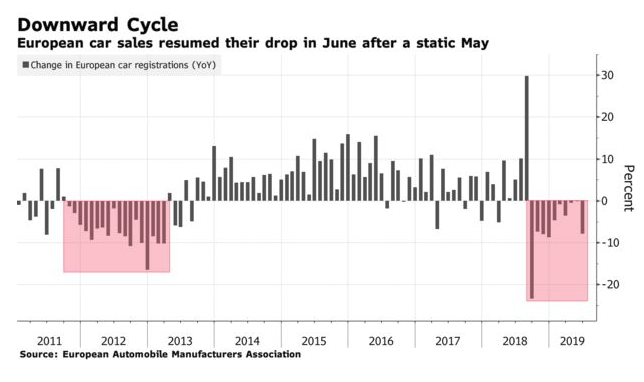

The global automotive collapse continues, denting the narrative of the “strong consumer”, as countries again posted poor YOY comps despite the industry starting to show signs of shakiness during mid-2018. The China/U.S. trade war and global economies that have slipped into recession have played a role in one of the largest global slowdowns in the automotive sector to date. And that trend is now accelerating in the EU.

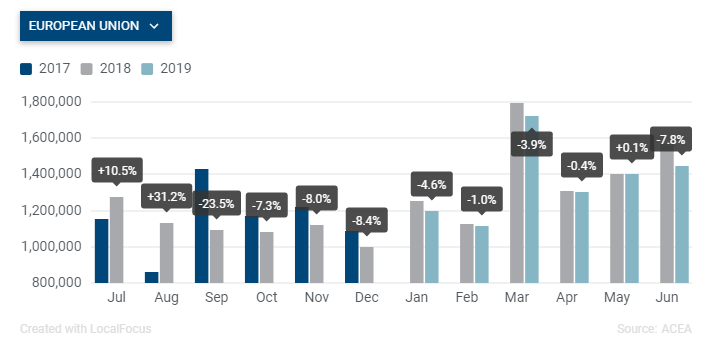

According to new data from the European Automobile Manufacturers Association out of Brussels shows, new car registrations in the EU plunged again, this time by 7.8% to 1,446,183 units in June, the biggest monthly drop of 2019.

The drop is being attributed to a negative calendar effect due to the fact that June only counted 19 working days across the EU compared to 21 days in 2018. The five major EU markets all posted declines as a result, with France falling 8.4% and Spain falling 8.3%. However, that’s hardly the full story as individual auto manufacturers in the EU are not showing any signs of relief, according to Bloomberg:

- Daimler last week issued its fourth profit warning in just over a year due to the costs of a recall and allegations of emissions-tampering in diesel cars. The carmaker also blamed weaker global markets.

- BMW in May reported its first loss in a decade in the main automotive division.

- Renault’s partner Nissan Motor Co. was the worst hit during the first six months of this year, registering a 24% drop in European sales.

- After Nissan, Honda and Fiat-Chrysler registered the worst sales in Europe since the start of the year with 15.4% and 9.5% declines respectively.

The European data continues an ugly worldwide trend for automobiles, as the first half of 2019 saw demand for new passenger cars across the EU down 3.1% to 8.2 million registrations. Alas, things don’t look to be getting better anytime soon, either. Peter Fuss, a partner at EY consultancy said: “We’re standing in front of a difficult second half of the year. Little positive impetus for the new car market in the EU can be expected in the coming months.”

The problems in the auto market are hardly contained to the EU.

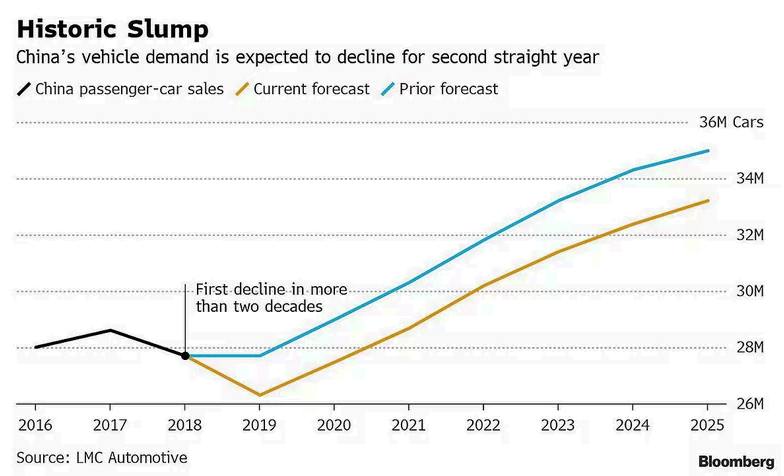

About a week ago, we reported that China was again bracing for another annual drop in auto sales. Earlier in the year, the CAAM had thought zero growth for the year was a possibility, but now it looks like vehicle sales will once again drop – even after an abysmal 2018.

The sector contracted for the 12th straight month in June and sales were down 2.8% in 2018.

via ZeroHedge News https://ift.tt/2JSTtEa Tyler Durden