How do you put the monetary genie back in the bottle?

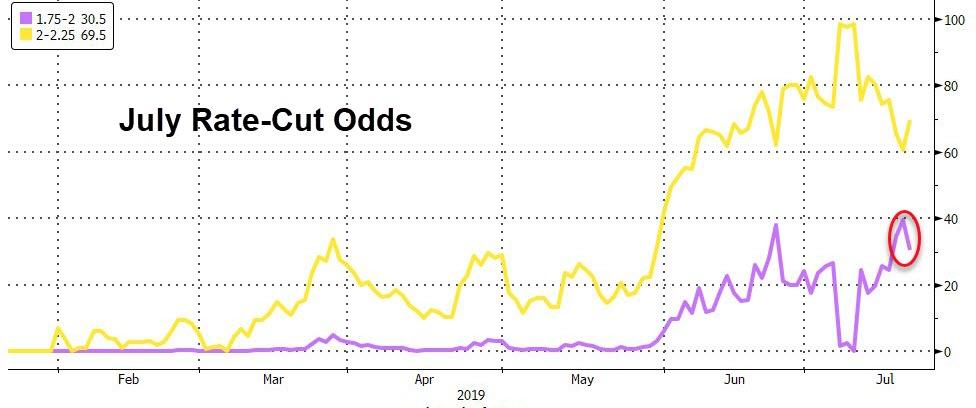

That is what the Federal Reserve is scrambling to figure out today after a day of unprecedented miscommunication by NY Fed president John Wiliams, who as we reported on Thursday, not only singlehandedly repriced market expectations for a 50bps rate cut on July 31, but went so far as to hint that ZIRP is coming back. The fact that even uber dove, St Louis Fed president James Bullard, afterwards said they were expecting 25bps at best, was their desperate attempt to reset market expectations back to 25bps, but by then it was too late, and as of moments ago, the market was pricing in roughly 40% odds of a 50bps rate cut in two weeks, down from 70% yesterday.

In retrospect, Williams made a massive communication mistake.

As Bank of America explained earlier today in a note from chief economist Michelle Meyer titled “The 50bps head fake”, in which she wrote that “on Thursday NY Fed President Williams gave a speech titled “Living Life Near the ZLB” arguing for monetary policy to be proactive and aggressive when confronting an “adverse” outlook. He argued that when short-term interest rates are close to zero, policymakers shouldn’t “keep their powder dry” and that they could not afford to take an “`wait and see’ approach to gain additional clarity about potentially adverse economic developments.” Shortly after, in a TV interview, Vice Chair Clarida strongly argued that it is prudent to take preventative measures with monetary policy when close to the zero lower bound (ZLB). Together, these comments moved markets closer to a 50bp cut at the end of the month.”

However, in an unprecedented move, the NY Fed subsequently released a statement stating that President Williams’s speech on Thursday afternoon was not intended to send a signal that the Fed might make a large interest rate cut this month but rather it was “an academic speech on 20 years of research.”

Why did the NY Fed do this?

Simple: as BofA explains, “the FOMC was uncomfortable with the market moving toward a 50bp cut and wanted to push the market back to a 25bp baseline.” In other words, as Meyer puts it, “Williams unintentionally misguided the markets”.

Which is also why the NY Fed had no other choice but to issue a press release given that the Fed’s blackout period starts on July 20th. If the Fed remained silent, the market would be convinced of a 50bp cut. This, as BofA summarizes, “was a debacle in communication” and here is what the bank thinks the Fed has meant to say

- Take out an insurance policy: As Williams argued, the “best thing you can do for your children is to get them vaccinated. It’s better to deal with the short-term pain of a shot than to take the risk that they’ll contract a disease later on.” The Big Three” – Powell, Clarida and Williams – have all stated that it is prudent to take preventative measures with monetary policy when close to the zero lower bound (ZLB). They are worried about heightened uncertainties and risks about the outlook.

- The current US data are irrelevant: As Powell noted in his testimony to Congress, his policy decision was not swayed by the strong jobs report. We have also since received a strong reading on core CPI, exceptionally robust retail sales and a rebound in manufacturing surveys. Even in the face of such data, Clarida stated that the Fed is not setting policy based on the current baseline but on the outlook. Again, this goes back to the idea of risk-management, and it tells us to ignore the recent US data.

