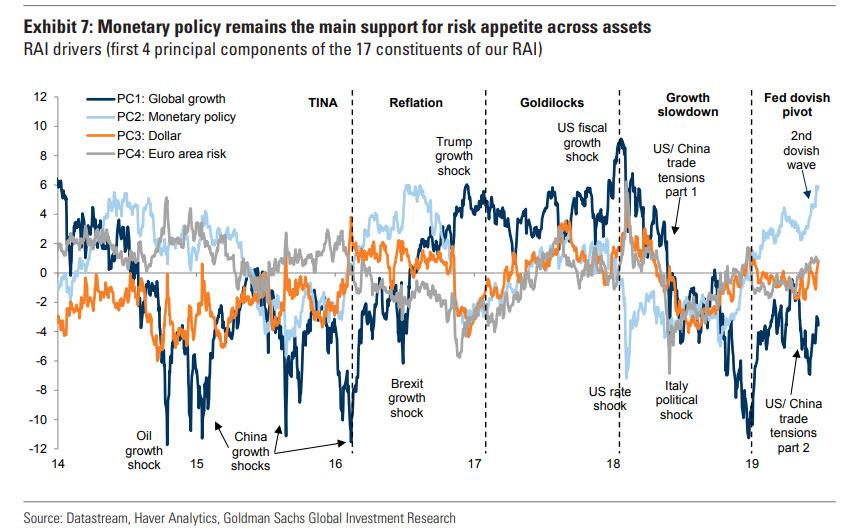

Yesterday we presented Goldman’s simple, yet accurate, explanation why there is now a “bull market in almost everything” – as the bank that appropriately has incubated more central bankers than anyone else, concluded, “monetary policy” remains the main driver of risk appetite.“

Goldman is, of course, right. But while that is the one – and only – reason behind the market’s relentless levitation for the past decade, what about the catalysts behind the most recent melt-up, which has sent global bond yields plunging to record lows… and the S&P 500 to record highs, something even Trump gleefully observed this morning.

S&P 500 hits new record high. Up 19% for the year. Congratulations!

— Donald J. Trump (@realDonaldTrump) July 3, 2019

According to Nomura’s Charlie McElligott, there are three distinct technical drivers behind the latest overnight extension of the global “duration rally”—as well as the mechanical catalysts behind the US Equities explosion higher

- “Net-Up/Gross-Up” flows now prevalent off the back of the recently-highlighted “UNDER-positioning” dynamic;

- Return of systematic VIX rolldown players as second-order catalyst for Stocks;

- Massive $Gamma at higher strikes, pulling Equities higher

Drilling down further into each of these separate catalysts, here is more from McElligott starting with…

1. “Net-Up”/“Gross-Up” flows due to “under-positioning” dynamic.

- Equities simply cannot get enough of this “dovish” US Rates trade either, with S&P futures making fresh all-time highs overnight—while it is the “Duration Sensitives” again leading in standard “Slow-flation” fashion: Nasdaq futures are +3.1% in 6 sessions (remember, “Secular Growth” is positively correlated to low yields, as they justify valuations), while yesterday saw the other end of the “Slow-flation Risk Barbell” being low-volatility “Defensives” leading the tape higher (REITS, Utes, Staples and Healthcare as four of the top five best S&P sector performers on the session)

- We are now very clearly seeing a major “net-up”/“gross-up” trade going through week-to-date, as funds are forced to re-engage into this US Equities breakout

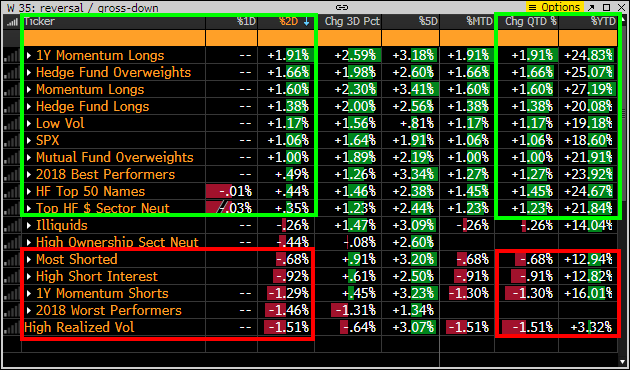

- We are seeing the “reversal of the reversal,” as the past two weeks’ worth of “Momentum Unwind” is now being “put back on” with violence—with YTD leaders / Crowded Longs / Overweights ripping higher again week-to-date, while conversely, “Popular / Momentum Shorts” are again being smashed (i.e. the Cyclical / Value stuff, with Industrials, Materials, Financials and Energy as the S&P’s four worst sectors yesterday)

Visually, the “momentum” factor ripping higher as winners are “piled back into” while “loser” cyclical shorts are being pressed

