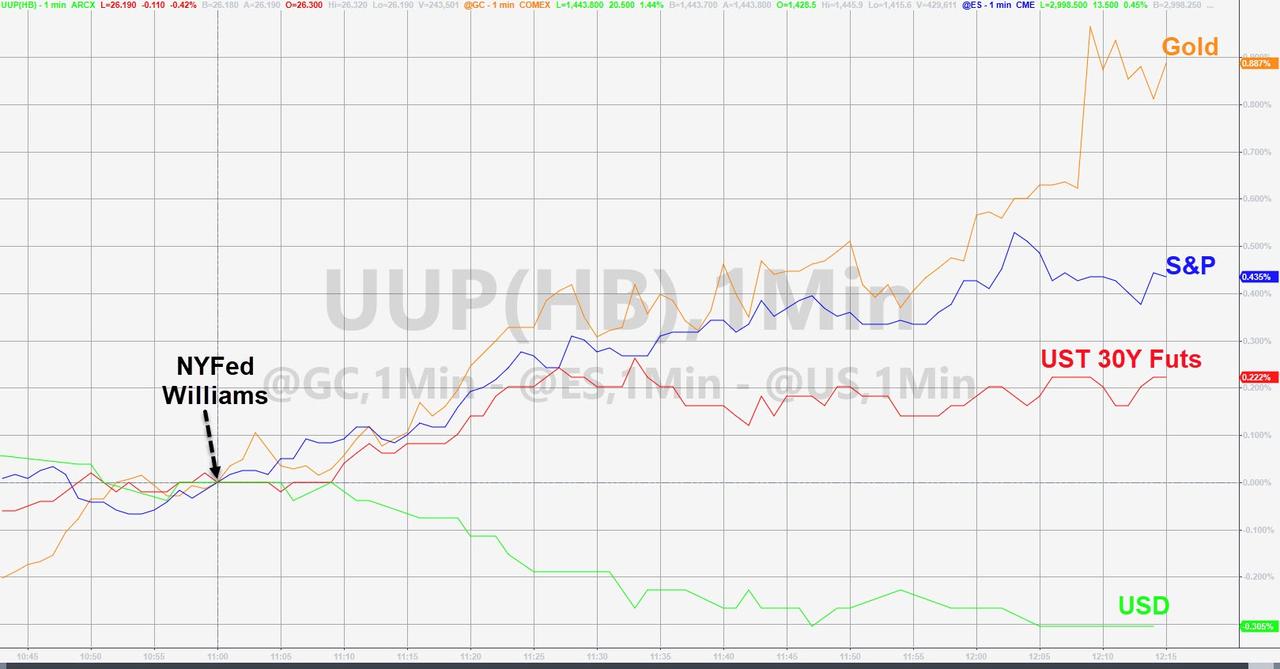

NYFed Williams basically implied ZIRP is coming back and soon and that sent the market’s expectations for July rate cuts soaring (50bps now at 65%!)…

NOTE – a week ago, Fed Chair Powell jawboned the odds of a 50bps cut down to ZERO!!

Piling on, Fed’s Clarida added that research suggests acting preemptively when rates are low.