- The Committee will fall in-line…or else: Fed officials who had previously pushed back on a near-term cut – Dallas Fed’s Kaplan and Kansas City Fed’s George, for example – have most recently hinted that they would support a near-term move lower in rates. Chicago Fed President Evans was more explicit in a recent interview advocating for easier policy in order to generate above-target inflation.

As such BofA believes that the Fed is going to cut at the end of the month, most likely by 25bp.

But wait, there’s more, because in a just published confirmation that BofA was indeed correct, in a top-billing article published moments ago on the WSJ, to avoid any further confusion, the Fed leaked using Wall Street’s paper of choice, that “Officials aren’t prepared for bolder action by making a half-point cut, as analysts and traders have speculated in recent days, according to the officials’ recent public statements and interviews” with the article adding that “the larger move appears unlikely for now because officials have said recent economic developments haven’t signaled an imminent downturn.”

The market reacted rapidly and adjusted the odds of a 50bps cut down to 30% (from over 70% after William’s comments last night).

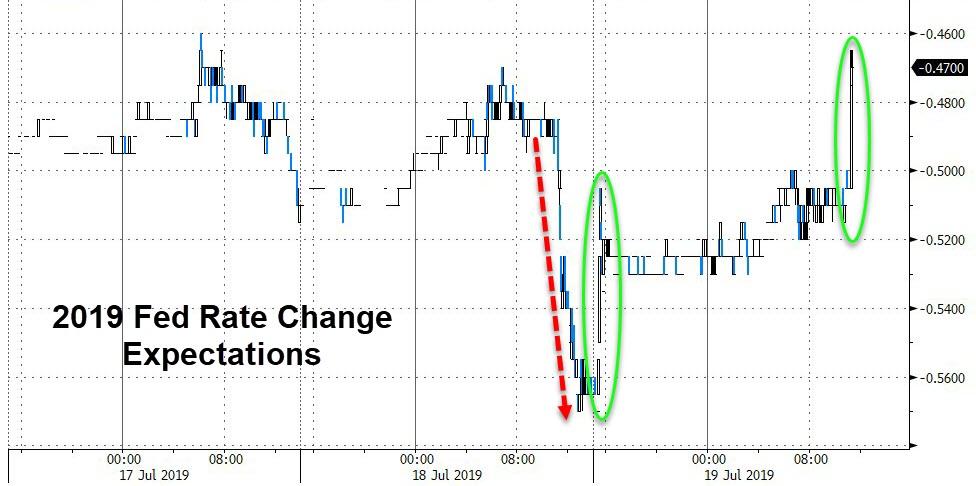

As expectations for Fed rate-cuts in 2019 shifted back below 50bps…

2Y Yields spiked.

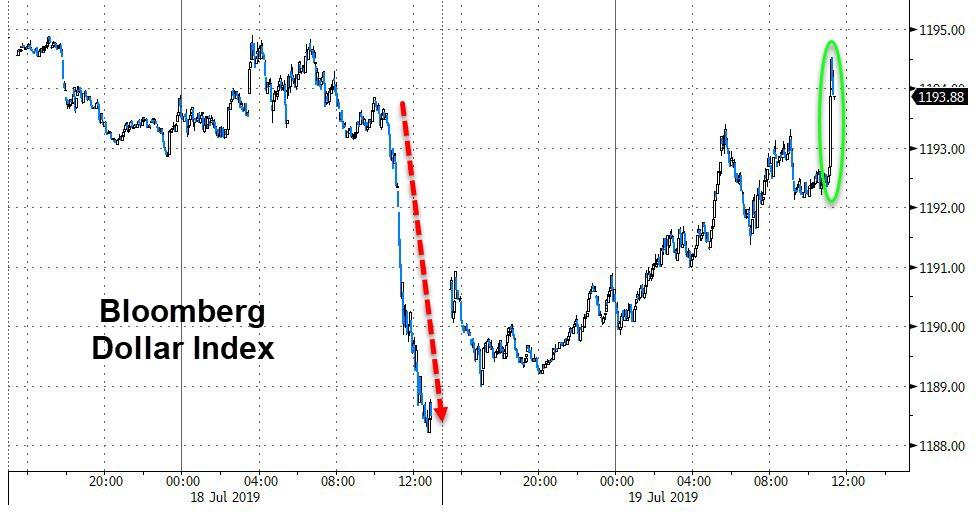

And the dollar jumped.

Stocks were a little more mixed as the spike in crude prices offset some of the hawkish tilt of The Fed’s leak.

via ZeroHedge News https://ift.tt/2Sq4yAw Tyler Durden