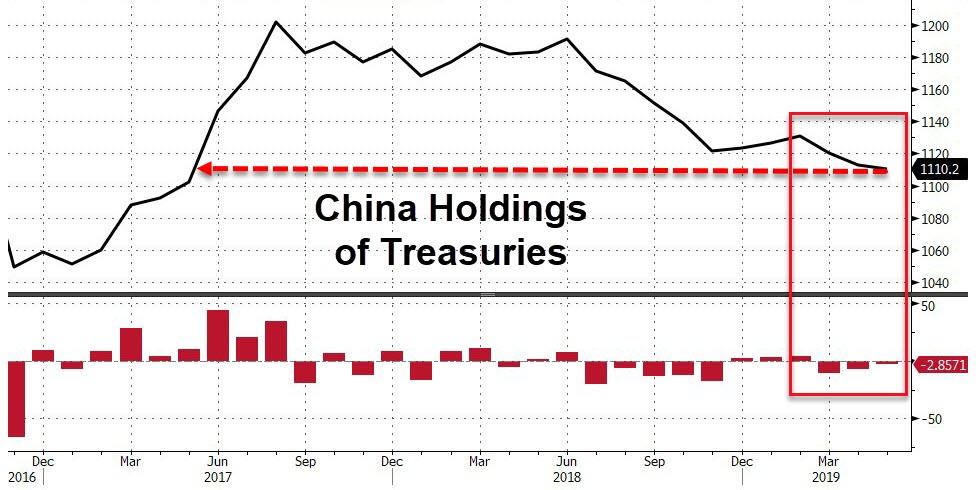

The latest TIC data for the month of May, released just after the close, showed that China continued to sell US Treasurys for the third straight month, bringing its total to just $1.11 trillion, down another $3 billion, and the lowest since May 2017…

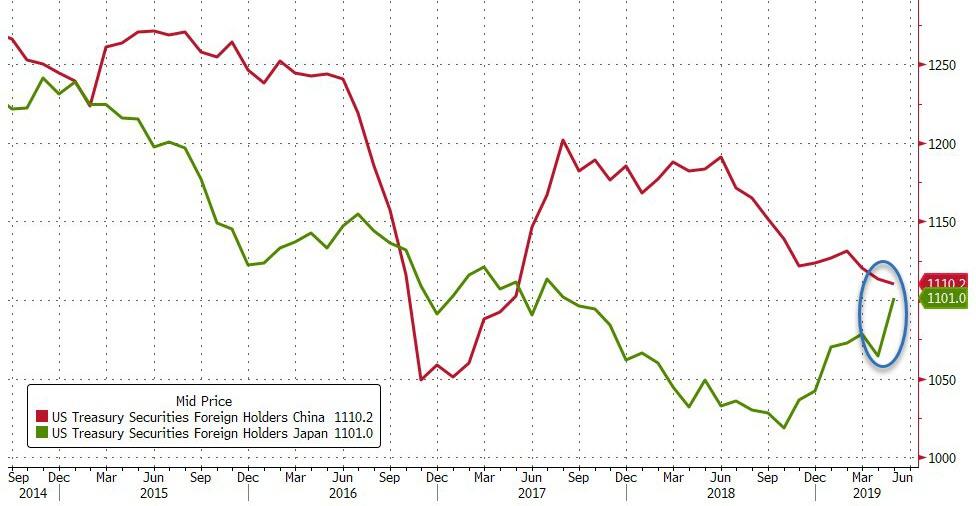

… Even as Japan bought a whopping $37 billion in US paper in May, its largest monthly purchase since August 2013, and bringing its total to $1.101 trillion, just $9BN shy of China’s $1.110 trillion.

Meanwhile, in a surprising development, the UK – which has been aggressively buying US paper either for itself, or in proxy for other purchasers – saw its holdings jump once again, rising to $323.1 billion, an increase of $22.3 billion in the month.

Similar to Belgium and Euroclear, it is far more likely that this surge is simply the result of some offshore fund serving a sovereign, but based in the UK, is doing the buying. Whether it’s China or someone else, will be revealed in due course.

