Oil prices are up modestly overnight, after yesterday’s worst post-OPEC reaction since 2014, as API’s notable crude draw sparked optimism for this morning’s official inventory data.

“Clearly, there is no getting away from economic bearishness and cooling demand fundamentals,” PVM Oil Associates Ltd. analyst Stephen Brennock wrote in a report.

“This morning, however, has provided a reprieve from the selling frenzy as those searching for a bullish catalyst pin their hopes on another drawdown in U.S. oil inventories.”

API

-

Crude -5mm (-3mm exp)

-

Cushing +882k (-1.26mm exp)

-

Gasoline -387k (-2.2mm exp)

-

Distillates -1.7mm (+1.0mm exp)

DOE

-

Crude -1.085mm (-3.5mm exp)

-

Cushing +652k (-1.26mm exp)

-

Gasoline -1.583mm (-2.2mm exp)

-

Distillates +1.408mm (+1.0mm exp)

After last week’s massive crude draw (and API’s overnight draw), expectations were for a notable draw from DOE but it disappointed with only a 1.09mm draw (-3.5mm exp).

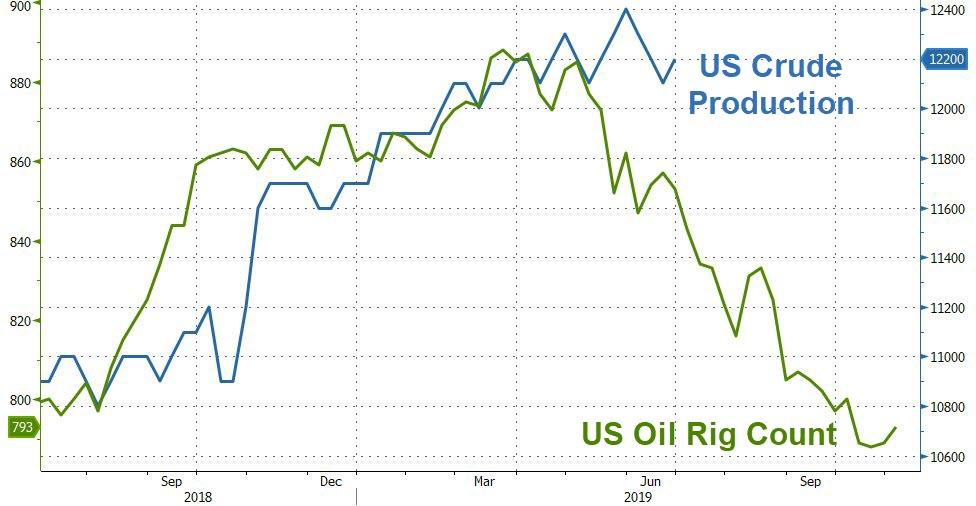

US crude production has been the talk of the global energy markets this week as OPEC+ desperately try not to admit their impotence and rose modestly last week…

WTI hovered near $57 ahead of the DOE data, but slipped towards the lows of the day after the smaller than expected draw…

Bloomberg Intelligence’s Senior Energy Analyst Vince Piazza concludes:

“OPEC+ maintaining curbs into 2020 doesn’t sway us from our cautious stance on crude prices. We’re more concerned about threats to global economic growth and potentially weaker petroleum demand. While U.S. oil production growth has slowed, in lockstep with our views at the beginning of the year, volume remains resilient at 12 million bpd, 11% over last year.”

via ZeroHedge News https://ift.tt/2RUShDZ Tyler Durden