirmation for Governor may be more contentious, given her stated skepticism of the Fed’s legally mandated goals of maximum employment and stable prices. Waller is a more conventional candidate, currently serving as director of research at the St. Louis Fed. That means he currently works for James Bullard, the most dovish member of the FOMC. Both nominees are highly likely to support lowering interest rates.

Turning back to the move in yields yesterday now. They were driven by the combination of dovish comments out of the BoE, a big slide for oil, and holiday-impacted volumes. Indeed it was Gilts which really led the charge with 10yr yields dropping -9.2bps, equalling the biggest drop since last November. At 0.722%, yields are also now at the lowest since September 2016 and they now trade below the BoE’s Bank Rate for the first time since November 2008. The same phenomenon occurred earlier this year in the US and is just 3.3bps away from happening in Europe, using bunds and the ECB’s deposit facility.

Although shockingly poor construction data kick started the move (more on that below), it was comments from Carney which was the bigger story after the BoE Governor said that “intensification of trade tensions has increased the downside risks to global and UK growth” and that it’s “unsurprising” that the market views a lower bank rate in the future. Carney also said that the MPC will be addressing the global growth outlook in the August report. The overall feeling from the speech was that the MPC is preparing the ground to potentially drop the tightening bias (that has recently perplexed markets) when they meet next month.

Even greater was the move for BTPs where 10y yields rallied -12.8bps. That takes the two-day move to -26.3bps, the sharpest rally since last June. In fact yields are -32.1bps over the last 5 sessions. In what is perhaps less of a surprise now, 2y BTP yields also dropped into negative territory briefly yesterday however they eventually closed just above that at 0.022% (-8.0bps on the day). 10yr Bunds were a more modest -1.1bps lower albeit to a new low of -0.367%. 10yr Spain (-4.5bps) and Portugal (-4.8bps) are all of a sudden now just 30-35bps away from 0% which feels all a bit surreal.

Speaking of which, 10y Greek yields also rallied -12.4bps yesterday and are now at a new record low of 2.138%. Amazingly, the spread over Treasuries is just 16.2bps. The last time the spread was that low was all the way back in 2007. For context, the spread was above 1,600bps during 2015. That spread compression to Treasuries came despite Treasuries rallying -4.8bps to 1.976% yesterday. All this came with 5y5y inflation breakevens dropping -4.5bps in the US and -4.2bps in Europe – just 2.9bps off the pre-Sintra all-time lows. Lagarde will have her work cut out!

As mentioned, one of the drivers of lower yields and softer inflation expectations was the sharp fall in oil prices. WTI crude fell -4.65%(up +0.36% this morning), its steepest drop since May. While OPEC and its other partners reached a new output deal earlier this week, the newsflow since then has been consistently poor. The various parties are struggling to agree on the specifications of the next output cuts, with officials from Saudi Arabia and Russia both out in the press (Bloomberg) yesterday giving different methodologies for how to calculate the cuts. The former said that they would change their baseline to the 2010-14 average, rather than continuously updating it based on a five-year moving average. In response, Russian Energy Minister Novak said that “a final decision to switch hadn’t been made.” This is pretty technical, but a change would equal around 670,000 barrels per day difference in output over a year.

Given all of the above bubbling in the background, it was a much more holiday-like session for equity markets. The S&P 500 (+0.29%), NASDAQ (+0.22%) and DOW (+0.26%) all fluctuated in small ranges while the STOXX 600 also closed +0.37%. Volumes were around -20% lower in the US too with markets shutting early today ahead of the Independence Day holiday tomorrow.

This morning in Asia markets are largely heading lower with the Nikkei (-0.61%), Hang Seng (-0.18%), Shanghai Comp (-0.70%) and Kospi (-0.87%) all down. The Japanese yen is up +0.25% while gold is +0.57%. In terms of overnight data releases, we saw China’s Caixin June services PMI reading at 52.0 (vs. 52.6 expected) bringing the composite PMI down to 50.6 (vs. 51.5 last month), the lowest reading since October 2018. The Chinese yuan is trading -0.13% to 6.8806. Elsewhere, futures on the S&P 500 are down -0.13% and yields on 10y USTs are down -2.1bps this morning after declining -5.1bps yesterday to 1.954%, the lowest level since November 2016 while 2y USTs are down -2.5bps this morning (-2.5bps yesterday as well) to 1.738 bringing the 2s10s spread to +21.6bps.

In other overnight news, the US Commerce Department imposed duties of more than 400% on imports of steel products produced in Vietnam using material from South Korea and Taiwan. In three preliminary circumvention rulings on Vietnamese steel, the Commerce Department said certain products produced in South Korea and Taiwan were shipped to Vietnam for minor processing before being exported to U.S. as corrosion-resistant steel products and cold-rolled steel. Elsewhere, the BoJ reduced its bond purchases across three maturity zones. The moves, however, were somewhat expected after the central bank last week altered its monthly bond-buying plan for July, seeking to address a flattening yield curve. Yield on 10yr JGBs are down -0.6bp to -0.156%.

As for other newsflow yesterday, a Bloomberg story attracted a bit of attention, suggesting that ECB policy makers see “no need to rush into a July rate cut” and instead would prefer to wait for further data. That would better fit with the view of a September cut at which point we’ll also get the new staff forecasts and the benefit of knowing what the Fed will have done. The bigger takeaway from the story, rather than the exact timing, is that it further confirmed that a rate cut is likely.

Across the Atlantic, the only Fedspeak came from Cleveland Fed President Mester, who is a known hawk and is not a voter this year. That said, she did lay out her argument against a near-term rate cut. She said that she “prefers to gather more information before considering a change in our monetary policy stance.” She said she doesn’t want to “always react to the market” and does not support a proactive rate cut to boost inflation now. Mester was pretty specific about what would change her view: citing “a few weak job reports, further declines in manufacturing activity, indicators pointing to weaker business investment and consumption, and declines in readings of longer-term inflation expectations.” That heightens interest in this Friday’s jobs report for those who make it back after the holidays.

As for data, it was a very sparse calendar yesterday however the highlight was a spectacularly bad construction PMI here in the UK. The June reading printed at 43.1 which was well below expectations for 49.2 and also 5.5pts down from the May reading. In fact it was the lowest since the crisis. I can only think it’s because my building work finally came to an end that month. The details didn’t look much better and combined with the manufacturing reading on Monday, the data is now increasingly hinting towards a recession here in the UK or at least the rising probability of a negative growth quarter. The services reading is due out today and arguably this is the more important driver of growth so it’ll be well worth watching.

The remaining data yesterday included a weak May retail sales print in Germany (-0.6% mom vs. +0.5% expected) albeit offset to upward revisions to the prior month, and a softer than expected May PPI reading for the Euro Area (-0.1% mom vs. +0.1% expected). In the US, the only notable release was the June Wards total vehicle sales which came in at 17.3 million, matching May’s figure and exceeding the 3m, 6m, and 12m moving averages.

Looking at the day ahead, the main focus this morning in Europe will be on the remaining June PMIs with the services and composite prints due. As for the US, with markets expected to close early ahead of Thursday’s holiday we’ve got a fairly heavy slate of releases to get through including the June ADP employment change print, initial jobless claims, May trade balance, June services and composite PMIs, June ISM non-manufacturing and final May durable, capital and factory orders. Away from that the ECB’s Nowotny and Villeroy are scheduled to speak along with the BoE’s Cunliffe and Broadbent.

via ZeroHedge News https://ift.tt/2Jrvr2S Tyler Durden