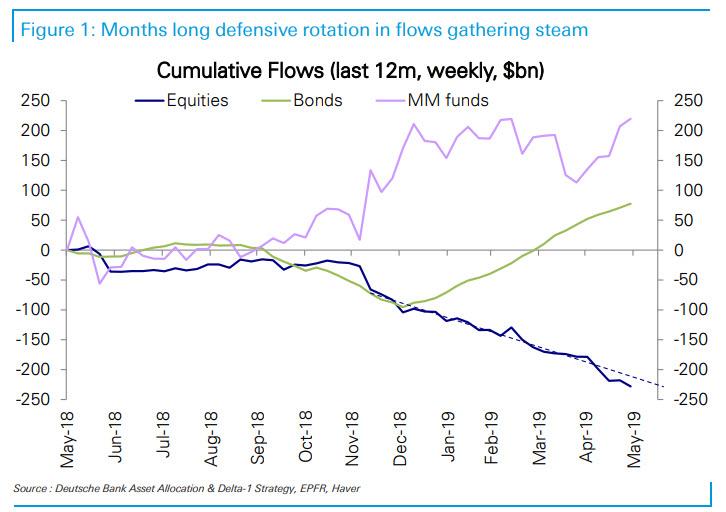

For much of 2019 we have highlighted what we said was the market’s biggest paradox: one where the higher the market rose, the more money investors would pull out of equities, and allocate to bonds.

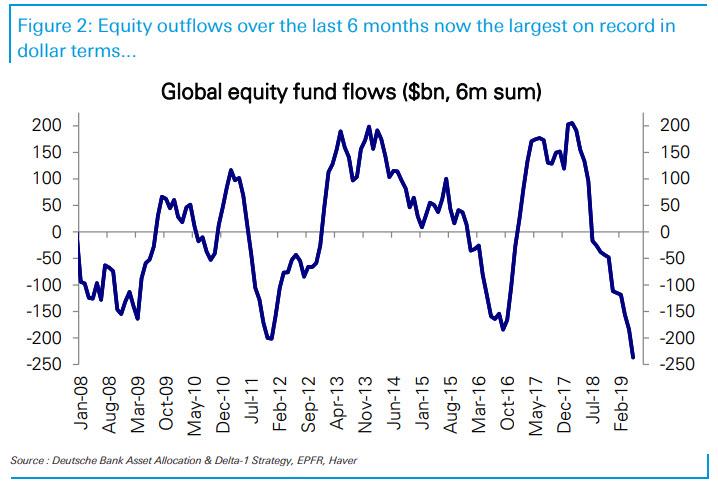

It culminated several weeks ago when , even as the S&P hit new all time highs, outflows over the last 6 months in dollar terms surpassed the previous record observed over any prior 6-month period.

And, according to EPFR, last week was no difference: just as S&P futures hit 3,000, there was more of the same with Bank of America noting a continuation of the familiar “Risk-off flows” as $6.3BN was allocated to bonds, while a whopping $15.1BN was pulled out of equities, resulting in a new record YTD total of $229BN into bonds, while $154BN was pulled out of equities.

