Authored by Jack Rasmus via Counterpunch.org,

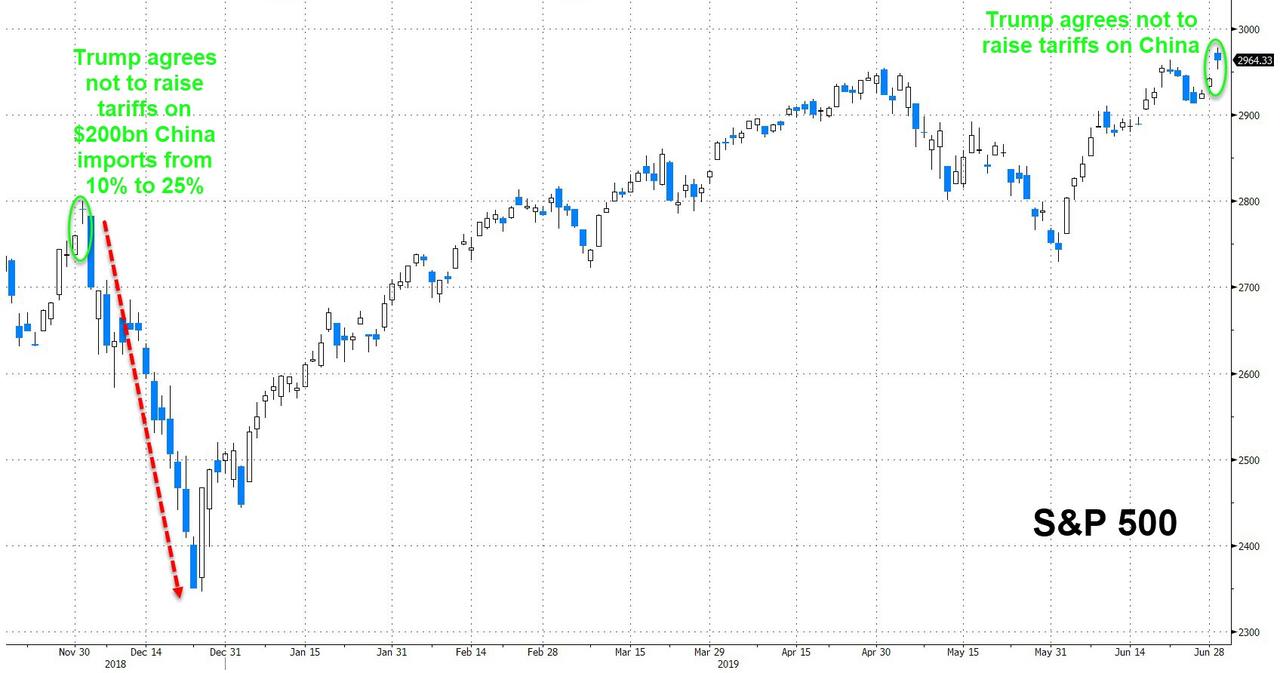

This past weekend, June 29, 2019 Trump and China president, Xi, met again at the G20 in Japan in the midst of a potential further escalating trade war. But the outcome looks eerily similar to that of the prior G20 meeting in Buenos Aires on December 2, 2018, when Trump and Xi also met.

Once more, the same post-G20 ‘spin is in’: i.e. Trump declares publicly he has such a great relationship with Xi. There’s a great trade deal soon forthcoming between the two countries. US and China trade teams will now begin to thrash out the details on the remaining 10% or so of US-China trade differences. In the interim, once again, Trump announced he will withhold imposing more tariffs (this time on an additional $325 billion of China imports to the US). In other words, coming out of the latest G20 it’s almost an exact déjà vu all over again to the outcome which occurred at last December 2, 2018’s G20 meeting between Trump and Xi in Buenos Aires.

Will it be different this time? Will there by an agreement? Or will Trump once again just be buying time—i.e. until just before the 2020 elections? Until he sees China’s economy softening further and he raises US demands further again? Or maybe Trump and his neocon trade advisers—Lighthizer, Navarro, Bolton who are now driving US trade (and most of US foreign) policy—don’t want to compromise and will accept nothing less than China’s capitulation on the nextgen technology issue that was at the core of the blow up of negotiations in May 2019?

It’s probably becoming increasingly clear to the Chinese that the US did not just launch a ‘tariff war’ back in March 2018. US policy is driving toward a bonafide economic war between the US and China longer term.

In the nearer term, the current differences may well transform the ‘tariff’ war into a ‘currency war’ that will spread contagion and reverberate globally across other economies—at a time at which the global capitalist economy is slowing fast and approaching as well a new financial instability. All China has to do is allow its currency, the Yuan-Renminbi, to devalue naturally in response to US policy and the slowing global economy. That devaluation would more than offset US tariffs. Thus far, China has intervened in global money exchange markets to prevent this. But all it needs to do is allow it to occur according to prevailing economic and market forces and just not intervene in global money markets further to prop up the Yuan. That will become inevitable as the China, US, and global economy weaken further in coming months. China doesn’t have to manipulate its currency. It only has to allow global market forces, unleased in large part by Trump policies, to naturally devalue the Yuan.

Then there’s China’s $1.3 trillion of US assets, mostly US Treasuries. It could slow its purchase of new US government debt, which it appears it may now be doing. Should the tariff-currency war intensify, if necessary it could stop or even sell off its dollar hoard of US Treasuries. It’s been moving toward that since September 2018, as its purchases of US securities first slowed and then declined in March 2019. That reduction of purchases, if not offset by other economies buying more, would drive up long term interest rates in the US and in turn the value of the US dollar still more—all of which further slows global growth.

