It’s not news that China and Russia have been buying gold by the hundreds of tonnes. It’s not news that Russia divested itself of most of its U.S. Treasury holdings last year in response to Donald Trump’s sanctions on Rusal, upsetting the global Aluminum market.

Russia has led the charge on central bank gold buying, having increased its official holdings from 400.3 tonnes in Q1 of 2007 to 2168.3 tonnes as of the end of Q1 2019. That’s a 442% increase in gold reserves.

China, on the other hand, has only in the past couple of years joined Russia’s party of announcing its gold buying on a monthly basis. Previously, China would simply drop a 500-600 tonne bomb on the markets and see what would shake out of it.

Now, few people who follow this stuff believe China’s government only owns 1916.3 tonnes of gold. Estimates range from 4000 to 6000 tonnes. Like Russia, very little of China’s domestic production of gold (404 tonnes in 2018) leaves China and makes its way into the global market.

It is mostly absorbed by the Chinese population via purchases off the Shanghai Gold Exchange (SGE). And the PBoC itself uses Chinese banks as proxies to buy its gold overseas from the U.K., Singapore and Switzerland.

Russia’s gold buying consumes most, and sometimes all, of Russia’s domestic production (297 tonnes in 2017). The same is true for Kazakhstan (68.4 tonnes) and a few other countries.

It’s easy when looking at these trends to see that something big may be on the horizon, that gold is on the verge of being re-monetized and a major shakeup to the world financial system is imminent.

That the multi-polar world is here. It’s not, but it’s coming.

The boys at The Duran had a fascinating (if a bit forward-looking) video recently where they discuss the situation brewing between the U.S. and China.

The basic thesis is that the U.S. and China are headed for a mostly amicable divorce of their economies, a disentangling as it were. And that that would then allow for the emergence of the so-called multi-polar world that both Russian President Vladimir Putin and Chinese Premier Xi Jinping are working towards.

On this point I don’t disagree. It’s a strong point Alex Mercouris makes here that the U.S. and China have acknowledged their growing contention in the global economy but that there is no need for a completely antagonistic relationship.

The U.S. doesn’t have to extend the unipolar moment into infinity to ‘win’ this ‘war’ with China. That is globalist thinking, maximalism to the extreme.

The U.S. and China can, strategically, disengage from each other while cultivating different paths for their futures. And this is the essence of the phrase ‘multi-polar.’ If that is Trump’s vision on this that is an improvement over the globalist Davos Crowd perspective so entrenched in Europe, which brooks no dissent from its Borg-like behavior.

It’s neither optimal nor likely but it sets a tone that will shift the future outcomes in the right direction. To do this Trump has to win re-election and be successful in confronting the Swamp via Jeffrey Epstein like I believe he’s doing.

However, and this is the bigger point coming back to gold, I do think Russia and China setting up their part of the multi-polar world based on a gold standard similar to Bretton-Woods is not workable.

There are a number of reasons for this but the main one is that Bretton-Woods never worked in the first place. The discipline of the reserve currency nation, the U.S., was never in observed. We violated the terms of the $35/ounce gold peg immediately.

First, by selling off the greatest hoard of silver ever amassed and then by simply printing the money during the Johnson and Nixon Administrations. It is insane to think that Russia and/or China will for any length of time exhibit any real fiscal discipline that would allow for a Bretton-Woods-style currency regime to work.

This is libertarian critique 101, folks. Just because the U.S. can’t keep its hand out of the cookie jar, doesn’t mean Russia post-Putin will. And the less said about the Chinese shadow banking bubble the better.

Moreover, the U.S. and the EU still have their gold reserves. Even if some or all of it has been lent out to suppress the price at times. I don’t believe that’s been the case since China opened up the Shanghai Gold Exchange and Russia began accumulating in earnest.

That would have put explosive upward pressure on the price of gold as thousands of tonnes would have had to be sourced to settle those positions. Instead, the U.S. and the EU were likely allowed to unwind any short positions over time which allowed years of annual production to flow east.

And this is the fundamental problem of a government-backed gold standard. It will not ever last. Governments create market interventions which have to be paid for via money printing or debt. And both of those things belie the discipline of the gold standard.

There is an infinite gap between the intention of China and Russia to build a multi-polar global financial system between East and West and the re-emergence of a gold-backed currency regime.

Because, for a moment, let’s get real about who owns what gold.

On the West side of the world we have the U.S., EU, BIS, the IMF and the Gulf states.