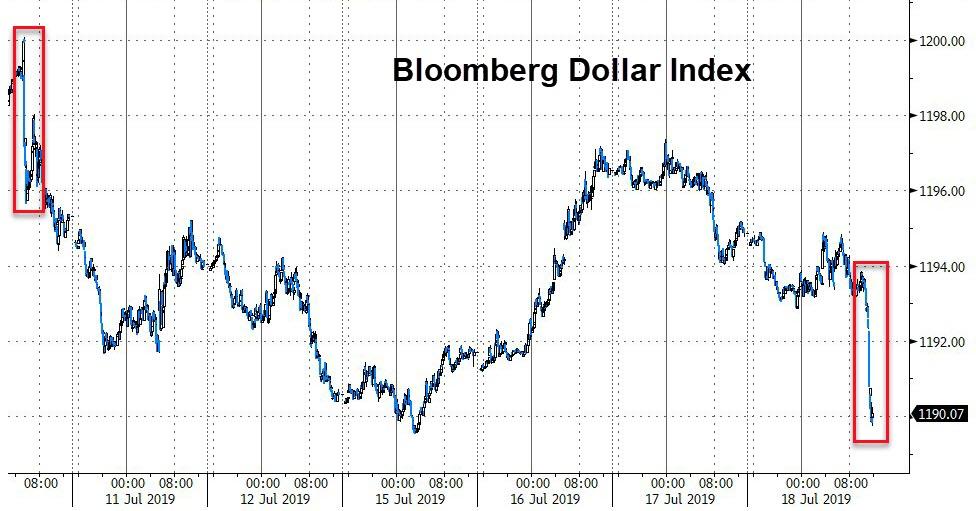

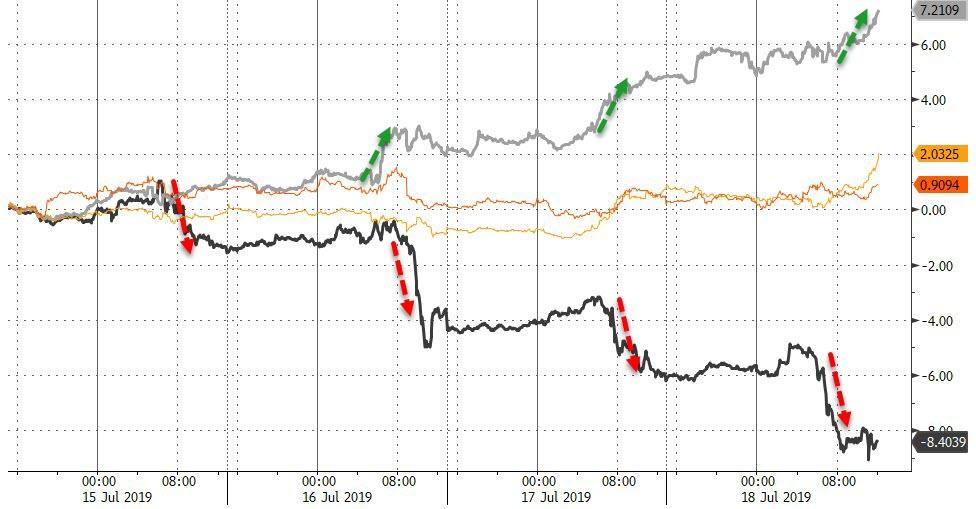

Gold, Bonds, & Stocks soared as the dollar dumped…

Seriously!! At record high stock prices!!!!

And all of that silliness sent stocks soaring… The Dow scrambled back to unchanged at the bell

With Nasdaq ripping back from its Netlfix-ing (even if NFLX didn’t budge – NFLX lost “A Deutsche Bank” in market cap today)…

S&P 500 desperately pushed higher to try and regain 3,000…

Trannies were tempestuous this week but remain entirely decoupled from global growth…

FANG Stocks (thanks to NFLX) reversed as expected at serious resistance…

IG and HY credit have notably decoupled…

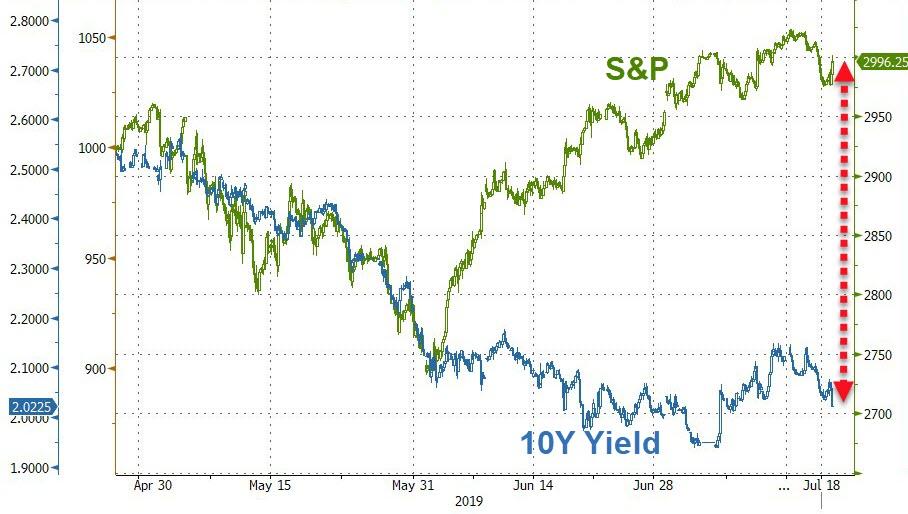

Stocks and bonds remain drastically decoupled…

Treasury yields tumbled after Fed’s Williams comments..

10Y Yield is heading back towards 2.0%…

The (3m10Y) yield curve was steepening intraday (heading back towards 0) until Williams spoke…

