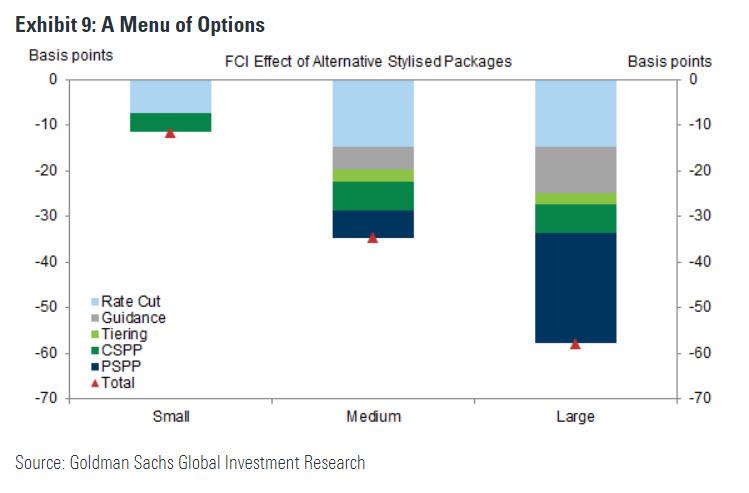

Three weeks ago, when previewing the restart of the ECB’s monetary easing in the form of even more negative rates and further QE – which just like the Fed’s rate cut and subsequent ZIRP, NIRP and QE is now inevitable – Goldman laid out three potential “bundles” which Mario Draghi could unveil as one of his last pre-retirement acts, depending on just how severe the ECB perceives Europe’s economic slowdown. There were as follows:

- First, a “small” program which includes a 10bp deposit rate cut and corporate purchases (scaled to EUR 5bn per month for six months).

- Second, Goldman constructs a “medium” package which includes a 20bp rate cut with tiering, somewhat stronger forward guidance, corporate purchases (EUR 5bn per month for nine months) and limited sovereign purchases (EUR 25bn per month for nine months).

- Third, the bank considers a “large” package that contains more aggressive sovereign purchases (scaled to EUR 75bn per month for twelve months) via an increase in the issuer limit, in addition to the other elements in the medium package.

In retrospect, it appears at least one major asset class was missing.

Stocks.

To be sure, it’s hardly a novel idea: back in 2016, Reuters first floated an ECB trial balloon that the central bank “may soon be forced to follow the Bank of Japan’s example and buy equities as part of any expanded stimulus programme,” even as it faces significant hurdles in helping all 19 euro zone members equally without distorting a key market for investors.

Citing analysts, Reuters noted that Draghi, and soon Lagarde, will have to pursue alternative options to loosen policy further to lift growth and inflation across the bloc: “Analysts say these could include large-scale share buying, a policy that the BOJ has already adopted after it started purchasing equity exchange traded funds (ETFs) for its own quantitative easing scheme six years ago.“

Now, none other than the head of the world’s largest asset manager, BlackRock CEO Larry Fink, has chimed in on this, and in his view the Japanification of Europe is almost complete, and that the ECB – as so many have speculated – will have no choice but to buy stocks to stimulate Europe’s slowing economy.

Fink, who back in April correctly predicted a broad market “melt up” – which was driven entirely by the Fed’s pathetic capitulation to Trump and its suggestion that it would cut several times in the coming year – appeared on CNBC this morning to make the case that the next European QE would also include stocks.

“55% of all European debt has a negative yield. I’m going to stick my foot out again: if the ECB is really going to try to restimulate the economy in Europe, they’re going to have to buy equities just like the Bank of Japan has done“, Fink told CNBC.

At least Fink whose business is all about higher stock prices, admits – unlike Dragh, – that this would be game over for capital markets: “Most monetarists would say that’s terrible.” And they woudl be right. However, at this point it is too late to change the outcome: “I believe that negative returns harm the economy” Fink concluded, and every European bank agrees with him.

The ECB will need to buy stocks in order to stimulate Europe’s economy, says $BLK CEO Larry Fink pic.twitter.com/uB2DUhUEbS

— Squawk Box (@SquawkCNBC) July 19, 2019

Which begs the question – when will there finally be a rebellion to the catastrophic, destructive and idiotic policies of central bankers that we have been raging against for the past decade?

The answer – never, because what is coming next is MMT, and wholesale money printing for the entire world, as the status quo makes a last ditch attempt to hyper-reflate and extend and pretend for at least a few more years before the entire financial system, and western way of life, comes crashing down.

via ZeroHedge News https://ift.tt/2M06rCL Tyler Durden