With US nonfarm payrolls in two of the past four months printing at a disappointing 75K or below, Wall Street expects a decent rebound when the BLS reports June payrolls tomorrow at 830am, which are seen rising up to 160K. Fed’s Powell suggested in his recent press conference that the central bank looks at the three-month trend, rather than a single print, and if the headline was realised, it would only be a touch above the three-month average rate at 155k, according to RanSquawk.

Alongside the rebound in jobs, the pace of wage growth is also expected to accelerate vs May levels, while there will also be attention on the U6 underemployment rate, which fell to a cyclical low in May, amid a stable participation rate, which is seen as a positive. Most importantly, the data will be a key part of the FOMC’s case on whether it chooses to cut rates or stand pat on policy at the July policy meeting. A “surprisingly” poor number: anything double-digit or lower, will send stocks soaring higher as it will guarantee at least one rate cut in 3 weeks, with a big possibility for two cuts.

Courtesy of RanSquawk, here are the key expectations for tomorrow’s report:

- Non-farm Payrolls: Exp. 160k, Prev. 75k.

- Private Payrolls: Exp. 153k, Prev. 90k.

- Manufacturing Payrolls: Exp. 0k, Prev. 3k.

- Government Payrolls: Prev. -15k.

- Unemployment Rate: Exp. 3.6%, Prev. 3.6%.

- U6 Unemployment Rate: Prev. 7.1%.

- Labour Force Participation: Prev. 62.8%.

- Avg. Earnings Y/Y: Exp. 3.2%, Prev. 3.1%.

- Avg. Earnings M/M: Exp. 0.3%, Prev. 0.2%.

- Avg. Work Week Hours: Exp. 34.4hrs, Prev. 34.4hrs.

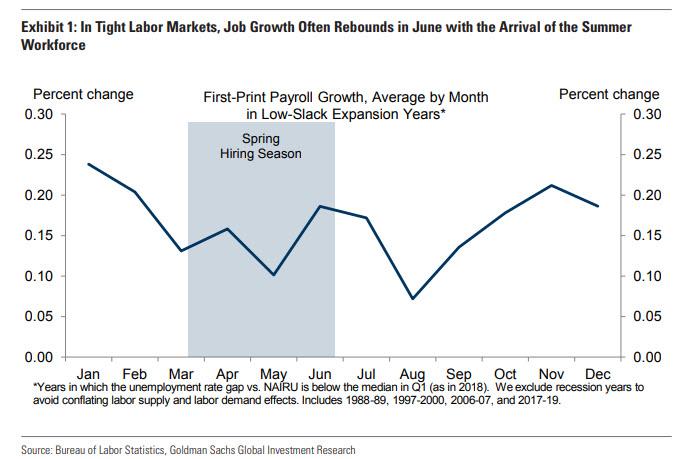

Arguing for an surprise beat, Goldman estimates nonfarm payrolls increased 175k in June, matching its average pace over the previous six months and a sharp rebound from the 75k gain in May, adding that it does not believe that Mississippi River flooding (or bad weather more generally) can explain last month’s job growth slowdown. Instead, its preferred explanation “is a modest deceleration in labor demand coupled with seasonal labor supply constraints—the latter of which often weigh on May job growth when the labor market is tight.” If so, the June arrival of students and recent graduates into the labor force should support a reacceleration in job growth in Friday’s report.

Why does this report matter?

Because it will either cement the case for a rate cut at the end of the month, or – if the report is especially strong, 250K and above, it may spark speculation that the Fed could remain on hold indefinitely. As such, “very good news would be very bad news for the market”, which has priced in roughly 20% odds of two rate hikes in July.

The Fed has indicated that it was monitoring the outcome of G20 summit, and the tone of incoming data in order to make the case for any July rate cuts. The G20 meeting has passed now, and the outcome was favourable. Data points have been mixed of late, and the payrolls data will one of the key drivers of the Fed’s decision making in order to determine whether a cut is appropriate. After the disappointing 75k reported in May, analysts look for 160k nonfarm payrolls to the US economy in June. In his recent post meeting press conference, chair Powell said he was watching the three-month average rate of payroll growth, rather than a single months’ print; as such, it is worth noting that the three month average inched up in May (to 155k from 144k), despite the disappointing headline.

