If this one piece of unscientific, preliminary data is to be believed, Amazon’s Prime Day may have finally hit a speed bump.

According to Bloomberg, internet searches for the term “canceling Amazon prime” were 18 times higher at the beginning of Amazon‘s two day sale than the previous day. The data could suggest that shoppers are interested in discounts, but without making a long-term commitment to Amazon.

Search intelligence firm Captify said:

“If Amazon is hoping to use Prime Day as a way to sign up and retain new Prime members, they might need to rethink their retention plan. According to search, consumers are signing up for Prime, getting their deals and then canceling membership shortly after.”

Amazon is expected to bring in $5.8 billion over the two days it runs the sale, and has just announced Prime members bought 175 million items during the 2-day event and that Prime day sales “surpassed the previous Black Friday and Cyber Monday combined.”

Analyst estimate that Amazon’s Prime membership retention rate is more than 90%, which is better than Costco’s membership retention rate. Amazon now offers monthly memberships for those who don’t want to sign up on a yearly basis, as well.

The average Prime member spends $1,400 a year on Amazon, which is more than double the $600 spent by those who are not Prime members. Amazon is estimated to have about 103 million Prime members in the US.

The data was extracted based on searches by 2.2 billion global consumers who used computers and other smart devices. At the same time, searches for Best Buy were up 255% and searches for Walmart were up 130% on the day before Prime day.

Rohaan Dullabhai, a senior insight strategist at Captify said: “Consumers are becoming more and more savvy. They are going to the discussion forums to find the best deals and taking advantage of all of these retailers competing with one another.”

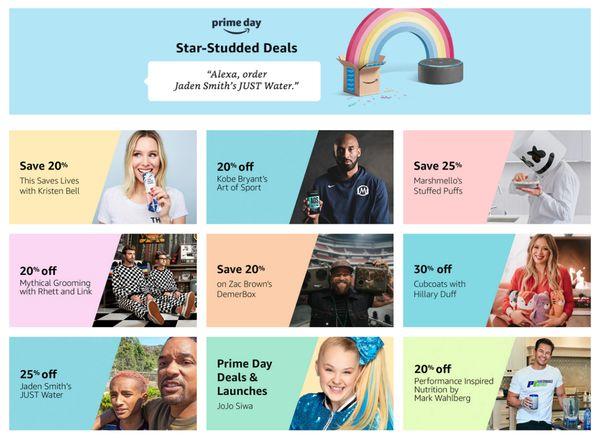

Just days ago, we wrote that Amazon may have been running out of tricks to maintain its Prime customer base, resorting to celebrity endorsements to try and generate interest in what is quickly becoming a super-saturated annual cash grab event. From Will Smith and his son slinging water to Kobe Bryant peddling deodorant – Amazon may have officially jumped the shark. They’ve even got actor and former Calvin Klein underwear model Mark Wahlberg pushing protein powder.

We noted then that Amazon’s competitors, in response, were simply scrambling to put better deals in front of click-happy consumers.

Josh Lowitz, co-founder of Consumer Intelligence said: “They can’t keep adding 10 million new Prime members every quarter because everyone has already made up their minds about that. This is more traditional marketing around a big sales event, which is more celebrity driven.”

On Tuesday morning, Amazon released preliminary data from its Prime Day sales, noting highlights about savings and global footprint. Inconspicuously absent from the press release were estimated revenue numbers, any commentary on margins and total purchase volumes compared to the year prior.

via ZeroHedge News https://ift.tt/2O9vjdU Tyler Durden