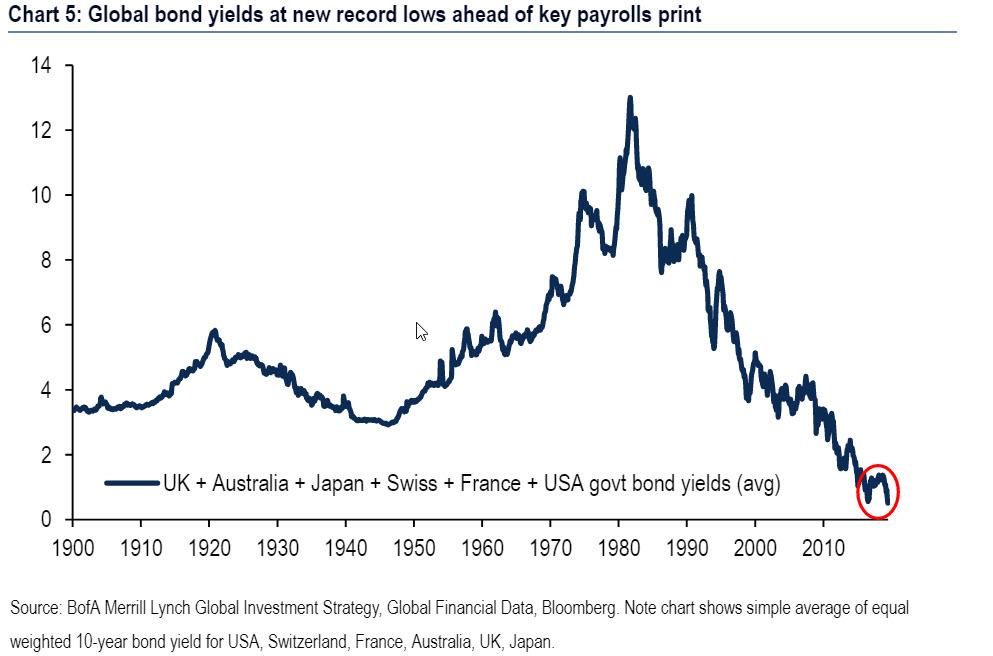

The ravenous appetite for yield – Friday’s post-payroll revulsion which sent the 10Y yield surging from 1.94% to 2.06% in a VaR shockingly quick amount of time – has resulted in global bond yields tumbling to new record lows on Friday.

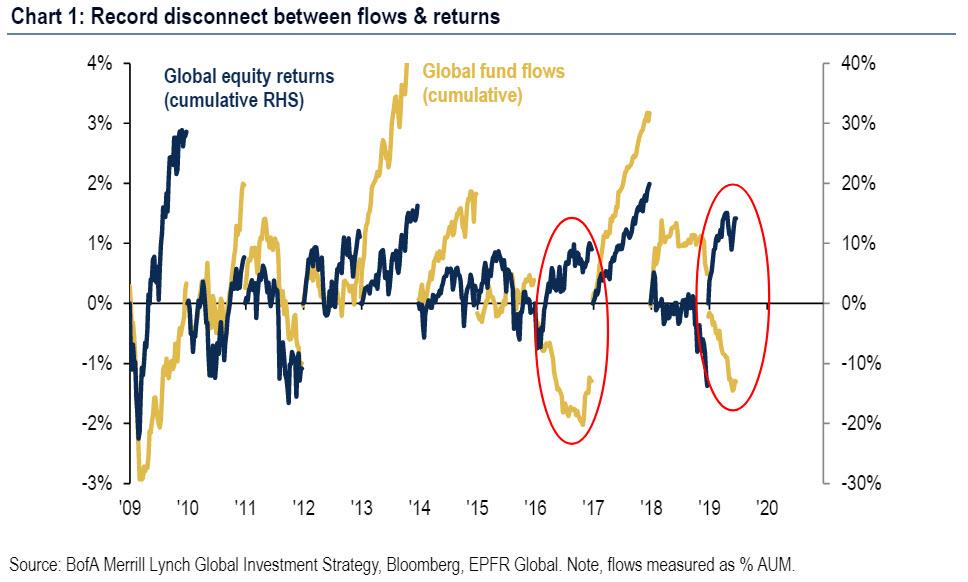

All of the above means one thing: as BofA’s Michael Hartnett writes, there is now a record disconnect between flows & returns in 2019, with only 2016 a similar year in terms of outflows/returns.

Yet while it is clear that something is clearly broken in the market, where investors don’t believe for a minute that the market’s record gains are sustainable and are cashing out at a record pace, there is still confusion as to what is causing this divergence.

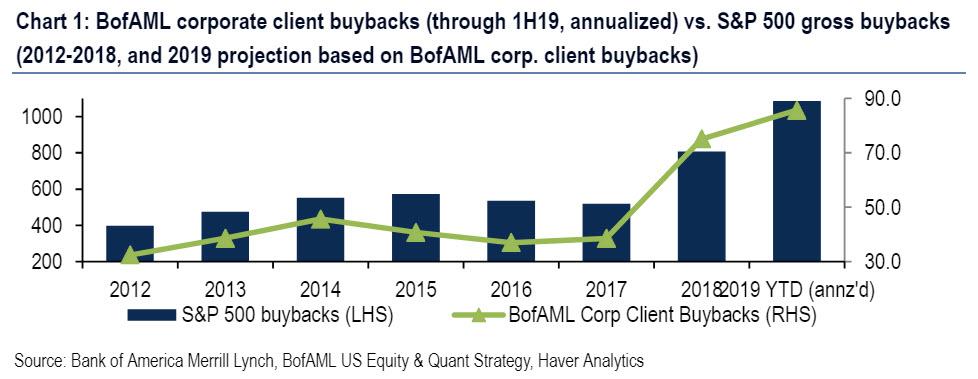

To be sure, the primary culprit we have discussed previously, remains corporate buybacks with BofA pointing out that buybacks remains the #1 source of market support in 2H’19, especially after US banks announced $129bn buybacks next 4 quarters.

