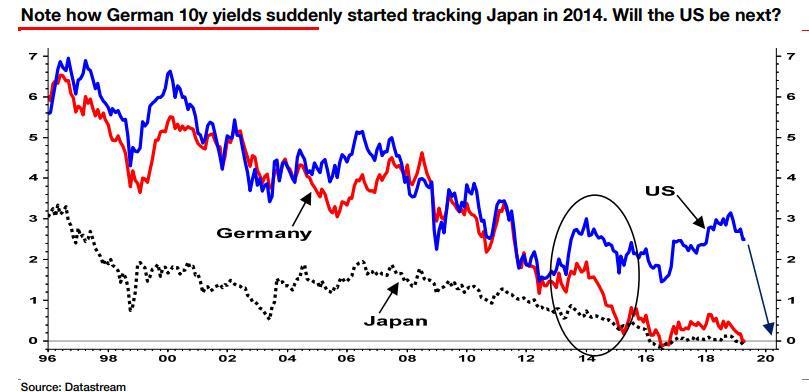

Here at Zero Hedge, we’ve dedicated plenty of attention to signs of “Japanification” in European bond markets…

… with the issue taking on even more urgency now that we have influential bond strategists earnestly advocating the purchase of equities by the ECB, and the Fed in the middle of a policy U-turn that has prompted the market to price in at least three interest rate cuts by the end of the year…

…previously “conspiratorial” ideas like the Fed buying equities to turbocharge its stimulus program are beginning to look eminently plausible.

For readers who are unfamiliar with the term, “Japanification”, also known as Albert Edwards “Ice Age” concept, it involves the dawn of a new economic paradigm characterized by stagnant growth and pervasive deflation, where central bank debt monetization is needed to finance public spending to keep economies from sliding into contraction.

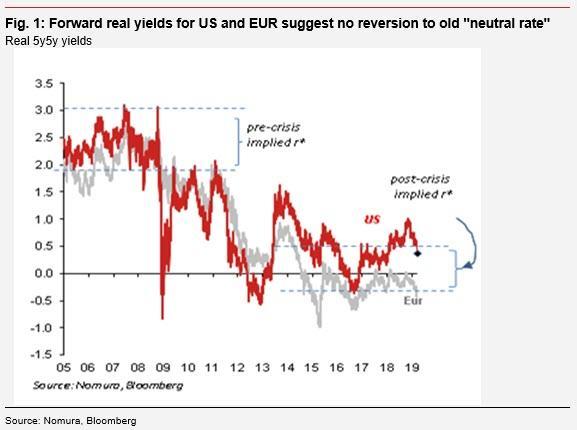

Already, there’s reason to believe that both the US and Europe are heading for the same monetary policy trap as Japan. Case in point: the neutral rate – or r*, as the economists at the Fed like to call it – has failed to revert back to its pre-crisis level.

And with the Fed likely to cut rates later this month and global bond yields tumbling to levels not seen in years, if ever, hedge fund manager Kyle Bass has revealed his latest trade in an interview with the FT: Bass is betting that the Fed will slash interest rates to just above zero next year as the US economy slides into a recession, forcing the Fed to restart QE, and possibly even consider more radical alternatives like buying equities.

Though economic data in recent weeks has staged a mild recovery (which ended with Wednesday’s home-sales data), the general trend remains clear: As Powell reminded us last week, all signs point to a slower economy ahead.

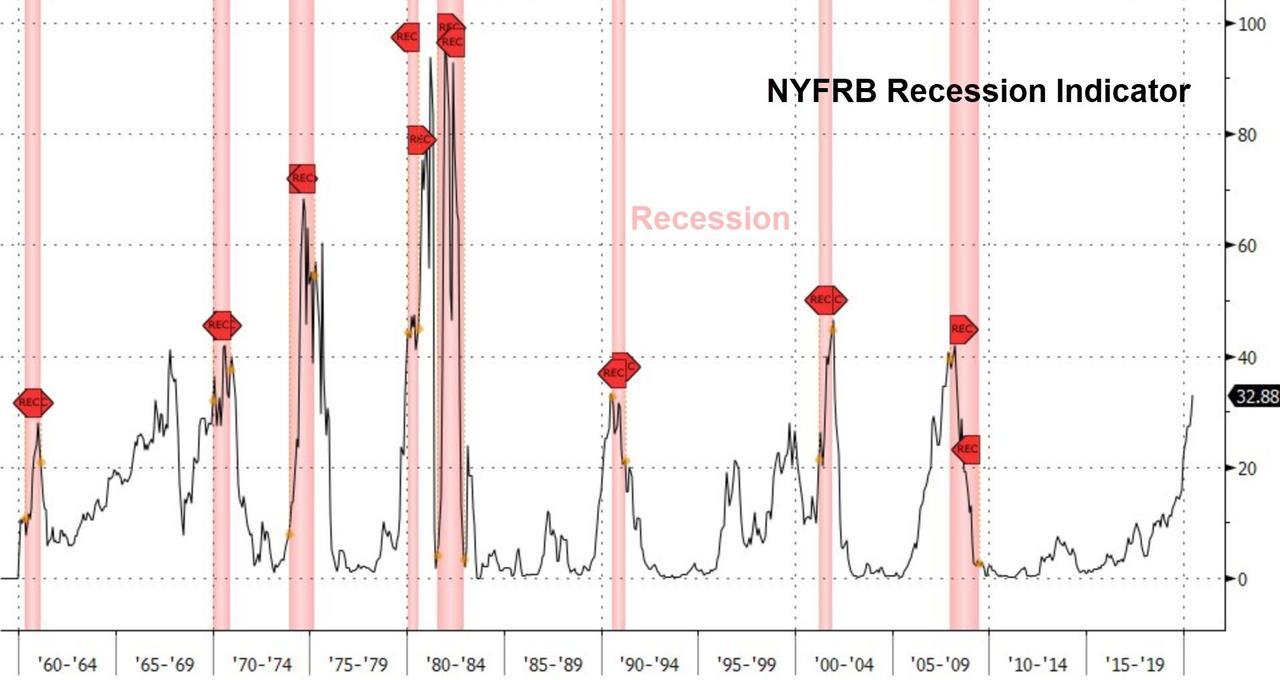

To be more precise, Bass believes the longest economic expansion in US history will come to an end next year. And to be fair, this isn’t exactly a radical view: a recent survey that asked CFOs for their outlook on the economy found that two-thirds of them believe the next recession will begin by the first quarter of 2021.

But if you’re inclined to discount the ‘soft’ survey data, the NY Fed’s recession indicator, which, as Morgan Stanley notes, has proven eerily reliable in the past, is also flashing a warning sign.

However, once the Fed re-launches QE and cuts rates this time, Bass suspects the US economy will become stuck in the “tractor beam” of low rates and QE, and remain stuck in easing mode – much like the BOJ – forever.

“As we have all learned, once an economy falls into the tractor beam of zero rates, it’s almost impossible to escape them,” Bass told the FT. The Heyman Capital founder said his concerns about the economic outlook are rooted in the flattening yield curve, particularly the inversion that saw long-term rates fall below the rate on the three-month T-bill.

“In the long run the US is heading the same way,” he said. “Growth numbers are going to come down and real growth might go to zero. We’re probably never going to go away from zero rates.”

Unlike his contrarian bet on the housing market, Bass is hardly alone in betting on lower interest rates. Unfortunately, if his view turns out to be correct, millions of financially insecure Americans and retirees struggling to live on a fixed income are going to be in for a rough time.

via ZeroHedge News https://ift.tt/2JE5xdG Tyler Durden