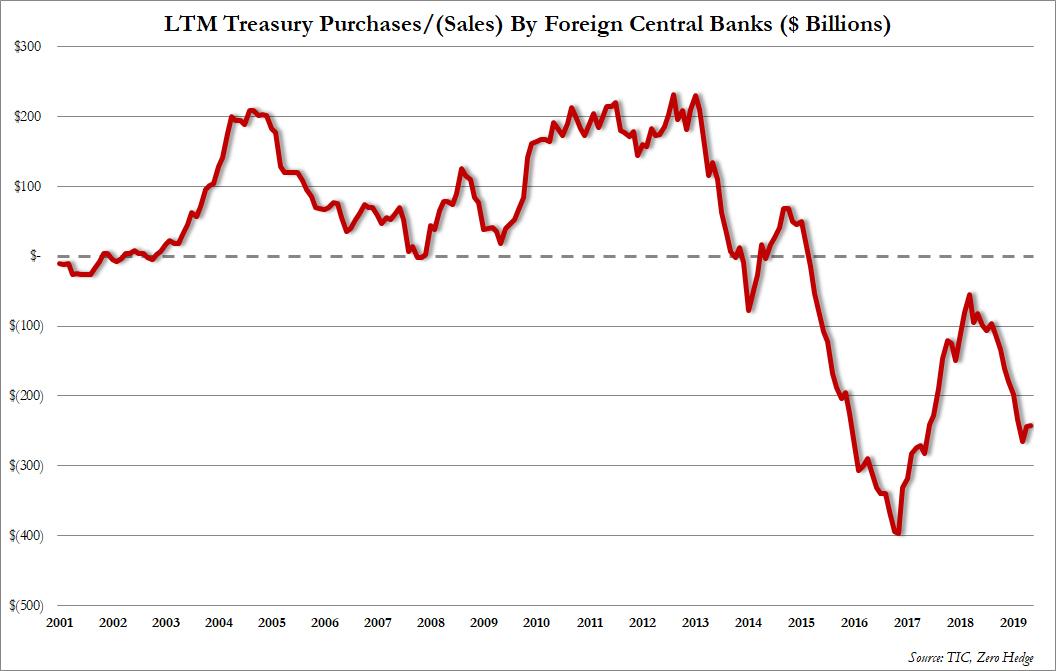

Yet despite the occasional purchaser, foreign official institutions (central banks, reserve managers, sov wealth funds) have seen their holdings of US TSYs slide by another $22 billion, the 9th consecutive drop in the holdings of foreign official institutions, and yet because the decline this May was smaller than the drop in May of 2018, the LTM net sales posted a modest drop.