Rising US rates and the dollar will likely precipitate another US stock and junk bond sell-off, similar to that which occurred late 2018. And we know Trump doesn’t like stock market declines.

There are numerous other ‘actions’ the Chinese could take in response to US neocons intensifying or prolonging the US-China tariff-trade war, further driving the differences into a broader economic war. Various bureaucratic obstacles to US corporations’ majority ownership of operations in China, ‘buy China’ not America in China movements, restrictions on the sale of what’s called ‘rare earths’ minerals key to technology and military production would likely be imposed. Even if US neocons don’t understand this, or don’t care, widespread business and banking interests do and could intervene more forcefully should Trump’s drift toward economic war continue.

Economic Slowdown & Recession ‘Wild Card’

And there’s a wild card in the trade war deck that may check the neocons influence perhaps. That’s the current softening of the US and China economies. That could force both sides to an agreement. Trump may grab the major concessions on China purchases and US majority ownership rights in China and announce a big victory—just before the 2020 US elections.

China’s economy is clearly slowing, growing likely no more than 4%-5%, not the official 6.5%. But so too is the US economy as well, which will start to become more obvious once the data for the 2nd quarter US GDP start to come in by late July.

The US 1st Quarter GDP numbers were propped up by temporary factors associated with inventory over-investment and net exports, both of which are fading rapidly this quarter. Moreover, US household consumer spending is barely growing, most recently at less than 1%. The housing sector has slowed for the past 17 months. Manufacturing orders and production is now stagnant and business investment has turned negative. Lagging indicators, like jobs, are now beginning to turn down as well. The US Central bank’s lowering of interest rates in the second half of 2019, which is helping to drive the massive $1.5 trillion in stock buybacks and dividend payouts scheduled for this year, may succeed in putting a temporary floor under stock markets. But the real side of the US economy is being driven to slowdown, or even worse by year end. More bank research departments, big finance capitalists, and even some economists, a notorious conservative and timid forecasting lot, have begun to predict recession by year end 2019.

A more rapidly slowing US economy, now clearly beginning, may thus change the trade negotiations dynamic, forcing both sides to some kind of a deal. And if the US slips into recession by winter 2019-20, which this writer has also been predicting the past year, the pressure to cut a deal will grow.

Trump may yet be convinced to take the China concessions already on the table—and temporarily suspend the US demand for China’s capitulation on the technology issue. Trump could yet take what’s been offered by China—i.e. to buy $1 trillion more US farm goods and allow US corporations majority ownership of operations in China—and declare a major victory in the trade negotiations in 2020 just before the elections. The nextgen tech-military confrontation—the real core of the US-China dispute—could be re-raised and revisited thereafter later. That’s one possible scenario. Because for Trump a ‘deal is never a deal’, it’s never concluded, but subject to reopening whenever he so chooses.

Breaking an agreement is standard practice for Trump. Just ask the Mexicans, where Trump recently threatened to levy 25% more tariffs even after US concluding a new NAFTA 2.0 deal last year. Or ask the Iranians, who thought they had an agreement with the US. Or the Europeans who thought they had a Climate deal. For Trump, negotiations are a continuing process, punctuated by happy talk events stroking foreign leaders, followed by more threats of sanctions, and personal insults and intimidations, to force a reopening of deals once thought concluded by trading partners—allied and challengers alike.

In other words, even if a China-US trade deal is done, perhaps next year, the trade war with China will not be over. It will have just begun, as it evolves toward a broader ‘economic’ war after the 2020 elections, perhaps even before.

The key to a China trade deal occurring sooner. rather than later, is whether Trump and US big bankers and multinational capitalists can convince the neocons and the military industrial complex to agree to a short term deal with China now that provides only token nextgen technology concessions—backed by the Trump-Neocon assurance that the US will reopen and resume the technology offensive after the 2020 elections once again.

For the US economic and political elites are in basic agreement with the neocons behind the Trump daily circus on the nextgen technology issue. Neither will allow China to challenge US global hegemony next decade by leveraging nextgen technologies that are the key to both economic and military hegemony. It’s just a question of timing by the US—elites, Trump, neocons. Take two bites of the bargaining apple from the Chinese, and come back later for the big bite: i.e. the fight over nextgen technology. Either that or Trump and the Neocons will continue to insist on three bites all at once.

This writer’s guess and prediction is that the now slowing US and global economy will result in the former, and the US will reopen any deal reached and renew its technology demands after the 2020 elections. For the current tariff-trade war is just the opening salvo in an epic struggle between the US and China. The technology war has already begun, albeit in early stages. The Trump trade war today is just the opening move today to a more fundamental technology war tomorrow.

Historical Precedents

Just as European and American imperialists jockeyed and maneuvered in the years leading up to 1914 and the first world war, with their focus on disputes over markets and global natural resource control, in the 21st century the jockeying and maneuvering has similarly begun—albeit this time with a different focus on nextgen technologies, over who controls global money flows, whose currency will continue to dominant, over who calls the shots in global institutions like the IMF, World Bank, WTO, and so on.

The 2020s decade ahead will prove a highly dangerous period. The global capitalist economy is slowing, as has always done periodically. A new restructuring of global capitalism is on the agenda, as it was in the late 1970s, in the mid-1940s, and during the years immediately leading up to 1914.

Trump’s trade wars and other policies should be understood as part of a broad reordering of US economic and political policies, and relations with other nation States allied and adversary alike, to ensure the continuation of US global economic and military hegemony for the coming decade. Nextgen technology development is at the core of that restructuring and restoration of US hegemony. Trump is just the appearance, the historic vehicle, behind the deeper global capitalist transformation in progress.

via ZeroHedge News https://ift.tt/2XqA1Is Tyler Durden