Just how “efficient” is the stock market in this day and age when risk prices are set solely by the Fed?

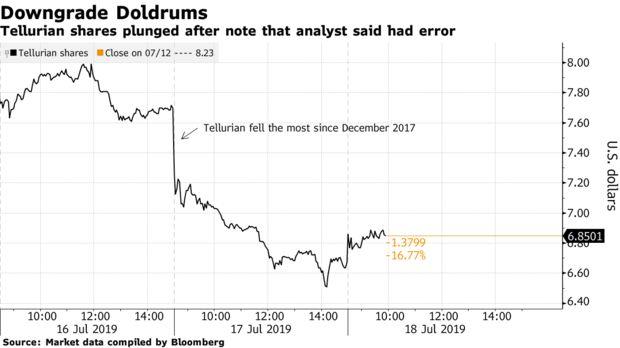

Consider the following fiasco: on Thursday one day after Stifel Nicolaus analyst Ben Nolan downgraded nat gas company Tellurian from Buy (and $16 PT) to Hold (with a nearly 50% lower price target of $9), which wiped out 13% from the market cap of the Houston-based company, Nolan decided to check his numbers and… found an error.

“After further examination, we have located an error in our calculation of the proposed private equity component of Tellurian’s capital structure,” Nolan disclosed the analysis error in a note titled “Mea Culpa on TELL Share Count”, one day after his downgrade triggered the stock’s biggest loss since December 2017, as Nolan said low gas prices would hurt the company’s marketing margins and cash flows.

“Subsequently, we are reducing our share count estimate and adjusting our earnings estimates to compensate for the new share count.”

Oops.

As Bloomberg notes, the original downgrade report was later republished with an “erratum,” removing the data underlying Stifel’s investment scenario. “We are re-publishing this note without those items because we feel they are not relevant to the subject matter,” the note said, when what it meant to say was that the entire thesis should have been scrapped, but if Nolan did that, investors may pay more attention to his lack of math skills than any business challenges facing Tellurian. In other words, “ignore my factual mistakes, and focus on everything else i say.”

Despite the mea culpa, Tellurian rose 5.4% to $7.03 on Thursday, unable to recoup even half the prior day’s losses.

Of course, this is not the first time an analyst makes a mistake and then tells his clients about it: according to Bloomberg, a Barclays analyst in 2017 downgraded SemGroup just hours after she told clients the prior week’s rout left the pipeline company at an attractive valuation, warranting the equivalent of a “buy” rating. The about-face came after the firm discovered their share-count math artificially inflated valuation.

Bottom line: much if not all sellside research is not only conflicted, but goalseeked to reach a predetermined conclusion, either with the purpose of generating investment banking revenue (“Buy” recos), or generate more trading commissions from a hedge fund client of the bank (“sells”).

For what really matters, just keep an eye on the Fed.

via ZeroHedge News https://ift.tt/2XXvX32 Tyler Durden