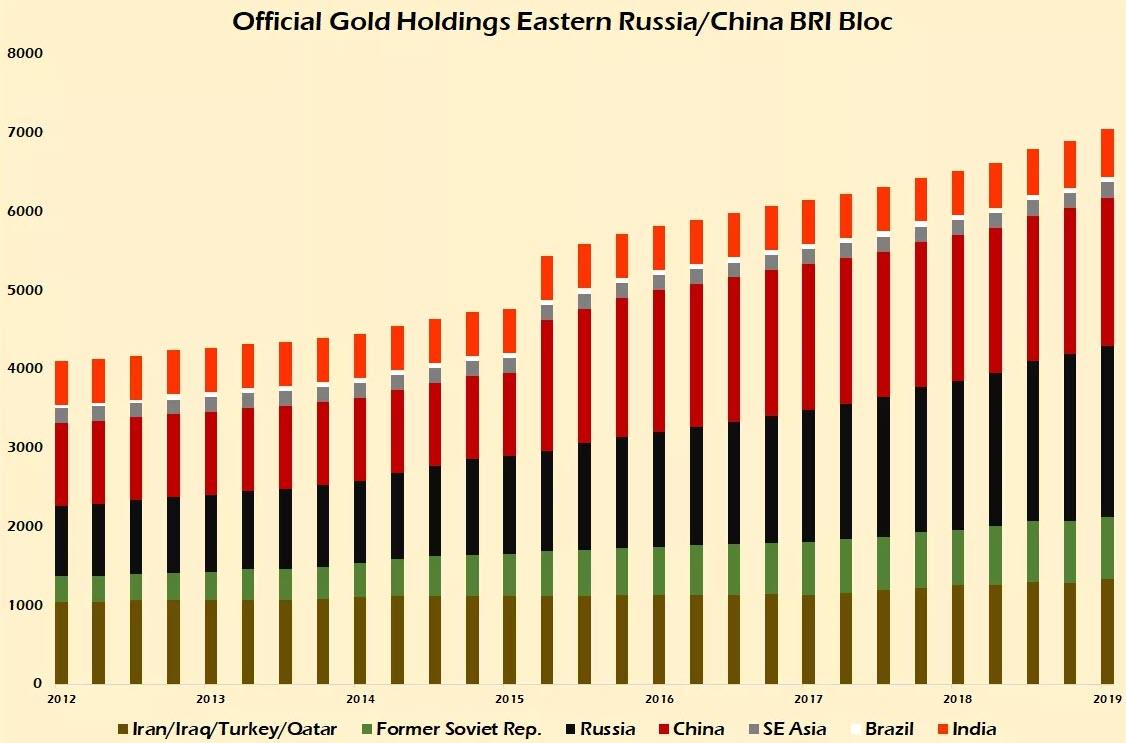

On the other side we have the central banks in the Russia/China orbit who are currently accumulating gold or are becoming independent actors on the world stage. It’s a bigger list than in the past twenty years, but that list is still small (The BRI Bloc (as defined by me herein) consists of the following countries: Russia, China, India, Iran, Iraq, Turkey, Qatar, Belarus, Uzbekistan, Tajikistan, Kyrgyzstan, Kazakhstan, Thailand, Malaysia, Serbia and Brazil).

Going through World Gold Council numbers for Q1 2019 we get the following numbers. Just over 7000 tonnes of gold for what I’m calling Eastern BRI Bloc, those countries that are both accumulating gold in their reserves and are important partners in China’s Belt and Road Initiative (BRI). It’s impressive that they have added more than 3000 tonnes over the past six-plus years.

Total Belt + Road Bloc Gold Holdings Still Dwarfed by U.S. Reserves.

However, that’s still less than the U.S.’s 8133.5 tonnes let alone the more than 10,000 tonnes that make up the reserves of the European Union countries and doesn’t include the 2814 tonnes owned by the IMF, the 504 tonnes owned by the ECB itself or the 102 tonnes owned by the Bank of International Settlements.

For any discussion of this bloc challenging the reserve status of the U.S. and European systems, There would have to be at least another 6000 tonnes available between China and Russia that are not on their official books to even being to make that argument look realistic.

Let’s use M1 money supply figures for a proxy of what gold backing would look like, just to get a lay of the land.

For all of the talk of the U.S.’s imminent bankruptcy, the gold reserves at current prices make up 9.6% of M1 at current prices ($1415/oz). China’s official gold reserves make up just 1.0% of M1. Even if you believe the upper end of China’s estimated real gold holdings it’s still only 3.3% of M1.

If you count the estimated 16,000 tonnes held privately in China and that was convertible into currency that would still only get China up to 12.2% backing of M1 with gold.

Russia is the closest there is to a gold-backed currency there is. The ruble by that metric (M1) 84.0% backed by Russia’s official gold reserves.

That is an eye-popping number and it tells you that the Russians have very prudently saved over the past fifteen years or so. They have built what we Austrian economists like to call a ‘pool of real savings’ to lever into higher order investments.

Russia is now ready to deploy a significant part of its trade surplus and even some of its pool of real savings to build new and needed infrastructure for Russia. Putin mentioned in his annual 4-hour direct line that he was ready to begin spending some of Russia’s oil revenues, drifting away from neoliberal and monetarist Alexei Kudrin and towards the nationalist/Keynesian Sergei Glazyev.

Given the state of Russia’s finances and a 10+ billion per month trade surplus, this is a no-brainer really. It’s their down-payment on the multi-polar world.

And it marks a specific shift in attitude which will assist China in building out Belt and Road but it will do nothing to allow for a return to any kind of gold standard until China gets its financial house in order.

To sum up, what killed Bretton-Woods was the same thing that killed the British pound post-WWI, a refusal to price gold accurately by the governments printing the money. Britain could have kept the gold standard and more of its empire had it re-valued the pound to reflect the money supply in 1918.

It didn’t and it destroyed the British post-war economy. The same thing is happening now. And the U.S. will either have to allow the world’s assets to plunge by 50-90% or allow the price of gold to rise to reflect the amount of money in circulation.

Given the numbers I just laid out that should give you an idea of just how much higher gold has to go to balance the books of the world. And no one in power, other than the Russians, are prepared for that kind of event.

Because until that happens there is no incentive for gold to circulate as money, or the discipline of the gold standard to be observed.

What China is doing, like Russia and the rest of the BRI Bloc, is they are building gold reserves to build the confidence of the world for the day when trust in the Western system fails. By having significant gold ‘backing’ but without convertibility those countries today adding to their rainy day funds will be the places capital will flow towards to avoid the whirlwind.

That is when the multi-polar world can be inaugurated.

* * *

Join my Patreon if you want to understand how to navigate the gold bull market.

via ZeroHedge News https://ift.tt/2jOgCP9 Tyler Durden