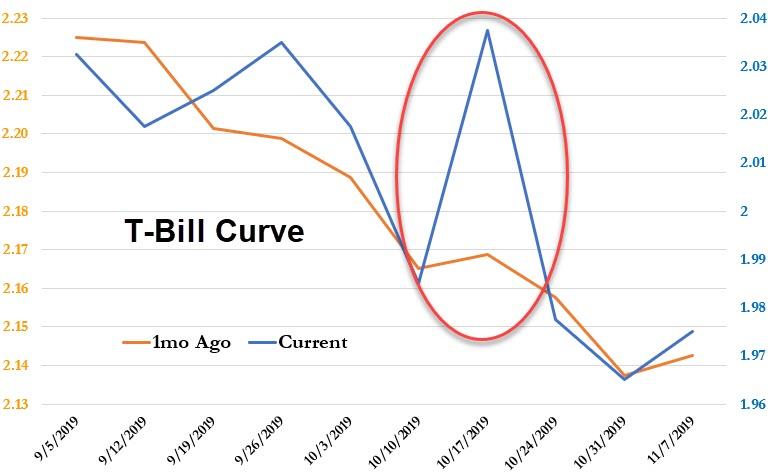

Debt Ceiling Anxiety is building fast in the Bills curve…

The Dollar collapsed after Fed’s Williams ZIRP comments…

Yuan spiked…

USDJPY plunged to near 1-month lows, decoupling from stocks…

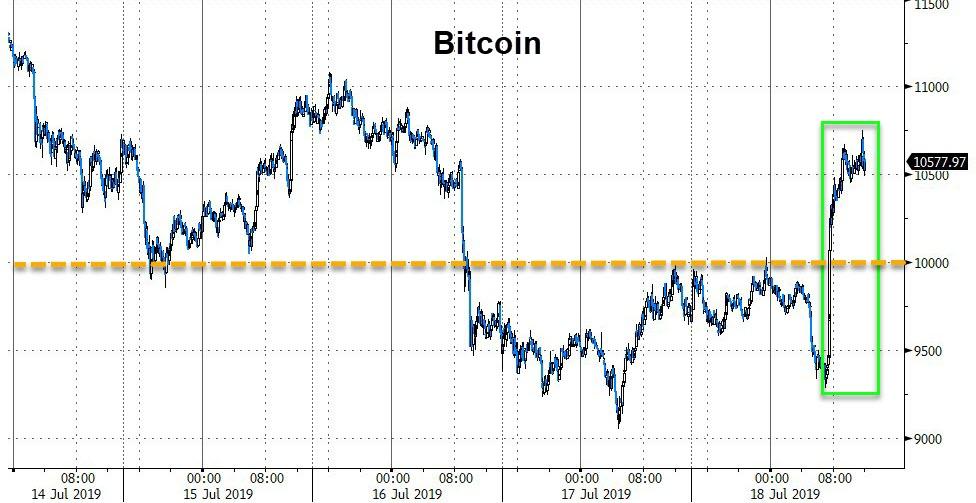

After more ugliness overnight, Cryptos surged today…

With Bitcoin blasting back above $10k…

Silver extended its huge week as crude crashed…

Gold surged on Williams comments…

Silver spiked over 2%…

Silver continues to outperform gold (off 26 year lows relative to the yellow metal)…

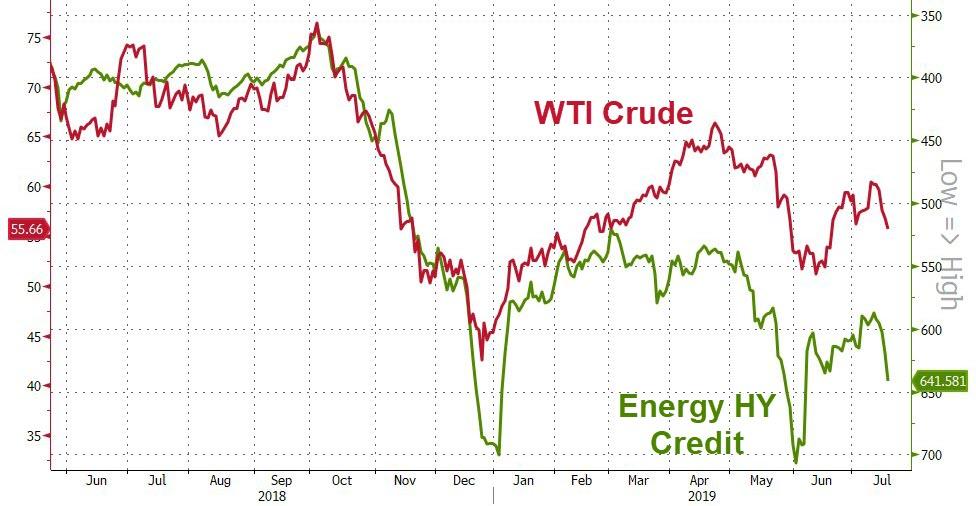

WTI continued its rapid decline, accelerating further on Iran nuclear deal headlines…

HY Energy credit has widened dramatically…

Oil’s slide has been largely ignored by stocks…

Finally, what do you want to hold here? Stocks or Silver?

And as far as the ridiculous spike in Philly Fed (the biggest jump in a decade), Gluskin-Sheff’s David Rosenberg clarifies:

Philly Fed should get its story straight. The index soared but Beige Book said “manufacturers reported slight growth in activity – a slower pace than in the prior period” and “…expectations of activity over the next six months changed little and remained subdued.”

— David Rosenberg (@EconguyRosie) July 18, 2019

Trade accordingly…

And before we leave, is noone else somewhat worried about what exactly it is that The Fed is panicking about that prompts them to jawbone the odds of a 50bps rate cut this aggressively with stocks at record highs?

via ZeroHedge News https://ift.tt/2O4fSnB Tyler Durden