However, there is no doubt that the pace of additions is easing as the US economy enters the late cycle stage. Capital Economics looks for a sub-trend and below consensus 125k in June, which it says suggests that the labour market is succumbing to the broader slowdown in economic growth. The consultancy notes that the weak May jobs report comes while the alternative household measure of employment slows more sharply: “That wouldn’t usually receive much attention because the small sample size means household employment is much more volatile than the payroll estimate,” Capital Economics argues, “but the household survey has historically been quicker at detecting turning points.” CapEco explains that the payroll data relies on the birth-death model of employment at new firms and those going out of businesses, which do not do a great job in real-time, and says initial payroll estimates at the onset of past downturns are frequently revised lower.

Key factors going into tomorrow’s jobs report

JOBLESS CLAIMS:

Weekly jobless claims data for the nonfarm payroll survey period fell by 5k in the week to 217k, and the four-week rolling average measure also decreased. Combined with the continuing claims measure, the pace of layoffs remains low, analysts said, and the trend rate of jobless claims remains between 210-220k, close to all-time lows as a share of the workforce.

ADP:

The headline missed expectations again, printing 102k in June against the Street’s view for 140k. Pantheon Macroeconomics explains that the ADP figure is generated by a model which incorporates data from firms which use ADP’s payroll processing services but also includes the previous month’s official measure, because payrolls tend to mean-revert. The consultancy says that May’s modest 90K increase in private payrolls, therefore, constrained the June ADP measure., and notes that the official numbers, however, are based only on survey data for the reference month, so Friday’s nonfarm payrolls data should be stronger than ADP suggests. “The bigger picture here is that payroll growth had to slow this year because the economy is no longer being boosted by last year’s tax cuts,” Pantheon writes, “more recently, however, payroll growth has been unusually sluggish as a result of the hit to business confidence from the drop in stock prices in Q4. But the key private sector survey measures of hiring, notably the ISM surveys and the NFIB survey, have substantially recovered.” Pantheon looks for job gains of 175K per month in Q3, and sees the June figure (released Friday) around +160K.

BUSINESS SURVEYS:

The manufacturing ISM report saw the employment sub-index rise by 0.8 points to 54.5, indicating employment rose for the 33rd consecutive month. “Employment continued to expand, and at marginally higher levels compared to May. An Employment Index above 50.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment. Comments were predominantly ‘pro hire’ in support of capacity expansion, replacing retiring workers and adding summer help. Few comments were in support of hiring freezes and head-count reductions,” ISM’s Fiore said. The non-manufacturing survey, meanwhile, saw the employment sub-index fell by 3.1 points to 55.0, though has remained above 50.0 for 64 straight months now. Comments from respondents include: “We are currently recruiting for vacant positions” and “Downsizing due to closing brick-and-mortar stores.”

CHALLENGER:

June announced job cuts printed 41,977, and US-based employers announced plans to cut 140,577 jobs from their payrolls in the second quarter of this year, down 26% from the 190,410 cuts announced in the first quarter, Challenger reported. It said that despite the drop, Q2 cuts are 34% higher than the 104,800 cuts announced in the same quarter last year. For the June data specifically, Challenger said that despite the monthly drop, June’s cuts are 13% higher than the 37,202 cuts announced in June of last year, which is the eleventh consecutive month job cuts are higher than the corresponding month the year prior. “Job cuts are trending higher overall. In addition to Retail, we’ve seen significant cuts in the Industrial Manufacturing and Automotive sectors in recent months,” Challenger said, “manufacturers are grappling with not only technological changes, but also increased competition, tariffs, changes in consumer behaviour, and skills shortages. The Automotive sector particularly has experienced some setbacks, as consumer demand for traditional vehicles wanes.”

WAGES:

Goldman Sachs estimates that average hourly wages will rise by 0.4% M/M, on the back of rounding, and that would boost the Y/Y rate to 3.2% it said. “Our forecast reflects favourable calendar effects and a possible boost from rebounding supervisory earnings—which have underperformed the production-worker subset in each of the last three months.”

