What a farce.

A few short hours after NY Fed President John Williams sparked mayhem in the markets by dropping the most dovish of hints in a speech:

“First, take swift action when faced with adverse economic conditions.

Second, keep interest rates lower for longer.

And third, adapt monetary policy strategies to succeed in the context of low r-star and the ZLB.”

Signaling to the market that lower, sooner, and longer is the way forward, a Fed spokesman has issued a ‘just kidding’ statement in a desperate attempt to walk back market expectations.

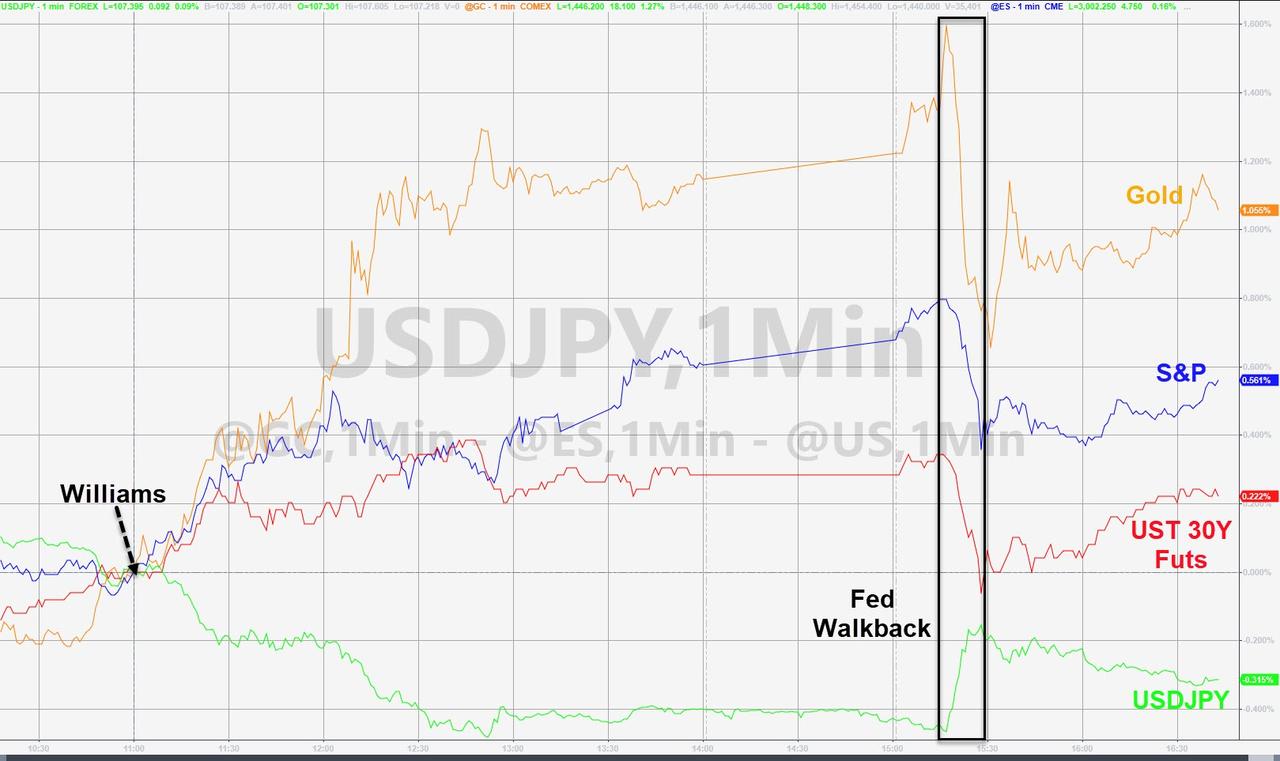

After Williams spoke, bond yields tumbled along with the dollar as stocks and gold spiked and the market’s odds of a 50bps rate-cut in July spiked to over 70%!

And so a New York Fed spokesman quickly ran to the nearest reporter to explain that Williams didn’t intend to suggest Thursday that the central bank might make a large interest rate cut this month.

“This was an academic speech on 20 years of research. It was not about potential policy actions at the upcoming FOMC meeting.”

Oh sure yeah. So what exactly was the point of it? Have we ever been this low in rates before? What little credibility The Fed had after its massive flip-flop this year has just been washed down the toilet of ivory tower speculation.

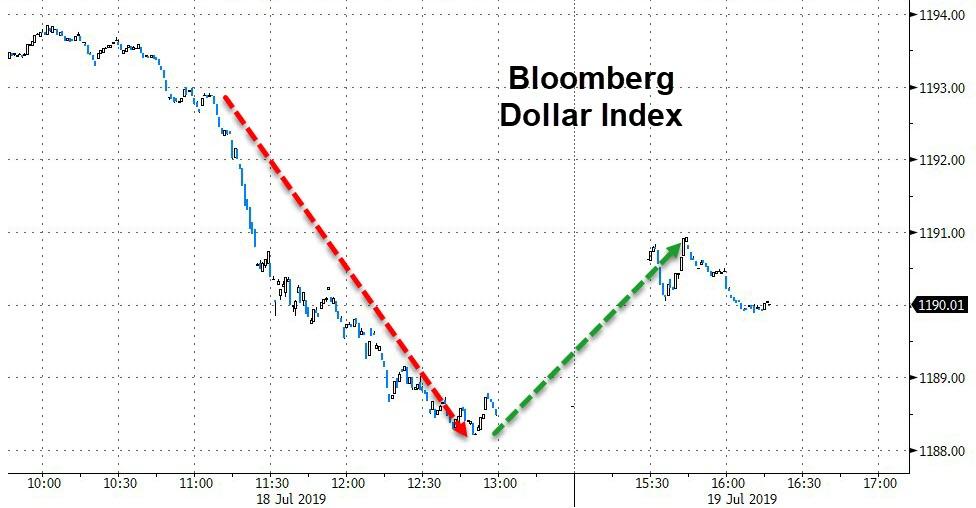

The market reacted to the walk-back with the dollar rebounding…

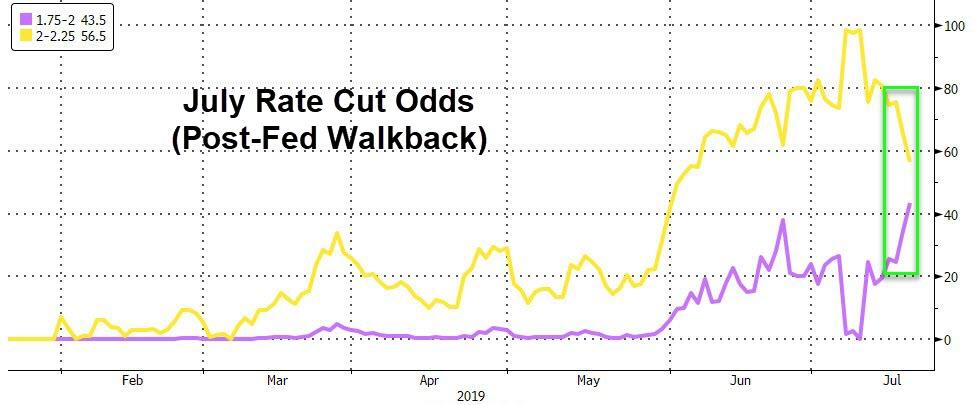

Fed rate change expectations tightening…

And the odds of a 50bps cut tumbling from over 70% to around 40%…

All still adjusted for Williams speech, the dollar is still down,and gold, bonds, and stocks higher…

via ZeroHedge News https://ift.tt/2JFy6ri Tyler Durden