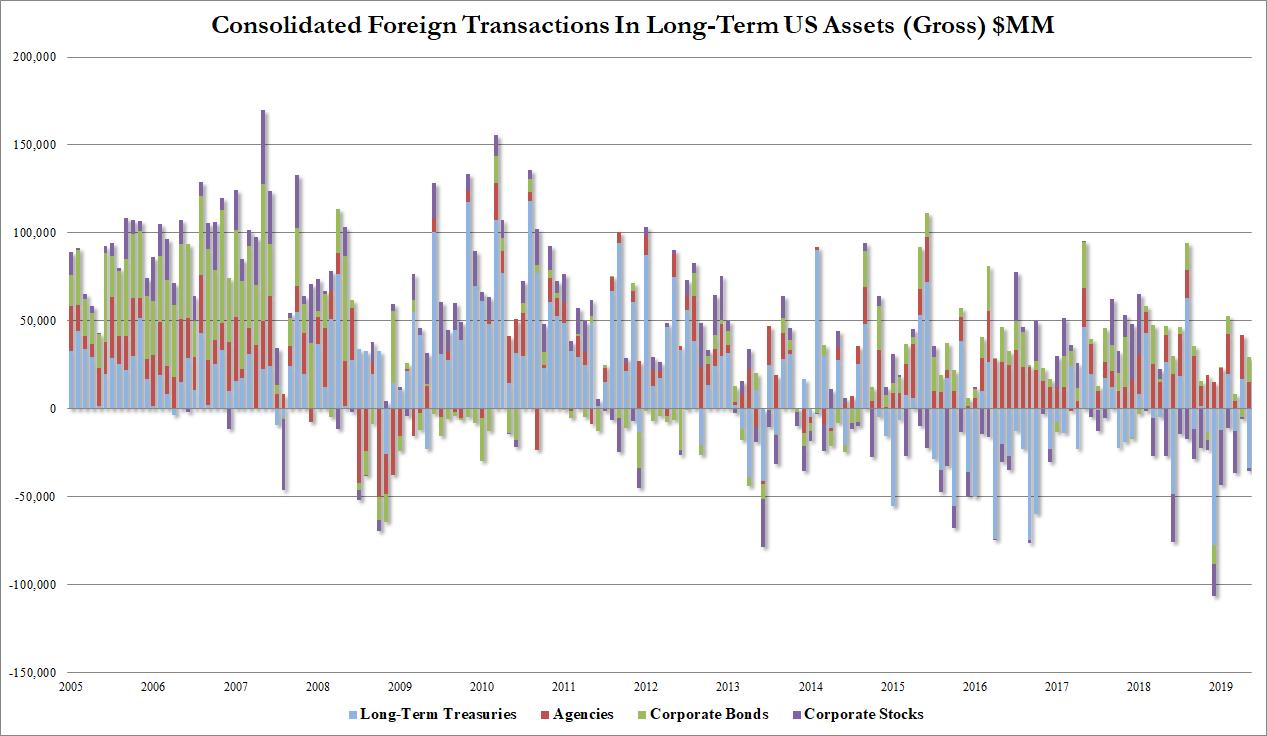

Overall, May – and the past 12 months in general – were not good for US Treasurys, as foreigners, both public and private sold a total of $33.8 billion in US Treasurys and $1.4 billion in corporate stocks, offset by purchases of $15.1 billion in Agencies and $14.9 billion in Corporate bonds.