Key factors arguing for a stronger report:

Seasonality. Goldman views the labor market as somewhat beyond full employment, and believes the dwindling availability of workers weighed on job growth in the May report. As shown in Exhibit 1, in years with relatively tight labor markets, payroll growth tends to slow in May and reaccelerate in June and July. This could reflect the timing of students and recent graduates joining the labor force—and the related possibility that some firms pull forward hiring earlier in the year (anticipating a shortage of workers in the late Spring). Indeed, tje May job growth was particularly soft in several service industries that showed strong gains in the first four months of the year, including education and health (+27k in May vs. Jan-Apr average of +58k), other services (-1k vs. +12k), and leisure and hospitality (+26k vs. +35k).

Public Education. The 14k May decline in public education payrolls is expected to reverse in Friday’s report. As shown in Exhibit 2, May swings in this sub-industry tend to mean-revert in June, and there is the possibility that the relatively late May survey week (ended the 18th) resulted in the exclusion of some employees at state colleges (who had already left for the summer).

Jobless claims. Initial jobless claims edged down over the four weeks between the payroll reference periods (-3k to 219k on average) and remain very low by historical standards.

Service-sector surveys. Service-sector business surveys were sequentially softer in June but generally remain at solid levels. Our headline non-manufacturing tracker declined by 0.9pt and the employment component declined by 0.3pt to 54.3. Despite the sequential declines, the tracker’s levels continue to suggest that service-sector employment continues to rise at a healthy pace. Service-sector job growth rose 82k in May and averaged 143k over the last six months.

Arguing for a weaker report:

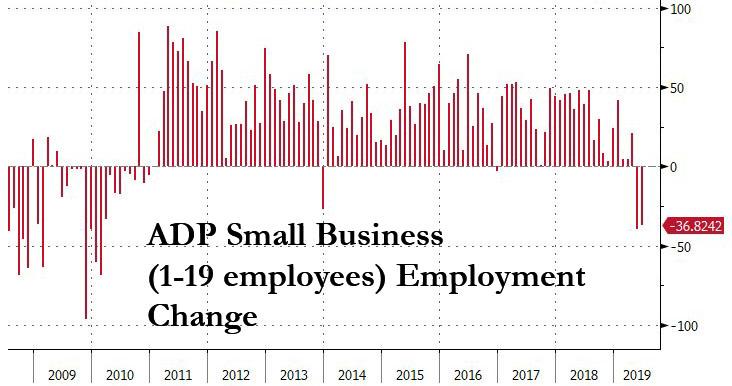

ADP. The payroll-processing firm ADP reported a 102k increase in June private payroll employment, well above the 41k rise in May but still 38k below consensus. While we had expected a soft report because of the various inputs to the ADP model this month, Mark Zandi (the chief economist of Moody’s Analytics who oversees the ADP report) indicated on CNBC that small-business hiring has stalled. Accordingly, we view the ADP report as a negative factor this month.

Manufacturing surveys. Manufacturing-sector surveys were soft in June, as our headline manufacturing survey tracker declined by 3.0pt to 50.6—a three-year low. Our manufacturing employment tracker pulled back by less (-1.2pt to 53.5), as the employment components generally outperformed and remained at healthier levels. Manufacturing payroll employment rose 3k in May and has increased by 8k on average over the last six months.

Trade war escalation. The return of the trade war has weighed on some US growth data, particularly the May and June manufacturing surveys. The higher tariff rate on imports from China implemented over the course of May and early June—coupled with the uncertainty surrounding Mexico trade (tariffs announced May 30th and cancelled June 7th)— will likely weigh on June payrolls in some exposed industries. For example, Goldman is assuming a decline in manufacturing employment, and notes that the agreement at the G20 to delay additional Chinese tariffs occurred well after the June payroll survey period.

Job availability. The Conference Board labor market differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—declined by 5.9pt to +27.6 in June, its largest monthly decline since February 2009. While concerning, the widely reported May payrolls miss likely influenced survey responses, and the resulting weakness may be telling us more about May than about June. If so, it may contain minimal information about the pace of June job growth, reminiscent of a similar situation in March (the labor market differential declined by 5.3pt but job growth reaccelerated from +56k to +153k). Other job availability readings were mixed, as JOLTS job openings remained high (-25k to 7,449k in April, up from 7,142k in February).

via ZeroHedge News https://ift.tt/2LzGCJH Tyler Durden