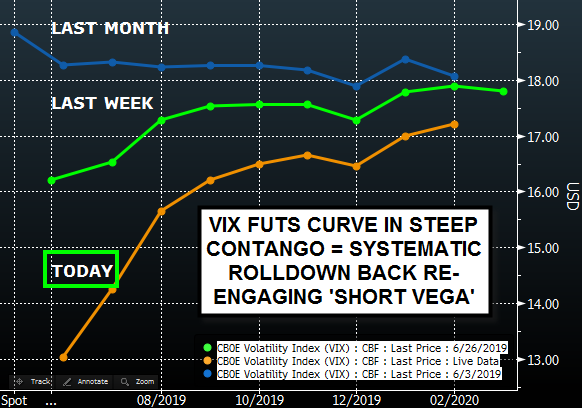

2. VIX Futures curve is back in steep contango

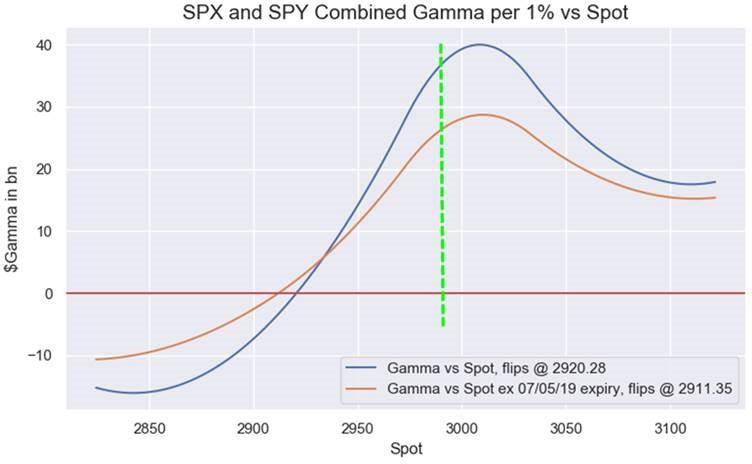

As front vol gets crushed, sending the VIX futures curve steep into contango, systematic vol players are re-engaging in roll-down strategies, which reflexively becomes a second order catalyst for Equities, as Dealers need to get long more Delta or create more Gamma via options to hedge i.e., Dealer hedging of this flow is daisy-chaining into “more Delta buying” and / or “more Gamma at upper strikes”.

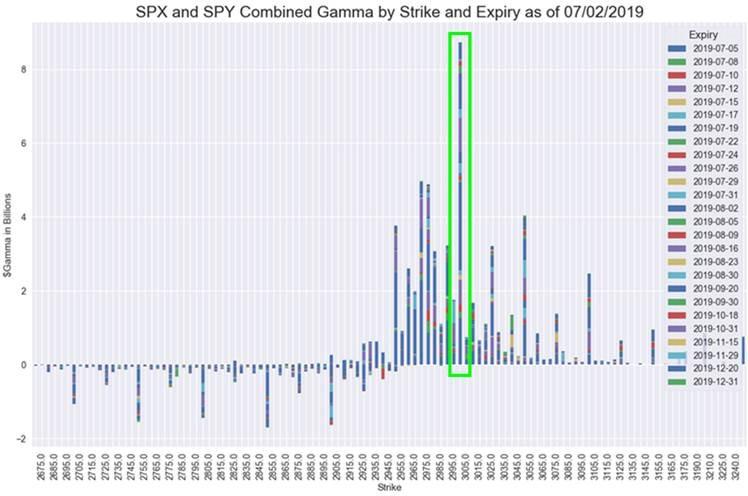

3. Gamma Gravity

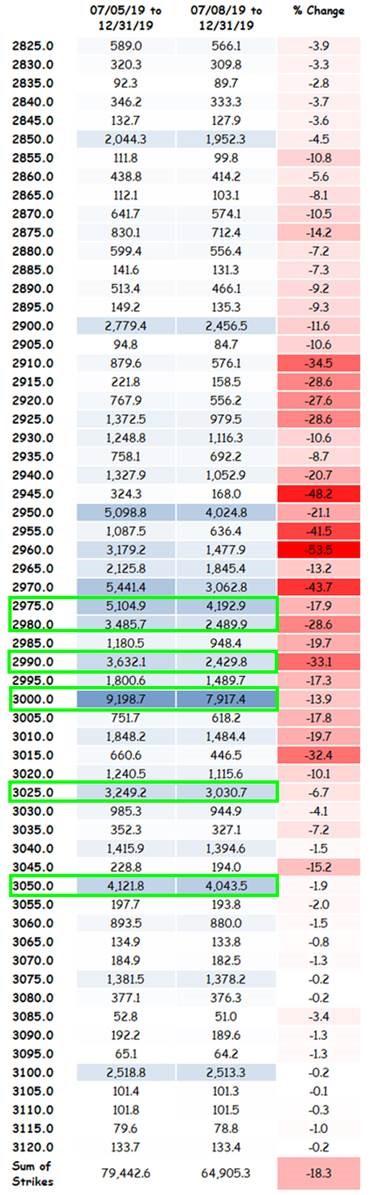

There is “MONSTER” notional $Gamma at UPSIDE strikes in SPX / consolidated SPY options which acts to “pull” us higher. According to McElligott, the 3000 strike is nearly a multiple of other strikes from a $Gamma perspective—but there are lumpy notionals all the way up (2975, 2980, 2990, 3000, 3025 and 3050)

Finally, here is a breakdown of gamma by strike, “showing the amount of pull to the upside.”

via ZeroHedge News https://ift.tt/2LAprb0 Tyler Durden