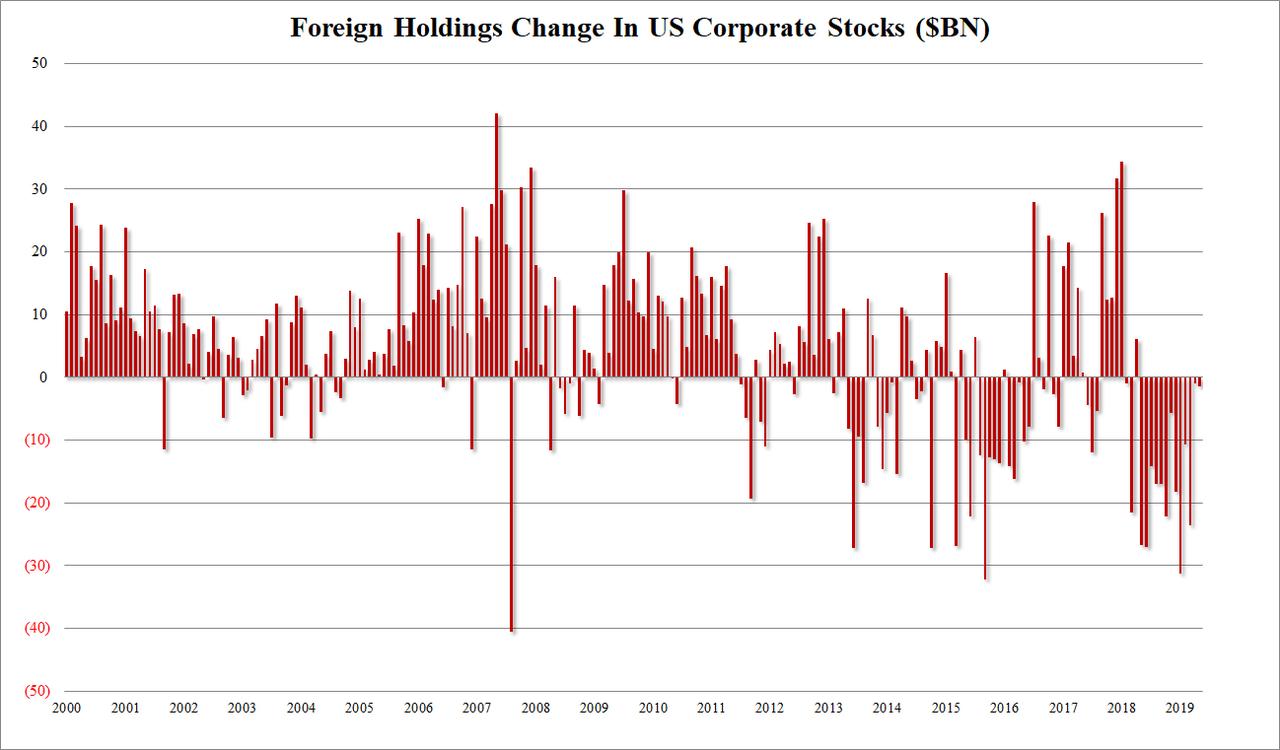

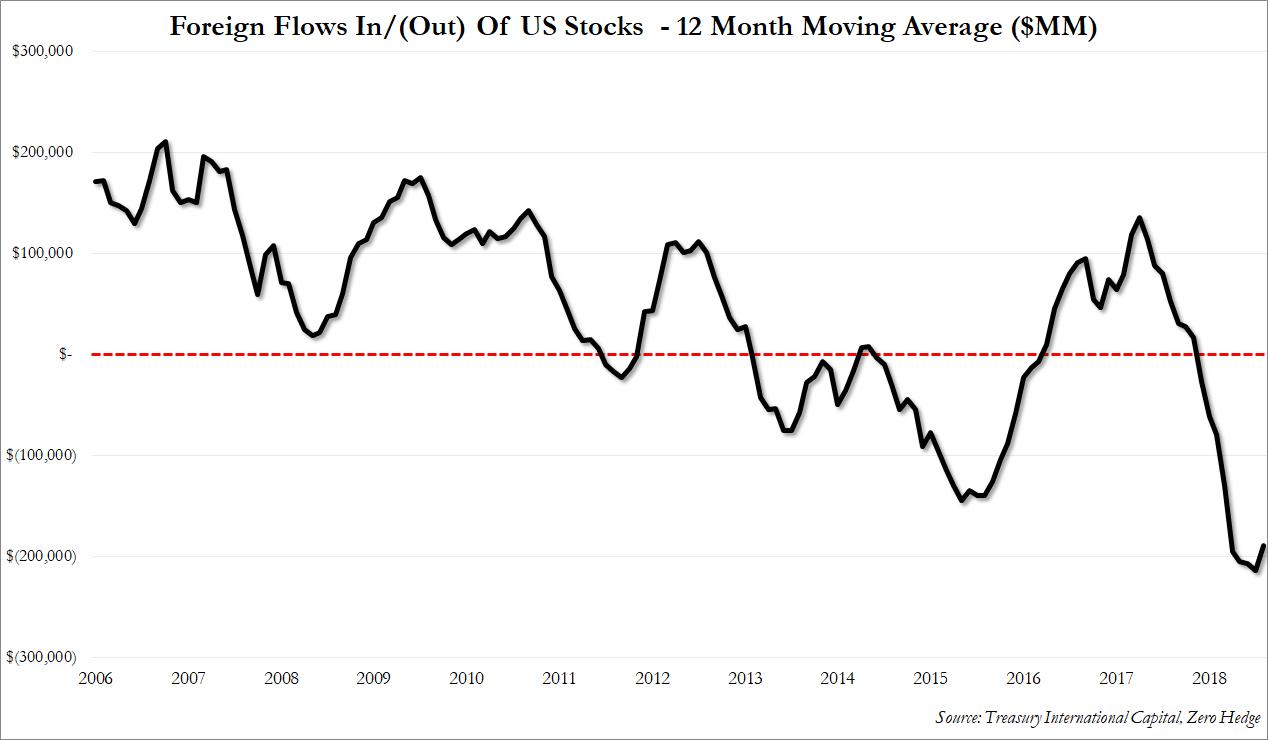

However, for yet another month, the real action was away from the bond market, and in US stocks, where TIC data showed that foreigners sold US stocks for a record 13th consecutive month and 153 of the past 16:

The aggregate $215 billion in sales in the past 13 months, is the largest liquidation of US equities by foreigners on record.

And while it is perhaps not surprising that in May foreigners dumped US stocks – after all it was the worst month for the S&P in 2019 – what is odd, is that in June and July, US stocks barely noticed the ongoing liquidation, and after several attempts at taking out 3,000 in the S&P, finally pushed right through in July, despite what we showed just this weekend continues to be relentless selling by both individual and institutional investors, and – now – also by foreigners.

So with the S&P at all time highs, are we going to find out in two months that foreigners continued to dump anything that wasn’t nailed down?

Which again begs the question, just how powerful are stock buybacks – which were the only official buyers of stocks in the past few months – to not only offset selling by virtually everyone else, but also push the market to new highs?

via ZeroHedge News https://ift.tt/2khfuUy Tyler Durden