In a separate report, BofA also points out that buybacks ordered by its clients are on pace for a record at $43bn in 1H19 vs. $75bn in full-year ’18. This suggests we will see a record, over $1 trillion in S&P 500 buybacks this year (as BofA client buybacks have historically represented ~8% of total S&P 500 buybacks).

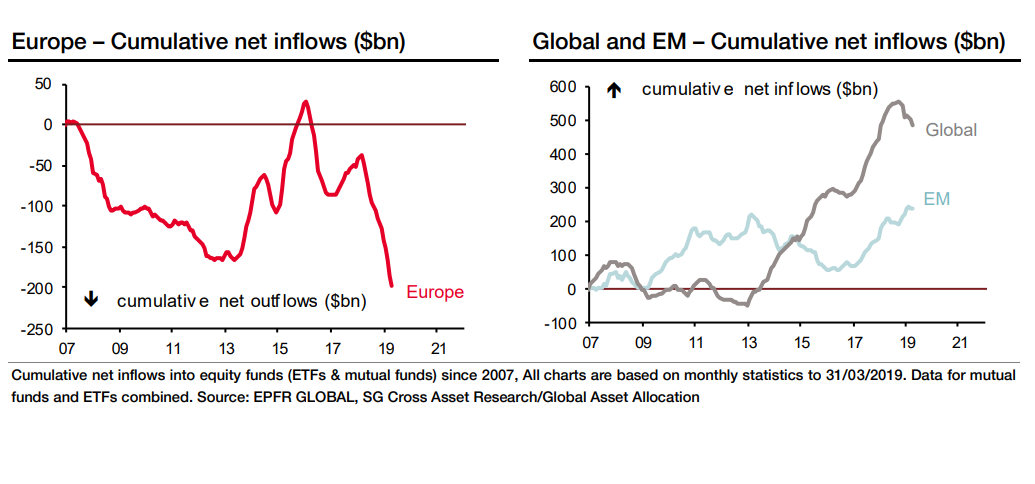

And yet, while it is perfectly reasonable to “explain” the market’s record levitation amid investor outflows with price-indiscriminate purchases by corporations themselves, this explanation felt lacking to SocGen, which when observing the $200 billion investor exodus in European stocks coupled with the rally in European stocks, concluded that this paradox is structural.

The issue is familiar – instead of the US, the market in question is Europe, where love for local equities, given the constant redemptions from the region’s stock funds, is lacking to say the least. And yet, at the same time, market gains have pushed up the value of Stoxx Europe 600 Index members, adding as much as $1.5 trillion this year alone.

According to SocGen’s Roland Kaloyan, this is not so much due to buybacks – as Europe has had far less than the US – but rather due to money managers switching from regional to global stock funds, giving them exposure to European equities, but as part of an international portfolio.

“The trend in asset management industry is that funds are exiting traditional regional funds dedicated to the U.S. and Europe and reallocating to global funds,” Kaloyan told Bloomberg.

Such a shift away from regional to international funds in the past three years – which has resulted in withdrawals of $200 billion from European stock funds in the period – is expected to continue as asset managers focus on getting exposure to global industry leaders as opposed to specific geographic locations, according to SocGen. He believes that future exchange-traded and mutual funds will need to be predominantly global to attract investor appetite.

SocGen recommends staying away from small-cap European stocks since this segment is less liquid and more sensitive to fund outflows than larger companies.

“In global funds, investors get exposure to large multinational European corporations. This year’s rally has been driven by quality names and it was driven by global portfolio managers, not regional ones,” said Kaloyan.

Furthermore, this switch from regional funds to global ones also leads to a reassessment of sector valuations, according to SocGen, as stocks that looked expensive within the European equity universe – such as consumer staples – no longer do so within the global space.

So is the explanation of why there has been record outflows from equity funds in Europe just because of adjusting of industry rather than geographic preferences? Perhaps, although that would not explain why the US has similarly suffered from massive outflows, because fund flows between those two nations would be more or less a “zero sum” total. And yet the fact that there continues to be massive outflows from the US and Europe and Asia, and inflows in fixed income suggests to us that SocGen is – sadly – wrong, and that instead of focusing on industries, investors simply want less risk exposure, and as a result are flooding into safe havens such as government bonds (although on days like today when the market is violntly repricing its rate cut expectations, it is probably wiser to replace “flooding” with “dumping”…

via ZeroHedge News https://ift.tt/2YzdIgj Tyler Durden