There are few mistakes more embarrassing for a trader than the so-called “fat finger”. For those unfamiliar with the industry slang, a fat finger happens when a trader accidentally presses the wrong button, increasing the size of a trade by an order of magnitude, or several orders of magnitude.

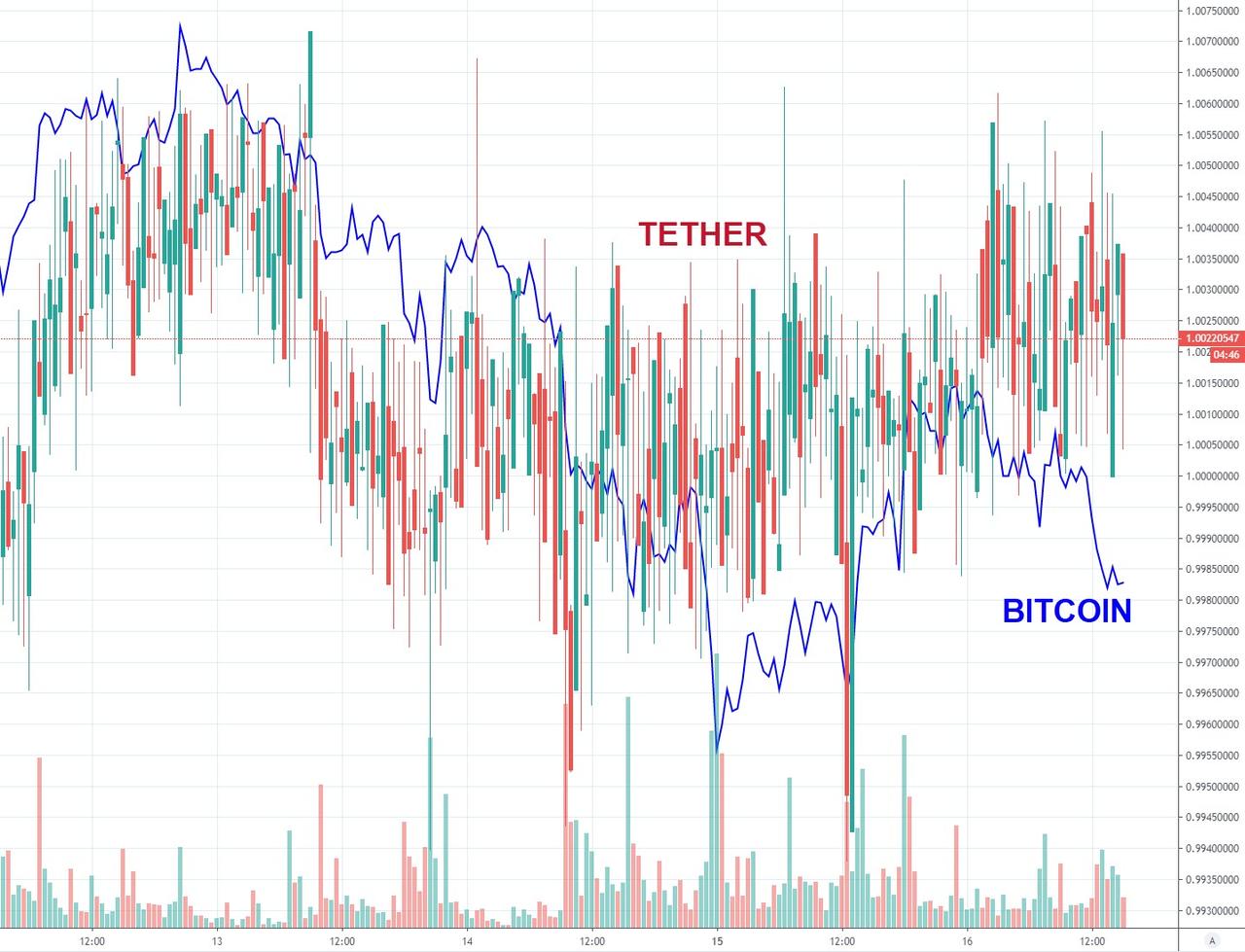

In what could be described as a milestone for the still-maturing cryptocurrency market, an embarrassing ‘fat finger’ mistake sowed chaos in the crypto market over the weekend. After the company that manages the stablecoin Tether accidentally doubled the number of tokens in circulation while processing a routine transfer, the price of bitcoin dropped 12% in mere minutes as the snafu spooked the market, according to WSJ.

Here’s an explanation of how the mix-up unfolded, courtesy of CoinTelegraph.

Whale Alert – a Twitter account dedicated to reporting large cryptocurrency transactions – noted that 50 million USDT tokens were transferred from cryptocurrency exchange Poloniex to the Tether Treasury via the Omni protocol on the Bitcoin (BTC) blockchain.

The account subsequently reported that Tether Treasury minted 5 billion USDT tokens on the Tron blockchain, after which it burned them.

Then, Tether minted another 50 million USDT on the same chain, burned another 4.5 billion USDT, and finally transferred 50 million Tron-based USDT tokens to a wallet presumably belonging to Poloniex.

In a nutshell, what happened was Tether (the company that manages the stable coin) was helping crypto exchange Poloniex conduct what’s called a “chain swap” – moving tether tokens from one crypto token’s blockchain to another. At some point during this process, an employee at tether accidentally created $5 billion of the tokens (which are supposed to be 1:1 exchange value to the dollar) instead of $50 million. After realizing their mistake, they went back and ‘burned’ (read: deleted) the extra tokens.

Because of the error, the number of tether tokens in circulation doubled very suddenly, from $3.9 billion to $8.9 billion. When the tokens were deleted by the Tether Treasury, bitcoin tumbled.

Tether’s impact on the price of bitcoin has long been controversial. In a research paper published last year, academics from the University of Texas documented how they claimed Tether was being used to manipulate the price of bitcoin.

Earlier this year, Ben Munster of Decrypt.co documented how the creation of $600 million in tether corresponded with a jump in the price of bitcoin from $8,500 to $11,000.

Paolo Ardino, the CTO of Bitfinex and Tether, offered a kind of half-hearted non-apology for the chaos unleashed by one careless employee.

Unfortunately we have to play with different toolchains across multiple blochains and sometimes issues happen. We’re working anyway to prevent this from happening in the future. @Tether_to https://t.co/QxAF0QorY5

— Paolo Ardoino (@paoloardoino) July 13, 2019

Now, if only the traders who lost money when bitcoin tumbled try to recoup their losses in court…

via ZeroHedge News https://ift.tt/2ld1NpL Tyler Durden