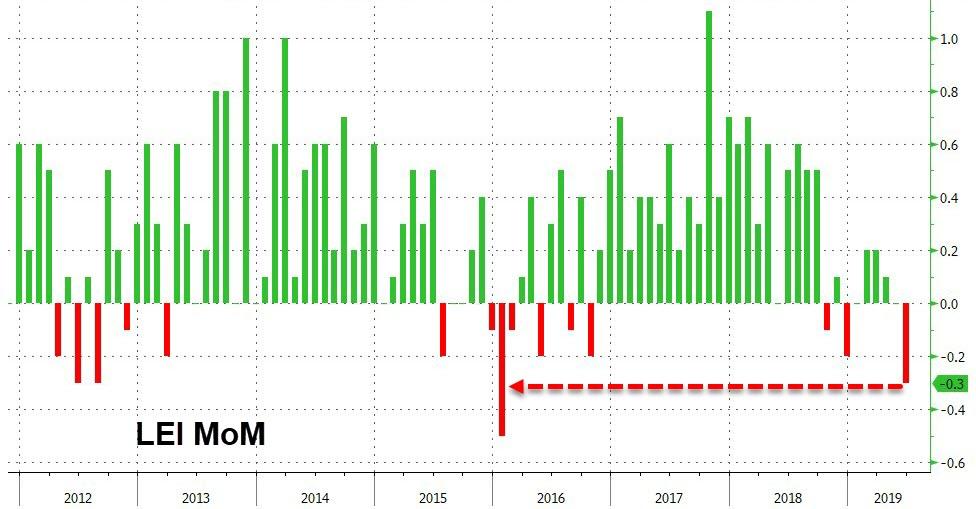

The Conference Board Leading Economic Index (LEI) for the U.S. tumbled 0.3% in June to 111.5, following no change in May, and a 0.1% rise in April.

This is the biggest MoM drop since January 2016…

-

The biggest positive contributor to the leading index was leading Credit index at 0.12

-

The biggest negative contributor was building permits at -0.18

The ten components of The Conference Board Leading Economic Index® for the U.S. include:

-

Average weekly hours, manufacturing

-

Average weekly initial claims for unemployment insurance

-

Manufacturers’ new orders, consumer goods and materials

-

ISM® Index of New Orders

-

Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

-

Building permits, new private housing units

-

Stock prices, 500 common stocks

-

Leading Credit Index™

-

Interest rate spread, 10-year Treasury bonds less federal funds

-

Average consumer expectations for business conditions

“The US LEI fell in June, the first decline since last December, primarily driven by weaknesses in new orders for manufacturing, housing permits, and unemployment insurance claims,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board.

“For the first time since late 2007, the yield spread made a small negative contribution. As the US economy enters its eleventh year of expansion, the longest in US history, the LEI suggests growth is likely to remain slow in the second half of the year.”

Seems like stocks may have got over their skis again?

Rate-cuts?

via ZeroHedge News https://ift.tt/2NZyvsH Tyler Durden